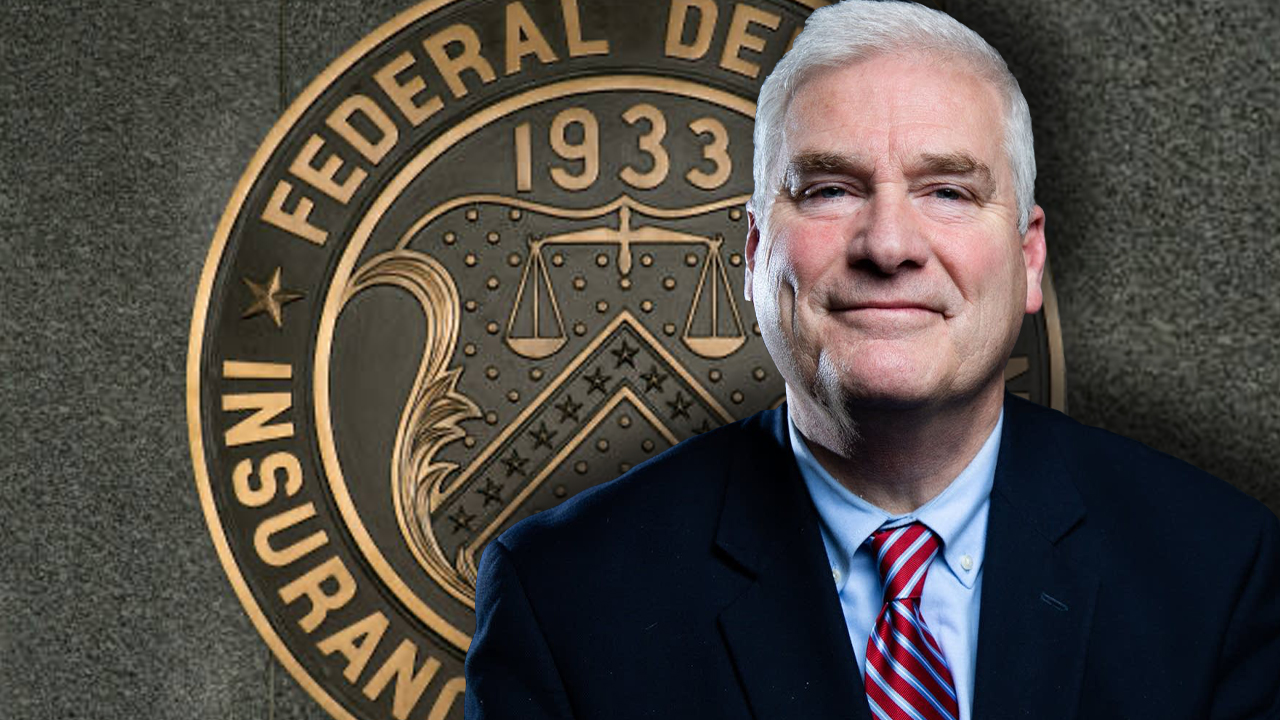

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed he despatched a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance coverage Company (FDIC), relating to studies that the FDIC is “weaponizing latest instability” within the U.S. banking trade to “purge authorized crypto exercise” from the US. Particularly, Emmer requested Gruenberg if the FDIC instructed banks to not present banking companies to cryptocurrency companies.

GOP Majority Whip Emmer Questions FDIC’s Involvement in Purging Authorized Crypto Exercise

Tom Emmer, a Republican politician from Minnesota, sent a letter to the chairman of the FDIC questioning whether or not the company directed banks to not present companies to digital foreign money companies. “Current studies point out that federal monetary regulators have successfully weaponized their authorities over the past a number of months to purge authorized digital asset entities and alternatives from the US,” Emmer’s letter learn.

The Minnesota congressman added:

People from throughout the trade, together with former Home Monetary Providers Committee chairman Barney Frank highlighted the focused nature of those regulatory efforts to ‘single out’ monetary establishments and ‘ship a message to get individuals away from crypto.’

Emmer has been querying different U.S. lawmakers and companies about their actions in opposition to crypto companies, together with questioning Securities and Alternate Fee (SEC) chair Gary Gensler about actions taken throughout the arrest of FTX’s disgraced co-founder, Sam Bankman-Fried. The politician has additionally launched laws that might prohibit the U.S. central financial institution “from issuing a [central bank digital currency] on to anybody.”

Emmer’s feedback about former lawmaker Barney Frank stem from the Signature Financial institution board member’s commentary about being shocked by Signature’s collapse. Frank stated he suspected there was an “anti-crypto message” behind the financial institution’s demise. The New York State Division of Monetary Providers disagrees and defined that putting Signature into receivership of the FDIC had “nothing to do with crypto.”

Regardless of the regulator’s denial of such accusations, Emmer’s letter to the FDIC’s Gruenberg implicitly asks the chairman whether or not the FDIC particularly directed banks to not present banking companies to cryptocurrency companies.

”Have you ever communicated — explicitly or implicitly — to any banks that their supervision can be extra onerous in any method in the event that they tackle new (or keep current) digital asset purchasers,” the politician requested. Emmer is insisting that Gruenberg present the knowledge as quickly as doable and no later than 5:00 p.m. on March 24, 2023.

What are your ideas on the regulation of cryptocurrency in the US and the potential impression it may have on the way forward for the trade? Do you imagine that regulators are unfairly concentrating on crypto companies? Share your opinions within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.