Steadily, alongside the cryptocurrency trade, stablecoins are rising in energy and recognition. Their development outcomes from the steadiness they provide in opposition to cryptocurrency volatility.

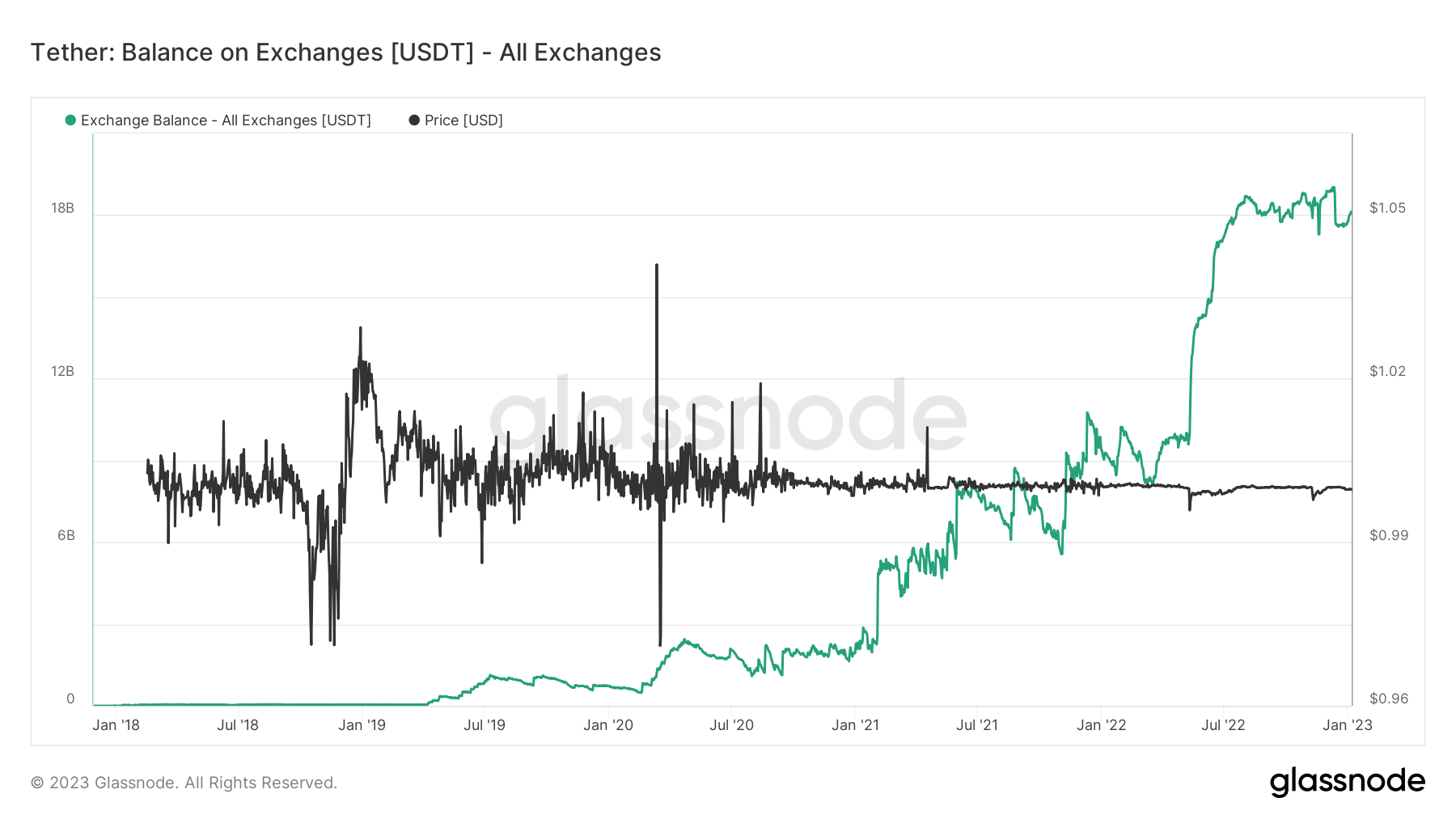

In the intervening time, USDT stays the biggest stablecoin by market cap, as USDC, Binance USD, and DAI make up the highest 4.

