Este artículo también está disponible en español.

Solana (SOL) has been using a wave of volatility, not too long ago hitting a brand new all-time excessive of $295 earlier than dropping over 22% amid market fluctuations. Regardless of this sharp correction, SOL has proven resilience by recovering a lot of its losses, leaving buyers optimistic about its potential for additional good points within the coming weeks.

Associated Studying

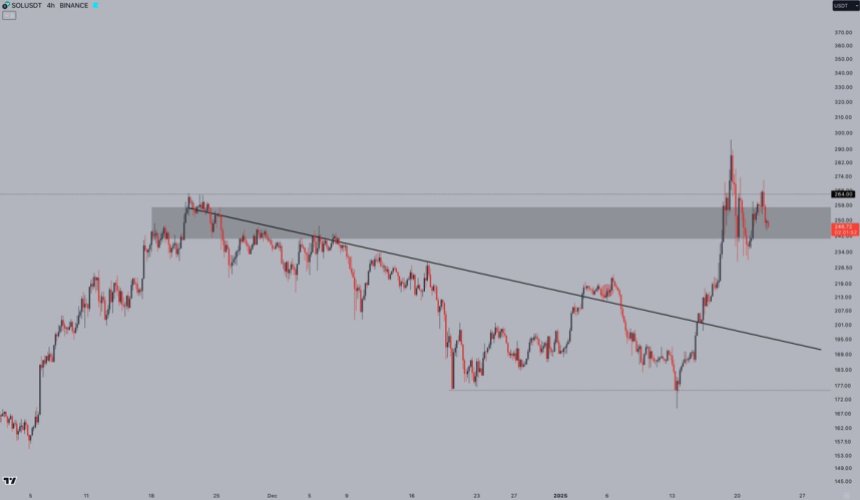

Prime analyst Jelle has weighed in on the scenario, offering an in depth technical evaluation that gives perception into SOL’s present worth motion. In accordance with Jelle, Solana is experiencing “extra violent strikes, as anticipated,” whereas compressing round its earlier all-time highs. This compression is a pure part following such a big rally and is seen as a wholesome consolidation that would set the stage for the subsequent leg greater.

With key ranges holding agency and sentiment enhancing, Solana seems well-positioned for a possible breakout. Buyers are carefully monitoring the market dynamics as SOL prepares for what could possibly be one other main surge.

As one of many standout performers within the crypto market, Solana’s capacity to navigate this volatility and push previous resistance ranges can be essential in figuring out its trajectory within the weeks forward. The approaching days might mark the beginning of a brand new chapter in SOL’s spectacular journey.

Solana Testing Essential Liquidity

Solana has been making headlines with its aggressive worth actions, particularly after breaking its all-time excessive (ATH). Following its spectacular rally, SOL has entered a part of consolidation whereas holding key demand ranges, signaling the potential for sustained bullish momentum. This era of compression is seen as a pure and wholesome a part of the market cycle, particularly after such a powerful upward transfer.

Crypto analyst Jelle not too long ago shared an in depth technical evaluation on X, shedding gentle on Solana’s present market conduct. In accordance with Jelle, SOL has skilled violent worth motion strikes because it compresses proper round its earlier all-time highs. This consolidation part, whereas unstable, is important to construct a strong basis for the subsequent leg greater. Jelle famous that it’s encouraging to see key ranges holding agency, including that it feels prefer it’s solely a matter of time earlier than Solana resumes its bullish trajectory.

Analysts throughout the board stay optimistic about Solana’s outlook, with many predicting that the approaching months can be extraordinarily bullish if SOL can keep its present construction. Holding these key demand ranges is essential to sustaining momentum, and a breakout from this consolidation part might propel Solana into new worth discovery.

Associated Studying

As one of the crucial promising blockchain networks within the crypto area, Solana’s resilience amid aggressive worth motion highlights its energy and rising investor confidence. With technical and basic indicators aligning, Solana is poised to stay a standout performer because the market anticipates its subsequent transfer. The approaching weeks can be pivotal in figuring out whether or not SOL can capitalize on its sturdy basis and ship one other wave of serious good points.

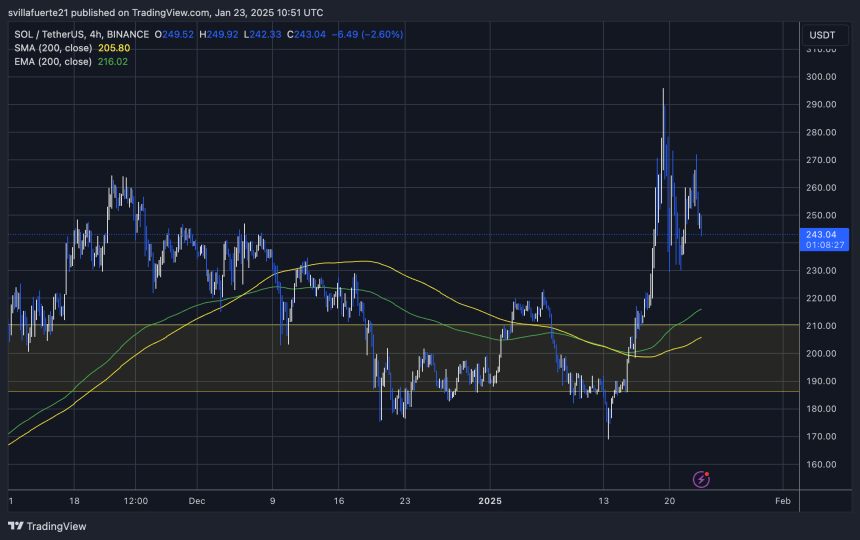

Value Motion Particulars: Key Ranges To Maintain

Solana (SOL) is at the moment buying and selling at $243, down over 10% since yesterday because the broader altcoin market faces promoting stress. This decline comes amid Bitcoin’s consolidation slightly below its all-time excessive (ATH), which has left altcoins struggling to keep up bullish momentum.

For SOL to recuperate and regain upward traction, it’s essential for bulls to defend the present worth ranges. Holding above $243 is essential to stopping additional draw back, whereas a decisive push above the $265 resistance mark would sign a return to energy. Breaking this degree with conviction might reignite investor confidence and set the stage for a renewed rally.

Associated Studying

Nevertheless, the dangers of a deeper correction stay if SOL fails to carry help. A drop beneath $230 would doubtless set off further promoting stress, resulting in prolonged losses and testing decrease demand zones. Such a transfer would problem Solana’s latest bullish construction and delay its possibilities of a restoration.

Featured picture from Dall-E, chart from TradingView.