As November unfolds, the Shiba Inu value motion hangs within the steadiness, with technical evaluation revealing a battleground of resistance and assist ranges that would decide the path of the meme coin within the coming weeks. Nonetheless, the bullish indicators are presently robust and will level to a continuation of the rally within the brief time period.

Shiba Inu Value Evaluation: Weekly Chart

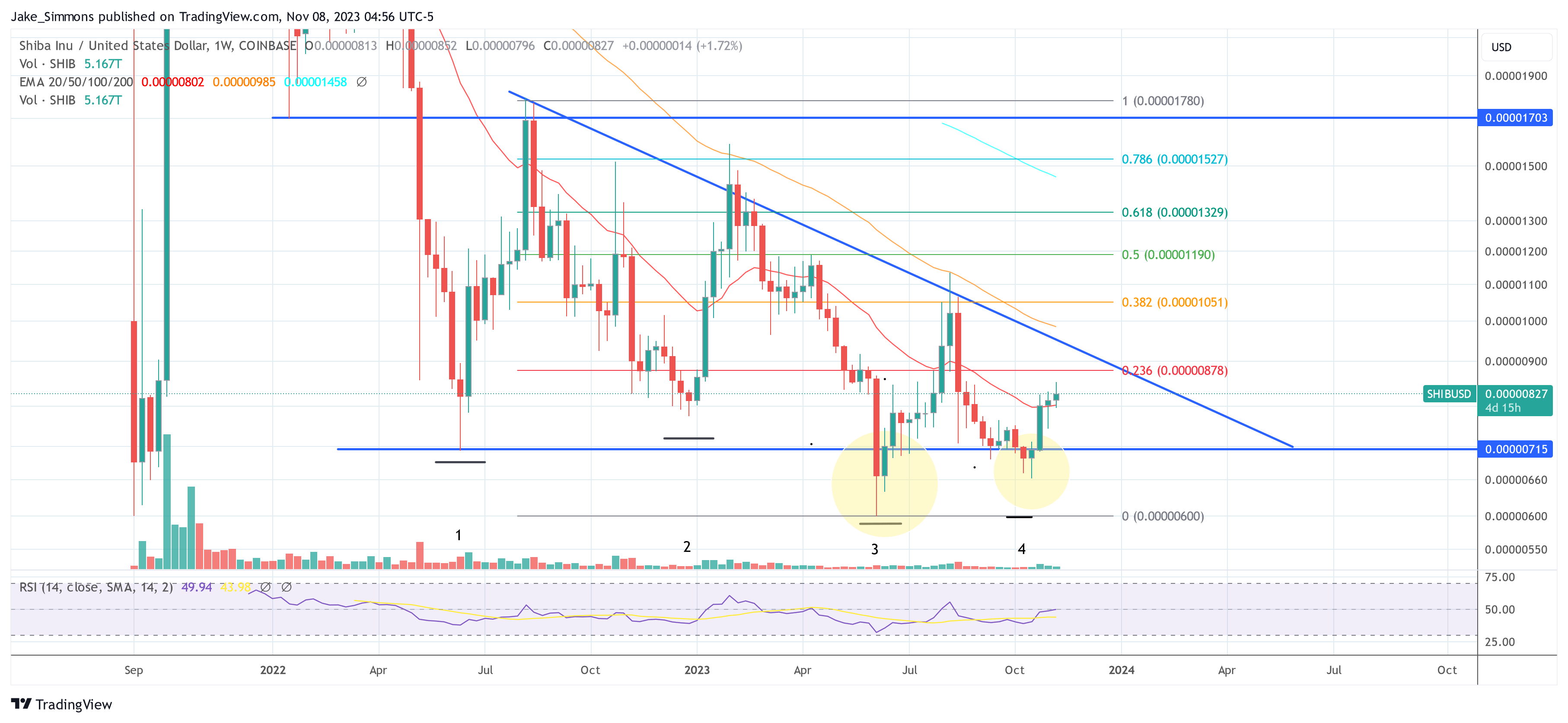

The SHIB/USD weekly chart illustrates a dynamic battle between bullish and bearish forces. A quadruple backside sample, evident at assist ranges labeled 1, 2, 3, and 4, demonstrates a constant rebound inside a two-week timeframe. This sample signifies a resolute protection by the bulls, providing a sign that signifies a stable base within the vary of $0.000006 to $0.000007.

In distinction, the descending triangle sample poses a bearish menace. The flat assist line at $0.00000715 and the sloping blue pattern line connecting decrease highs depict a narrowing area for the bulls, suggesting a possible lower in shopping for momentum. The amount profile helps this, with notable declines accompanying the touches of the descending pattern line.

After rising above the 20-week EMA (purple line), SHIB is going through the 0.236 Fib degree at $0.00000878. Overcoming this resistance is pivotal for SHIB to claim bullish dominance and try to interrupt the descending pattern line simply above $0.00000900. A profitable breach might see the value intention for the 50-week EMA at $0.0000985 and subsequently the 0.382 Fib degree at $0.00001051, a transfer that might signify a considerable reversal from the prevailing downtrend within the long-term value chart.

Notably, the EMAs on the weekly chart point out a nonetheless bearish sentiment with the longer-term transferring averages positioned above the shorter-term ones, hinting at a sustained bearish pattern. Nonetheless, the latest value uptick might point out an early signal of a shift in momentum if sustained.

Day by day Chart Insights

The each day chart gives a extra granular view of SHIB’s latest value motion. The 20-day EMA has crossed above the 50 and 100-day EMAs, a bullish signal that would foresee additional upside. The each day RSI can also be on an uptrend, which aligns with the present bullish narrative, suggesting there’s room for upward motion in November.

Nonetheless, a latest rejection on the 0.382 Fib degree ($0.00000844) and a slip beneath the 200-day EMA ($0.00000836) at first of the week launched warning into the bullish case. The 200-day EMA, a essential long-term indicator of momentum, has traditionally acted as a decisive pivot level for SHIB.

The value fluctuation round this line and subsequent exams of the descending pattern line underscore its significance. A breach above the 200-day EMA might sign the beginning of a rally, doubtlessly propelling SHIB by an estimated 13% in direction of the overhead resistance posed by the descending pattern line.

At present, SHIB is buying and selling barely beneath the 200-EMA. Remarkably, SHIB attacked the pattern line of the ascending triangle (blue line) sample within the weekly chart every time it surpassed the 200-day EMA. Notable can also be that this all the time occurred inside one week.

Thus, the 200-day EMA appears to be essentially the most essential resistance within the brief time period. If Shiba Inu breaks above the indicator, the value might rally roughly 13% to the blue pattern line of the ascending triangle sample.

Afterward, the Shiba Inu value might then make its ninth try within the final 15 months to interrupt out of the big triangle sample. This will likely be one other make-or-break second for SHIB, both huge bullish momentum is unleashed or the Shiba Inu value might fall once more towards the neckline of the descending triangle at $0.00000715.

Featured picture from Crypto.com, chart from TradingView.com