Fast Take

The inflationary state of affairs the economic system has been grappling with since 2021 has prompted a contemporary have a look at Bitcoin’s efficiency.

Central banks have leveraged the Client Value Index (CPI) methodology to focus on their 2% inflation mandate, a mannequin that has its critics because of the illustration of the ‘basket’ of products, provided that totally different people have various day by day consumption patterns.

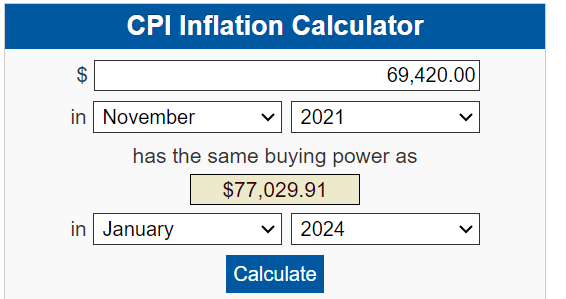

The true gravity of inflation’s influence on the digital asset market may be seen when adjusting Bitcoin’s all-time excessive of roughly $69,420 in November 2021 to a CPI inflation-adjusted determine. The calculation, based mostly on CPI metrics, reveals a putting actuality: for Bitcoin to actually reclaim its zenith, it could want to succeed in nearer to a worth of $77,000, in response to information supplied by the US Bureau of Labour Statistics.

Whether or not Bitcoin serves as a hedge in opposition to inflation or a device for forex debasement stays a contentious subject. Nonetheless, its long-term returns proceed to gasoline these discussions, emphasizing its potential position in both an inflationary or stagflationary surroundings.

The put up The Bitcoin all-time excessive in an inflation-adjusted world is $77,000 appeared first on CryptoSlate.