Robinhood added Grayscale ETH and BTC trusts after leaning closely on the crypto trade not too long ago so let’s have a better have a look at our newest crypto information at this time.

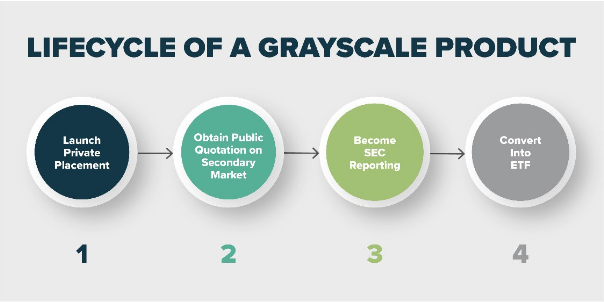

For just a few years, the buying and selling app Robinhood listed just a few cryptocurrencies however prior to now month, it’s introduced that quantity to 11 and it’s now making obtainable two equities property associated to the worth of crypto. As of at this time, Robinhood added Grayscale ETH and BTC trusts and now the customers should buy GBTC and ETHE through the app. Each of those investmetns merchandise commerce like a inventory and permit buyers to get publicity to the worth of EBTC and ETH with out having to truly purchase them. The funding agency took care of the custody in change for a administration price and the patrons bought a share of the BTC and ETH. Whereas each GBTC and ETHE are tied to the worth of the cryptocurrencies that are not often traded on a 1:1 foundation, part of the rationale for the distinction in value is the lengthy lockup durations when the bigger holders promote and have an effect on the worth of the open market.

There’s two new methods to entry crypto on @RobinhoodApp. You can begin buying and selling $GBTC and $ETHE at this time. https://t.co/n09aiEVhqEhttps://t.co/6tFrYCsmzx pic.twitter.com/AxKH7xZ0nS

— Grayscale (@Grayscale) May 6, 2022

The discrepancy might clarify why Robinhood merchants don’t have to fret concerning the custody points however can get these property for reasonable costs and hope the hole closes. In response to the info from Ycharts, ETHE is promoting at a reduction of 26.1% which implies it’s 6% cheaper to purchase ETHE than ethereum whereas GBTC is buying and selling at a 25.5% low cost. If the SU SEC accepts Grayscale’s proposal to transition the BTC Belief right into a BTC ETF, the low cost will disappear since ETFs permit them to commerce nearer to the asset’s value. The SEC nonetheless hasn’t authorized any BTC-backed ETFs.

Because the Robinhood crypto COO Christine Brown’s departure from the corporate, the brokerage rolled outa few main additions to the digital asset choices. It added Polygon, sHIB, Compound, and Solana to the listings of Bitcoin, Bitcoin Money, Ethereum, Dogecoin, Bitcoin SV, and Litecoin whereas per week earlier than, on the BTC convention in 2022, it introduced its intentions to make use of the LN for sending sooner and cheaper transactions. It additionally revealed that the customers will have the ability to switch the crypto property off Robinhood which is one thing that the corporate promised since early 2021.

Crypto has been one of many few vivid spots for the corporate which reported an 18% drop in income for Q1 and laid off 9% of the employees. The income nonetheless was up from $48 million to $45 million for the quarter however nonetheless down by 39% from a year-to-year comparability.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be at liberty to contact us at [email protected]