The Solana community is struggling to take care of its on-chain exercise amid declining buying and selling curiosity. Just lately, the crypto market witnessed a crash that led to a worth correction for SOL, driving its worth in the direction of help ranges. Though SOL’s worth later rebounded, the continual low on-chain information is inflicting issues amongst buyers concerning the sustainability of this upward motion.

Solana Faces A Drop In New And Lively Addresses

Previously 24 hours, the value of SOL skilled a major enhance, leading to a considerable wave of liquidations by sellers. Knowledge from Coinglass reveals that there was a complete of $13.2 million in SOL liquidations, with roughly $9.5 million of that quantity coming from the liquidation of brief positions.

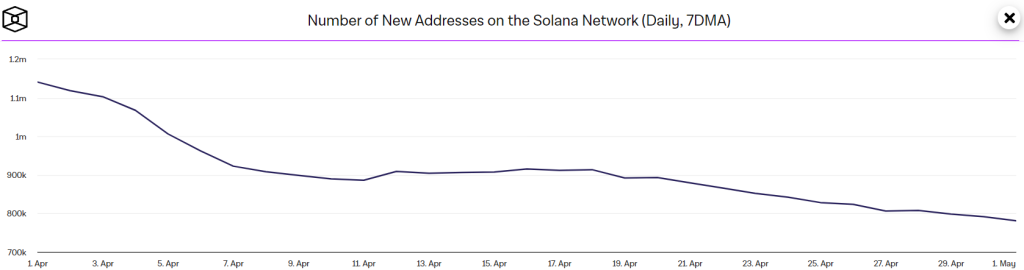

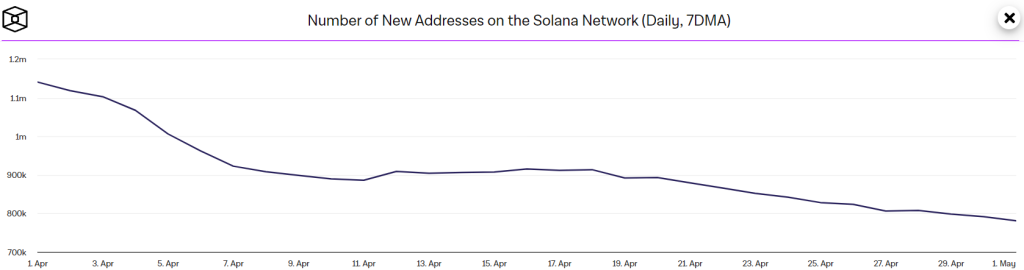

The Block’s information dashboard reveals that the Solana blockchain has seen a notable lower in new addresses just lately. Over the previous 15 days, the variety of new addresses fell by 14.7%, dropping from a weekly excessive of 915,000 to 780,000.

Additionally learn: Solana On The Verge Of A Breakdown! SOL Worth To Hit $100 This Week?

Usually, a sturdy inflow of latest addresses is an indication of wholesome community development and elevated utility, which in flip can enhance Solana’s worth. Conversely, a slowdown like the present development can set off issues amongst buyers, as it’d replicate points corresponding to declined attraction of the blockchain, potential technical challenges, or elevated competitors from different blockchain platforms. Thus, SOL worth may wrestle in its ongoing restoration efforts.

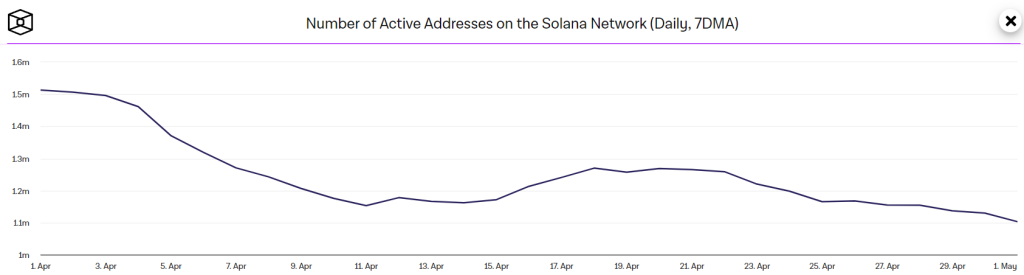

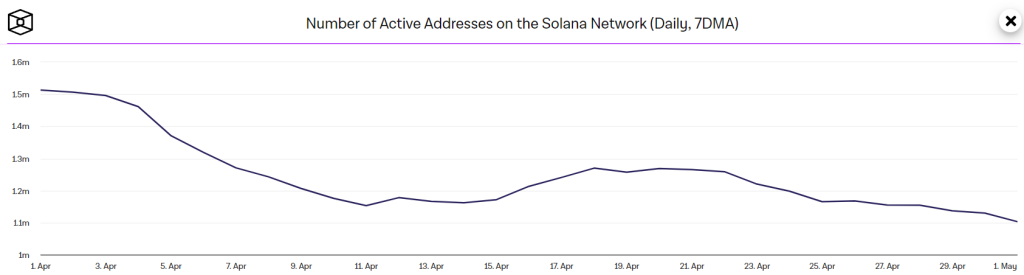

Moreover, the lower within the variety of lively addresses on the Solana blockchain, from a peak of 1.21 million to 1.1 million, additional impacts the SOL worth negatively. This decline suggests declined consumer engagement and transaction exercise, which may weaken investor confidence and probably decrease the demand for SOL.

Analysts anticipate that the present restoration in SOL worth could quickly stall because it approaches resistance channels with out adequate shopping for stress, probably resulting in a reversal for Solana.

What’s Subsequent For SOL Worth?

The lack of bears to halt a rebound at $120 for Solana signifies that bulls proceed to dominate the market. Bulls proceed to interrupt above quick Fib channels and push the SOL worth towards its essential resistance close to 200-day EMA at $150. Nonetheless, sellers are anticipated to strongly defend a surge above that development line. As of writing, SOL worth trades at $138, surging over 11% within the final 24 hours.

On the bearish hand, there may be slight help at $116-$120, but if this threshold is breached, the tempo of promoting could intensify, probably driving the SOL/USDT pair right down to $100. A deeper drop may delay the onset of the following upward development.

For bulls to regain momentum, they should shortly ship the value above the 200-day EMA, at present at $150. This transfer may catch aggressive bears off guard, probably triggering a brief squeeze. Following this, the pair may goal the 50-day SMA at $166.