The continuing promoting stress throughout the cryptocurrency market has shifted the general sentiment towards a downtrend. On this, Solana (SOL), the world’s fifth largest cryptocurrency by market cap is gaining notable consideration from crypto lovers because it holds itself constructive when it comes to worth modifications previously 24 hours.

Solana Beat Bitcoin and Ethereum

Along with this, SOL has outperformed main cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). At press time, SOL is buying and selling close to $172 and has skilled a worth surge of over 3.4% previously 24 hours. Throughout the identical interval, its buying and selling quantity declined by 20%, indicating worry amongst merchants and buyers seemingly as a result of present market situation.

Solana Technical Evaluation and Upcoming Degree

Based on knowledgeable technical evaluation, SOL seems bullish. It lately broke out from a two-day robust consolidation between the $162 and $170 ranges. Following this breakout, it might soar by 10% to achieve the $190 stage within the coming days.

As of now, SOL is buying and selling above the 200 Exponential Transferring Common (EMA) on a day by day timeframe, indicating an uptrend.

With this latest breakout, quick sellers have liquidated almost $3.5 million value of quick positions, whereas bulls have registered a liquidation of $350,000. This liquidation exhibits that bears are at present exhausted.

Bullish On-Chain Metrics

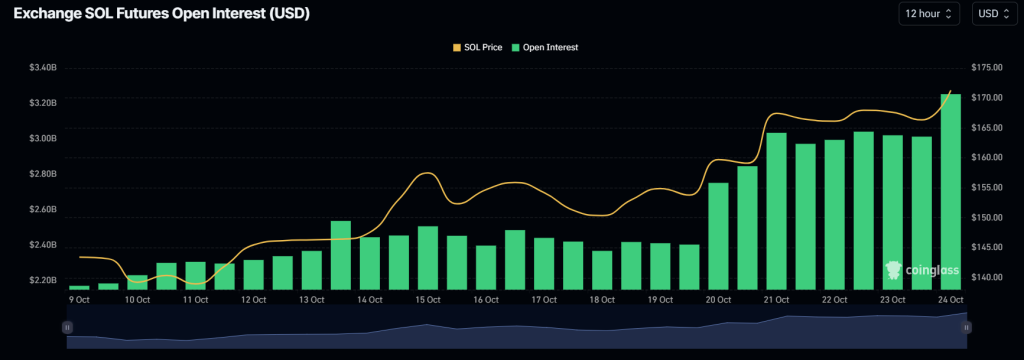

SOL’s bullish outlook is additional supported by on-chain metrics. Based on an on-chain analytics agency CoinGlass, SOL’s Lengthy/Quick ratio at present stands at 1.02, indicating a robust bullish market sentiment amongst merchants. Moreover, its open curiosity has jumped by 11%, indicating buildups of recent positions seemingly as a result of latest consolidation breakout.

Merchants and buyers typically contemplate the rising open curiosity and a protracted/quick ratio above 1, when constructing lengthy positions. Combining these on-chain metrics with technical evaluation, it seems that bulls are at present dominating the asset and will help bulls to realize the goal.