Trucking firms have distinctive payroll wants that usually require specialised software program to handle the complexities. One of the best payroll software program for trucking firms provides effectivity to managing payroll, monitoring driver miles and hours labored, automating fee processing, Worldwide Gasoline Tax Settlement reporting, integrations with transportation administration methods, and making certain compliance with federal and state rules.

SEE: Payroll processing guidelines (TechRepublic Premium)

This information gives an summary of the most effective payroll software program for trucking firms, with details about options, pricing and necessary components to contemplate when choosing the right payroll software program for your enterprise.

Soar to:

Greatest payroll software program for trucking firms

With the fitting payroll software program, trucking firms can precisely and effectively handle their payroll processes. To assist trucking firms make your best option, we’ve evaluated numerous payroll software program options; some are specifically catered to the trucking and transportation trade, whereas others are prime payroll options for basic use. After intensive analysis and evaluation, we’ve discovered that the next suppliers supply the most effective payroll software program for trucking firms:

| Product | Constructed-in IFTA monitoring | Expense monitoring | Contractor fee plan | Beginning worth |

|---|---|---|---|---|

| Axon Software program | Sure | Sure | No | Customized pricing |

| QuickBooks | No | Sure | No | $75 per 30 days plus $5 per worker per 30 days |

| Gusto | No | Restricted | Sure | $40 per 30 days plus $6 per worker per 30 days |

| ADP | No | Restricted | No | Customized pricing |

| Axis TMS | Sure | Sure | No | $100 per 30 days |

| TruckLogics | Sure | Sure | No | $9.95 per 30 days |

Axon Software program

Axon Software program is a cloud-based transportation administration system and payroll software program resolution designed explicitly for the trucking trade. Its payroll-specific options assist trucking firms to handle their payroll and monitor driver hours.

In contrast to ADP and Gusto, Axon software program calculates IFTA, gasoline taxes, and different trucking-specific taxes and charges. It additionally gives a safe payroll platform that complies with federal and state rules.

Axon Software program affords customizable reporting and integrates with different trucking-specific methods resembling TMS, digital logging units and accounting methods.

Key options

- Compiles authorities types and studies, together with W2, W3, 1099, T4 and T4As.

- Permits truck drivers to share their GPS location and talk with in-house directors through telephone or textual content message.

- Manages driver, proprietor, operator and service calculations for wages and bills.

- Offers an end-to-end report on gear income, cost-per-mile and miles-per-gallon.

Professionals

- Actual-time truck location monitoring.

- All-in-one resolution for trucking enterprise operations, together with dispatching, accounting, payroll and upkeep.

- Tracks IFTA and gasoline tax.

- Routinely compile authorities types and paperwork, resembling W2s, W3s, 1099s, T4As and extra, with a single click on.

Cons

- Steep studying curve.

- Lacks clear pricing.

Pricing

Pricing data is out there upon request. Potential patrons also can e book a free demo to guage product options.

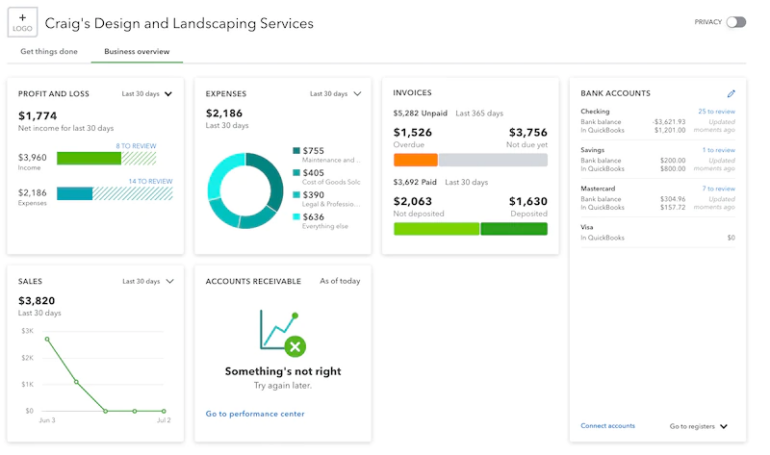

QuickBooks

QuickBooks is among the hottest and broadly used payroll software program options for trucking firms. It’s a complete accounting software program program that manages funds, tracks revenue and bills, creates invoices, and generates monetary studies and payroll. QuickBooks additionally affords integrations particularly tailor-made to the trucking trade for fleet administration, dispatch and driver monitoring.

QuickBooks integrates with instruments resembling HyperTrack and RAMA Logistics Software program, permitting customers to simply monitor fleets, monitor mileage, monitor load standing, dispatch vehicles and freight, and pay drivers and carriers. Integrating these instruments makes it straightforward for customers to remain on prime of their firm’s transportation operations and guarantee well timed funds.

Key options

- Accepts playing cards, eChecks and ACH transfers.

- Permits customers to automate recurring invoices, monitor bill standing and ship fee reminders.

- Automated tax calculations.

- Federal and state payroll tax submitting.

- Presents direct deposit.

- Advantages administration.

- Permits customers to create and e-file limitless 1099-MISC and 1099-NEC types.

- Handle 1099 contractors

- Obtain payroll studies resembling historical past, financial institution transactions, tax funds, and paid day off.

Professionals

- Similar-day or next-day direct deposit out there.

- Tax penalty safety.

- TMS integration.

- Time monitoring functionality.

- Obtainable in all 50 states.

- 401k plans

Cons

- No IFTA monitoring.

- Studying curve for brand spanking new customers.

- Restricted assist.

Pricing

QuickBooks affords a number of pricing plans — and frequent reductions — so companies can select the options they want whereas staying inside their finances. Additionally they supply a 30-day free trial. These are a number of the firm’s mostly bought pricing packages for payroll:

- Payroll Core + QuickBooks Easy Begin: $37.50 per 30 days plus $5 per worker per 30 days (with out present reductions, this package deal is $75 per 30 days).

- Payroll Core + QuickBooks Necessities: $50 per 30 days plus $5 per worker per 30 days (with out present reductions, this package deal is $100 per 30 days).

- Payroll Premium + QuickBooks Plus: $80 per 30 days plus $8 per worker per 30 days (with out present reductions, this package deal is $160 per 30 days).

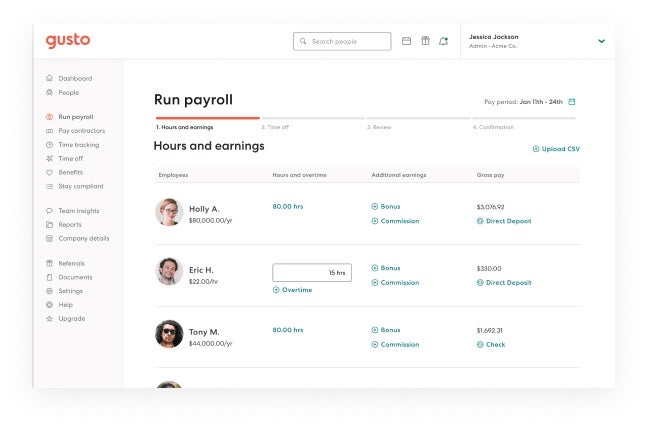

Gusto

Gusto is certainly one of our greatest payroll processing options for small companies and trucking firms. The platform gives companies with the assets they should handle payroll, advantages, HR and compliance for driver workers, contractors and different staff. It’s a cloud-based service that may be accessed from wherever, making it very best for distant staff.

Gusto additionally affords a number of different helpful options for trucking firms, together with an computerized time-tracking function that information hours labored by drivers and contractors throughout totally different tasks or websites. Though Gusto integrates with Timeero — a time, mileage and GPS monitoring software program resolution — in comparison with QuickBooks, Gusto lacks key TMS or fleet administration integrations. This may occasionally restrict the utility of Gusto for bigger trucking firms.

Key options

- Information federal, state and native taxes.

- Integrates with accounting, time monitoring and expense administration instruments.

- Permits customers to generate and obtain studies for payroll historical past, financial institution transactions, contractor funds, paid day off and tax funds.

- Provides pre-tax deductions for advantages and post-tax deductions resembling garnishments.

- View and export payroll information.

Professionals

- Subsequent-day direct deposit is out there.

- Helps a number of pay schedules.

- Limitless payroll runs.

- Works for hourly and salaried staff.

Cons

- Well being advantages not out there in all states; restricted to 39 states.

- Easy plan has restricted options.

- Lacks TMS integrations.

Pricing

Gusto affords three pricing plans, plus a contractor-only fee choice:

- Easy: $40 per 30 days plus $6 per worker per 30 days.

- Plus: The seller is at present working a proposal that goes for $60 per 30 days plus $9 per worker per 30 days. The common worth is $80 per 30 days plus $12 per worker per 30 days.

- Gusto affords 25% reductions for the primary six months; subsequently, your first three months might price $60 per 30 days plus $9 per worker per 30 days.

- Premium: Quotes out there upon request.

- Contractor solely: $35 per 30 days plus $6 per contractor. The bottom worth is discounted for the primary 6 months.

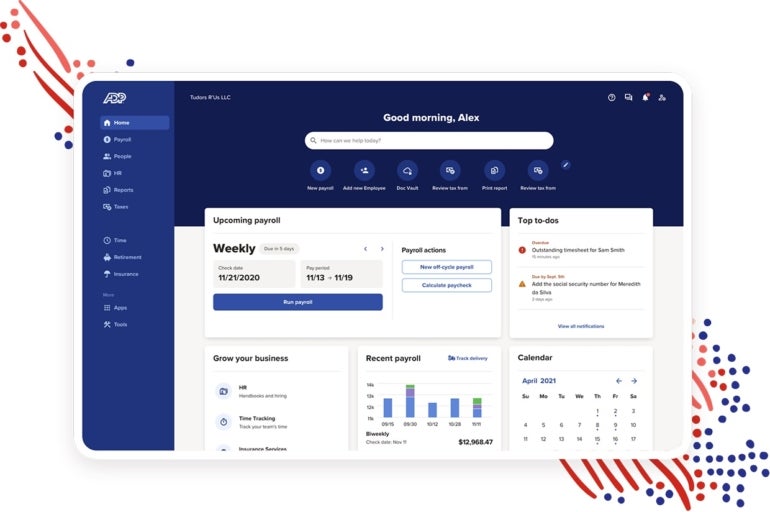

ADP

ADP, in any other case referred to as Automated Information Processing, is a payroll software program supplier that gives companies of all sizes and industries — together with trucking firms — a set of providers that may assist with payroll and different HR administration duties.

The corporate’s payroll platform consists of tax submitting and direct deposit choices, in addition to integrations with TMS options resembling TripLog. The platform additionally consists of assist for managing driver and non-driver worker designation advantages, like retirement accounts or well being care contributions. It’s customizable, so customers can tailor the options and modules to particular enterprise wants.

Key options

- Payroll debit playing cards and multi-state payroll in all plan ranges.

- Tax reporting with W-2s and 1099.

- Labor regulation poster compliance.

- Conducts single-county background checks, together with SSN validation, prison historical past and seek for the present county of residence.

- Time and attendance administration.

- Helps over 100 third-party integrations.

Professionals

- 24/7 assist.

- Similar-day direct deposit is out there.

- Characteristic-rich platform.

- Complete reporting and analytics.

- Automated processes for payroll, advantages and tax submitting.

Cons

- Lacks IFTA reporting.

- Lacks clear pricing.

- Tax submitting prices further.

Pricing

ADP affords 4 payroll plans. Particular details about every pricing plan is out there upon request.

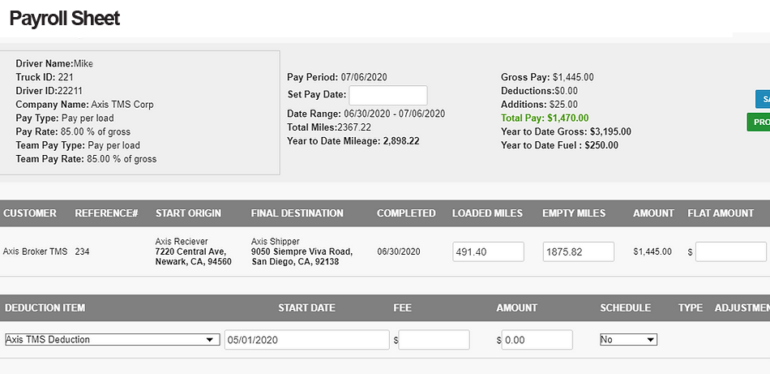

Axis TMS

Axis TMS is cloud-based trucking administration software program that gives carriers and fleets with an end-to-end resolution for managing their enterprise. This platform permits customers to simply monitor, handle and enhance the effectivity of their trucking enterprise operations.

Axis TMS gives customers with a variety of options to streamline processes associated to driver payroll, buyer invoicing, dispatch, route optimization and gasoline tax reporting. Trucking firm customers can work with each software program and {hardware} options from Axis TMS; {hardware} options embody tablets for drivers, sprint cameras, asset trackers and sensors.

Key options

- Professional app permits customers to handle payroll, preserve monitor of fee standing, generate and distribute invoices, and ship real-time notifications to drivers.

- Truck location monitoring alongside the outlined route, with ETA calculator, arrival standing and trailer availability standing included.

- IFTA mileage and gasoline sync.

- Finish-to-end doc scanning.

- Automated bill era.

- Weekly, bi-weekly or month-to-month payroll runs for drivers.

Professionals

- Offers area of interest options which are related to trucking firms.

- Useful assist crew.

- Presents numerous fee choices, together with pay-per-load, pay-per-mile and pay-per-hour.

Cons

- The consumer interface could possibly be improved.

- Customers have reported that the answer is occasionally glitchy.

Pricing

Axis TMS pricing is categorized into two teams: Month-to-month fee plans for patrons with lower than 150 vehicles and enterprise plans for patrons with over 150 vehicles. Driver payroll is included in all plans.

Month-to-month fee plans

- One to a few vehicles: $100 per 30 days.

- 4 to fifteen vehicles: $315 per 30 days.

- 16 to 40 vehicles: $600 per 30 days.

- 41 to 75 vehicles: $1,125 per 30 days.

- 76 to 150 vehicles: $2,250 per 30 days.

Enterprise prospects

- Enterprise Tier (12-month settlement): $25 per truck plus $4,500 one-time server setup charge.

- Enterprise Tier (36-month settlement): $17.50 per truck plus $3,500 one-time server setup charge.

Add-ons

- IFTA tax prices an additional $50 per submission.

- Tax filings service price begins at $75.

TruckLogics

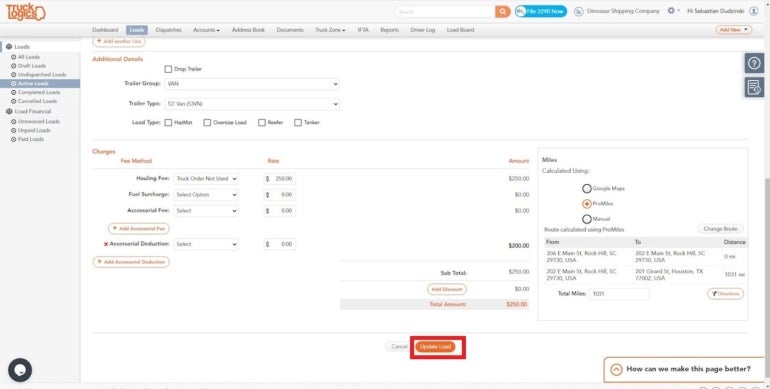

TruckLogics is a web-based trucking software program platform that helps trucking firms handle their enterprise operations. It gives instruments to handle buyer relationships, route optimization, driver administration, dispatching, gasoline monitoring, invoicing and fleet monitoring.

TruckLogics additionally affords options for compliance, analytics and reporting. Its built-in payroll module permits you to handle driver payroll, calculate wages and monitor driver hours. It additionally consists of instruments for IFTA and doc administration.

Key options

- Manages revenue and expense transactions.

- Manages acquired funds.

- Integrates with Motive, QuickBooks, EFS, DAT, Google Maps and Promiles.

- Offers year-end tax studies.

- Driver funds reporting.

Professionals

- Customers can monitor freight utilizing the cell app.

- Bill era.

- Generate IFTA tax studies.

- Intuitive consumer interface.

- Reasonably priced pricing.

Cons

- Customers reported gradual web page load time.

- Reporting options could possibly be improved.

Pricing

TruckLogics affords a 15-day free trial. The corporate affords numerous plans for various enterprise sizes which are payable month-to-month or yearly:

Proprietor Operator

For patrons with one to 2 vehicles:

- Professional: $9.95 per 30 days or $8.95 per 30 days billed yearly.

