A broadly adopted crypto strategist says a brief squeeze might materialize for an altcoin venture that simply suffered a $41 million hack.

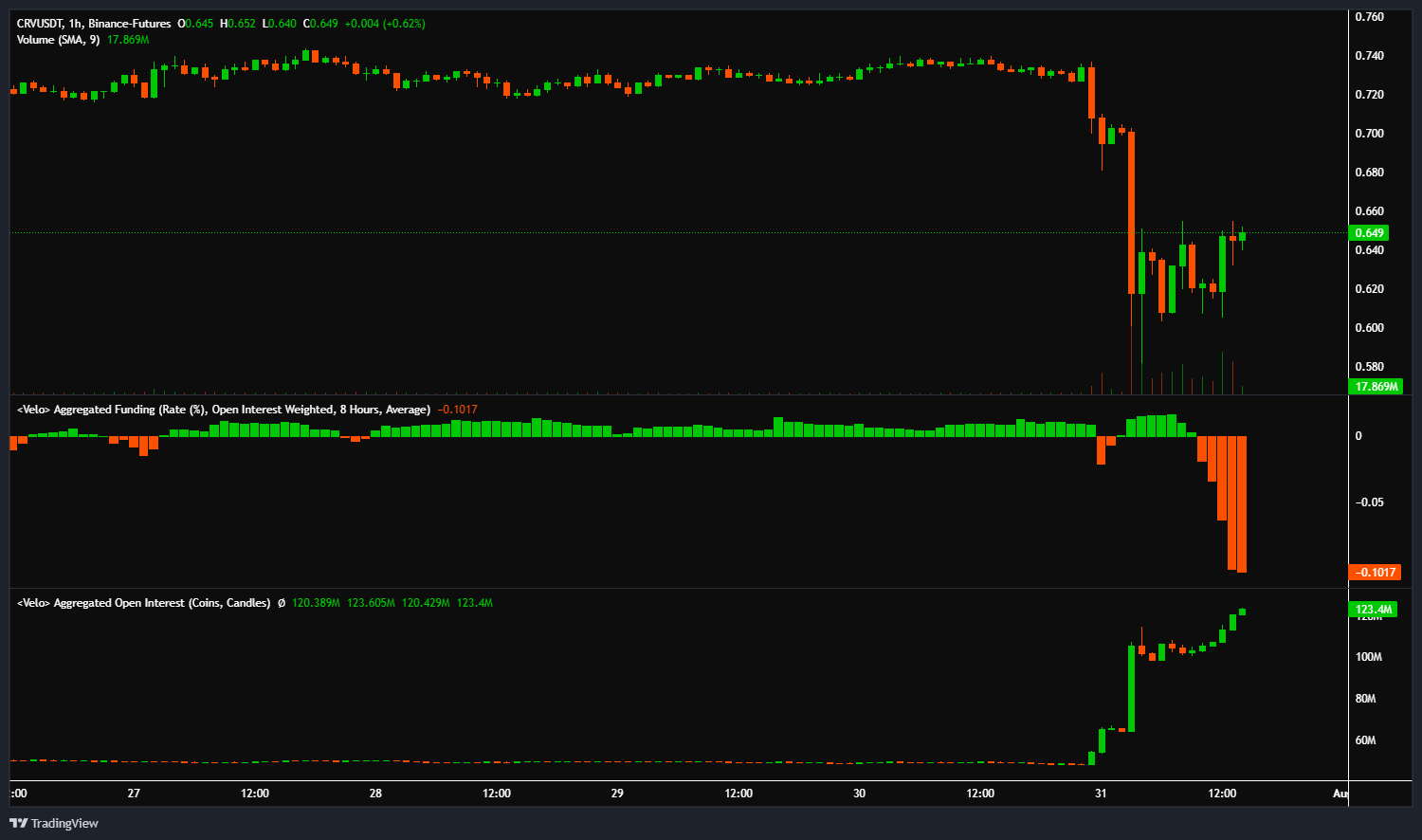

Pseudonymous analyst Credible Crypto tells his 343,200 Twitter followers that Curve (CRV) is experiencing an enormous quantity of quick curiosity.

Nevertheless, the analyst says that if the native token on the decentralized finance (DeFi) Curve platform doesn’t quickly transfer additional down from its present worth it might set off a brief squeeze.

A brief squeeze occurs when merchants who borrow an asset at a sure worth in hopes of promoting it for decrease to pocket the distinction are compelled to purchase again the property they borrowed as momentum strikes in opposition to them, triggering additional rallies.

“Additionally value noting the huge enhance in shorts down at these ranges. Whereas one other swing down looks as if the plain transfer to me (and clearly many others) the excessive quick curiosity right here might facilitate a squeeze in the wrong way if we don’t transfer down quickly. The following couple of days can be fascinating to say the least.”

