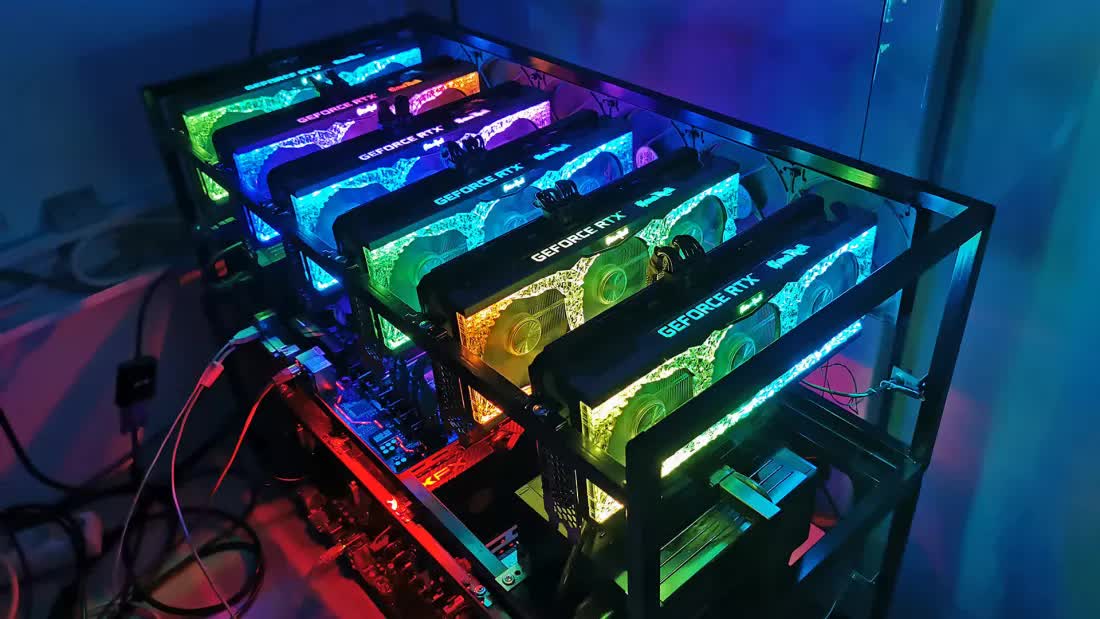

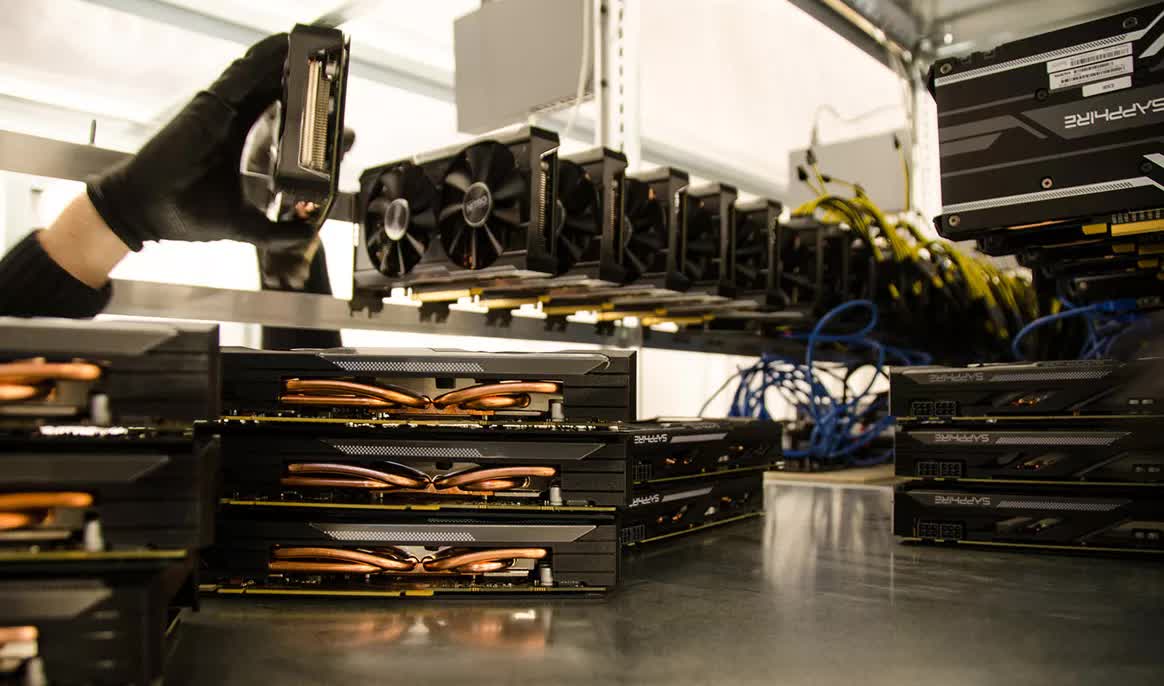

Facepalm: The SEC issued a $5.5 million tremendous to Nvidia after figuring out it did not declare essential gross sales knowledge in its 2017-2018 income stories. The slap-on-the-wrist penalty was accompanied by a proper assertion that Nvidia didn’t disclose cryptomining as a major supply of its income development through the interval in query, thereby depriving potential buyers of essential info.

The Securities and Trade Fee’s (SEC) Could 6 press launch cited Nvidia for “Insufficient Disclosures about Affect of Cryptomining.” The SEC alleges that Nvidia didn’t report their elevated crypto-based gross sales as required by Kind 10-Q, as a substitute attributing the rise to gaming-related development.

The omitted gross sales info and fluctuations left buyers with an incomplete image of the corporate’s efficiency, which is essential to analyzing enterprise threat and funding potential. Nvidia didn’t affirm or deny the allegations of improper disclosure and agreed to a cease-and-desist order accompanied by a $5.5 million penalty.

Brent Wilner, a member of the SEC’s Crypto Belongings and Cyber Unit, led the investigation into the corporate’s filings and historical past. The information comes on the heels of the SEC doubling the scale of the enforcement unit, which focuses on crypto belongings, exchanges, crypto lending, decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and stablecoins. Wilner discovered that Nvidia violated Part 17(a)(2) and (3) of the Securities Act of 1933 and the disclosure provisions of the Securities Trade Act of 1934.

The large enhance in gaming income throughout as little as a single fiscal quarter was an apparent crimson flag for investigators. Nvidia’s 2018 filings supported the regulator’s dedication. That yr the corporate reported $9.714 billion in income and attributed roughly half of that whole to gaming. What does this all imply in plain English? Nvidia began earning profits hand over fist through the 2017/2018 mining growth, they usually weren’t forthcoming about “how” they made it.

Whereas the investigation seems to be a win for customers and buyers who anticipate transparency from corporations they assist, the multi-million-dollar penalty shouldn’t be more likely to curb Nvidia’s present plans or general operations. Earlier this yr, Nvidia launched its monetary outcomes for the fourth quarter and financial yr 2022. The inexperienced large recorded quarterly revenues of $7.64 billion (a 53% enhance) and record-breaking revenues of $26.92 billion (a 61% enhance). Primarily based on these numbers, the corporate can take in the hardly noticeable $5.5 million settlement cost with out batting an eye fixed.