On September 27, 2024, the general cryptocurrency market skilled a worth reversal amid this Shiba Inu (SHIB) outperformed main cryptocurrencies with its spectacular efficiency. In keeping with the coinmarketcap information, SHIB has skilled a big worth surge of over 20% within the final 24 hours and is at the moment buying and selling close to the $0.0000187 stage.

SHIB Present Efficiency

Throughout the identical interval, its buying and selling quantity has skyrocketed by 220%, which signifies vital participation from merchants and traders amid the latest breakout. With this vital worth, you is perhaps questioning whether or not the SHIB worth rally will proceed or if we might even see a worth correction within the coming days.

Shiba Inu Technical Evaluation and Key Ranges

In keeping with CoinPedia’s technical evaluation, with its spectacular worth soar, SHIB just lately gave a breakout of an extended descending trendline and reached a robust resistance stage of $0.000020. If it breaks by way of this hurdle and closes a each day candle above the $0.0000213 stage, SHIB may soar by 35% to succeed in the $0.0000285 stage and even greater if the sentiment stays unchanged.

Moreover, SHIB is at the moment buying and selling above the 200 Exponential Shifting Common (EMA) on a each day timeframe, indicating an uptrend. This breakout and the worth above the 200 EMA have shifted the general market sentiment.

This breakout seems to be a robust bullish breakout for SHIB and has created bullish hope amongst traders and merchants, because it has been in a downtrend since March 2024.

Bullish On-Chain Metrics

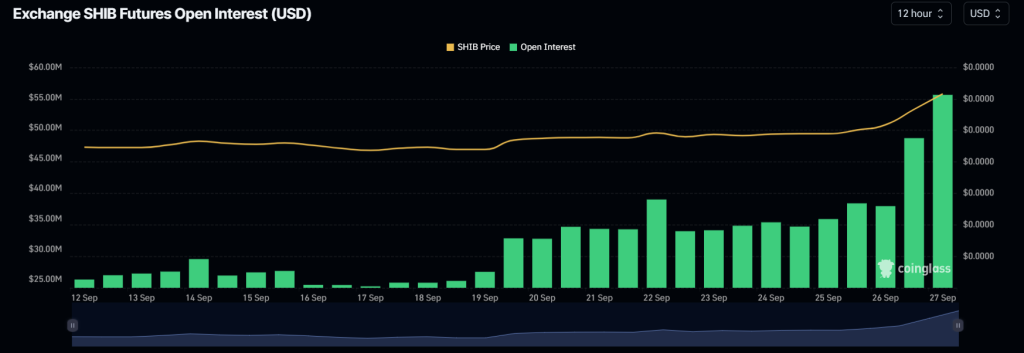

As of now, Coinglass’s SHIB Lengthy/Brief ratio at the moment stands at 1.015, indicating bullish market sentiment amongst merchants. Moreover, its future open curiosity has skyrocketed by 39%, probably indicating that bulls are betting extra on lengthy positions than quick ones.

Merchants usually take into account the mixture of rising open curiosity and an extended/quick ratio above 1, when constructing lengthy positions. At present, 50.53% of prime merchants maintain lengthy positions, whereas 49.47% maintain quick positions.