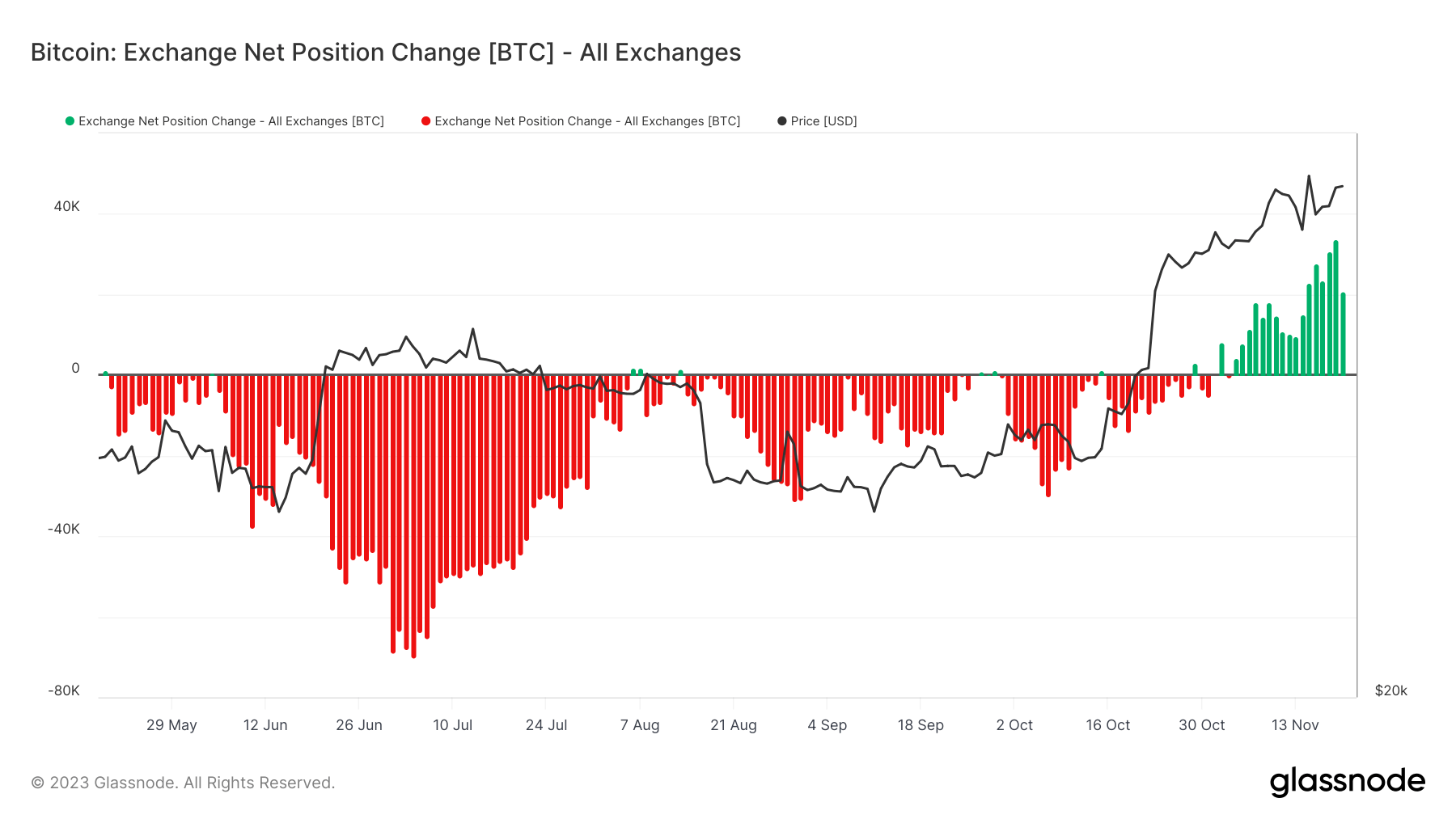

After six months of Bitcoin trade withdrawals outpacing deposits, a reversal occurred this month, signaling a change in holder conduct.

The trade internet circulation, which measures the distinction between Bitcoin deposits and withdrawals on exchanges, turned optimistic at the start of November, indicating a renewed curiosity in trade actions amongst Bitcoin holders.

This shift is especially important given the damaging inflows that continued from Might 20 to Oct. 31, suggesting a interval the place holders have been extra inclined to retailer their Bitcoin off exchanges, presumably for long-term holding or in anticipation of market restoration. Nonetheless, this pattern reversed in November, with the trade internet place change exhibiting a definite improve in Bitcoin being moved to exchanges. This inflow peaked on Nov.19, when a staggering 33,854 BTC have been deposited onto exchanges. Such a considerable spike can usually be interpreted as an indication of holders making ready to promote or commerce their Bitcoin, presumably on account of altering market circumstances or to capitalize on value actions.

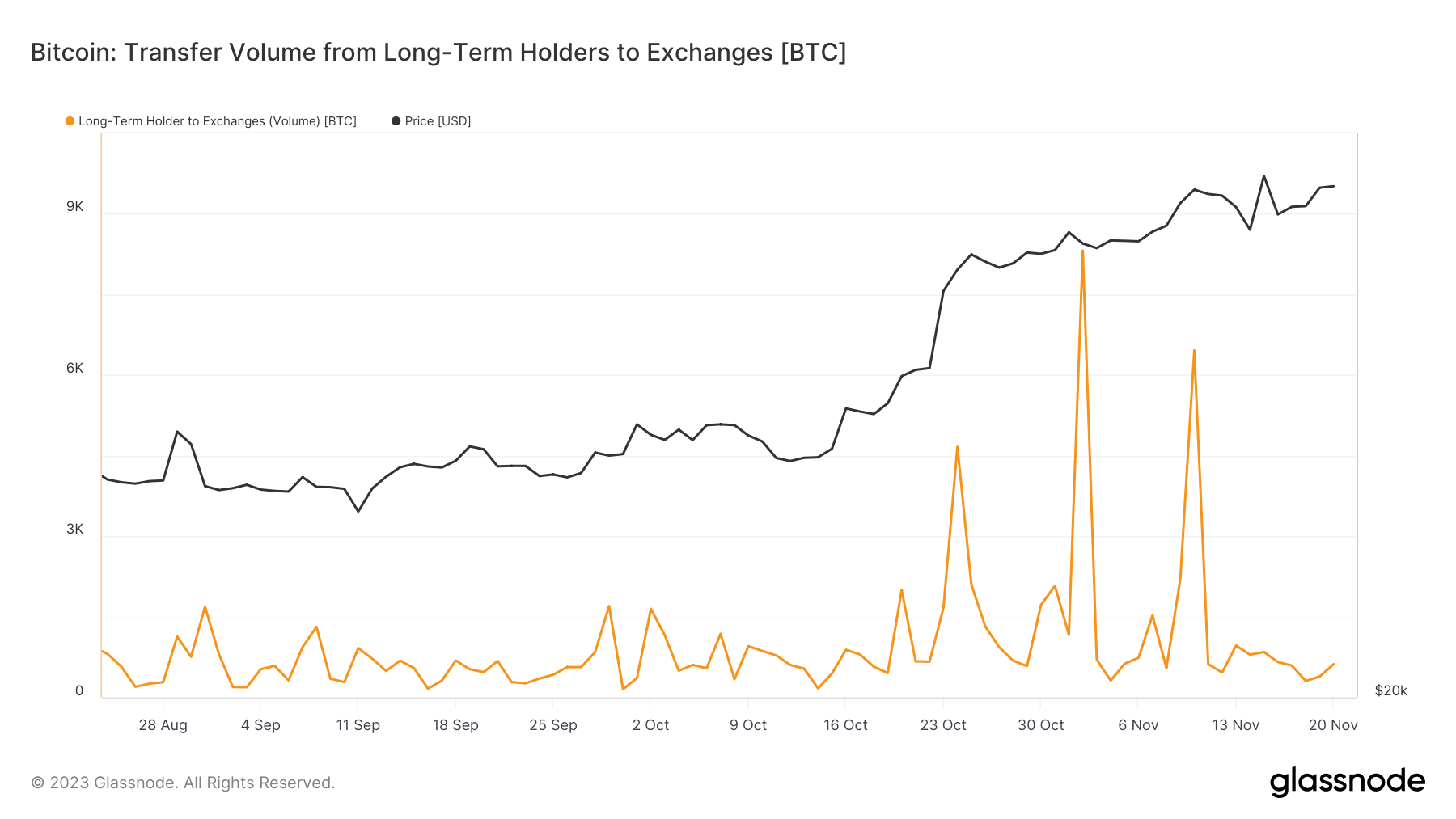

Analyzing the switch volumes by particular cohorts of holders gives extra profound perception. The switch quantity from long-term holders (LTHs) to exchanges is especially noteworthy, with two important spikes occurring in November: 1,163 BTC on Nov. 1 and a extra important 8,318 BTC on Nov. 2. These transfers counsel that some LTHs, usually characterised by their tendency to carry property via varied market cycles, selected to maneuver their holdings to exchanges, presumably indicating a shift of their long-term funding methods or reactions to present market dynamics.

