Key Takeaways:

- Stablecoin TVL on Solana exceeds 5%, signaling a wholesome ecosystem—outperforming a lot of the market.

- Solana noticed one other file excessive at 4 million day by day lively addresses, indicating stronger person engagement.

- Solana’s rising stablecoin provide may obtain a lift from anticipated regulatory change.

Whereas many L2 platforms are going by way of their shares of bull and bear cycles, Solana is quick establishing itself because the go-to platform, observing large development in its ecosystem worth and person exercise. Due to enhanced belief and utility, Solana’s stablecoin TVL has reached a serious milestone, whereas day by day lively addresses proceed to surpass rival networks.

Stablecoin Development Fuels Solana’s Spectacular Rise

The TVL of stablecoins in Solana’s ecosystem has exceeded 5%, in keeping with Anna Yuan, founding father of Perena, a Solana native stablecoin infrastructure protocol, citing knowledge from Artemis. It is a vital leap from almost 3 p.c in early January. Solana nonetheless trails behind each Ethereum, with a stablecoin TVL above $100 billion, in addition to TRON, which has over $50 billion, however its development trajectory is simple.

Solana is the third largest blockchain community measured by stablecoins, after Ethereum and Tron, in keeping with The Block. Supply: CryptoRank

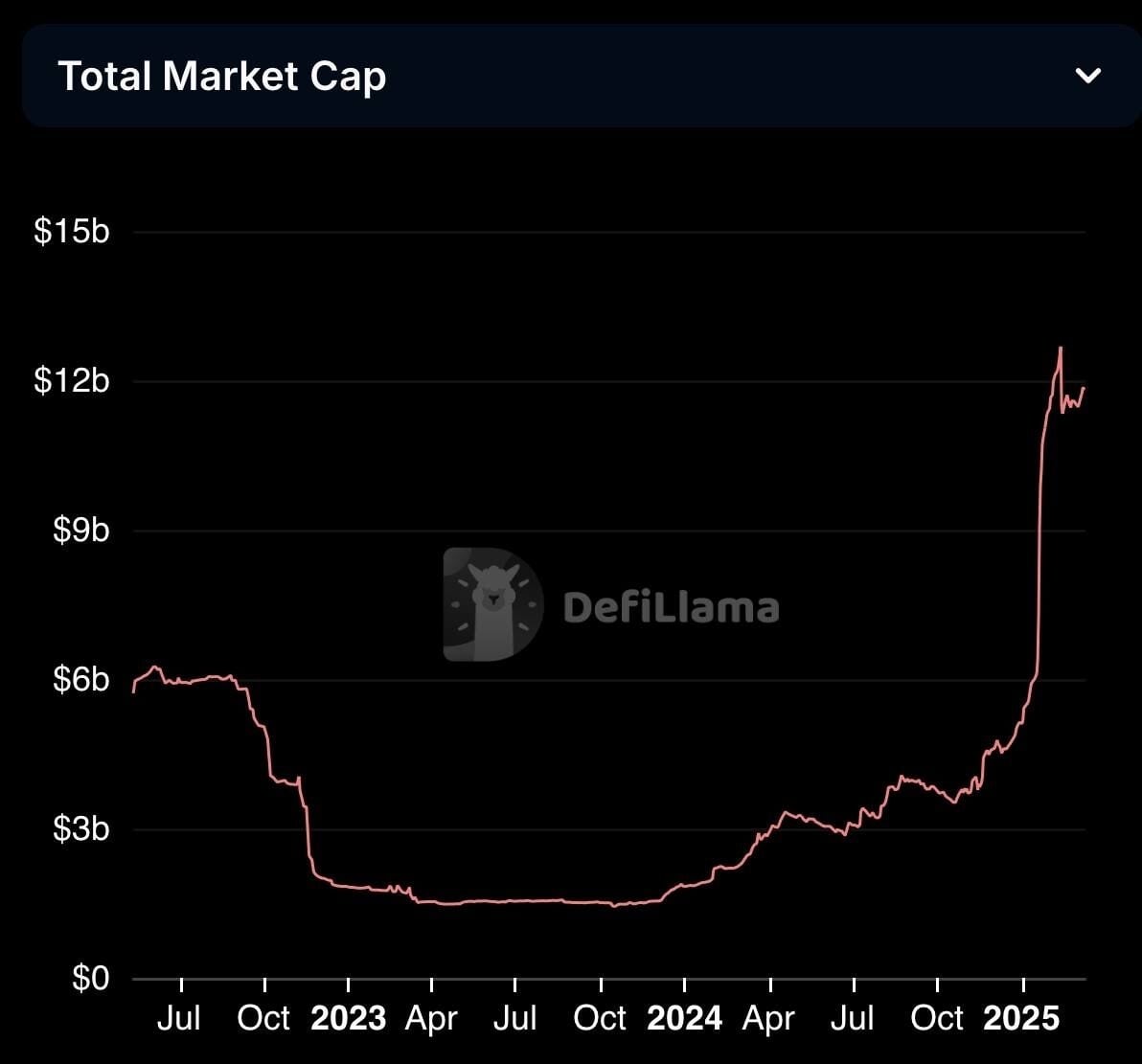

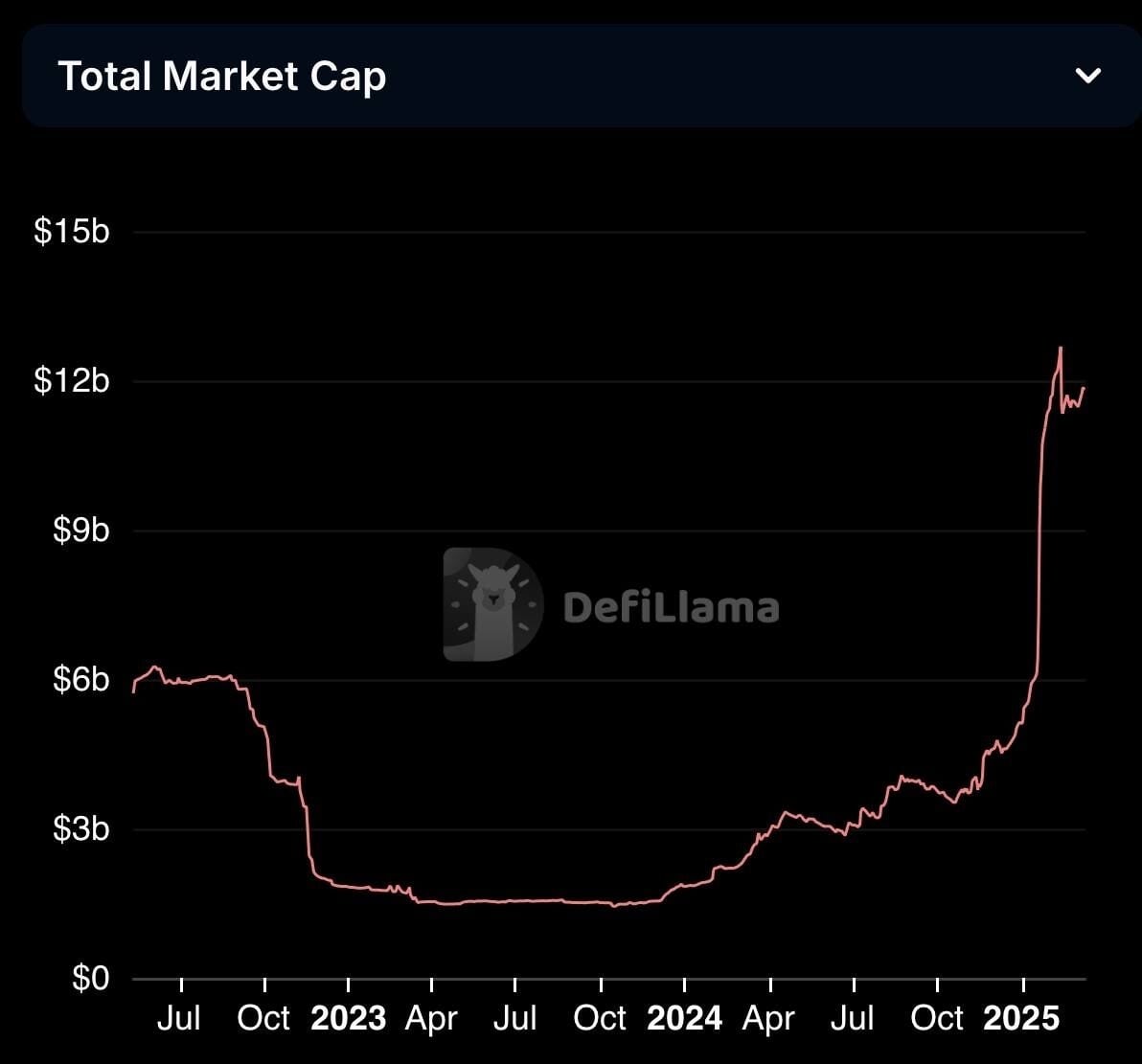

This development is partly resulting from Circle’s regular issuance of USDC on Solana. Since early 2025, Solana’s stablecoin provide has surged by 130% general, with a notable 112% enhance in January alone, reaching $11.8 billion. In truth, Circle had minted $250 million USDC that day, bringing the USDC issued since January 1, 2025, to $10 billion.

Consumer Engagement Soars with Memecoin Mania and Ecosystem Utility

Solana isn’t solely using a stablecoin wave—it is usually witnessing staggering development in person engagement, with 4 million day by day lively addresses, eclipsing networks comparable to TRON, which has 3 million. Notably, this spike in exercise is exemplified by a exceptional 86 million day by day transactions, demonstrating Solana’s scalability and rising adoption.

Solana’s stablecoin provide surged 112% in January 2025, hitting a file $11.1 billion, in keeping with a CCData report. Following Binance’s January 18 launch of the token, stablecoin holdings climbed 73.6% by late January. In the meantime, the variety of new addresses on Solana soared previous 9 million forward of Trump’s inauguration, additional underscoring the community’s rising recognition.

Favorable Laws and Constructive Worth Forecasts

Trying forward, regulatory strikes such because the upcoming GENIUS Act, which is presently within the US Senate, may additional improve Solana’s stablecoin place. Regulatory readability may encourage extra monetary establishments to discover Solana-based stablecoins, driving extra liquidity into the ecosystem. In truth, projections predict that the full stablecoin provide might attain $225.4 billion by 2025, almost tripling Solana’s whole contribution to $11.8 billion.

Analysts say that rising belief and utility within the ecosystem are key to attracting new DeFi tasks to Solana. This creates a virtuous cycle of accelerating adoption and funding in Solana’s ecosystem.

From a technical perspective, Solana’s worth motion is drawing investor curiosity. A cup-and-handle sample has fashioned, signaling a possible bullish breakout. If SOL surpasses $120 with robust quantity, analysts foresee a rally to $135–$140. In January, CryptoElites famous that SOL had damaged above a 2021 pattern line, suggesting a transfer towards $678–$1,099. One other analyst, CryptoExpert101, projected SOL may hit $1,000 in 2025.

Regardless of the optimism, volatility stays a priority. A drop under $110 may shift sentiment bearish, although SOL, now round $130, maintains an general constructive pattern.

Solana Scalability and Community Upgrades Essential for Sustained Development

Now that Solana is having fun with unprecedented ranges of person exercise and stablecoin adoption, the main focus should be on sustaining a mix of community effectivity and safety. Specialists warning that persistently excessive utilization may require continued funding to improve networks or purchase extra sources. For instance, builders at Solana are proactively getting ready to alleviate congestion the place obligatory, guaranteeing customers a easy transition. With a latest community improve that considerably elevated transaction processing speeds, the crew is clearly dedicated to scalability.

The whole market cap of Solana stablecoins has tripled since November. Supply: DefiLlama

In truth, only some months in the past, Senator Elizabeth Warren vehemently opposed the GENIUS Act, describing it as a “clear menace to nationwide safety.” She cited studies that World Liberty Monetary, a Donald Trump-backed venture, was negotiating a deal involving Binance. This additionally highlights the complexities of the regulatory setting and the potential impression of geopolitics on the stablecoin market. Regulatory uncertainty stays a problem, however clearer pointers may unlock new alternatives for Solana-based monetary merchandise.

Associated Information: Solana Worth Prediction: Right here’s When Solana Will Hit $300