A US district decide has ordered Ripple to reveal XRP’s monetary and institutional gross sales knowledge, a big victory for the SEC amid allegations of unregistered gross sales.

A U.S. district decide has not too long ago made a big ruling within the ongoing authorized battle between the Securities and Alternate Fee (SEC) and Ripple, ordering Ripple to reveal extra detailed monetary data and knowledge on its institutional gross sales of XRP. This choice is seen as a victory for the SEC, which has been in a lawsuit with Ripple for over three years. The lawsuit facilities round allegations that Ripple engaged in unregistered gross sales of its XRP token, a declare Ripple has contested.

The court docket’s order particularly requires Ripple to offer monetary statements for the years 2022 and 2023, together with contracts governing institutional gross sales of XRP that occurred after the SEC filed its criticism in opposition to Ripple. This data is deemed essential for figuring out the suitable penalties within the case, because the court docket seems to determine whether or not Ripple’s institutional gross sales of XRP have been in violation of securities legislation. The ruling follows a earlier choice by Decide Analisa Torres of the Southern District Court docket of New York, which discovered that whereas XRP gross sales to institutional traders constituted illegal securities gross sales, gross sales to retail traders didn’t fall underneath this categorization.

Ripple had argued that the corporate’s monetary well being was irrelevant to the lawsuit, a place the court docket finally rejected. The court docket agreed with the SEC that the data on post-complaint institutional gross sales of XRP is related to deciding on potential authorized cures, which can embody injunctions and civil penalties. This growth is a part of a broader SEC enforcement marketing campaign in opposition to main U.S. cryptocurrency exchanges and highlights ongoing regulatory challenges confronted by the crypto business.

The trial between Ripple and the SEC is ready to begin in April 2024, marking a crucial juncture in a case that has drawn vital consideration from the cryptocurrency neighborhood and regulators alike. Ripple’s authorized group has criticized the SEC’s strategy in the direction of the crypto business, framing it as excessively aggressive. The end result of this case might have wide-reaching implications for the regulation of digital property in america.

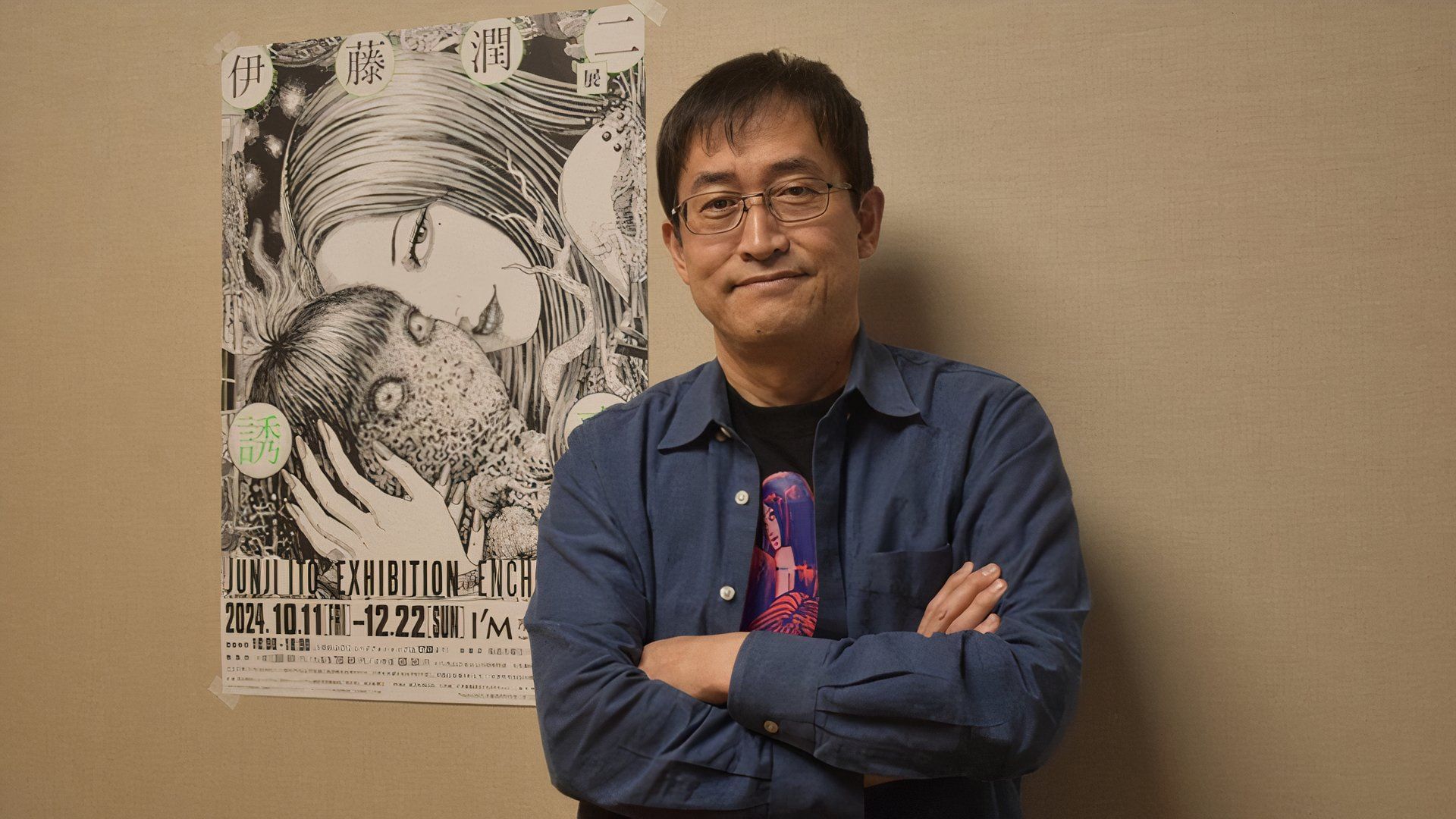

Picture supply: Shutterstock