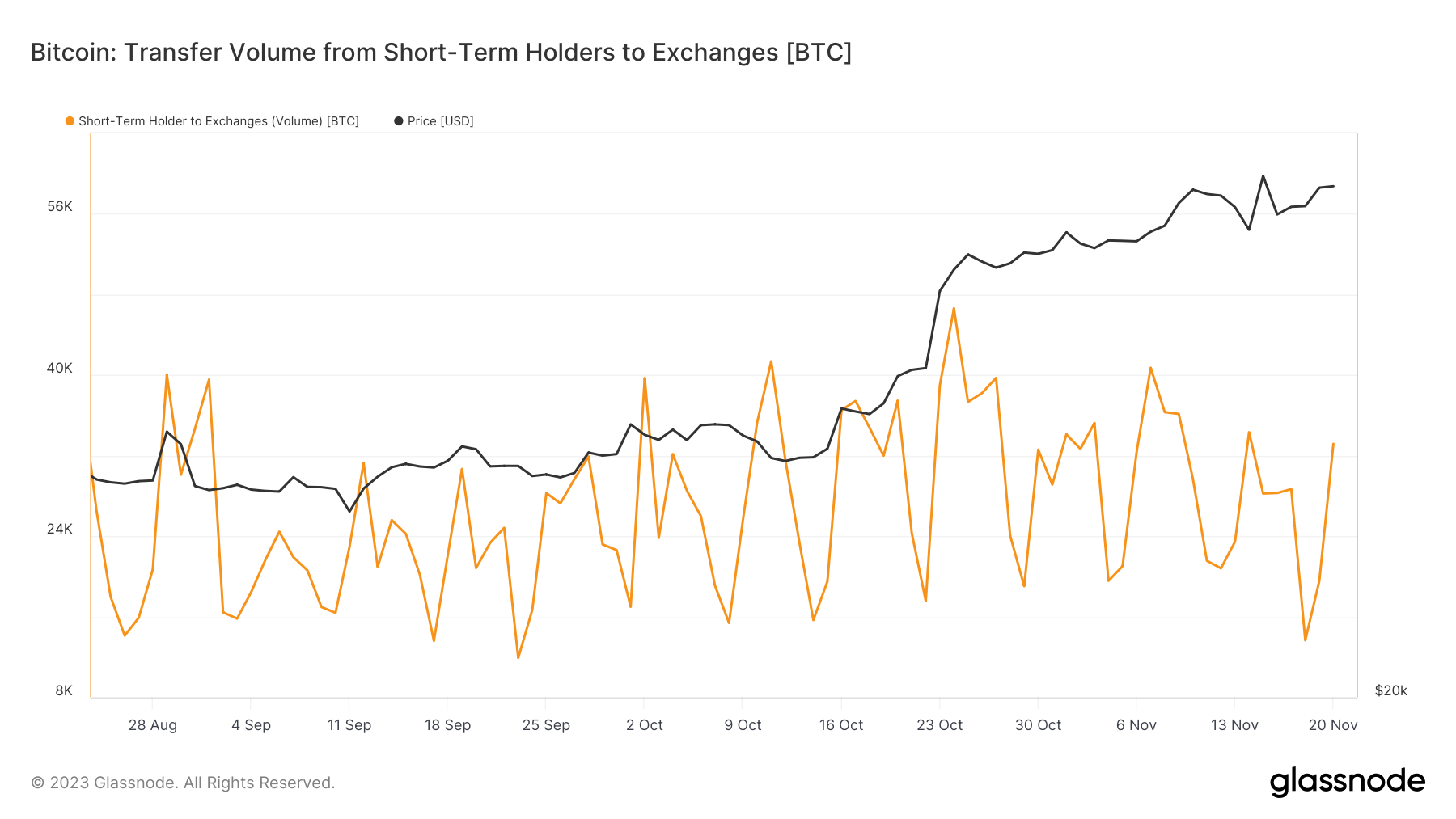

In distinction, the switch quantity from short-term holders (STHs) to exchanges was markedly increased, reflecting their extra energetic and responsive buying and selling conduct. Important inflows have been noticed on a number of days, together with 34,111 BTC on Nov. 1 and 33,170 BTC on Nov. 20. These figures align with the 12 months’s common however are indicative of the unstable nature of short-term holding, the place buyers usually tend to react to speedy market adjustments.

