After a major breakout above $138, it seems that crypto whales are making large bets on Solana (SOL) and are at the moment on a shopping for spree. On September 14, 2024, the on-chain analytic agency Lookonchain made a submit on X (beforehand Twitter) {that a} crypto whale had bought a major 10,000 SOL, price $1.37 million from Binance and staked it.

Crypto Whale Buys $1.37M of Solana

The submit on X additionally famous that this whale had purchased and staked a large 50,000 SOL, price $6.85 million. Moreover, it obtained a reward of over 174 SOL, price $23,700.

Solana Value Momentum

Regardless of this large buy, it seems that SOL could probably retest its breakout degree to substantiate the profitable breakout. At press time, SOL is buying and selling is buying and selling close to $137 and has skilled a value surge of over 3.75% within the final 24 hours. Throughout the identical interval, its buying and selling quantity elevated by 20%, indicating increased participation from merchants and traders following the breakout.

Solana Technical Evaluation and Upcoming Ranges

In accordance with the professional technical evaluation, SOL seems bullish and is at the moment dealing with robust resistance from the 200 Exponential Transferring Common (EMA) on the each day time-frame. At current, it’s essential for SOL to shut a each day candle above the 200 EMA to set off a major upside rally.

If SOL closes its each day candle above $140, there’s a robust risk that it might soar by 18% to the $165 degree and additional to the $185 if bullish sentiment persists. Nevertheless, this bullish thesis will solely maintain if SOL closes the each day candle above the $140 degree, in any other case, it might fail.

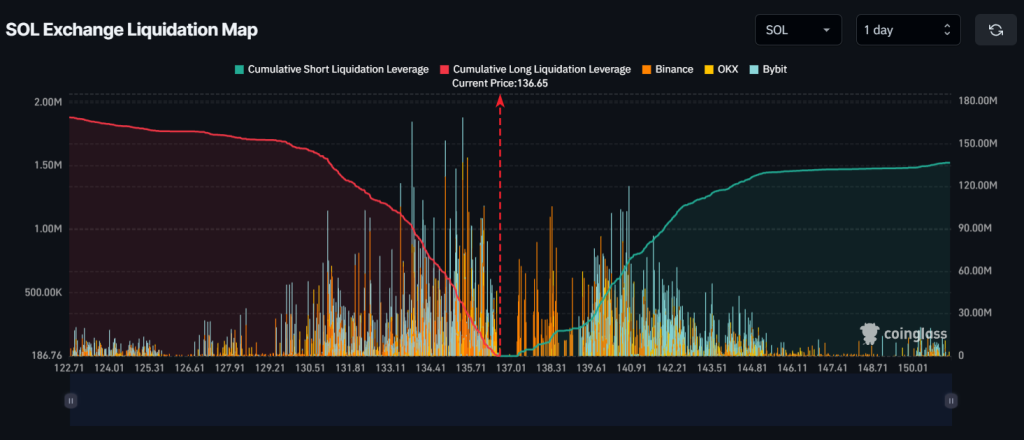

Main Liquidation ranges

At present, the foremost liquidation ranges are close to $135 on the decrease facet and $140.81 on the higher facet. Merchants are over-leverage at these ranges, in keeping with the coinglass Information.

If the market sentiment stays bullish and the worth rises to the $140.81 degree, almost $65 million price of quick positions will probably be liquidated. Conversely, if the market sentiment shifts and the worth falls to the $135 degree, roughly $38.5 million price of lengthy positions will probably be liquidated.

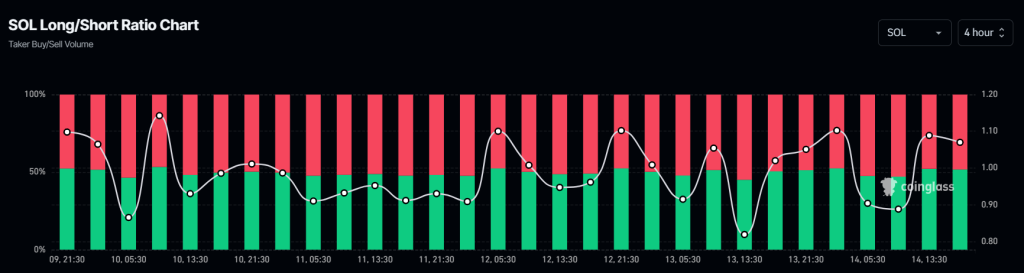

Merchants’ Bullish Market Sentiment

As well as, SOL’s Lengthy/Brief ratio at the moment stands at 1.0695, indicating merchants’ bullish market sentiment. Merchants and traders use this ratio to find out whether or not an asset is bullish and assist them determine whether or not to construct lengthy or quick positions. A price above 1 suggests bullish market sentiment, whereas a worth under 1 signifies bearish sentiment.

The information additionally highlights that at the moment, Solana’s 52.68% of prime merchants maintain lengthy positions, whereas 48.32% maintain quick positions.