Este artículo también está disponible en español.

The most recent on-chain information reveals that the stablecoin market is nearing a brand new milestone when it comes to valuation. Right here’s how the rising liquidity might influence Bitcoin and the final cryptocurrency market.

Can The Growing Stablecoin Cap Push Bitcoin Worth To $100,000?

Market intelligence platform IntoTheBlock has revealed in its weekly report that the stablecoin market capitalization has skilled notable development up to now month. In line with the crypto agency, the stablecoin market cap surged previous $190 billion this week for the primary time since late April 2022 when Bitcoin worth was hovering across the $40,000 mark.

This spectacular development comes on the again of Bitcoin’s unprecedented run to a six-figure valuation and the explosion of the overall market capitalization to over $3.4 trillion. IntoTheBlock famous that stablecoins have seen elevated adoption up to now few weeks, as traders proceed to run towards riskier belongings like cryptocurrencies.

Associated Studying

Particularly, this enlargement has primarily been in favor of Tether’s USDT, which continues to fully dominate the stablecoin market. Knowledge from IntoTheBlock reveals that USDT holds about 72% of the market share, with a market capitalization of over $133 billion — harking back to the crypto market highs of 2021.

Apparently, the demand for the Tether stablecoin seems to be climbing, with a weekly mint of over $3 billion of recent USDT tokens. Most notably, over $13 billion USDT has been minted because the begin of November, with the stablecoins largely flowing towards centralized exchanges.

This injection of contemporary liquidity into centralized exchanges has been mirrored available in the market, particularly with the sturdy bullish momentum witnessed up to now few weeks. Traditionally, rising stablecoin inflows into exchanges is positively correlated with market costs, as they usually symbolize larger “shopping for energy” for the traders.

As such, the continuation of this constructive pattern could possibly be pivotal to the dream of Bitcoin worth surpassing $100,000. Whereas the flagship cryptocurrency has seemingly recovered from its current droop beneath the $93,000 stage, it has not precisely proven power enough to surpass the six-figure milestone.

As of this writing, the worth of Bitcoin continues to hover across the $96,500 mark, reflecting a greater than 2% enhance within the final 24 hours. In line with information from CoinGecko, the premier cryptocurrency remains to be within the purple on the weekly timeframe, with a 3% decline up to now seven days.

BTC Market Changing into Steady And Mature: IntoTheBlock

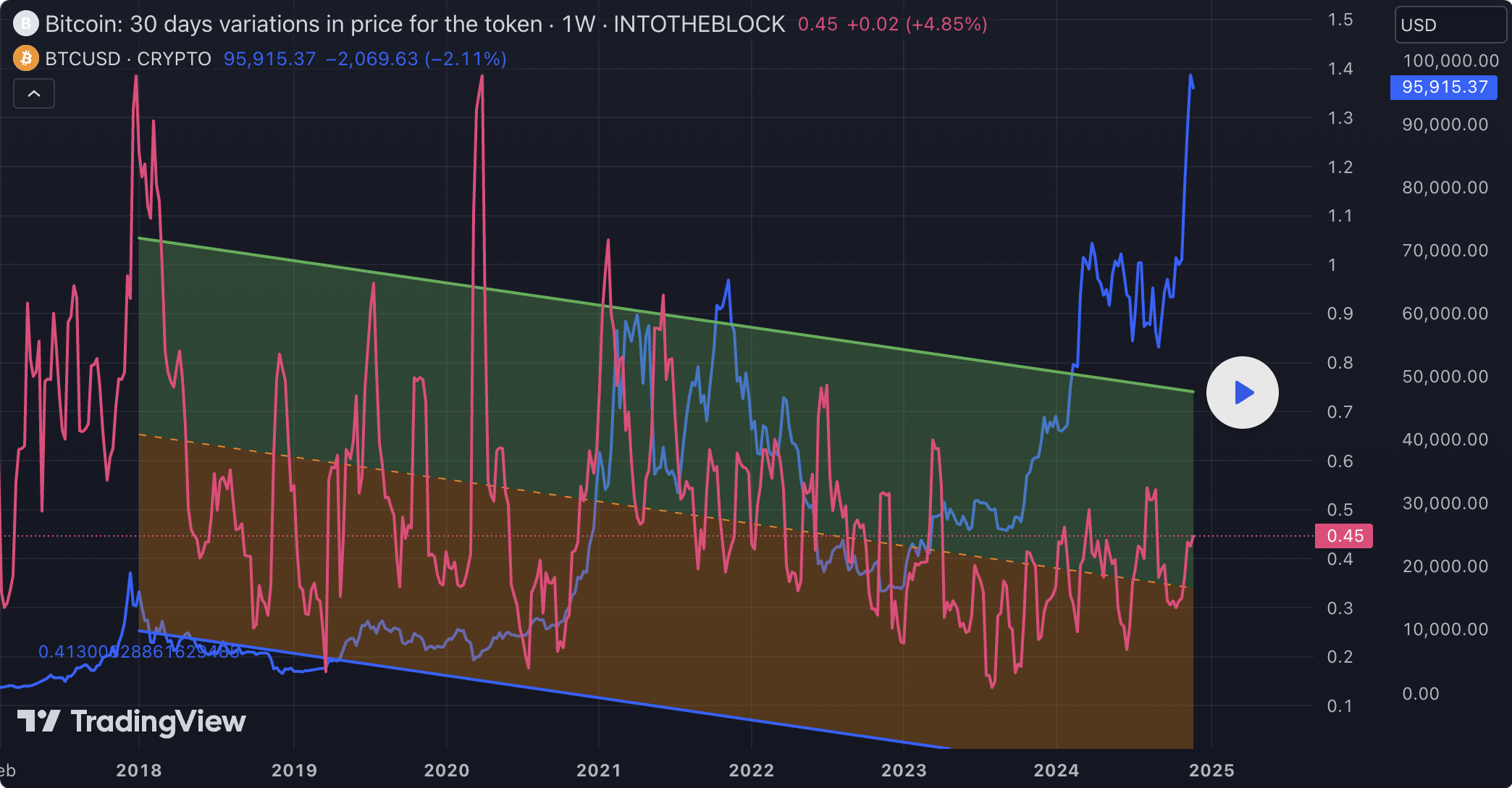

IntoTheBlock additionally disclosed in its weekly report that Bitcoin’s market local weather appears to be maturing, as volatility is presently trending downwards. In line with the blockchain platform, the market’s excessive volatility has been a long-standing criticism level for BTC as a retailer of worth.

Associated Studying

Nonetheless, IntoTheBlock famous that traders can anticipate the Bitcoin worth efficiency to be extra steady, as retail and institutional adoption will increase and volatility diminishes. Therefore, the premier cryptocurrency might turn out to be an much more dependable retailer of worth.

Featured picture from iStock, chart from TradingView