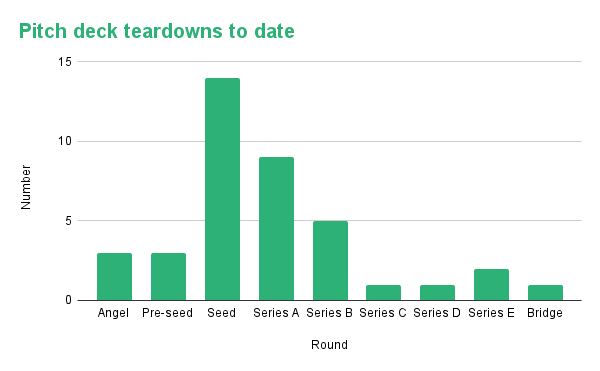

Welcome to our fortieth Pitch Deck Teardown! Goodness, time flies.

Of these 40, simply three have been angel rounds, so at this time, we’ll take aside the angel deck of MiO Market, a platform for media publishers and patrons. The corporate raised $550,000 at a $3.6 million pre-money valuation.

Breakdown of the pitch deck teardowns up to now. Picture Credit: TechCrunch / Haje Kamps

We’re searching for extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

MiO Market comes out of the gate exhausting and simply retains going. The deck didn’t embrace all of the essential bits, nevertheless, and I want the corporate had finished a number of issues in a different way, however we’ll get to that. For now, listed below are the 16 slides that make up its angel deck:

- Cowl slide

- Historical past slide (“Evolution of on-line marketplaces”)

- Imaginative and prescient and mission slide

- Downside slide

- Resolution slide

- Alternative slide

- Market-size slide

- Competitors slide (“B2B SaaS for Media Patrons/Sellers”)

- Worth proposition slide 1 (“Options for patrons”)

- Worth proposition slide 2 (“Intelligence for sellers”)

- Enterprise mannequin slide (labeled as “Go-to-market”)

- Traction slide

- Monetary slide (labeled as “Projections”)

- Group slide (“Founder”)

- Board of administrators slide

- Contact slide

Three issues to like

MiO nails its pitch in a number of actually essential components, which is ever so pleasant. Its crew slide focuses on all the appropriate issues, it does an excellent job explaining its worth prop and together with the corporate’s mission helps solidify the way it views the panorama.

Actually promising crew slide

[Slide 14] That’s the way you present founder-market match. Picture Credit: MiO Market

On the earliest levels of a brand new enterprise, traders don’t have quite a bit to go on: There’s not a lot of a product but, there isn’t a lot traction — there’s actually not a lot of something. So, how do you consider an early-stage firm? You take a look at issues like whether or not there’s a large enough market, drawback and alternative for return, however most significantly, it’s a must to think about whether or not that is the appropriate crew to deliver this product to market. On paper, CEO and founder Sean Halter is an efficient wager. He claims to have a long time of expertise and seems to have deep market understanding. These are all helpful. So what does a VC do subsequent? A bit of sunshine due diligence to see if what’s on the slide matches up.