A few weeks in the past, Brian wrote about ANYbotics’ $50 million Sequence B fundraise, which made me understand it’s been a sizzling minute since I’ve performed a robotics teardown. That modifications immediately, since ANYbotics was sort sufficient to share its pitch deck so we may take a better take a look at the highs and lows of four-legged ‘bots.

For the reason that startup claims it has $150 million in preorders/reservations from fuel, oil and chemical corporations, and the truth that this can be a development spherical, I do know that is going to be a traction-forward pitch. However there are lots of methods to weave that narrative. Let’s see how ANYbotics determined to carve that individual turkey.

We’re on the lookout for extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

ANYbotics despatched by way of a flippantly redacted deck that solely blurs buyer logos and financials. Listed here are the slides:

- Cowl slide

- Mission slide

- Downside slide

- Why now slide

- State of the business slide

- Firm historical past slide

- Product slide

- Answer slide

- Worth proposition slide

- Traction slide [redacted]

- Market measurement and market projections slide

- Expertise slide 1

- Expertise slide 2

- Workforce slide

- Aggressive panorama

- Go to market slide

- Financials slide [redacted]

- Testimonials slide [redacted]

- Thanks slide

Three issues to like

ANYbotics is a fairly cool firm, and I’m at all times curious how any robotics firm tells its story vis-a-vis the goliath within the room: Boston Dynamics is the identify that often springs to thoughts in the case of four-legged robots. ANYbotics does a terrific job on some fronts, although.

Listed here are three issues I cherished in regards to the pitch.

A logical evolution

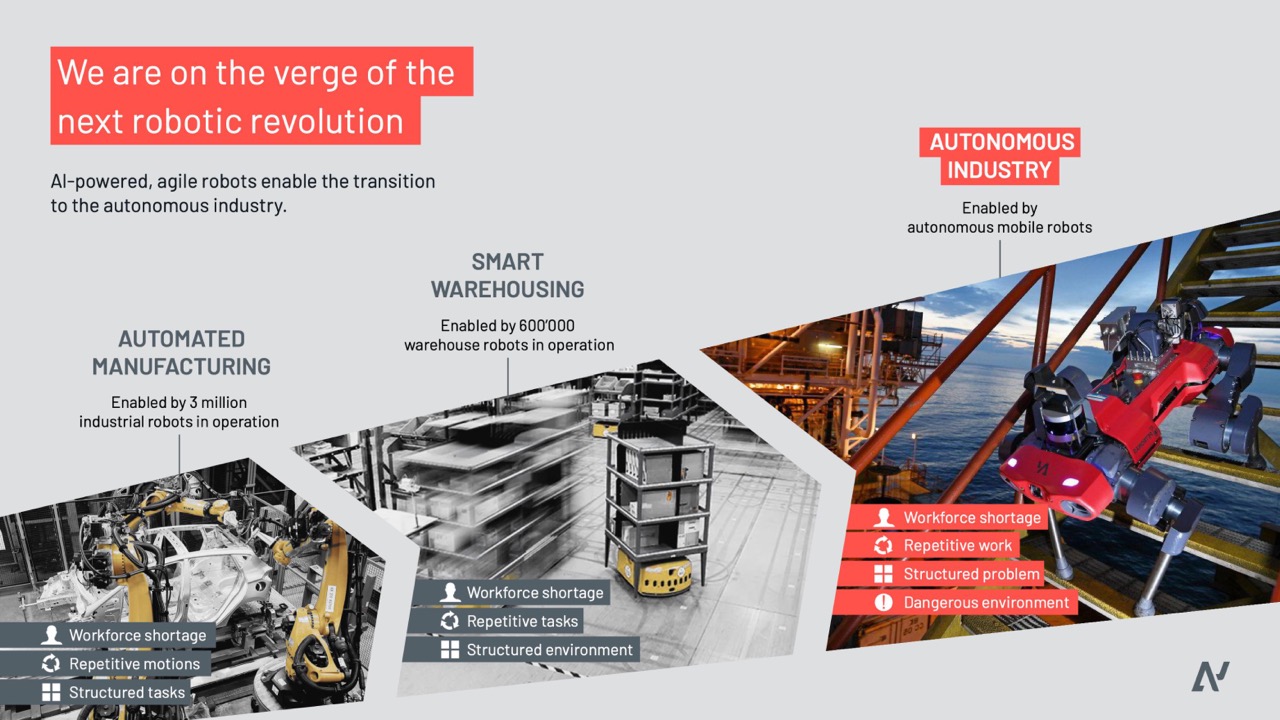

[Slide 4] Nothing is inevitable, however this can be a very compelling story. Picture Credit: ANYbotics

Skilled robotics traders gained’t actually want this slide, however ANYbotics is shrewd to incorporate it. Funding choices are hardly ever made in a vacuum, and in a VC agency, a broader partnership often have to be satisfied of the viability of an funding. Slides like this may do a variety of the heavy lifting in the case of telling the story.

