The world {of professional} employment group software program is abundantly wealthy. Firms have a variety of choices to run payroll and handle workers and human sources. However for small corporations on the lookout for easy, easy-to-use options, the highest software program choices could also be overcomplicated.

Neither Sq. Payroll nor Hourly is technically knowledgeable employer group answer as a result of they don’t handle day-to-day HR duties. Nevertheless, they’re each cost-efficient stable choices for small and medium corporations who wish to run payroll, deal with taxes, meet compliance and provide advantages.

What’s Sq. Payroll?

Sq. Payroll is designed for small and medium-sized companies. The platform simplifies payroll, tax, compliance and advantages. The corporate was based in 2009 and expanded from commerce to omnichannel options the place companies can promote, handle stock, have interaction with consumers and pay workers. Sq. has worldwide clients from Australia and Eire to Canada and Japan and works throughout all 50 U.S. states.

Learn the total Sq. Payroll evaluate for extra info.

What’s Hourly?

Hourly is an rising platform additionally designed for small and medium corporations. Based in 2018, Hourly focuses on staff’ compensation, insurance coverage integration and payroll. The corporate supplies options for enterprise house owners, insurance coverage brokers and insurers. The primary draw back of the platform is that, on the time, it’s solely obtainable for corporations working in California. The corporate has plans to increase to all 50 U.S. states sooner or later.

Learn the total Hourly evaluate for extra info.

Soar to:

Sq. Payroll vs Hourly: Comparability desk

| Options | Sq. Payroll | Hourly |

|---|---|---|

| Payroll | Sure. U.S. and worldwide. | Sure. Just for California primarily based companies. |

| Advantages | Sure. | No. |

| Tax and compliance | Sure. All 50 U.S. states. | Sure. Solely California. |

| Time monitoring and attendance | Sure. | Sure. |

| Employees’ comp | Sure. | Sure. |

| HR lifecycle options | No. Integration with Bambee obtainable. | No. |

| Availability | Worldwide and all 50 U.S. states. | Solely California-based companies. |

| Help | Premium plan 24-7. Different plans Monday to Friday assist. | Solely Monday via Friday assist throughout enterprise hours. |

| Free trial | No. | No. |

| Pricing begins at | $6 monthly per contractor. | $40/month + $6 per particular person. |

Sq. Payroll and Hourly Pricing

Sq. Payroll provides two plans for small companies. The primary, beginning at $35 monthly plus $6 monthly per particular person, is designed for corporations to pay workers and contractors. The second plan, for simply $6 monthly per contractor and no month-to-month fastened charge, helps payroll for contractors solely. Each plans embody limitless pay runs. Sq. Payroll doesn’t have a demo or provide free trials.

Hourly additionally has two plans. The Gold plan prices $6 monthly per particular person plus a set charge of $40 monthly. In distinction, the Platinum plan prices $10 monthly per particular person and has a set month-to-month fee of $60 monthly. Each plans have tax, compliance and limitless pay runs. Hourly doesn’t provide a free trial however provides its clients a 90-day money-back assure.

1

Workzoom

Well timed, correct payroll – in home! Workzoom is the all-in-one folks administration software program that can enable you to confidently deal with complexities with a easy pay course of so you may spend much less time journalizing pays and updating your G/Ls whereas remaining completely compliant.

Be taught extra

2

Paychex

Paychex is a cloud-based payroll administration system providing payroll, HR, and advantages administration techniques for small to massive companies. Paychex covers payroll and taxes, worker 401(okay) retirement providers, advantages, insurance coverage, HR, accounting, finance and Skilled Employer Group (PEO).

Be taught extra

Function comparability: Sq. Payroll vs Hourly

Payroll

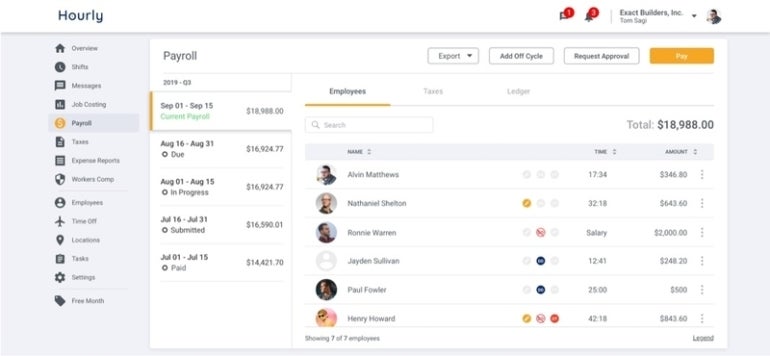

Sq. Payroll and Hourly are identified for his or her easy automated payroll runs. Each provide time and attendance monitoring to pay workers and contractors.