Distinguished stablecoins after FTX collapse

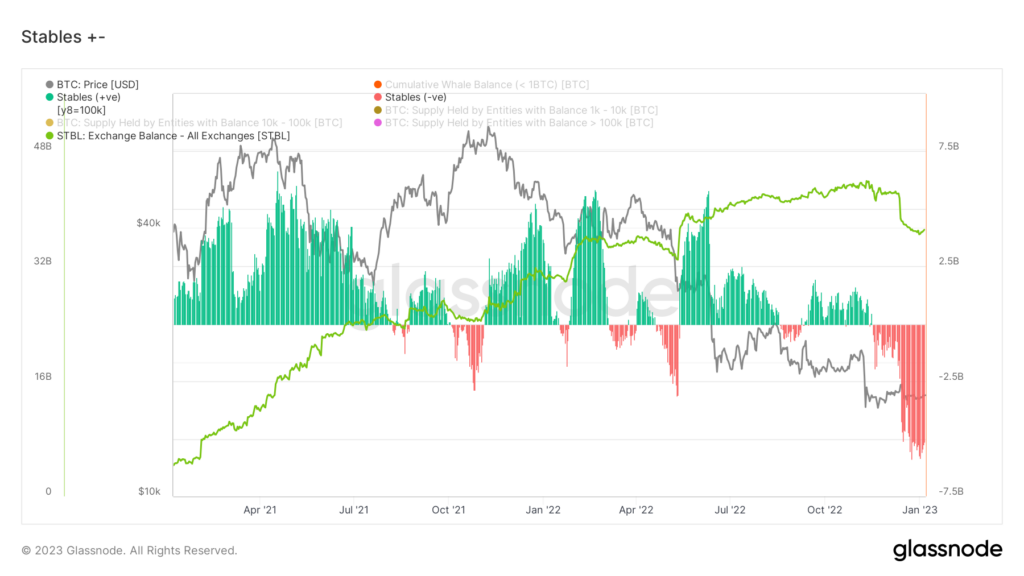

Everything of the stablecoin sector has a market cap of $138 billion, in accordance with CoinMarketCap. The massive 4 stablecoins contribute greater than $130 billion to the determine, dominating the stablecoin market. Regardless of their development and recognition, solely a minimal quantity of stablecoins are on cryptocurrency exchanges.

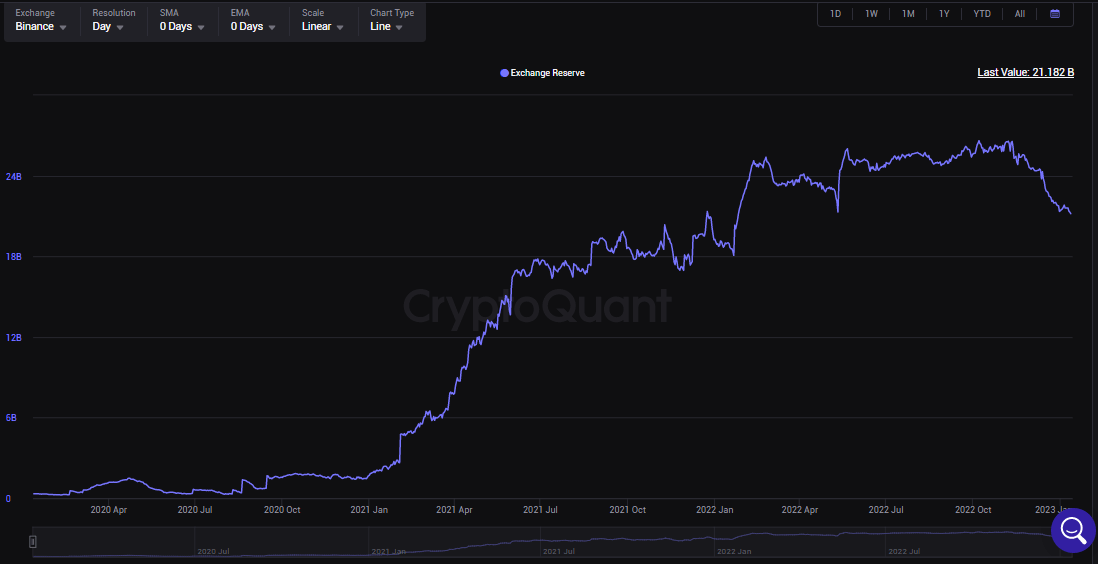

Presently, about 37 billion stablecoins are held in reserves of cryptocurrency exchanges. Binance is the best contributor to this determine, with about $24 billion in stablecoins in its reserve. Coinbase has greater than $973 million, Huobi $709 million, Bitfinex $145 million, Gemini 98 million, and Gate.io $78 million.