- Most well-liked: $19.95 per 30 days or $17.95 per 30 days billed yearly.

- Premium: $29.95 per 30 days or $26.95 per 30 days billed yearly.

Small Fleet

For patrons with three to seven vehicles:

- Professional: $29.95 per 30 days or $26.95 per 30 days billed yearly.

- Most well-liked: $49.95 per 30 days or $44.95 per 30 days billed yearly.

- Premium: $69.95 per 30 days or $62.95 per 30 days billed yearly.

Mid-Dimension Fleet

For patrons with eight to 14 vehicles:

- Professional: $49.95 per 30 days or $44.95 per 30 days billed yearly.

- Most well-liked: $69.95 per 30 days or $62.95 per 30 days billed yearly.

- Premium: $89.95 per 30 days or $80.95 per 30 days billed yearly.

Giant Fleet

For patrons with over 15 vehicles:

- Professional: $79.95 per 30 days or $71.95 per 30 days billed yearly.

- Most well-liked: $99.95 per 30 days or $89.95 per 30 days billed yearly.

- Premium: $119.95 per 30 days or $107.95 per 30 days billed yearly.

Different plans and add-ons

- Leased Operator: $7.95 per 30 days or $7.15 per 30 days billed yearly.

- Dealer: $39.95 per 30 days or $35.95 per 30 days billed yearly.

- IFTA studies for enterprise house owners: $24.95 per report.

- IFTA studies for service suppliers: $19.95 per report.

What to search for in trucking payroll software program

Trucking payroll software program is a useful device for any trucking enterprise. It could possibly simplify payroll administration, save money and time, and enhance accuracy and compliance with transportation-specific tax rules.

SEE: Journey and enterprise expense coverage (TechRepublic Premium)

When deciding on trucking payroll software program, it is very important take into account the next options:

Streamlined payroll processing

Search for software program that automates payroll processing, from calculating taxes and deductions to creating funds to staff. It will assist streamline your payroll course of, eliminating the necessity to enter data manually and making certain accuracy.

Greatest enterprise software program

Tax compliance

Tax compliance is paramount for trucking companies. Be sure the software program you choose can precisely calculate federal, state, and native taxes and deductions. The software program must also be capable of generate all vital types, together with W-2s and 1099s.

Reporting options

Think about software program that gives complete reporting capabilities. It will make monitoring worker hours, wages and taxes simpler. It must also present the flexibility to generate studies, resembling worker payroll summaries.

Integration capabilities

It’s very best to discover a trucking payroll resolution that may simply combine with different methods used within the trucking trade, resembling transportation administration methods. It will allow you to streamline information entry and cut back guide processes. It is going to additionally make it simpler to handle payroll data, run studies and make funds.

IFTA and gasoline tax

Trucking firms should adjust to numerous interstate journey rules, which require correct reporting of gasoline taxes and IFTA filings. Search for payroll software program that simplifies this course of by routinely amassing and processing related mileage data, permitting you to generate compliant IFTA and gasoline tax paperwork shortly. Some trucking payroll options might supply built-in doc administration instruments, which let you retailer these paperwork securely and retrieve them simply when wanted.

Consumer expertise

Be sure the payroll software program you choose affords an intuitive consumer interface that’s straightforward to navigate. It will assist guarantee staff can shortly full payroll duties with out confusion or frustration. It’s very best if the software program gives steering or tutorials to assist customers perceive use the system accurately.

Assist

You will need to select a payroll supplier that gives buyer assist choices like telephone, e-mail or reside chat. This gives you somebody to show to in case you encounter points or questions whereas utilizing the software program.

Deciding on the fitting payroll resolution in your trucking enterprise

When deciding on payroll software program in your trucking enterprise, search for straightforward setup, automated payroll processing, compliance with federal and state rules, reporting capabilities and integration with different accounting software program. Extra importantly, take into account the strengths of your inner operators and drivers alike.

The appropriate payroll resolution could make working your enterprise a lot simpler and extra environment friendly, however it’s essential to contemplate what you actually need from the software program and the way a lot it’s going to price to get these options and providers.

Learn subsequent: One of the best payroll software program in your small enterprise (TechRepublic)