This story is a part of Taxes 2023, CNET’s protection of the very best tax software program, tax ideas and every thing else you have to file your return and monitor your refund.

There are a variety of tax scams that resurface each tax season, however tax associated identification theft may be the worst. That is when somebody makes use of your Social Safety quantity to file a tax return in your title with the aim of stealing your tax refund.

Robert Rodriguez/CNET

You won’t even know you have been scammed till you file your tax return and it is rejected due to duplicate private data. You do have recourse with the IRS for identification theft, however you are in for a protracted course of.

Latest main privateness breaches at PayPal and T-Cell remind us of the vulnerability of our Social Safety numbers, which regularly work as each login and password for presidency providers and advantages. “It’s very cheap to imagine that your Social Safety quantity has been compromised not less than as soon as, if not many occasions,” stated Notre Dame expertise professor Mike Chapple in an interview with Forbes.

In case your Social Safety quantity is floating across the darkish net, how will you stop somebody from submitting a tax return in your title? One good transfer is to file your taxes early (earlier than anybody else can), however you may as well lock your tax return down with an IRS Id Safety PIN, or IP PIN.

Find out how an IRS IP PIN works, why you may need to get one and why the IRS may ship you one robotically. For extra tax ideas, take a look at the largest tax adjustments for 2023 and all of the potential tax credit and deductions for owners.

What’s an IRS Id Safety PIN?

An IRS Id Safety PIN is a singular six-digit passcode that may shield taxpayers from tax-related identification fraud. The code is thought solely to the person taxpayer and the IRS and may solely be shared with trusted tax preparers.

Taxpayers who’ve been victims of tax-related identification fraud up to now could also be issued an IP PIN by the IRS. In that case, it’s best to obtain a CP01A discover within the mail together with your six-digit code every year.

How do I create an IP PIN for my taxes in 2023?

Taxpayers can create their very own IP PIN in a couple of minutes on the Get An Id Safety PIN web page of the IRS web site. You may have to create a web based IRS account and confirm your identification first, if you have not already.

When you do not need to create an IRS account or request an IP PIN on-line, you may as well file IRS Kind 15227, “Software for an Id Safety Private Identification Quantity,” however provided that your adjusted gross revenue in your final tax return was lower than $73,000 for single filers or $146,000 for married submitting collectively.

After submitting Kind 15227, you’re going to get a phone name from the IRS to substantiate your identification after which obtain your IP PIN by way of the mail in about 4 to 6 weeks.

You can too get an IP PIN from a neighborhood IRS Tax Help Middle. You could find a location and guide an appointment by calling 844-545-5640. You may have to convey two types of identification, certainly one of which have to be a government-issued picture ID.

How do I exploit my IRS IP PIN?

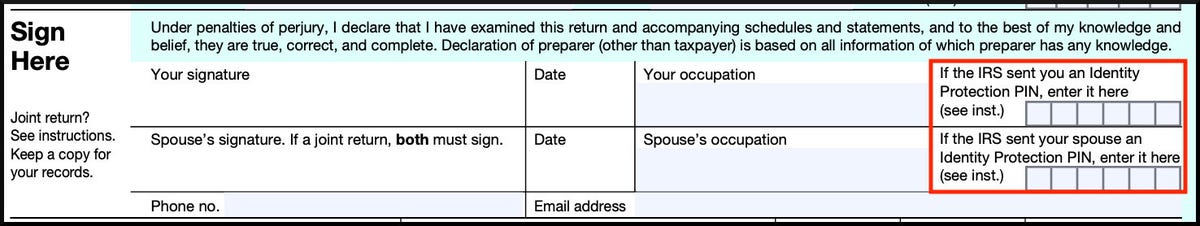

As soon as you have been issued an IP PIN by the IRS, you will have to enter it on any of the Types 1040 that you just use to file taxes, together with 1040-NR, 1040-PR, 1040-SR and 1040-SS. You may enter the IP PIN on the finish of the shape on the road the place you signal your tax return.

Your IP PIN goes on the finish of your Kind 1040 subsequent to your signature.

IRS/Screenshot by Peter Butler/CNET

When you’re utilizing tax software program to file your tax return, every program could have a step in its submitting course of the place it asks you to your IP PIN. When you and your partner are submitting collectively and each have IP PINs, you will have to enter them each.

When you file electronically and don’t embrace your IP PIN, your tax return shall be rejected. When you file with paper types and overlook to incorporate your IP PIN, your return shall be delayed for added processing to confirm your identification.

Every IP PIN solely lasts for one 12 months, so you will have to create a brand new PIN every tax season if you would like continued safety towards identification theft. The net instrument for producing IP PINs is on the market from mid-January to mid-November.

When you’ve obtained an IP PIN from the IRS by way of CP01A discover, you will proceed to obtain a brand new PIN within the mail every year earlier than tax season in December or January.

When the IRS expanded the IP PIN program to all Individuals in January 2020, it introduced that the company would add the power to decide out in 2022, however that change doesn’t appear to have occurred. The newest information we are able to discover about opting out of an IP PIN is available in an IRS launch from April 2022 that claims, “As soon as a person is enrolled within the IP PIN program, there is no strategy to opt-out.”

I created my very own IP PIN for the primary time throughout final 12 months’s tax season. Positive sufficient, once I logged into my account this 12 months, there was one other six-digit code ready for me.

What if I misplaced or by no means obtained my IRS IP PIN?

Taxpayers who generated an IP PIN or obtained one from the IRS and later misplaced or forgot the code might want to retrieve it as a way to file taxes electronically in 2023.

When you created an IP PIN utilizing the IRS’ on-line self-service instrument, you’ll be able to merely return to the IP PIN generator to search out your PIN once more. Log into your IRS on-line account and go to the Get an Id Safety PIN web page once more. The IRS warns, “You might be required to confirm your identification once more on account of our elevated account safety.”

When you had been despatched a CP01A discover with an IP PIN and misplaced it or by no means obtained it, you will have to name a particular IRS telephone quantity: 800-908-4490. After the company verifies your identification, you will obtain your IP PIN within the mail inside 21 days.

The IRS does have one odd exception to retrieving an IP PIN from a CP01A discover. You can not retrieve the IP PIN after Oct. 14 if you have not filed a 1040 or 1040 PR/SS type for the present and former 12 months.

In that uncommon case, the IRS advises you to file your taxes on paper. Submitting on paper with no required IP PIN will trigger a processing delay however will even set off identification verification to your tax return that can doubtless resolve your state of affairs.

For extra on taxes in 2023, see whether or not you have to pay taxes on Social Safety advantages and find out about latest rule adjustments for reporting revenue from Venmo and PayPal.