As a result of market uncertainty and low belief in centralized exchanges after the collapse of FTX, about 3.93 billion stablecoins have left exchanges within the final 30 days.

Regardless of the prevailing crypto winter, USDT has loved extra of a secure presence within the reserve of cryptocurrency alternate. Since August 2022, USDT has largely stayed flat at $18 billion within the reserve of cryptocurrency exchanges.

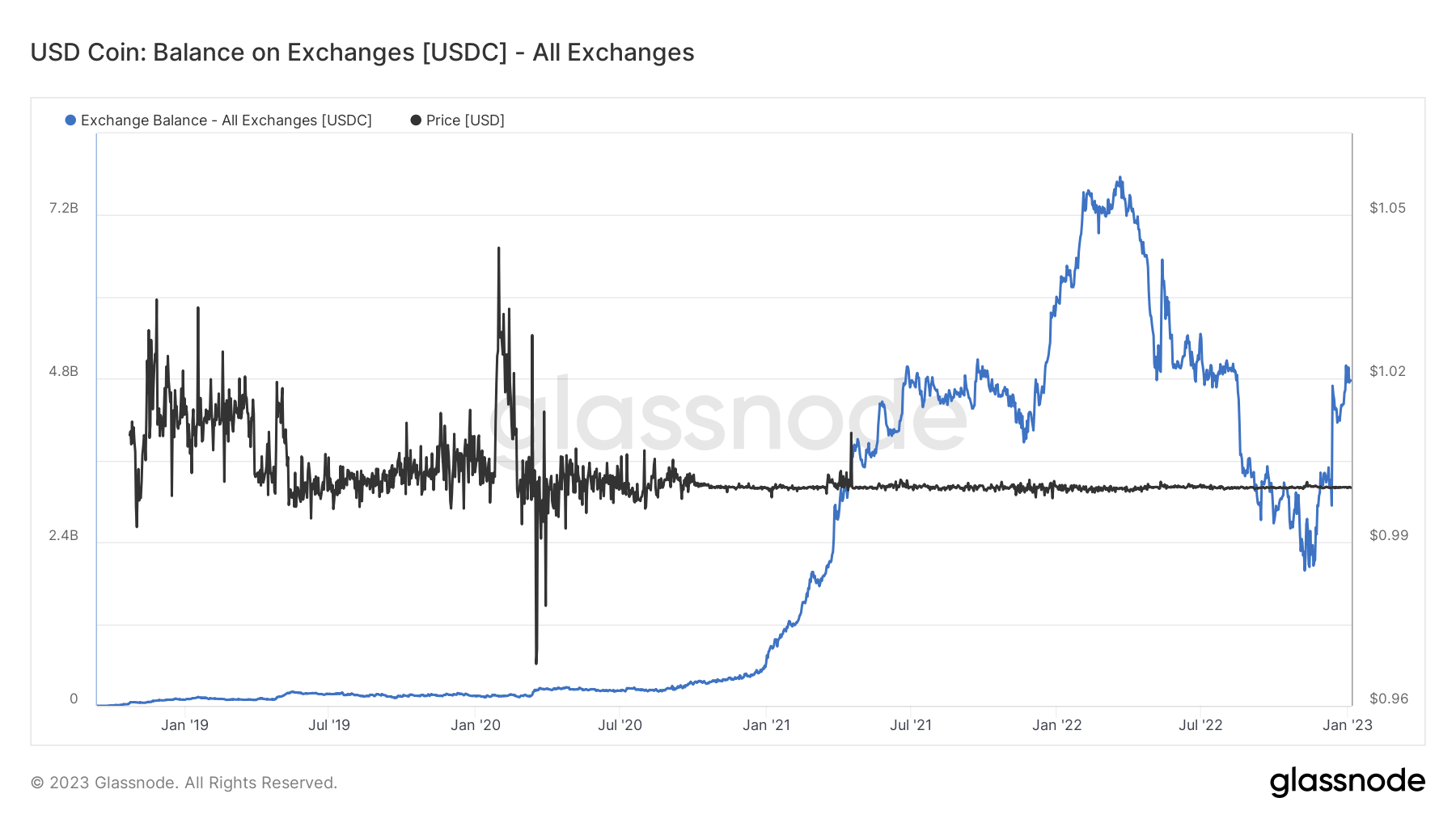

USDC, alternatively, has loved some development whereas making an attempt to curb USDT’s dominance within the stablecoin market. For the reason that collapse of FTX in early November 2022, the quantity of USDC within the reserve of cryptocurrency exchanges doubled to $5 billion.

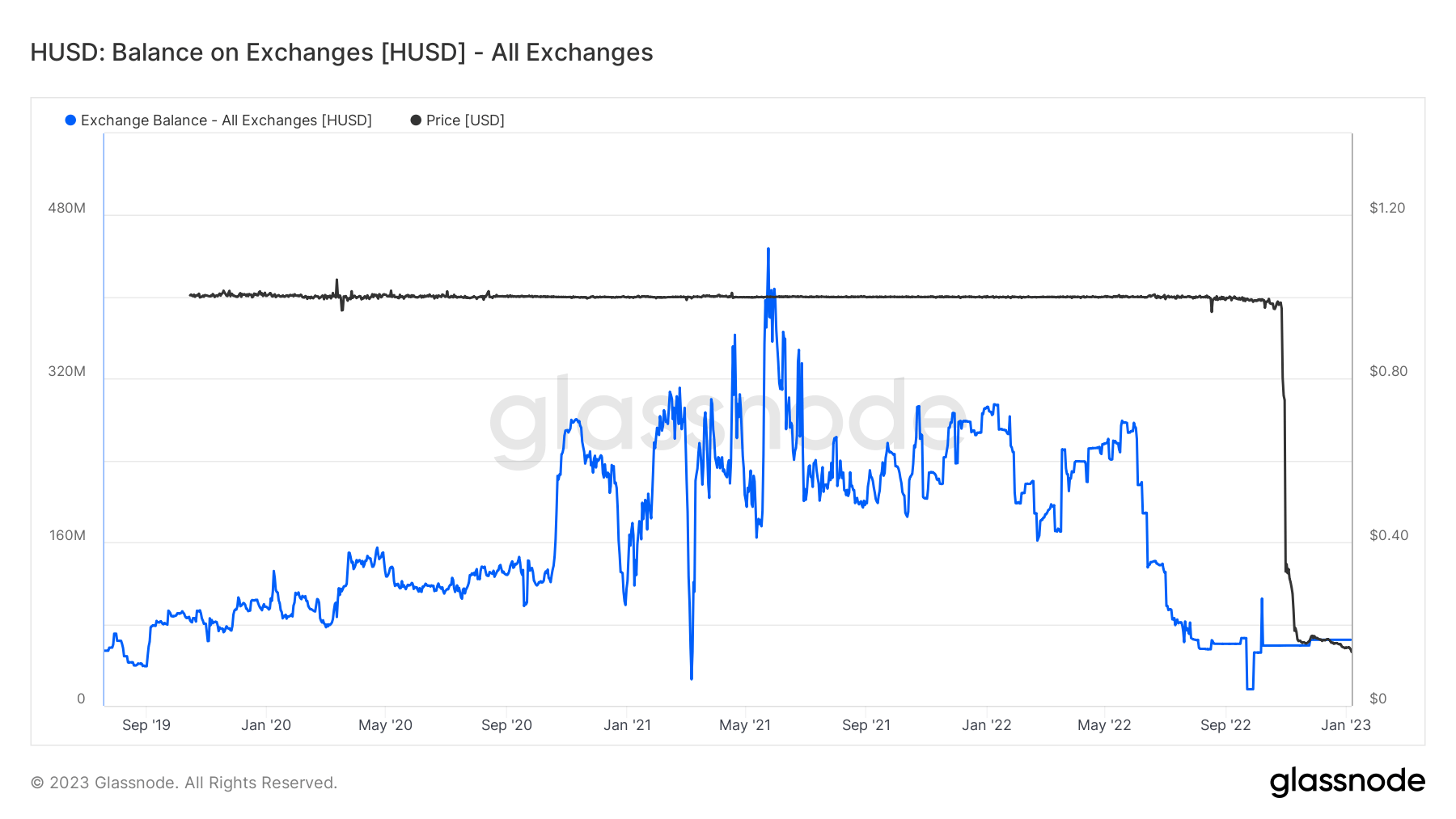

Nevertheless, the resilience the stablecoin sector has been having fun with because the collapse of Terra Algorithm stablecoin UST is considerably below menace. Following the announcement of Huobi World to delist the HUSD stablecoin, the token has suffered a large decline.

Shortly after the announcement, the stablecoin fell 72% off its greenback peg, and now HUSD is buying and selling at 13 cents. In a pointy dip, the quantity of HUSD in cryptocurrency alternate reserves is about to surpass its all-time low of $65 million.

Stablecoin reserve in centralized exchanges

Following the collapse of FTX, traders started to doubt the reliability of Centralized exchanges. As of January 12, Binance recorded about $5.202 billion outflow of stablecoin because the collapse of FTX.

Likewise, inside two months after the demise of FTX, Coinbase Professional noticed a internet outflow of $690 million, Huobi $277 million, Bitfinex $125 million, Gemini $398 million, and Gate.io $42 million.

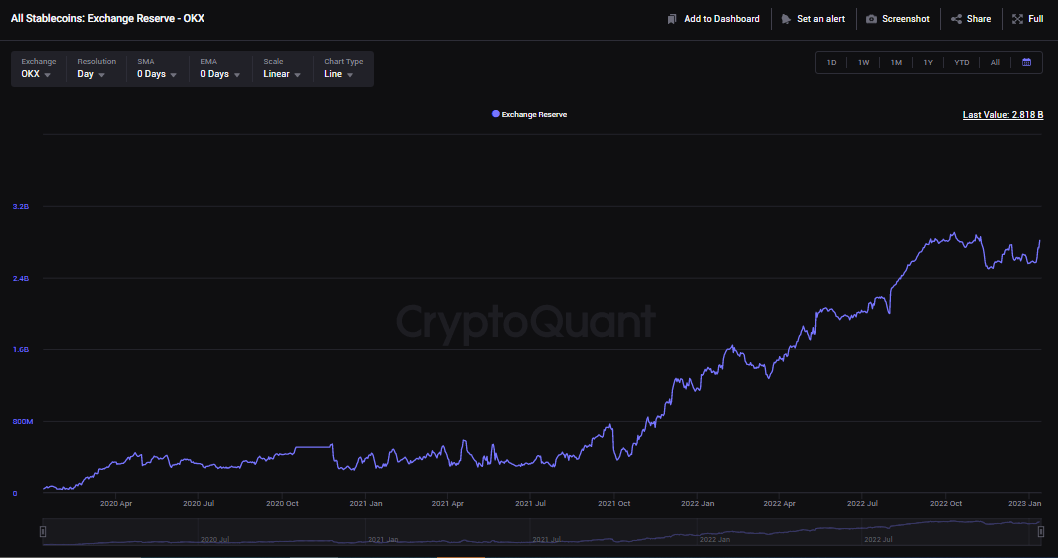

OKX, on the constructive facet, didn’t report a deficit; as an alternative, the cryptocurrency alternate loved a $43 million internet influx.

Inside this era, cryptocurrency exchanges witnessed about $6.2 billion internet outflow of stablecoin, with Binance struggling essentially the most, in accordance with Cryptoquant. Nevertheless, the outflow can’t be thought of important since Binance held about $39.9 billion price of stablecoin, in accordance with its proof of reserve report from Nov. 10.

Exchanges like Binance and Crypto.com launched proof-of-reserves with Mazars in November to determine customers’ belief. Even so, the corporations later confronted backlash from the neighborhood as some argued that the report didn’t reveal the complete reserve of the exchanges.

In a harsh consequence, Binance, inside a day, witnessed a large withdrawal of stablecoins that amounted to about $2.1 billion.

It’s obvious from the charts that customers nonetheless have belief points with centralized exchanges since stablecoin reserves proceed to fall.