Crypto analytics agency Glassnode says that liquidity is drying up within the altcoin market as an urge for food for risk-on belongings declines.

In a brand new evaluation, the agency says key altcoin metrics are at cycle lows indicating market weak spot.

Says Glassnode,

“Liquidity continues to dry up throughout the digital belongings as community settlement, trade interplay and capital flows reside at cycle lows, closely underscoring the present acute apathy skilled by the market.

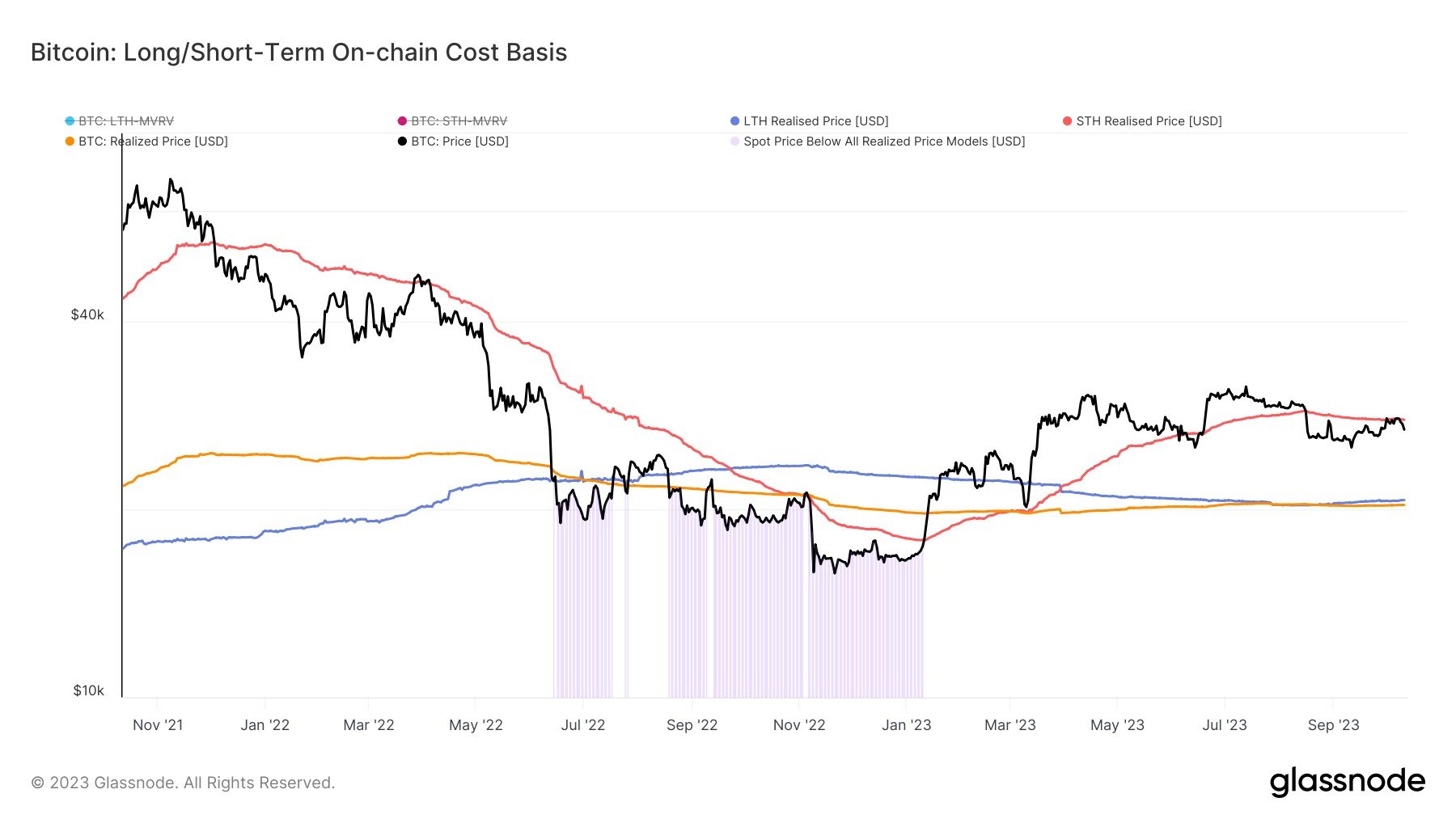

The long-term holder cohort stays resolute as their provide continues to ascend to new ATHs (all-time highs) while HODLer development stays strong, tightening the energetic tradeable provide.

Regardless of massive fluctuations in valuation for altcoins, a symptom of the prevailing low liquidity surroundings, our new altcoin framework which simulates the waterfall impact of capital rotation suggests a risk-on regime just isn’t in play, offering confluence to the shortage of liquidity out there to digital belongings.”

Glassnode additionally says that the Bitcoin (BTC) “Scorching Provide,” metric, which measures the quantity of cash which have transacted inside the final week, signifies BTC market liquidity is reaching lows final seen in prior bear markets.

“This lull in market liquidity is strikingly obvious when evaluating the Scorching Provide metric…

To exhibit simply how quiet the Bitcoin provide is, we examine the Scorching Provide to its long-term imply minus 0.5 customary deviations.

From this, we assemble a framework to focus on durations of low and contracting market liquidity, the place Scorching Provide is beneath this Imply -0.5 SD stage. These highlighted areas present that the present liquidity situations stay just like the 2014-15 and 2018-19 bear markets, having been on this situation for 535 days.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney