Bitcoin’s fall from its all-time excessive to a low of $15,700 has been one of the vital dominating narratives this 12 months. Bitcoin misplaced 75% of its worth since Nov. 10, 2020, and over 65% for the reason that starting of the 12 months.

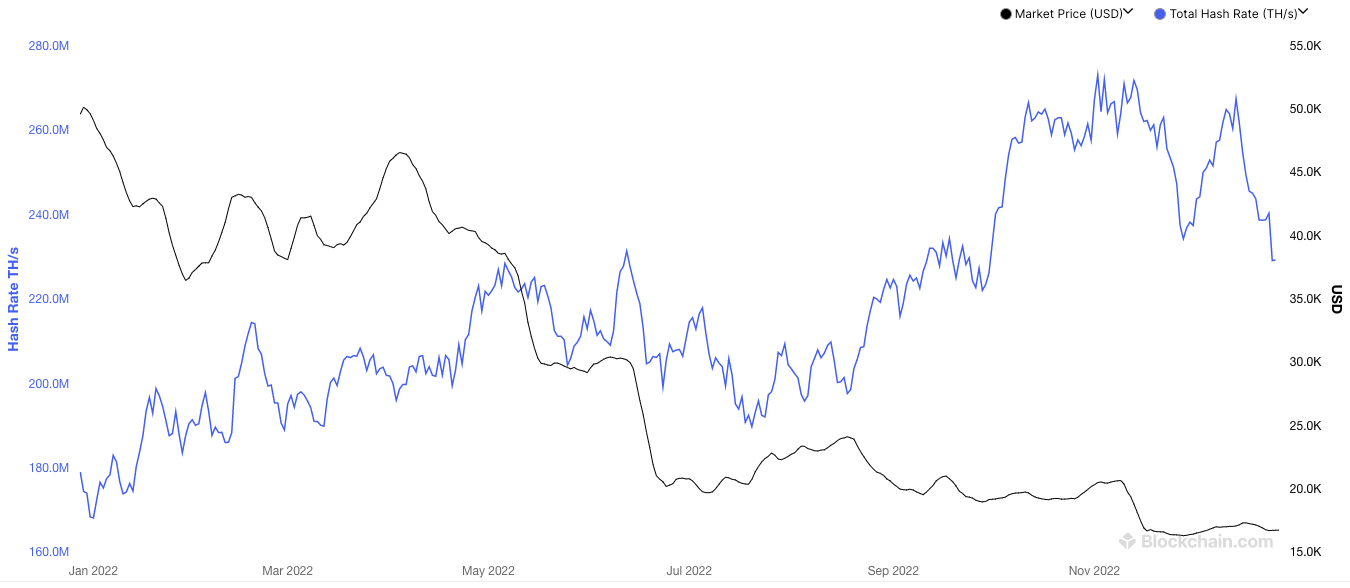

Nonetheless, a way more outstanding story than Bitcoin’s volatility is the divergence between its value and its hash price.

Regardless of dropping three-quarters of its worth in a 12 months, Bitcoin’s hash price reached its all-time excessive of 271.8 EH/s. This divergence between the hash price and the worth is a singular prevalence that hasn’t occurred in any of the earlier bear markets.