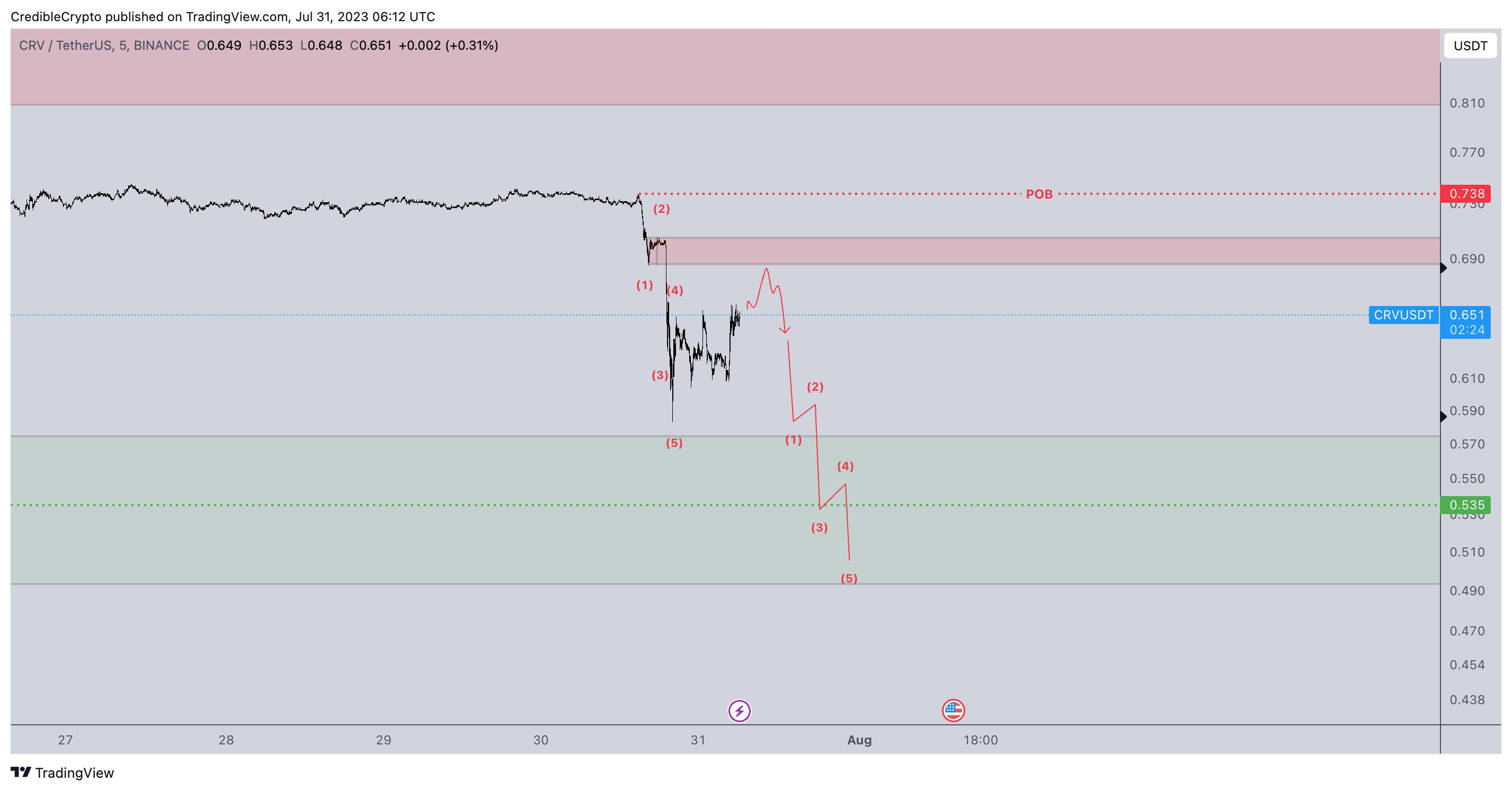

In accordance with the dealer, CRV might decline from its present worth at time of writing of $0.59 to $0.49, a 17% lower. He makes use of the Elliott Wave principle, which states that the principle pattern of the value motion of an asset happens in a five-wave sample to reach at his backside worth goal.

“Whereas the mud could also be beginning to decide on the latest CRV occasions, we’re nonetheless ready on a few wild playing cards that must be addressed earlier than we will return to focusing completely on the charts. These points are most likely addressed within the subsequent 48-72 hours.

Within the meantime and from a purely technical perspective, I don’t assume our drop is completed but. If we will get again above the RED ZONE and level of breakdown (POB) then it doubtless is, however till then I count on that this transfer down just isn’t but full – and searching for a push into the GREEN zone beneath for now. This is similar zone I highlighted in my prior chart a few month in the past – so the degrees haven’t modified. Let’s see how issues develop over the subsequent couple days.”

Curve said on Sunday that due to a vulnerability with the programming language Vyper 0.2.15, a number of liquidity swimming pools on the platform had been exploited. Customers within the affected swimming pools had been informed to withdraw their funds.

Blockchain safety infrastructure agency BlockSec estimates the hack resulted in a theft of greater than $41 million.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney