Onchain Highlights

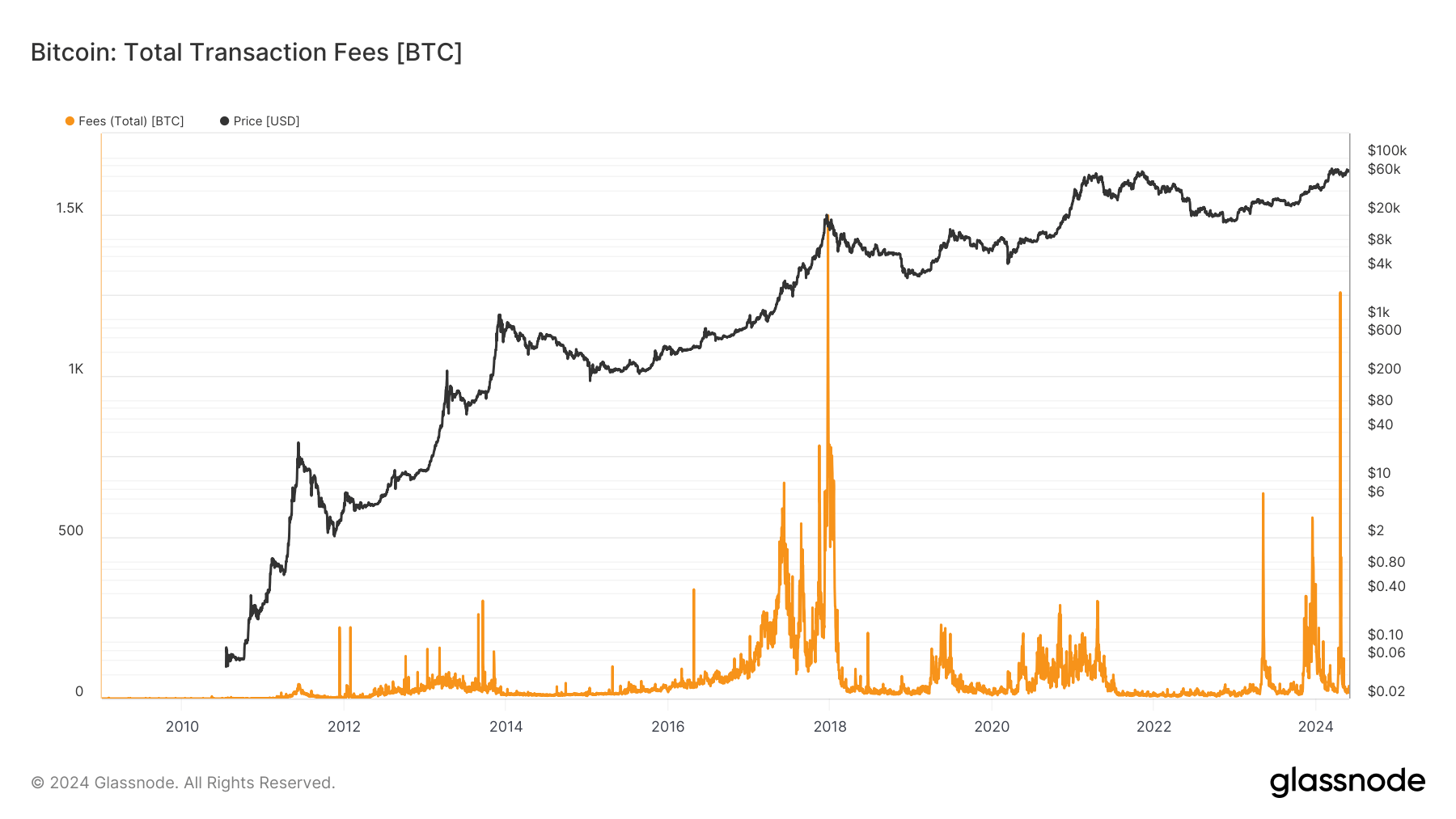

DEFINITION: Whole transaction fess are the full quantity of charges paid to miners. Issued (minted) cash should not included.

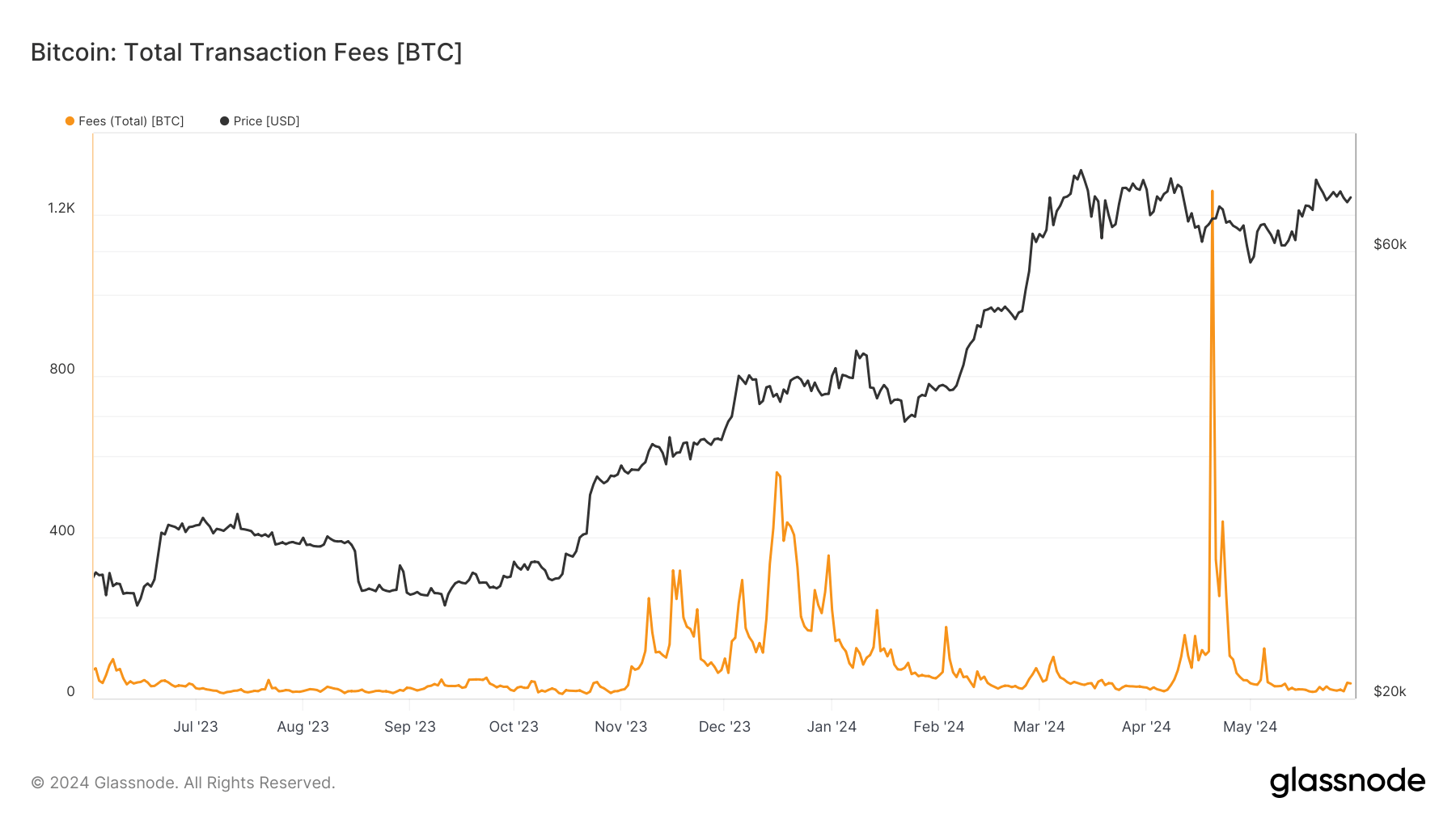

Bitcoin’s complete transaction charges surged notably earlier in 2024. Following the halving occasion in April, charges have seen a marked improve, momentarily reaching file highs. This rise is basically attributed to the introduction of Runes, a brand new protocol, which considerably boosted community exercise and congestion, leading to a considerable uptick in transaction charges. On April 20, transaction charges peaked at 1,257.71 BTC, accounting for over 75% of miner income for the day.

Since then charges have subsided as Ordinals and Runes pale in recognition.

The elevated charges had varied impacts on the Bitcoin ecosystem. For example, the surge in charges has made Bitcoin transactions extra expensive, which in flip led to a lower in energetic addresses on the community, reaching a three-year low. Regardless of this, the rise in transaction charges showcases the feasibility of a shift in miner income composition as a future reliance on charges for Bitcoin sustainability, which can inevitably be wanted as soon as all Bitcoin has been mined.

Whereas charges not too long ago dropped again to ranges much like mid-2023, a current uptick has been noticed, and any resurgence in Inscriptions recognition might see charges return to elevated ranges.

Because the yr progresses, it will likely be essential to watch how these price situations affect Bitcoin’s usability and miner profitability. The long-term results of those modifications will probably play a big position in shaping the way forward for Bitcoin transactions and community participation.