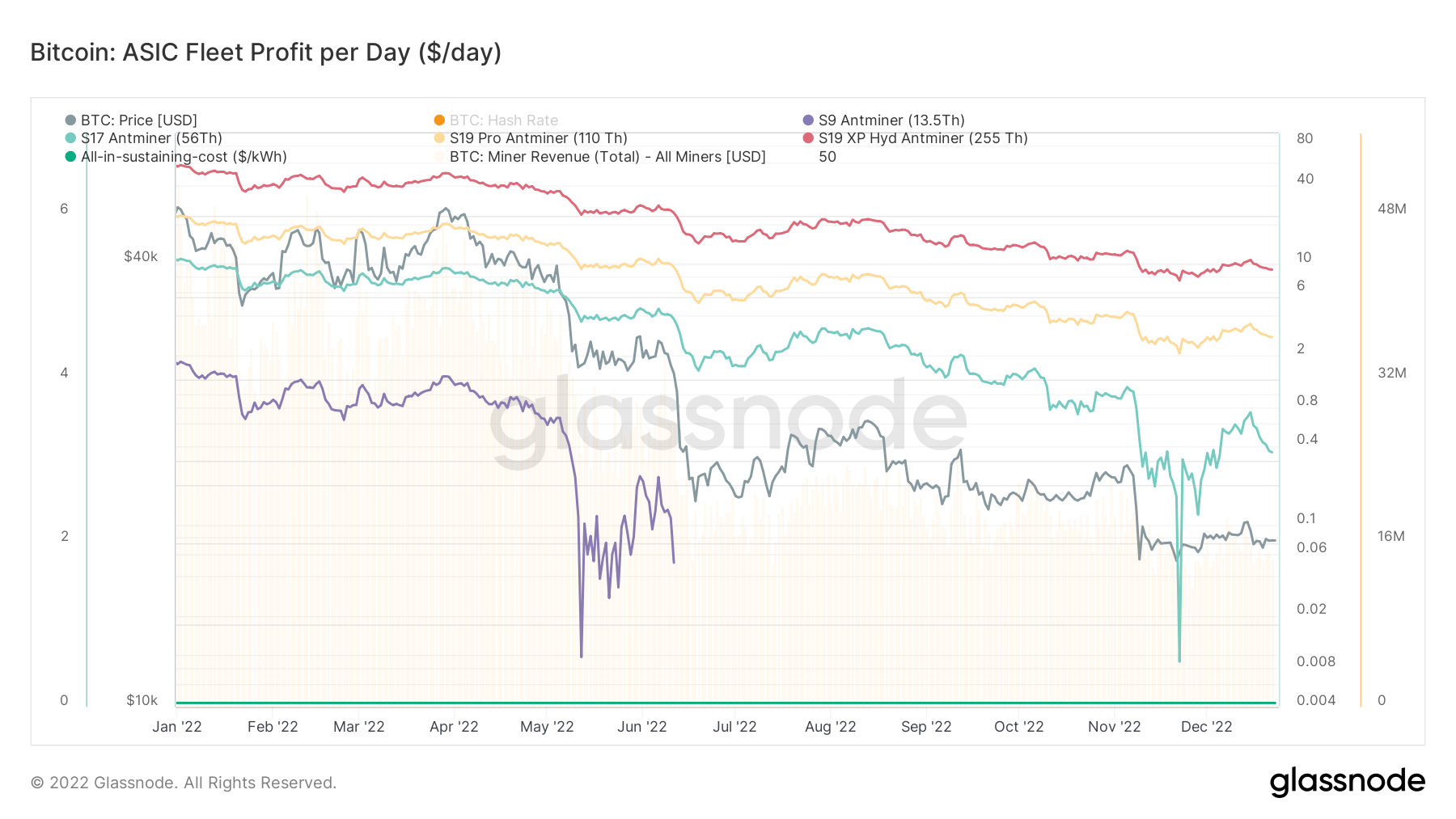

The skyrocketing hash price turns into an excellent larger outlier when evaluating it to miner revenues. CryptoSlate beforehand analyzed miner income and located that income proceed to lower even for the biggest and most effective mining operations.

