Information reveals the sharks and whales of the biggest stablecoins have been accumulating, one thing that will develop into bullish for Bitcoin.

Sharks & Whales Have Been Loading Up On Stablecoins Just lately

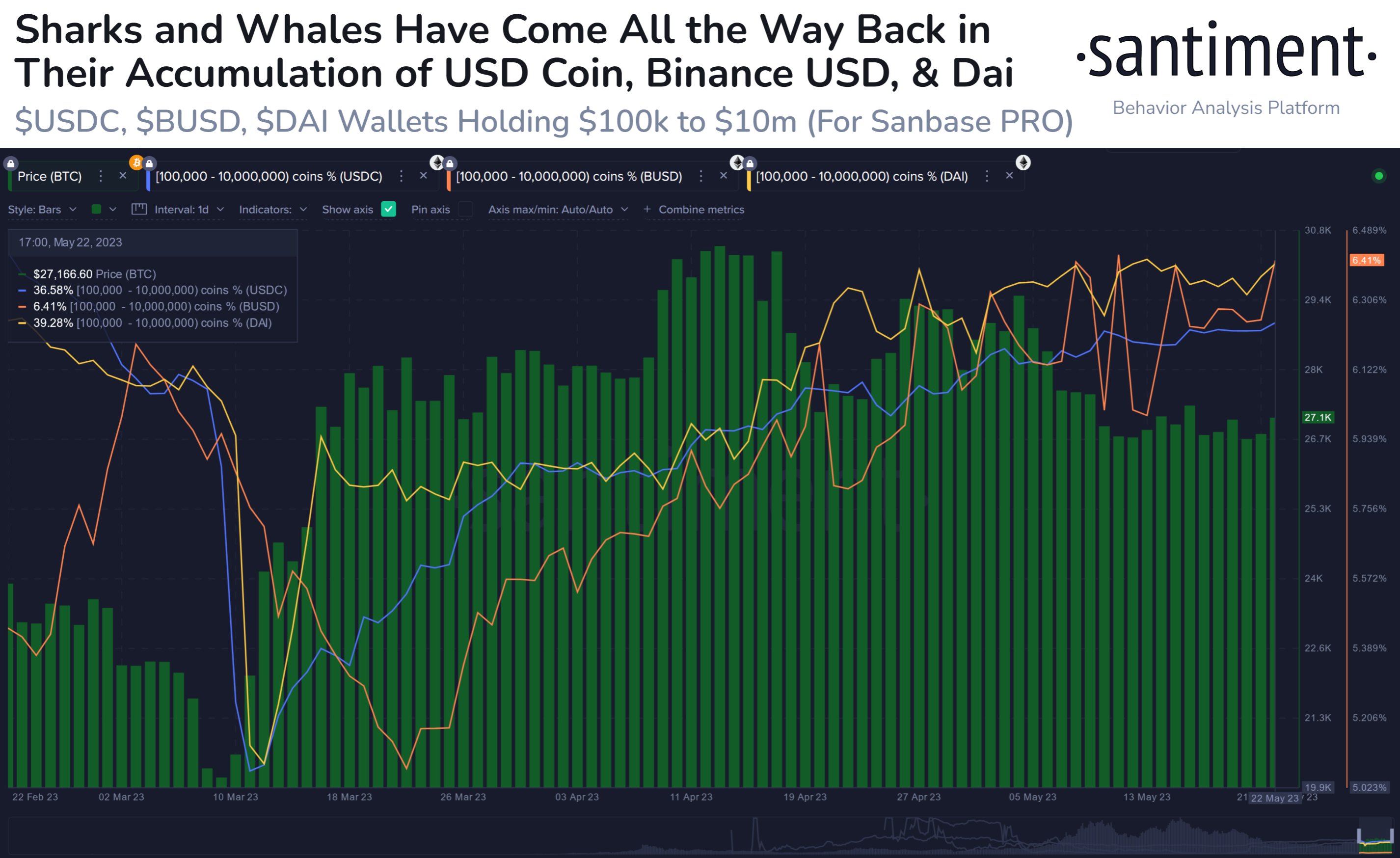

In response to information from the on-chain analytics agency Santiment, the sharks and whales have not too long ago improved their share of the whole provide of stablecoins like USD Coin (USDC), Dai (DAI), and Binance USD (BUSD).

The related indicator right here is the “Provide Distribution,” which tells us what share of a cryptocurrency’s whole circulating provide is being held by which pockets group available in the market.

Addresses are divided into these “pockets teams” based mostly on the whole variety of tokens that they’re holding in the meanwhile. Within the context of the present dialogue, the 100,000 to 10 million cash cohort is of curiosity.

This group naturally contains the wallets of all of the buyers who’re carrying a steadiness of no less than 100,000 and at most 10 million tokens. Because the belongings in query listed here are USD-pegged stablecoins (which means that their worth is fastened at $1), the bounds of this vary convert to $100,000 and $10 million, respectively.

As these quantities are huge, solely the biggest of the buyers available in the market could be sitting on these addresses. The sharks and whales are two such cohorts which can be giant sufficient to cowl these wallets.

These teams may be fairly influential available in the market, as they’ve the ability to maneuver a notable quantity of cash without delay. Clearly, the whales could be the extra essential group of the 2, as they’re the bigger cohort.

Now, here’s a chart that reveals the pattern within the Provide Distribution of those sharks and whales for 3 of the preferred stablecoins within the sector:

All three of those provides appear to have gone up in current weeks | Supply: Santiment on Twitter

As displayed within the above graph, the provides of those three stablecoins hit a low again in March, however have since then noticed a rise. Which means sharks and whales of the respective tokens have been accumulating throughout this era.

Typically, buyers use stables each time they wish to keep away from the volatility related to different belongings like Bitcoin. So, sharks and whales selecting up these cash could be a signal that they’ve been exiting the opposite belongings not too long ago.

Finally, nevertheless, such buyers who’ve taken secure haven in stablecoins could alternate these tokens again for the unstable cash, as soon as they really feel that costs are proper to leap in.

Each time these holders swap their stables, the costs of the belongings that they’re shifting into can naturally observe a shopping for strain. This means that the at present piled-up stablecoin provides of the sharks and whales may be checked out because the potential dry powder that could be deployed into belongings like Bitcoin.

Within the final couple of weeks, the USDC, DAI, and BUSD provides of those humongous holders have flatlined, which means that they could have slowed down their exit from the unstable cash. If the pattern now reverses and so they begin scooping up the opposite cryptocurrencies with their stables, BTC may probably really feel a bullish impact.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,700, down 1% within the final week.

BTC has erased the beneficial properties from yesterday | Supply: BTCUSD on TradingView

Featured picture from NOAA on Unsplash.com, charts from TradingView.com, Santiment.internet