This slide tells traders one thing they already know: Manufacturing robots have been round for a very long time, warehousing robots are simply discovering their stride, and the market is prepared for the following step of the evolution. Framing the story of robotics as a journey from structured duties, in direction of structured environments after which in direction of structured issues was a sublime alternative, and by outlining the historical past, the corporate is already hinting on the drawback house and the advantages to prospects. It’s a fairly refined and masterful stroke of storytelling.

Startups ought to study from this to contextualize their product available in the market. Why are you doing what you do? What got here earlier than? How will you extrapolate present markets and merchandise to point out how your organization will be profitable? Is there any manner you’ll be able to inform the story of your market like ANYbotics did right here?

Exhibiting the breadth of alternatives

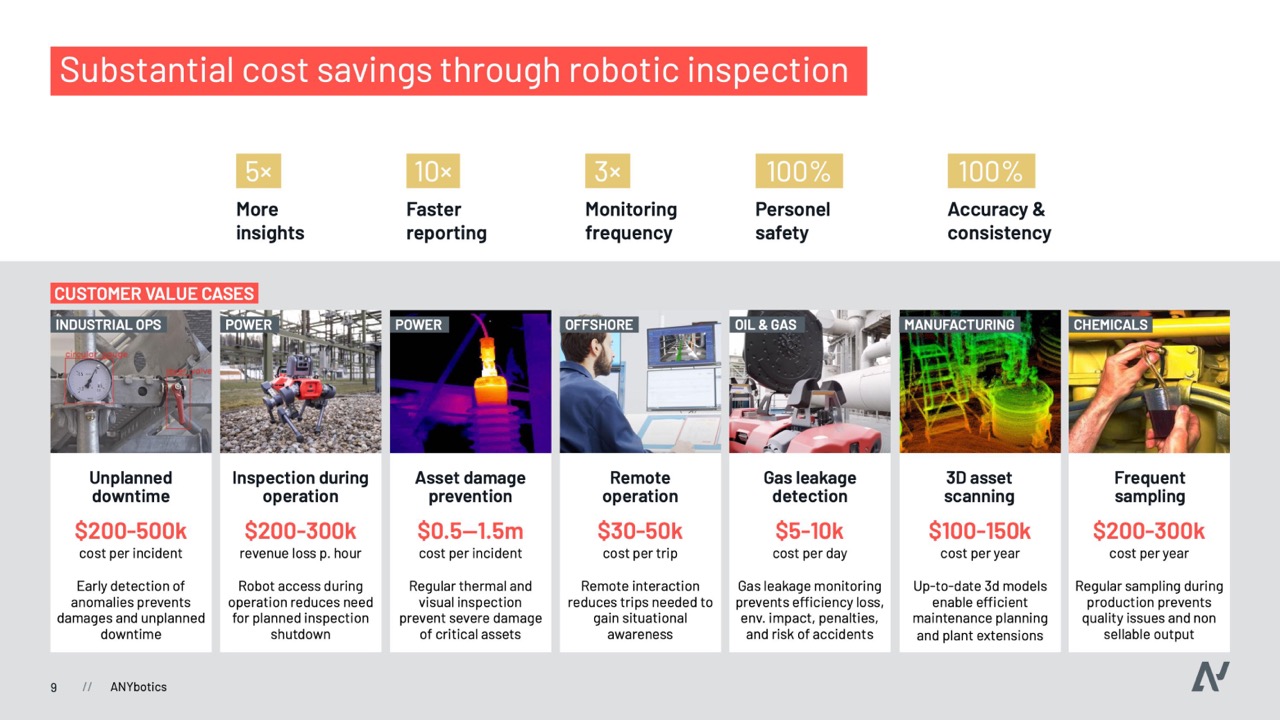

[Slide 9] That’s a variety of use instances. Picture Credit: ANYbotics

If this slide had proven up in an early-stage deck, I’d have lambasted the corporate for an entire lack of focus. However this isn’t a pre-product firm hand-waving and saying, “Eh, there’s tons of alternatives, I assume.” It is a firm elevating $50 million to spur development. Assuming ANYbotics has a strong go-to-market technique for every of those worth propositions, this slide communicates the utility of autonomous, all-purpose robots that can be utilized in a ton of conditions the place not using a robotic will be pricey, pose security dangers, or each.

Additionally: Together with the worth propositions within the slide helps deliver the dimensions of the market to life and illustrate among the development alternatives.

