Solana (SOL) has been hovering, wanting on the efficiency within the day by day chart. At spot charges, the coin is buying and selling above $50, up 520% prior to now yr when it slipped under $8 following the collapse of FTX, a now-defunct crypto alternate, and Alameda Analysis, a buying and selling wing linked with FTX and one of many main crypto market makers.

Solana Blistering Rally At The Again Of Dropping Liquidity?

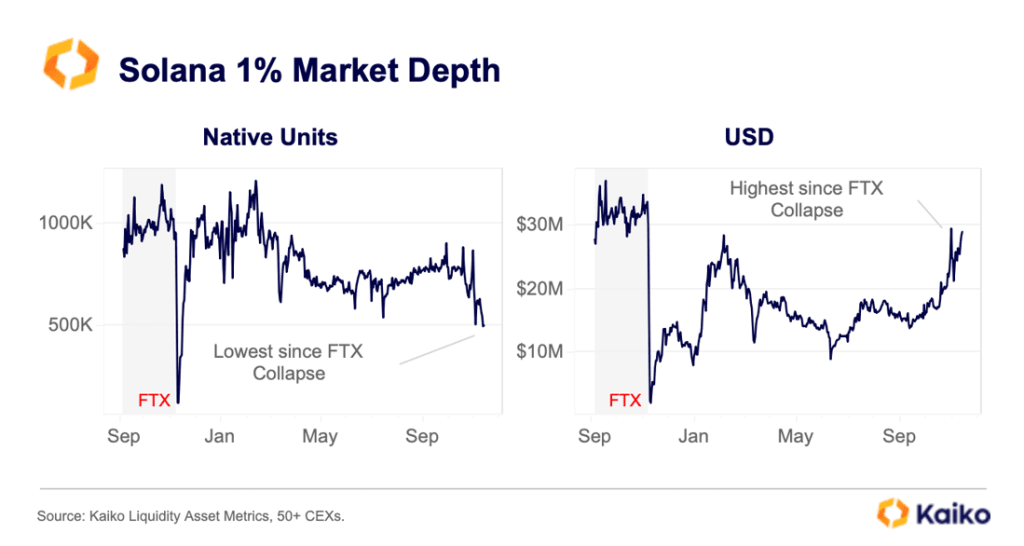

Although Solana is “blistering” and at new 2023 highs, Kaiko, a crypto analytics platform, is concerned in regards to the disparity in liquidity in USD and “native unit” phrases. Sometimes, the “native unit” refers back to the base unit of account of any forex, on this case, SOL.

Native items can be utilized to measure market depth because it offers simpler entry for gauging the relative liquidity of the coin with out the necessity to convert it to different denominations, like USD or BTC, for instance.

As Kaiko notes on November 14, at a 1% market depth, Solana’s liquidity in USD phrases is on the highest degree because the collapse of FTX. Nonetheless, SOL’s liquidity by means of one other lens, the coin is struggling. Utilizing “native items” as a liquidity gauge, it’s on the lowest level because the FTX collapse.

SOL Nonetheless Reeling From FTX Collapse, What Occurs Subsequent?

The collapse of FTX was vital not just for SOL and its native tokens but additionally for the broader crypto markets. Following the chapter of the Sam Bankman Fried alternate in November 2022, SOL costs cratered as concern of contagion throughout the board additionally noticed Bitcoin (BTC) costs shrink, failing at its perceived function as a secure haven.

By November 2022, Bitcoin had flash crashed under $16,000, with Solana dumping from highs of $220 to as little as $8. This contraction additionally noticed crypto’s liquidity, which was extra adversarial in Solana.

how liquid SOL is in its native items, it’s obvious that liquidity is but to get well and may require extra time regardless of the overall optimism throughout Solana communities. In keeping with Kaiko, it means that market makers are opting to keep up secure liquidity for SOL even with hovering costs in USD phrases.

Presently, SOL costs are regular above $50 however keep an uptrend versus the USD. There are a collection of decrease lows in decrease time frames, early indicators that the upside momentum could be cooling off, and SOL merchants probably exiting their lengthy positions. Even so, $38, marking November 2022 highs, is a crucial response level for technical analysts.