Diversification might have saved traders plenty of ache amid this week’s AI-fueled selloff. The Every day Breakdown explains.

Friday’s TLDR

- AI shares took a beating, however…

- Diversification might have helped

- Charting earnings estimates

The Backside Line + Every day Breakdown

This week was purported to be busy, chaotic, noisy and overwhelming — nevertheless it wasn’t supposed to begin earlier than the solar rose on Monday morning.

We went over a few of the AI-fueled carnage on Tuesday — like how Nvidia misplaced nearly $600 billion in market cap that day — however we additionally went over another constructive observations.

These “positives” spotlight how diversification can maintain a portfolio upright throughout an sudden storm.

Diversifying can protect the ache

Nvidia fell 17% on Monday, whereas the Semiconductor ETF (SMH) fell “simply” 9.8%. I’m not attempting to make a one-day lack of almost 10% sound fairly — it wasn’t — however traders gaining publicity to AI by way of the ETF moderately than Nvidia had been capable of protect their portfolio from a few of Monday’s wrath.

Identical for traders who used know-how ETFs just like the QQQ or XLK vs. direct publicity to shares like Broadcom, Oracle, or Dell. These within the Utilities ETF (XLU) sidestepped a bulk of the brutal selloffs we noticed in Constellation Power and Vistra.

That every one stated, there’s no reward with out some degree of threat.

Buyers who’ve been capable of seize a big portion of Nvidia’s rally could not remorse getting caught up in yesterday’s selloff — it’s simply a part of a trip that may be bumpy at instances. For others although, Monday’s selloff was a get up name that having too many eggs in a single basket may end up in a painful consequence.

The right way to Diversify

Buyers outdoors of AI could not have even seen the market motion earlier this week.

That’s because the Dow completed larger on the day, together with 7 of the 11 sectors within the S&P 500. Heck, 4 of these sectors had been up 1% or extra on the day and financials closed at document highs.

That’s not an inexpensive shot at traders who had been over-exposed to AI shares, it’s a reminder that having publicity to a wider basket of belongings may help mitigate a few of the massive losses we generally see on Wall Road.

One idea I like to speak about is “anchor tenants.”

Whereas a standard phrase in actual property, it is a idea that I prefer to impart on portfolios through the use of a widely known, diversified fund (or funds) as my “anchor” tenant(s), then constructing particular person ETFs and shares round them. This enables me to remain invested available in the market, whereas gaining publicity to particular person themes I really feel extra strongly about.

As an example, think about how a lot better a portfolio would have fared on Monday if, say, 60% of it was allotted to an S&P 500 ETF like VOO, SPY or IVV vs. being all-in on semiconductor shares. If that portfolio additionally had some publicity to the Dow — the DIA ETF — it could have sheltered Monday’s losses much more.

The Backside Line

Buyers ought to all the time do what works finest for them and will know their threat urge for food earlier than filling their plate with a bunch of doubtless risky belongings.

If traders had been caught off-guard by Monday’s speedy selloff, they need to think about if a bit of diversification would do them some good. Identical goes for a portfolio that wasn’t caught up in Monday’s dip however is over-concentrated in different belongings.

Need to obtain these insights straight to your inbox?

Enroll right here

The setup — Uber

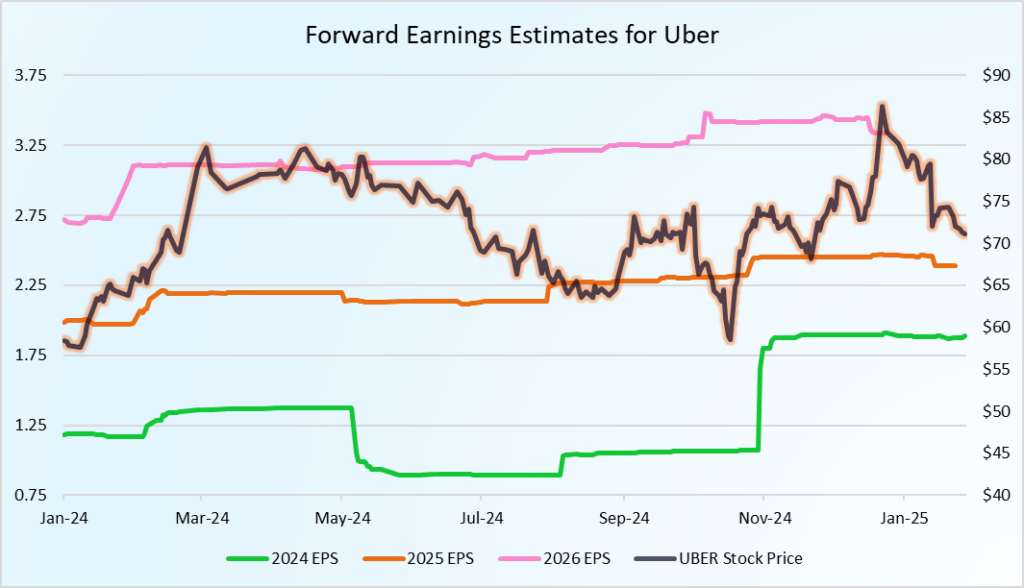

I wish to current a distinct kind of chart than what we often see. This chart is for Uber. Whereas shares are solely down about 2% over the previous yr, that badly lags the S&P 500, which is up about 23% in the identical span.

Worries about Tesla’s Robotaxi and Alphabet’s Waymo service have weighed on Uber, at the same time as earnings estimates for 2024, 2025, and 2026 proceed to climb. That’s precisely what the chart under exhibits, with the left axis exhibiting earnings estimates and the appropriate axis representing Uber’s share worth.

Discover how multi-year earnings estimates have principally drifted larger since about July. Additionally discover how annually of earnings estimates are larger than the opposite, exhibiting an anticipated improve annually. Regardless of that, shares of Uber have struggled.

Does this current a possibility for traders?

It’s certainly one of many issues to contemplate, however earnings estimates — significantly for the present yr and the next yr — is an effective place to begin for basic traders. Bear in mind, on Wall Road it’s not about what you probably did, it’s about what you might be doing now and can do sooner or later.

Nobody has a crystal ball, so there’s no assure that future estimates — for Uber or in any other case — will pan out to be too optimistic or if analysts are underestimating the enterprise. However for traders, earnings are place to begin when attempting to construct a case for or in opposition to an organization based mostly on fundamentals.

For Uber particularly, I’ll simply say this: Rising earnings expectations don’t assure the inventory will rise too, however growing income definitely isn’t a nasty factor.

Disclaimer:

Please observe that resulting from market volatility, a few of the costs could have already been reached and situations performed out.