I’d have cherished to see a slide in regards to the pipeline for promoting to those prospects to go along with this one, but it surely’s potential that a few of that info is on the redacted slides. However as a startup, in case you’re saying just about everybody may very well be your buyer, you’d finest be ready to again it up and clarify the way you’re going to succeed in “everybody.”

IT’S OVER NINE THOUSAND

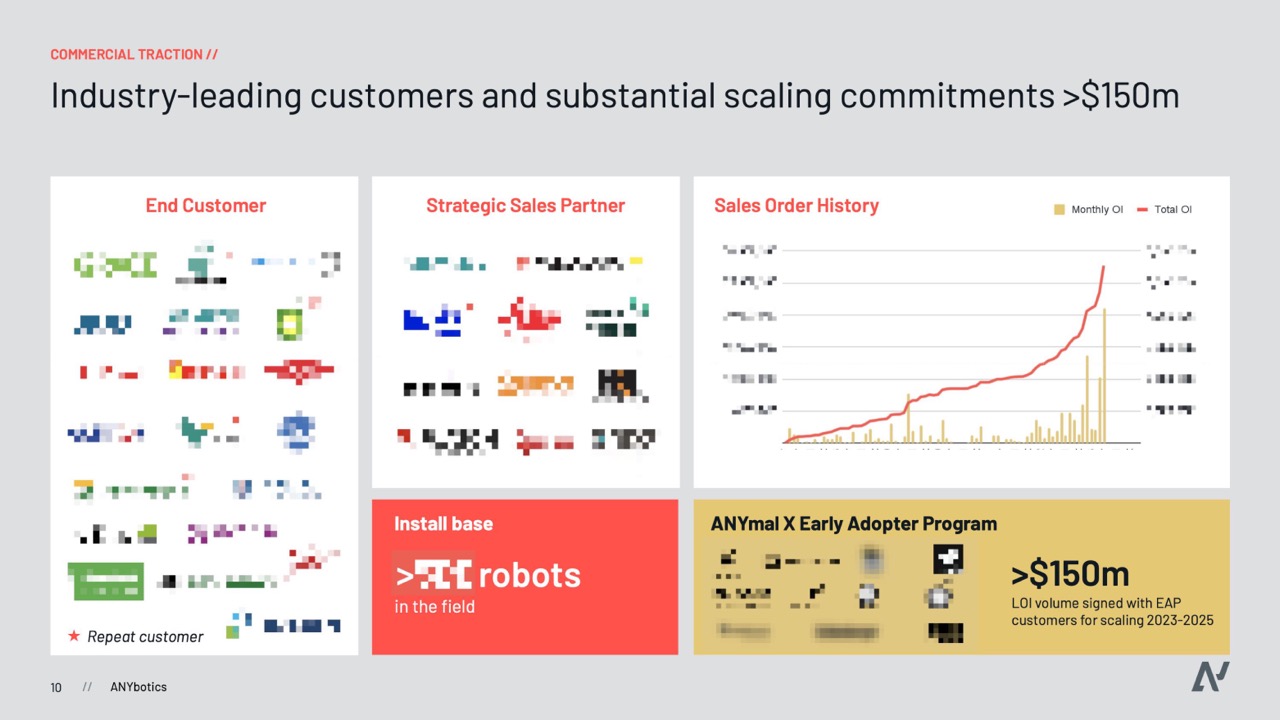

Forgive the meme, however I needed to share this closely redacted slide and what I seen:

[Slide 10] Expo-bloody-nential for the win. Picture Credit: ANYbotics

As anticipated, ANYbotics raised this development spherical primarily based on beefy traction. Have a look at the month-to-month and complete working earnings graph on the highest proper: Over the course of its historical past, the corporate has seen suits and bursts of gross sales and earnings, however issues went just a little foolish within the final 20% of the graph.

You have got robust traction and a option to proceed that traction. The place do I ship my funding verify?

I might have informed this story in a different way. As a substitute of cramming this slide with logos and gross sales companions, I’d have featured the gross sales order historical past up entrance and backed it up with a way of exhibiting that the exponential development isn’t a fluke, however the results of a repeatable gross sales method.

Once you inform the story that manner, it nearly doesn’t matter what the remainder of the deck says. You have got robust traction and a option to proceed that traction. I count on that ANYbotics goes into extra element on this entrance on slide 16, and if I have been a possible investor, I’d discover myself asking a vital query: The place do I ship my funding verify?

In the remainder of this teardown, we’ll check out three issues ANYbotics may have improved or performed in a different way, together with the corporate’s full pitch deck!

Three issues that may very well be improved

An essential a part of elevating development funding is exhibiting the way you’re going to attain that development. Sadly, and maybe understandably, the corporate redacted among the slides that assist us get the complete image of that development (slide 17, particularly). Nonetheless, studying between and across the traces, I can spot some issues that may profit from a tune-up.