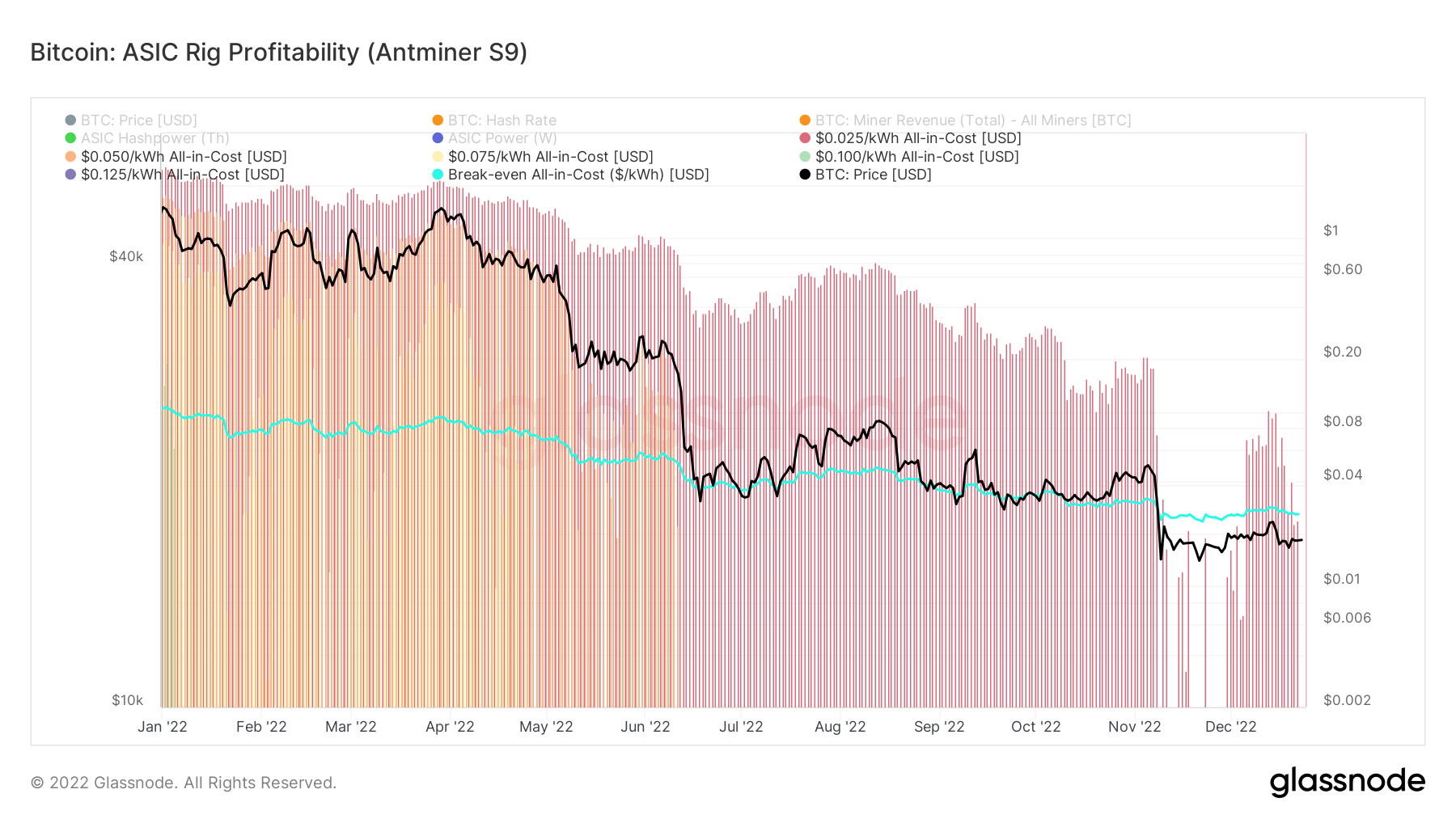

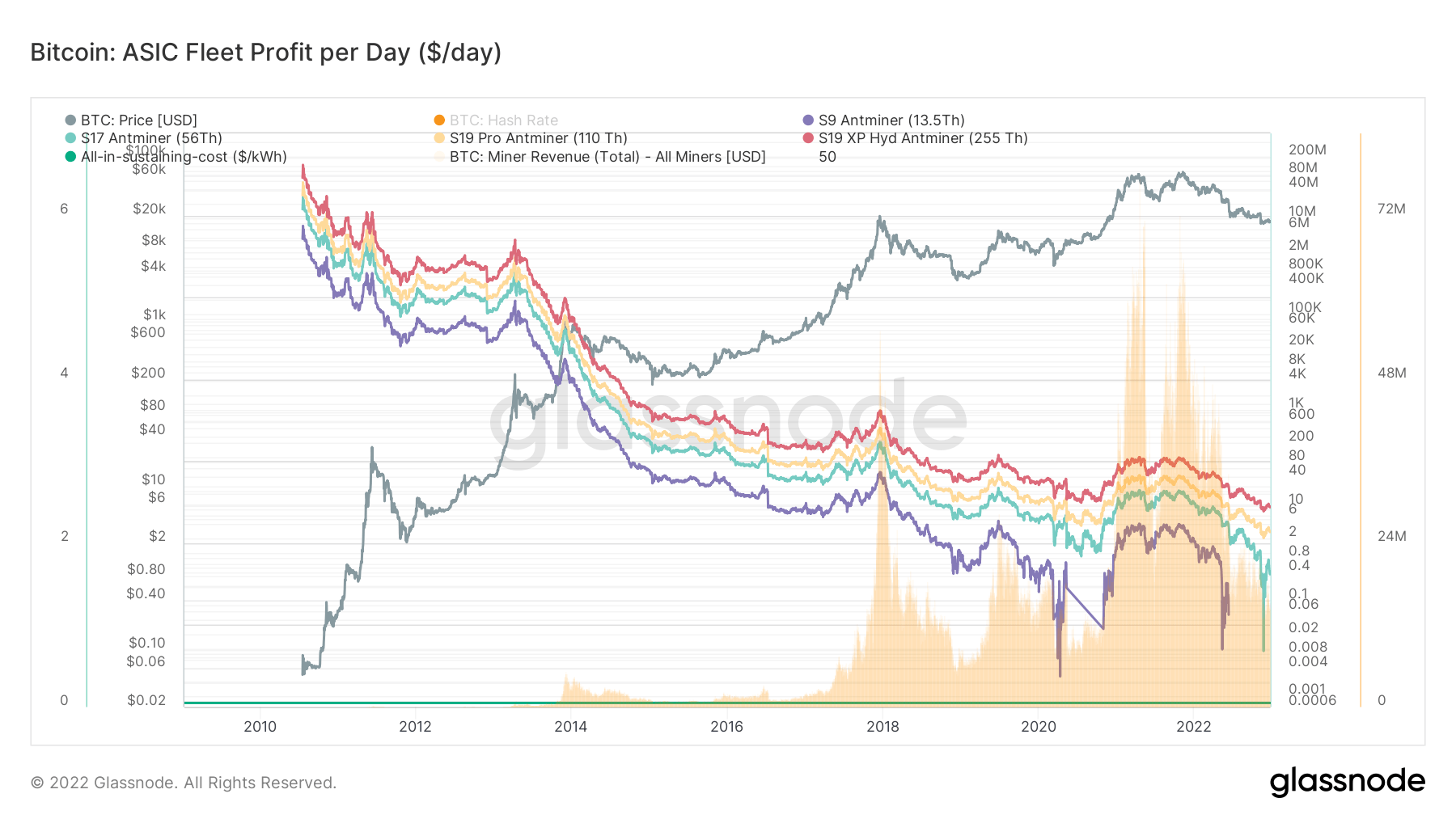

CryptoSlate’s evaluation of two widespread Bitmain miners paints a bleak image of the mining trade. Trying on the Antminer S9 and Antminer S17 reveals that machines are battling profitability.

Launched in 2017, the Antminer S9 remained worthwhile all through years of market volatility. Nonetheless, as the worldwide hash price started to develop in 2020, the S9 noticed its profitability fall till it lastly turned unprofitable in Might 2022, when nearly all machines had been faraway from the community.

With an all-in-sustaining price of round $0.05/kWh, Bitcoin’s value would wish to surpass $19,000 for the Antminer S9 to develop into worthwhile once more.

