Este artículo también está disponible en español.

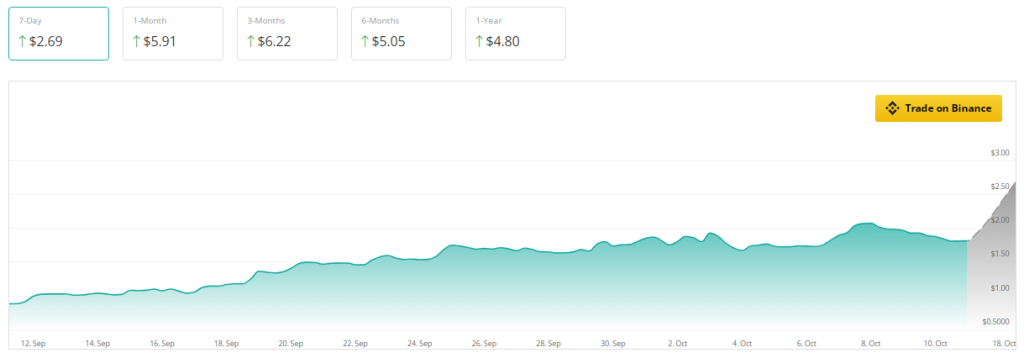

Over the previous 30 days Sui [SUI] has been on a roll, tripling its market capitalization and displaying excellent progress. Over 100% improve in worth drove the token’s market capitalization above $5 billion. However as is all the time the case with cryptocurrencies, what rises should fall not less than momentarily.

Supply: Coingecko

Associated Studying

The coin’s surge is exhibiting indications of stalling after weeks of accelerating momentum. Merchants at the moment are carefully observing what can occur subsequent for this once-red-hot asset. In response to crypto value prediction website CoinCheckup, SUI is promoting 220% beneath its anticipated value for subsequent month, suggesting a doable undervaluation.

Value Slips And Declining Market Exercise

SUI was buying and selling at $1.84 at press time after shedding 5% of its worth inside solely 24 hours. Primarily based on CoinMarketCap, buying and selling volumes have likewise dropped by 4%. This decline in exercise suggests, not less than in the meanwhile, a reducing curiosity within the token.

The technical indicators hardly appear significantly better. Monitoring cash circulation into and out of an asset, the Chaikin Cash Circulation (CMF) has additionally been on a downward slope within the final seven days. This is a sign that cash is fleeing SUI, normally resulting in points for value stability. Furthermore, the CMF has entered unfavourable territory, suggesting that buying curiosity is at the moment subordinated to promoting stress.

SUI: Slowing Momentum However Potential Bounce

The token began to unload as its Relative Power Index (RSI) dropped beneath a key sign line, indicating declining momentum. Nonetheless, there’s a optimistic side right here. Ought to the RSI present a optimistic flip as soon as extra, it could point out a shopping for probability for individuals who suppose SUI has long-term promise.

If promoting retains on, analysts say SUI may check help at $1.70; this won’t be a unfavourable final result. Sturdy help ranges draw consumers who see worth at decrease ranges, thereby performing as a foundation for the value to extend as soon as once more. SUI should barrel its well beyond the resistance at $2, a elementary psychological and technical barrier, whether it is to interrupt out from its current downturn.

Cooling Curiosity

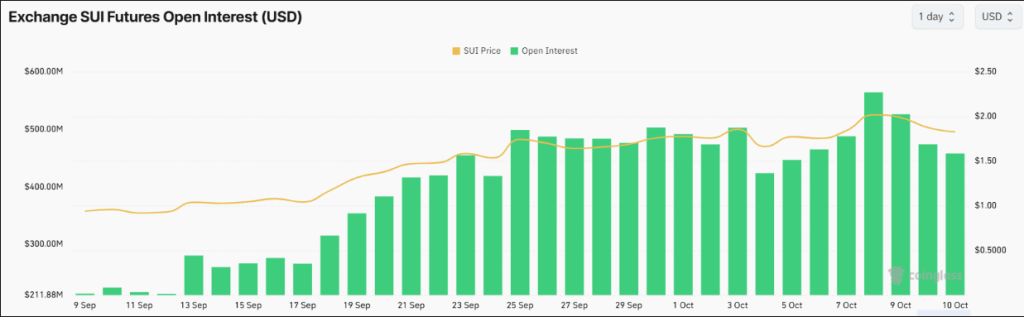

In the meantime, SUI, which has currently been seeing explosive progress, additionally appear to be cooling off. From an all-time excessive of $560 million to $450 million, open curiosity declined 10% over the previous 24 hours. This suggests that merchants are closing positions as pleasure declines, thus serving to to elucidate the overall promote stress on the coin.

Some merchants would see the drop in open curiosity as an indication of alternative even with this cooling off. Costs falling all the time imply that consumers will re-enter the market, significantly in the event that they really feel SUI is underpriced.

Associated Studying

SUI nonetheless has promise long run. Over the next three months, analysts challenge a doable 240% value rise; over the following yr, a 160% improve. For SUI, particularly with a long-term perspective, the longer term seems vivid even when the highway forward may very well be rocky.

Featured picture from ThoughtCo, chart from TradingView