Solana (SOL), the fourth-largest cryptocurrency has gained notable consideration from the cryptocurrency neighborhood because it breaks out of bullish worth motion patterns. Following the breakout, SOL is presently consolidating close to the help stage of $204, indicating potential accumulation earlier than a significant rally begins.

Solana Technical Evaluation and Upcoming Ranges

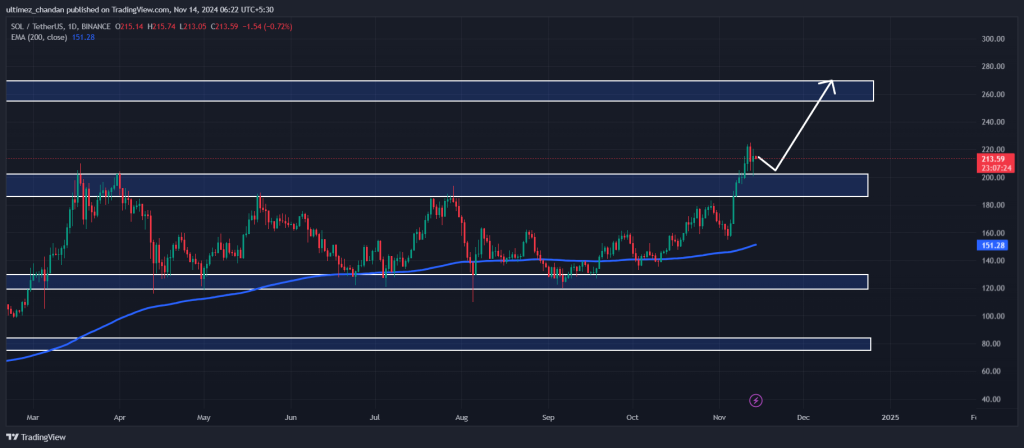

In keeping with professional technical evaluation, SOL seems bullish because it breaks out of a nine-month-long parallel channel sample. Specialists counsel that this breakout has shifted the sentiment from a range-bound market to a bullish one.

Nevertheless, the market has been consolidating in a decent vary for the final three days, which suggests potential accumulation and alerts a bullish outlook for SOL holders.

Based mostly on latest worth motion and historic worth momentum, if SOL breaks out of this small consolidation, there’s a sturdy risk it might soar by 25% to succeed in the $260 stage within the coming days. At the moment, the asset is buying and selling above the 200 Exponential Transferring Common (EMA) on the day by day time-frame, indicating an uptrend.

Bullish On-Chain Metrics

SOL’s constructive outlook is additional supported by on-chain metrics. In keeping with on-chain analytics agency Coinglass, Solana’s Lengthy/Brief ratio presently stands at 1.05, indicating sturdy bullish market sentiment amongst merchants. In the meantime, its open curiosity has skyrocketed by 11% up to now 24 hours and 4.7% up to now 4 hours.

This rising open curiosity suggests rising participation from merchants, and the value consolidation additionally alerts a bullish development.

The mix of those on-chain metrics with technical evaluation means that bulls are nonetheless dominating the asset amid the value consolidation and will help SOL in its upcoming bull run.

Present Value Momentum

At press time, SOL is buying and selling close to $214.85 and has skilled a worth surge of voer 1.10% up to now 24 hours. Throughout the identical interval, its buying and selling quantity jumped by 2.6%, indicating rising participation from merchants and traders amid a possible upside rally.