Este artículo también está disponible en español.

Like most digital belongings, Ethereum witnessed a correction this week by dropping over 5% within the final 24 hours whereas buying and selling simply above $2,500. Whereas the elevated on-chain exercise may ultimately make the bulls wager for the bounce again of Ether, just a few specialists differ with this angle.

Crypto veteran analyst Peter Brandt predicts additional downfall in Ether to the extent of lack of over 60% from its current worth, with no indication of fixing.

At the moment, Ether is buying and selling at a 42-month low. Whereas Bitcoin re-tested the $70k mark early this week, Ether maintains a sluggish worth motion and is just too far off from the specialists’ goal of $4k.

Associated Studying

Ether’s Robust Bearish Motion

Ethereum trades at its 42-month low in opposition to the world’s high digital asset, which suggests a bearish momentum. Zooming out of the worth chart, Ethereum is on a downward spiral and a painful market correction for holders and buyers.

In line with Brandt, Ethereum’s bearish sentiment will proceed with no reassuring indicators of reversal.

Attention-grabbing to notice that there was not a purchase sign in $ETH

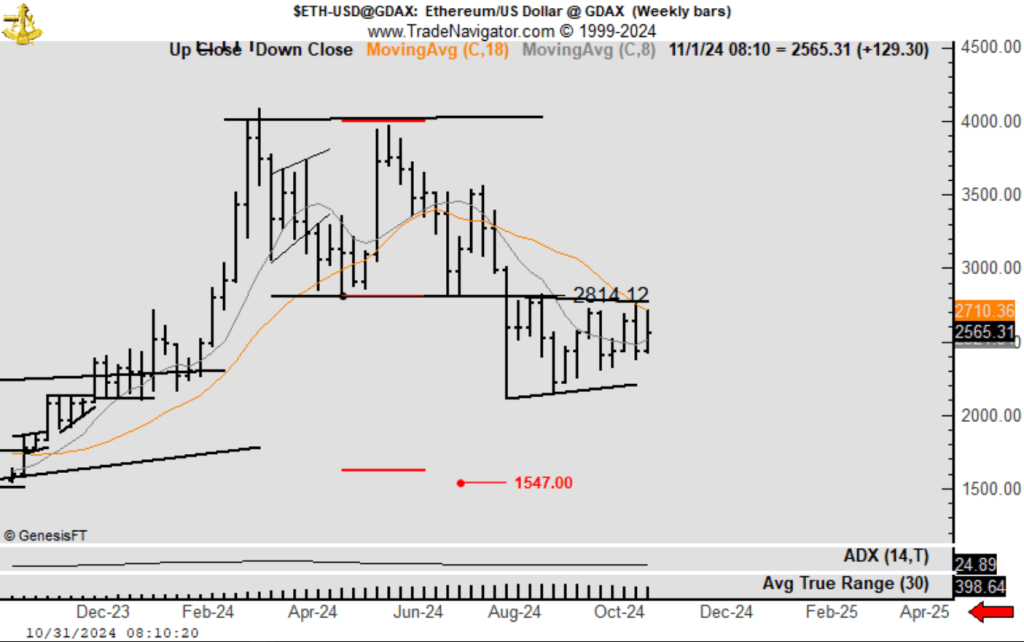

The truth is, chart stays bearish with unmet goal at 1551 pic.twitter.com/sjkXyTQXU2— Peter Brandt (@PeterLBrandt) October 31, 2024

In a Twitter/X submit, Brandt shared a graph saying there’s no however sign for Ether. He added that Ethereum’s chart is bearish, with the bulls making it tough to hit the $1,551 goal.

The 1-day-chart highlights the asset’s continued bearish second momentum that began final August, characterised by a descending channel. Ethereum’s bearish flag is horrible information for merchants and holders, suggesting a continued downtrend.

Analyst Sees Bearish Metrics For Ethereum

Apart from the bearish alerts on the graph, Brandt additionally famous just a few discouraging metrics for Ethereum. For instance, Ether has dropped by over 5% over the past 24 hours, registering a sharper decline than Solana, at -4.91%, and Bitcoin, at -3.87%.

Additionally, Brandt famous that the ETH/BTC buying and selling ratio dipped to 0.03613, a 42-month low, as BTC continues to guide the broader crypto market. Though Ethereum is at the moment priced at $2,507, Brandt sees the asset dipping even additional to $1,551, reflecting a attainable 62% decline from its present worth.

$1,551 As Ethereum’s Unmet Goal

Brandt sees $1,551 because the asset’s unmet goal and a key milestone. In his evaluation, this stage serves because the holders’ level of capitulation. The latest dips in worth have affected buyers’ and holders’ confidence, with Ethereum struggling to maintain the $2,400 assist.

Associated Studying

Because the second greatest crypto, Ethereum has displayed preliminary indicators of a rally. Many observers have predicted a market rally, concentrating on a long-term worth of $6,000. Brief-term estimates put Ethereum’s worth at $2,750.

Nevertheless, Brandt gives a extra bearish outlook for Ethereum, saying that the asset will go downhill until a brand new set of technical indicators emerges.

Featured picture from Tokpie, chart from TradingView