On-chain knowledge reveals that Litecoin merchants are displaying indicators of capitulation because the asset’s much-anticipated halving occasion is only some hours away now.

Is Litecoin Halving A Purchase The Rumor, Promote The Information Occasion?

The “halving” right here refers to a periodic occasion the place Litecoin’s block rewards (that’s, rewards that miners obtain for mining blocks) are completely minimize down in half.

This occasion takes place roughly each 4 years and the following one, which might be the third, is scheduled to occur in round 5 hours if knowledge from the mining platform NiceHash is to go by.

The LTC halving is only some hours away now | Supply: NiceHash

This third halving occasion will cut back the cryptocurrency’s block rewards from 12.5 LTC to six.25 LTC. Traditionally, these occasions have been necessary for the asset, as they mark factors the place the cryptocurrency’s manufacturing fee (which is nothing however the block rewards, as miners releasing these cash is the one method to mint new LTC) shrinks, and therefore, the coin turns into extra scarce.

As these halving occasions are so vital, the market naturally speculates round them, resulting in the coin experiencing volatility. In a brand new tweet, the on-chain analytics agency Santiment has revealed how the merchants have been behaving in anticipation of at this time’s Litecoin halving.

The information for the 2 indicators | Supply: Santiment on X

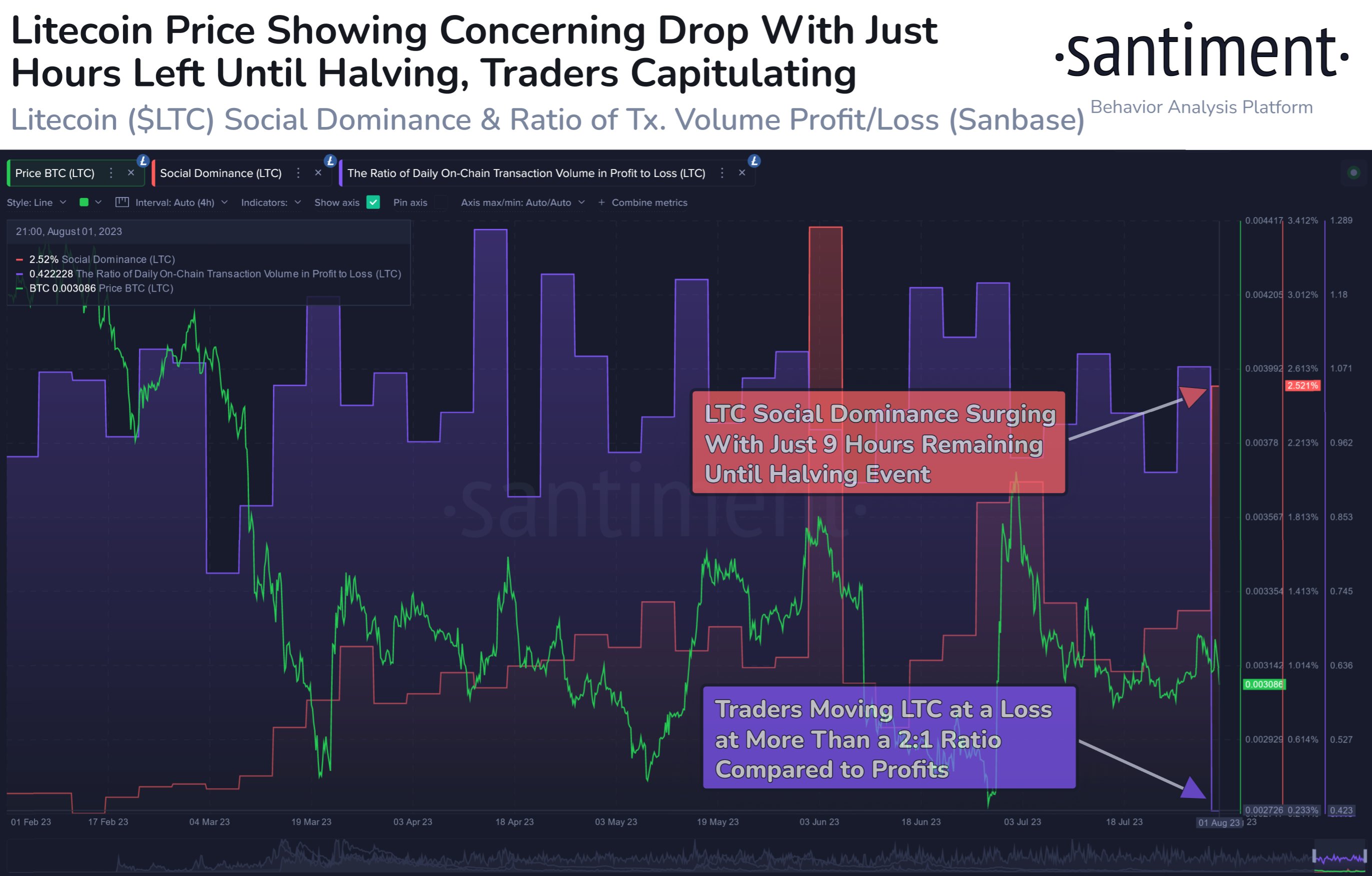

Within the above graph, Santiment has connected the info of two metrics associated to LTC: “social dominance” and the “ratio of on-chain transaction quantity in revenue to loss.”

The previous of those tells us what share of debate on social media associated to the 100 largest property within the cryptocurrency sector is coming from Litecoin alone.

From the chart, it’s seen that this indicator has noticed a big spike at this time, displaying that buyers are collaborating in a lot of discussions associated to at this time’s halving.

The opposite indicator retains observe of the ratio between the profit-taking and loss-taking volumes on the community. As displayed within the graph, this metric has taken a plunge beneath the 1 mark just lately.

The ratio being lower than 1 implies that loss-taking is the dominant drive available on the market for the time being. The loss quantity isn’t solely greater than the revenue quantity proper now, nevertheless it’s truly outweighing it at a ratio of greater than 2:1.

This extraordinary loss-taking could also be coming from the buyers who bought cash forward of the halving believing it to be a bullish occasion, however as Litecoin has solely gone down decrease just lately, the holders have panicked and are promoting at losses in an try and keep away from going additional underwater. The excessive social dominance of the asset may likewise be due to FUD-related discussions blowing up.

Primarily based on these indicators, it’s attainable that Litecoin could also be going by a basic “purchase the rumor, promote the information” occasion.

LTC Value

On the time of writing, Litecoin is buying and selling round $91, up 1% within the final week.

Seems just like the asset has gone down throughout the previous day | Supply: LTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web