Solana (SOL), the world’s fifth-biggest cryptocurrency by market cap, is poised for draw back momentum as its each day chart flashes a warning signal. On December 3, 2024, the sentiment throughout the cryptocurrency panorama seems bearish, with belongings struggling to realize momentum.

Solana (SOL) Technical Evaluation and Upcoming Ranges

Amid the value correction part, Solana (SOL) has failed to carry its essential assist degree and has fallen beneath the $227 mark. In accordance with skilled technical evaluation, after hitting its all-time excessive, SOL entered a consolidation part, forming a bearish head-and-shoulders worth motion sample.

In immediately’s bearish, or relatively price-corrective, stance, SOL breached the neckline of the bearish sample and tried to shut a each day candle beneath it. Primarily based on current worth motion and historic momentum, if SOL closes a each day candle beneath the $226 degree, there’s a sturdy chance it might decline by 10% to succeed in the $200 mark within the coming days.

On the optimistic facet, SOL is buying and selling above the 200 Exponential Transferring Common (EMA) on the each day timeframe, indicating an uptrend. In the meantime, the Relative Power Index (RSI) suggests a possible upside rally within the coming days, as its worth is close to the oversold zone.

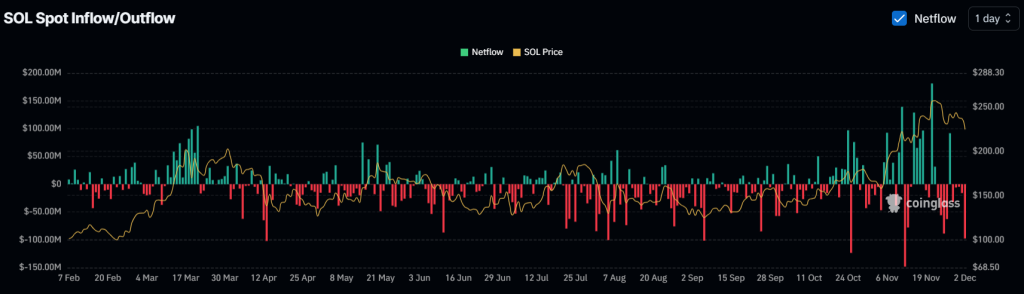

The outflow of $159M SOL

Regardless of the bearish outlook, whales and establishments have proven sturdy confidence and curiosity within the altcoin, based on the on-chain analytics agency Coinglass. SOL’s spot influx/outflow knowledge reveals that over the previous 4 days, exchanges have witnessed a major outflow of $159 million value of SOL.

Within the cryptocurrency context, outflow refers to whales withdrawing tokens from exchanges to their wallets, which is taken into account a bullish signal and suggests a possible upside rally within the coming days.

Contemplating the outflow, evidently SOL buyers could also be capitalizing on the present market sentiment and worth decline by buying extra belongings.

Present Value Momentum

At press time, SOL is buying and selling close to $222, having skilled a 6.55% worth decline previously 24 hours. Throughout the identical interval, its buying and selling quantity surged by 101%, indicating heightened participation from merchants and buyers in comparison with the day past.