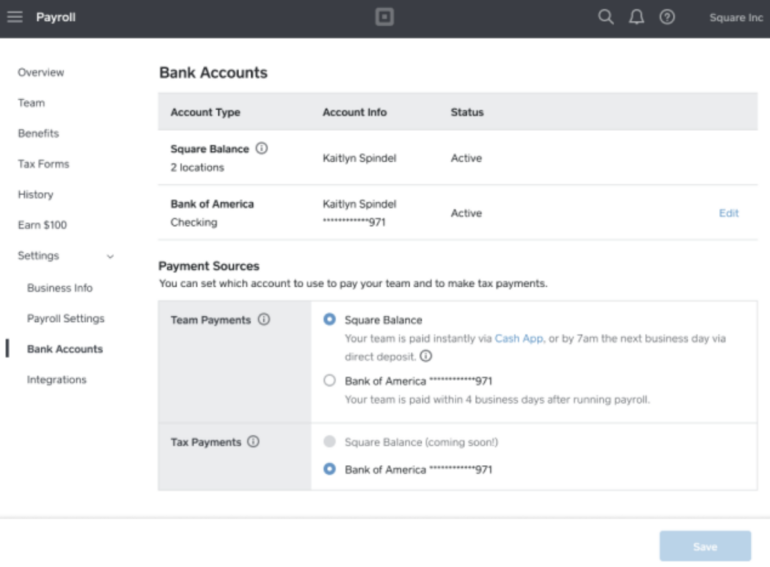

Sq. lets clients pay W-2 workers and 1099 contractors and does direct deposits or guide checks. Pay runs may be personalized and off-cycle runs come at no cost. The platform additionally supplies assist through chat, cellphone or e-mail throughout enterprise hours and automated federal, state and native payroll tax filings. Premium plans have 24/7 buyer assist.

Hourly provides a extra minimalistic payroll dashboard designed to simplify the expertise. The corporate and its staff can entry the net or cell app. The platform supplies tax assist, robotically information taxes, tracks time and attendance and provides direct deposits and paper checks. A major distinction between each options is that Hourly contains staff’ compensation insurance coverage within the payroll dashboard.

HR options

It’s essential to notice that Sq. Payroll and Hourly don’t provide superior or fundamental built-in HR options. If your organization is on the lookout for applied sciences to modernize HR operations, from onboarding to hiring, skilling and coaching, and retaining staff or termination, you must undoubtedly take into account different alternate options. Main PEO options that supply complete HR instruments embody Gusto, Rippling, Papaya International, ADP and Paychex.

SEE: Be taught extra about PEO platforms with HR instruments in a evaluate of the perfect PEO corporations of 2023.

Sq. Payroll permits customers to combine with Bambee to leverage HR tech and provides a platform known as Sq. Group Administration that helps corporations set up scheduling, timecards and extra. Hourly doesn’t present HR accomplice integration.

Tax and compliance

Sq. Payroll helps companies keep on high of taxes and meets compliance in all 50 U.S. states.

With Sq. Payroll, customers can:

- Run automated federal and state tax filings.

- Carry out automated quarterly and annual tax filings.

- Handle tax withholdings and funds.

- Run multistate payroll and tax and pay workers who do business from home.

- Generate yearly filings and varieties, together with W-2 and 1099-NEC varieties, for workers and contractors at no additional value.

- Guarantee ongoing compliance with updates on tax legislation adjustments.

- Handle IRS varieties 940, 941, 944 and 1099-NEC.

- Handle Social Safety Administration varieties W-2 and W-3.

SEE: Uncover the highest Sq. Payroll opponents and alternate options for 2023

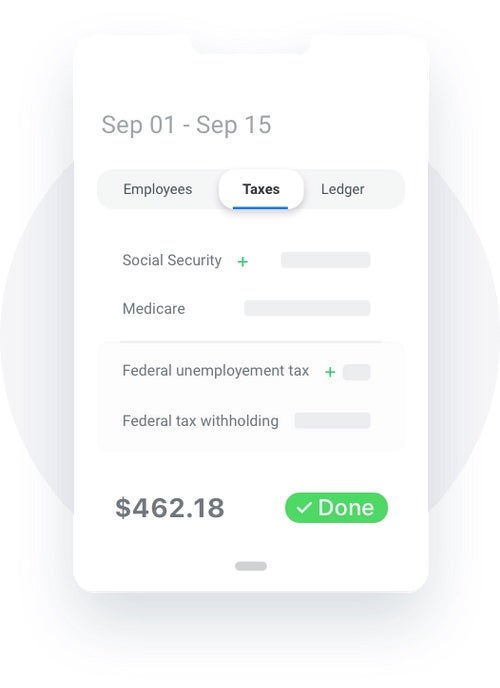

Hourly tax and compliance are restricted to the one state during which it at the moment operates, California.

With Hourly, companies in California can:

- Get tax and compliance assist.

- File payroll taxes with the proper authorities businesses robotically.

- Handle varieties, together with W-2s and 1099s.

- Keep up to date on tax legislation adjustments.

- Calculate tax.

- Meet compliance with hourly staff.

- Present workers with clear entry through internet or cell app.

