In a latest interview with Bloomberg, Reggie Browne, Co-World Head of ETF Buying and selling and Gross sales at GTS, shared insightful predictions concerning the potential buying and selling dynamics of spot Bitcoin exchange-traded funds (ETFs). Browne foresees these ETFs buying and selling at a major premium, estimating as excessive as 8% above their web asset worth (NAV).

Why Spot Bitcoin ETFs May Commerce At A 8% Premium To NAV

“I believe the spreads will likely be very aggressive and tight. The market maker neighborhood is resilient and ready to supply loads of liquidity,” Browne stated. Nonetheless, he highlighted a essential concern, saying, “I believe it’s going to be the premium to NAV… US dealer sellers can’t commerce Bitcoin money inside their dealer sellers. So that you’re going to need to commerce hedges over futures and commerce it on a premium, after which take that off, and I believe there’s loads of complexity there.”

This complexity, in response to Browne, arises from the money creation mannequin compelled by the SEC and regulatory constraints that restrict direct Bitcoin buying and selling inside US dealer sellers, compelling them to depend on futures for hedging. He expressed, “What I believe, probably, you could possibly see 8% of premium above honest worth. It’s an enormous quantity, however let’s see the way it performs out.”

Moreover, Browne touched upon the topic of in-kind creations and redemptions, features that have been factors of rivalry throughout negotiations with the Securities and Trade Fee (SEC). Regardless of the challenges, he stays optimistic about their future implementation. “Completely, I believe this was actually simply to get the ball transferring… the in-kind will come after we climb a few mountains,” Browne remarked.

Echoing Browne’s sentiments, Eric Balchunas, a Bloomberg ETF skilled, commented on the potential premium, expressing shock on the anticipated excessive charge. He drew a comparability with Canada’s spot ETFs, that are additionally money creations however have a lot smaller premiums, regardless of occasional spikes.

[Browne] thinks bid-ask spreads on spot ETFs will likely be tight however (thx to money solely creations) premiums may very well be as excessive as 8%. That’s actually excessive and I’m a bit shocked tbh. For context Canada spot ETFs are money creations and their premiums are very small.. albeit the occasional 2% day.

The crypto neighborhood is intently monitoring the SEC because it approaches a essential deadline to resolve on the primary batch of a number of spot Bitcoin ETF purposes by tomorrow, January 10. Outstanding asset managers similar to BlackRock, Constancy, Ark Make investments, Bitwise, Franklin Templeton, Grayscale, WisdomTree, and Valkyrie are amongst these with pending purposes.

Browne believes that the approval of spot Bitcoin ETFs might entice substantial investor curiosity, projecting large inflows over the primary 12 months. “I anticipate buyers so as to add not less than $2 billion to identify Bitcoin ETFs throughout the first 30 days they commerce, if authorised. For the complete 12 months, I see $10 billion-$20 billion within the funds,” he famous. This prediction underscores the numerous curiosity and potential market influence of spot Bitcoin ETFs.

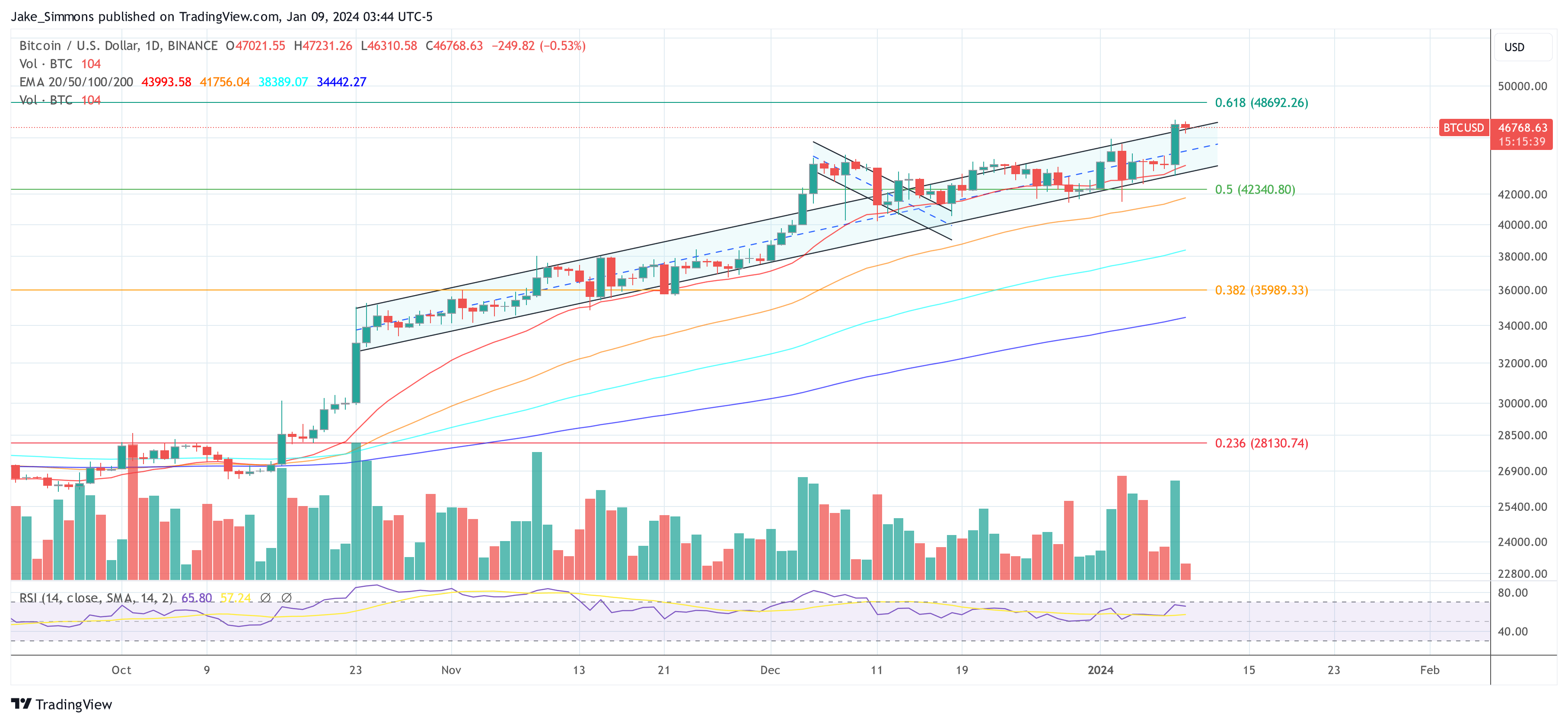

At press time, BTC traded at $46,768.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site fully at your individual threat.