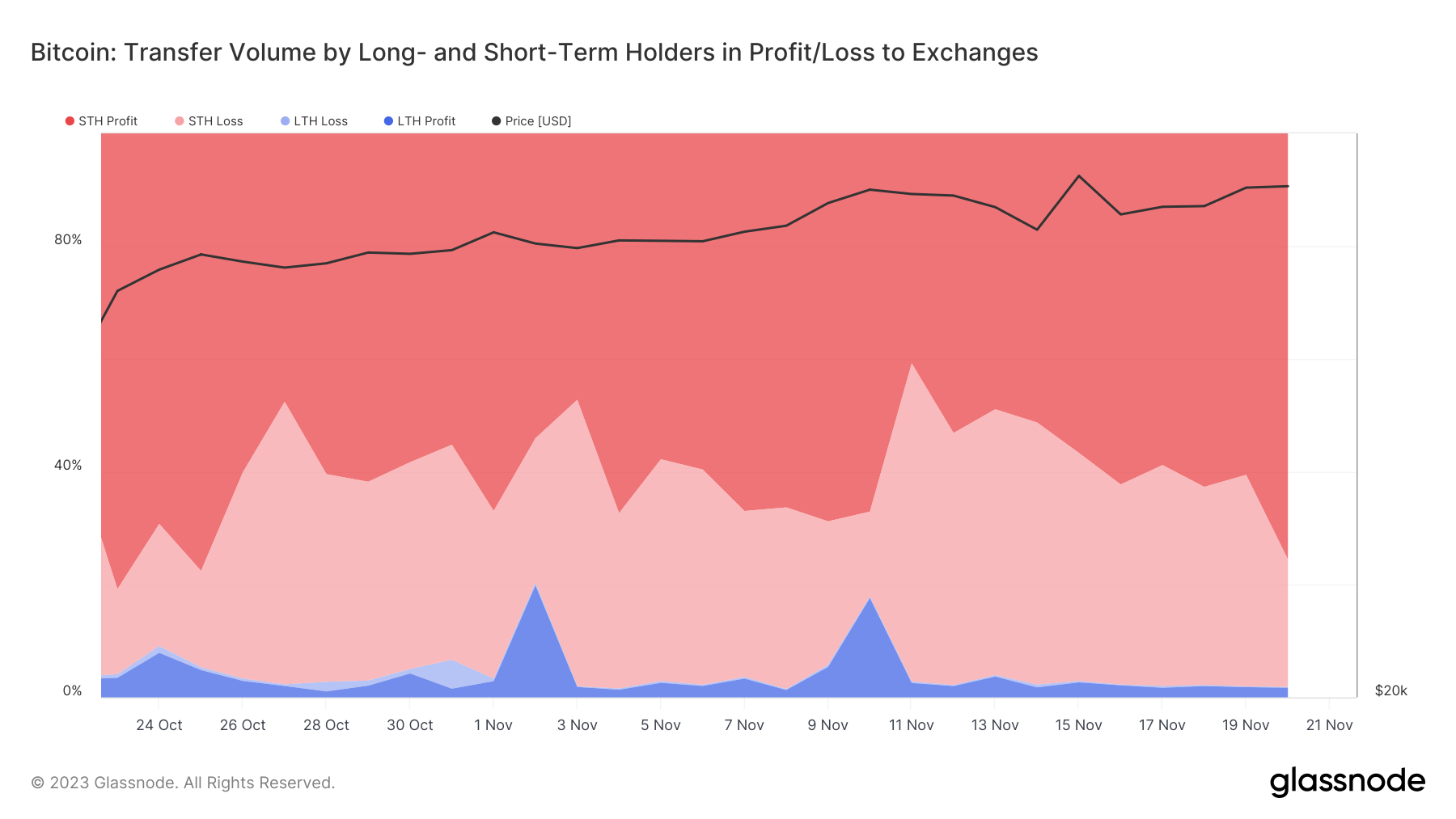

One other vital measure to think about is the quantity of Bitcoin moved to exchanges by long-term and short-term holders and whether or not they’re making a revenue or loss. This metric reveals the proportion of holders in revenue throughout their transfers. On Nov. 1, 66.9% of STHs and solely 2.8% of LTHs have been worthwhile, reflecting these two teams’ completely different funding horizons and techniques. By Nov. 20, the proportion of worthwhile STHs elevated to 75.5%, whereas that of LTHs decreased to 1.69%. This pattern signifies that extra STHs, extra attuned to short-term value actions, have been capitalizing on their income.

The elevated trade inflows from STHs and LTHs, significantly with a good portion of STHs in revenue, counsel a market the place short-term buying and selling dynamics are more and more influential. STHs, buoyed by current income, are driving this pattern, doubtlessly trying to lock in positive factors amidst fluctuating costs. Nonetheless, regardless of these actions, Bitcoin’s value remained comparatively steady, rising barely from $35,421 on Nov. 1 to $37,485 on Nov. 20.

This stability, regardless of the elevated trade inflows and promoting strain, may counsel a strong underlying demand absorbing the sell-off, or a market nonetheless in equilibrium, ready for a extra decisive directional transfer.

The submit Surge in Bitcoin trade deposits breaks six-month withdrawal streak appeared first on CryptoSlate.