Time monitoring, advantages and staff’ compensation

Sq. Payroll supplies automated and synchronized time monitoring, attendance, staff’ compensation and advantages. Whereas its staff’ compensation insurance coverage options aren’t as elaborated as these provided by Hourly, it may well present workers with pay-as-you-go staff’ compensation insurance coverage that robotically syncs together with your payroll.

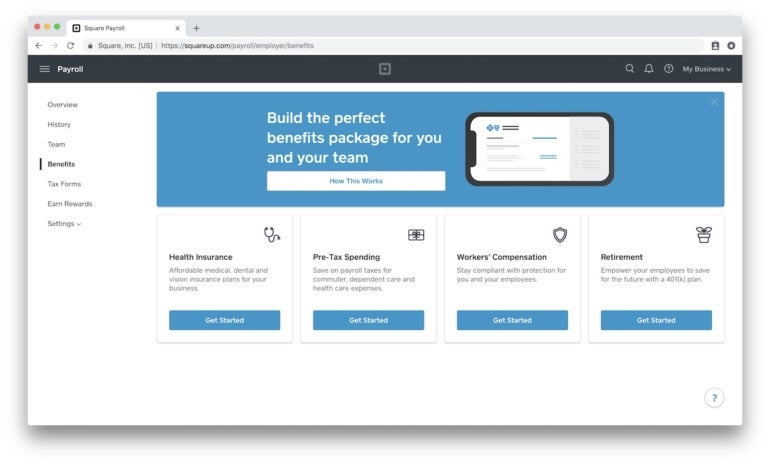

Relating to advantages, Sq. permits corporations to entry healthcare (medical, dental and imaginative and prescient plans) and retirement advantages, which additionally robotically sync with the payroll dashboard.

The corporate has partnered with main advantages suppliers, insurance coverage and retirement 401(okay) plans. The platform handles every part, from worker enrollment to calculating deductions and contributions for every pay run.

Hourly’s fundamental strengths are its time monitoring and attendance expertise and its staff’ compensation insurance coverage administration instruments. Nevertheless, the platform can’t join companies with staff’ advantages similar to medical, dental and imaginative and prescient insurance coverage or 401(okay) retirement plans.

Help

Sq. Payroll has a devoted buyer staff obtainable Monday via Friday throughout working hours to help corporations. Help queries may be accomplished through cellphone, e-mail or reside chat. Sq. Payroll premium plans provide 24/7 cellphone assist in English.

Hourly supplies assist throughout working hours from Monday to Friday. Prospects can contact assist through cellphone or e-mail.

Sq. Payroll execs and cons

Execs

- Simple-to-use interface.

- Price-effective answer.

- Best for small corporations that must run payroll.

- Supplies payroll, compliance, tax and advantages in all 50 U.S. states.

- Simple to study.

- Designed for small companies.

- Can carry out worldwide pay runs.

Cons

- Doesn’t have a free trial.

- Doesn’t provide built-in HR options.

- Solely premium plans get 24-7 assist.

Hourly execs and cons

Execs

- A superb choice for corporations in California that want easy payroll mixed with staff’ compensation and time monitoring.

- Manages tax, compliance and payroll within the state of California.

- Integrates superior staff’ compensation options with payroll.

Cons

- Solely obtainable for companies positioned in California.

- Doesn’t provide a free trial.

- Doesn’t provide well being advantages or retirement options.

- Doesn’t have built-in HR instruments.

Methodology

To put in writing this software program comparability report, we evaluated Sq. Payroll and Hourly and examined their official websites, sources and documentation. We additionally test-drove the software program when potential.

Ought to your group use Sq. Payroll or Hourly?

Evaluating two software program choices may be daunting once they’re each designed to carry out related duties, however this isn’t the case with Sq. Payroll and Hourly. Whereas they each deal with payroll options, solely corporations that function in California ought to take into account Hourly, as the corporate supplies its providers and options solely in that state.

SEE: Uncover how Hourly compares to ADP.

In distinction, Sq. Payroll provides payroll, advantages, tax and compliance in all 50 U.S. states and might deal with worldwide pay runs. Each options are simple to make use of and have aggressive costs, however availability provides Sq. Payroll a big benefit over Hourly.

Hourly strengths are undoubtedly its staff’ compensation instruments and time-tracking expertise. However Sq. Payroll additionally competes in that space, because it provides each to some stage. Total, Sq. Payroll would appear like a extra stable various, however for corporations in California, Hourly is unquestionably a cloud platform to think about.

1

Workzoom

Go to web site

Well timed, correct payroll – in home! Workzoom is the all-in-one folks administration software program that can enable you to confidently deal with complexities with a easy pay course of so you may spend much less time journalizing pays and updating your G/Ls whereas remaining completely compliant.

Be taught extra about Workzoom

2

Paychex

Go to web site

Paychex is a cloud-based payroll administration system providing payroll, HR, and advantages administration techniques for small to massive companies. Paychex covers payroll and taxes, worker 401(okay) retirement providers, advantages, insurance coverage, HR, accounting, finance and Skilled Employer Group (PEO).

Be taught extra about Paychex