Este artículo también está disponible en español.

Solana (SOL) hit one other file: Immediately, it has over 75 million month-to-month lively addresses. The surge speaks to rising recognition of the community, particularly in areas like developer and consumer exercise throughout the decentralized purposes (dApps), DeFi, and NFT sectors.

Associated Studying

With such a rise in Solana’s actions, the platform stretches even additional away from others because it stays some of the scalable and environment friendly blockchains out there.

Regardless of this constructive momentum, latest market exercise has seen vital volatility for SOL. On September 18, Solana skilled $121,000 in brief liquidations and almost $3.20 million in lengthy liquidations, with Binance seeing the vast majority of the lengthy positions liquidated. This heavy liquidation of lengthy positions indicators that merchants could be cautious in regards to the near-term worth actions of Solana.

Supply: Artemis

Value Forecast Exhibits Potential

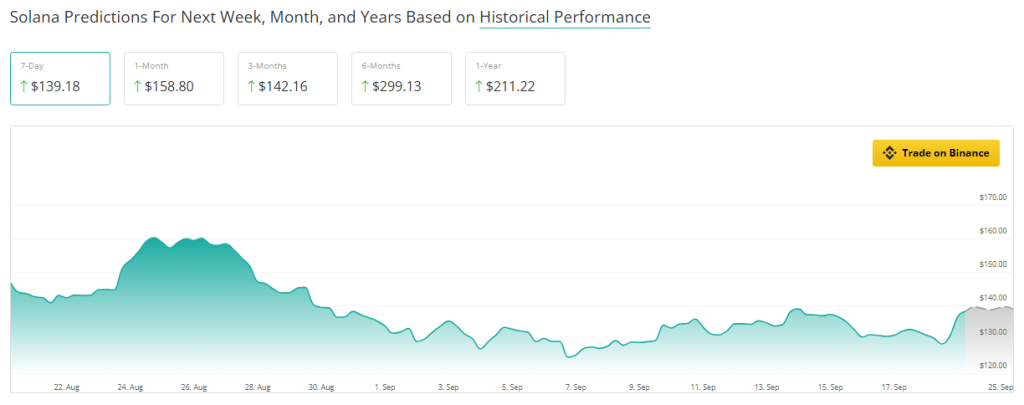

Whereas short-term volatility is a priority, Solana’s worth forecast factors to a brighter future. Presently, SOL is buying and selling 14.59% beneath its estimated worth for subsequent month, indicating short-term bearish strain. Nevertheless, the worth is predicted to develop by 2.59% over the following three months, with even stronger progress anticipated additional down the street.

In six months, Solana’s worth might surge by 115%, with a 52% enhance projected over the following yr. This means that although the short-term future shouldn’t be so promising, Solana is a giant funding prospect within the long-run.

On the time of writing, SOL is buying and selling at $141.21 up 10.1% and 4.1% within the each day and weekly timeframes, knowledge from Coingecko exhibits.

Surge In Consumer Exercise

One of many key components why Solana has sturdy potential is that it has an more and more rising consumer base. Lively addresses on the community elevated exponentially, from mid-2023, and stood at 75.2 million in absolute phrases thus far.

That displays that Solana is scaling nicely and may course of massive volumes of transactions whereas the charges are low; extra builders and customers flocked to the platform, and Solana’s ecosystem continues to develop.

This consumer progress isn’t only a short-term phenomenon. The launch of latest options and updates within the coming months might additional speed up adoption, significantly within the DeFi and NFT areas the place scalability is a key issue.

Associated Studying

A Community For The Future?

The expansion in lively addresses in addition to the intense worth forecast ought to put Solana on steady floor. Though liquidations and sideways motion in near-term may increase some considerations among the many traders, the long term appears promising.

For now, traders might have to be cautious about short-term volatility, however Solana’s long-term prospects stay strong. These seeking to make investments for the longer term might discover Solana’s present worth entry level earlier than the anticipated progress takes maintain.

Featured picture from Protos, chart from TradingView