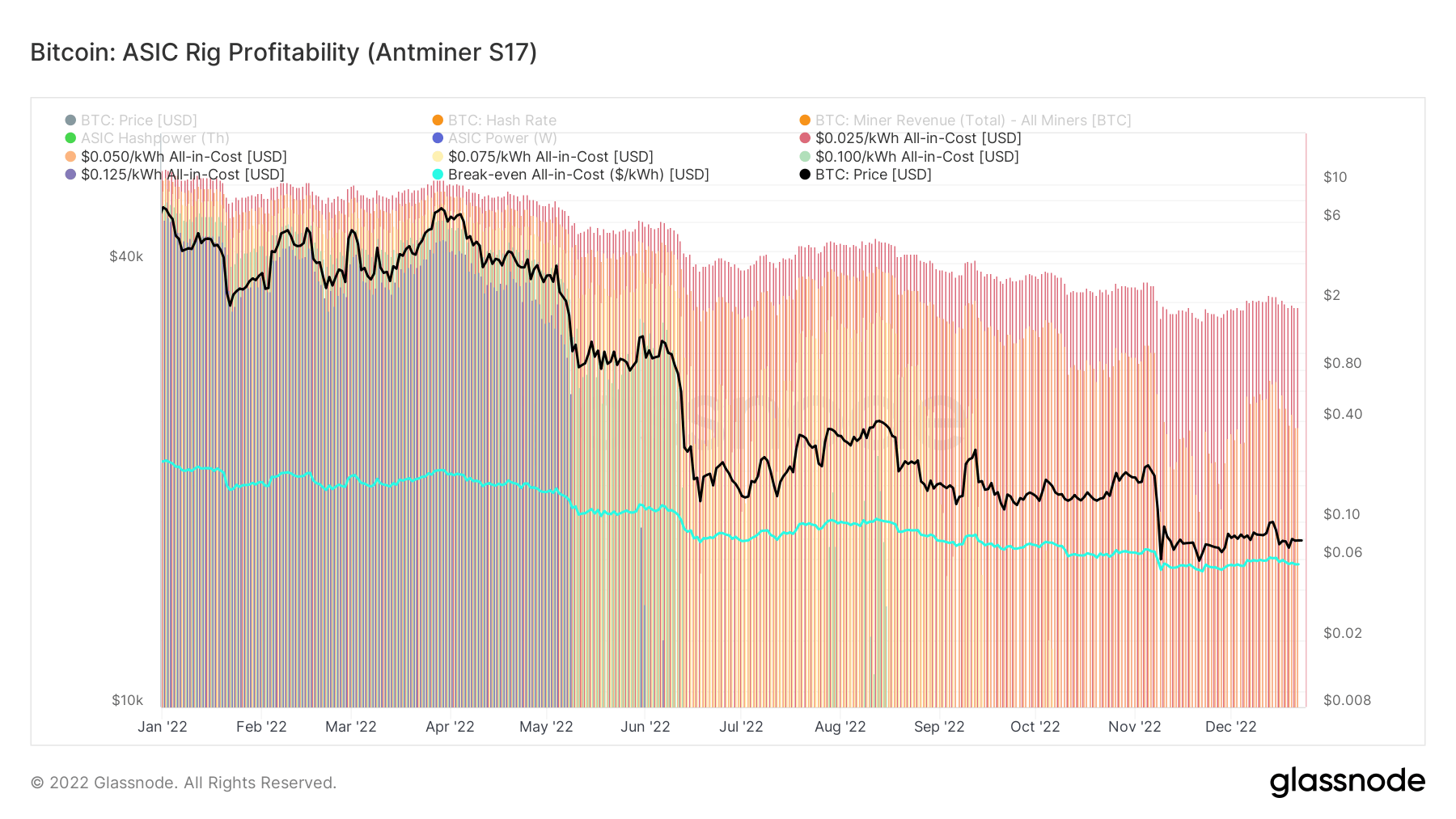

The Antminer S17 continues to be worthwhile. Launched in 2019 as a extra highly effective iteration of the S9, the S17 produced a most hash price of 56 TH/s. Bitcoin’s present value and rising hash price put the profitability of the S17 at simply $36 per day. This slim revenue has been reducing nearly every day and is anticipated to drop even additional within the coming weeks.

The S17 has been battling profitability all year long. The Terra collapse in June 2022 made the S17 unprofitable for the primary time ever, as Bitcoin dropped properly beneath $16,000 wiping out billions from the market.

The continuing market volatility, mixed with the ever-expanding hash price, is at the moment placing the profitability of the S17 into query. Trying on the profitability chart for the S17 reveals that the machine is experiencing a development just like the S9.

Barely breaking even, the S17 would develop into unprofitable if Bitcoin had been to fall beneath $15,500. Crossing the $15,500 might push miners to unplug hundreds of S17s.