Solana (SOL) has recovered 30% of its worth for the reason that Black Monday crash, hovering between the $155-$140 vary. Latest stories revealed the Solana-based funding merchandise had been among the many largest losers final week after registering over $30 million in outflows.

The token continued its sideways trajectory regardless of the detrimental internet flows and memecoin’s buying and selling exercise decline over the week. Because of this, SOL’s current efficiency was praised by some crypto analysts who deem the cryptocurrency a secure guess.

Associated Studying

Solana ETPs See Document Outflows

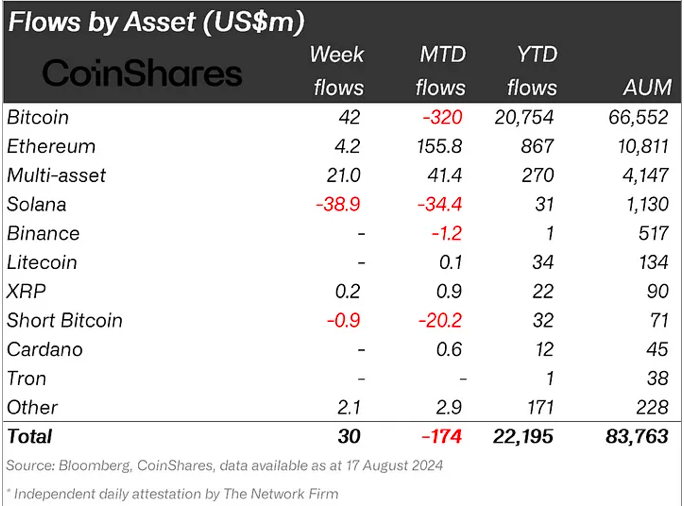

CoinShares’ current report revealed that final week’s Alternate-Traded Merchandise (ETPs) internet flows registered a optimistic however “low” $30 million. The information confirmed that crypto-based funding merchandise noticed minor inflows up to now 7 days, with blended flows among the many suppliers.

Per the report, the established ETP issuers continued to lose market share to suppliers of the newer funding merchandise. The crypto funds’ weekly buying and selling quantity additionally fell to $7.6 billion, dropping almost 50% from the $19 billion registered the week prior.

All through the week, Bitcoin (BTC) noticed the most important inflows among the many crypto property, with a $42 million optimistic internet movement. Quick-Bitcoin ETFs registered $1 million in outflows on its second consecutive detrimental week.

Ethereum-based merchandise solely registered 10% of the flagship cryptocurrency’s inflows, recording $4.2 million since August 12. The optimistic $104 million internet flows from new suppliers had been overshadowed by Grayscale Ethereum Belief (ETHE)’s $118 million in outflows.

Nonetheless, Solana funding merchandise had the most important outflow by cryptocurrency after Solana ETPs noticed $39 million in detrimental week flows. 21Shares Solana ETP’s -$37 million ranked third as the most important outflow by funding product final week, solely behind ETHE and GBTC.

SOL Proceed Sideways Trajectory

CoinShare’s report highlighted that Solana ETPs’ detrimental efficiency occurred alongside the “sharp decline in buying and selling quantity of memecoins, on which it closely depends.”

Knowledge from CoinGecko revealed that Solana-based memecoins noticed a 3.7% decline within the final 24 hours, registering a $3.59 billion market cap. Its market exercise additionally displayed an identical 3% decline since Sunday, falling to a every day buying and selling quantity of $1.1 billion.

Regardless of this, the Solana ecosystem has moved sideways over the weekend, hovering between the $243 billion to $245 billion market cap since August 15. SOL’s worth additionally moved between $140 and $155 over the weekend, a spread it has maintained since August 12.

Crypto analyst Altcoin Sherpa instructed that the token will see “extra chop and consolidation” within the coming weeks. Nonetheless, he asserted that the $125-$150 worth vary is a “excellent place to build up SOL.” The analyst additionally considers the token “remains to be 1 you may comfortably maintain for some time.”

Associated Studying

Equally, Crypto Jelle famous SOL’s current efficiency, stating that it’s “nonetheless in the identical sideways vary, whereas the remainder of the market made decrease lows.” To the analyst, SOL will take off laborious “as quickly as Bitcoin finds a bid,” and a brand new all-time excessive (ATH) is “very a lot on the menu.”

As of this writing, SOL is buying and selling at $144, a 1.4% drop within the final 24 hours.

Featured Picture from Unsplash.com, Chart from TradingView.com