Tether (USDT), some of the well-liked stablecoins within the crypto world, is dealing with a giant hazard. The European MiCA (Markets in Crypto Belongings) rules are making issues robust. These new guidelines may severely influence Tether’s operations in Europe. Paolo Ardoino, CEO of Tether and CTO of Bitfinex, explains that MiCA is placing strict limits on the quantity and issuance of stablecoins. It additionally requires that 60% of stablecoin reserves be held in money deposits inside banks. The issue? These money deposits are uninsured over €100,000. This might result in huge financial institution runs, inflicting instability for each stablecoins and conventional banks.

A Symptom of Failing Nationwide Economies

In an interview with Cointelegraph, Ardoino shared his ideas. He mentioned that the success of USDT exhibits the failures in lots of nationwide economies. Tether offers individuals an alternate when their economies are struggling. Take Japan, for instance. The inventory market there may be crashing, and the yen is unstable. Governments and central banks have been printing an excessive amount of cash. This has led to financial instability. That’s the rationale extra persons are turning to crypto and stablecoins like USDT.

Tether’s Technique and Compliance Efforts

Regardless of the robust roads, Tether isn’t backing down. The corporate is actively speaking with European regulators to amend these new rules. Ardoino identified that Tether isn’t alone in dealing with these challenges; even their major rivals are involved about the identical points. Ardoino is hopeful that via these conversations, they’ll work out a regulatory framework that’s each protected and sensible. In the meantime, they’re planning to develop their Tether workforce to 200 staff by the center of subsequent 12 months. The principle focus will likely be on powering up its compliance workforce. This transfer displays how severe they’re about tackling any points associated to illicit actions involving its stablecoin.

Achievements and Future Prospects

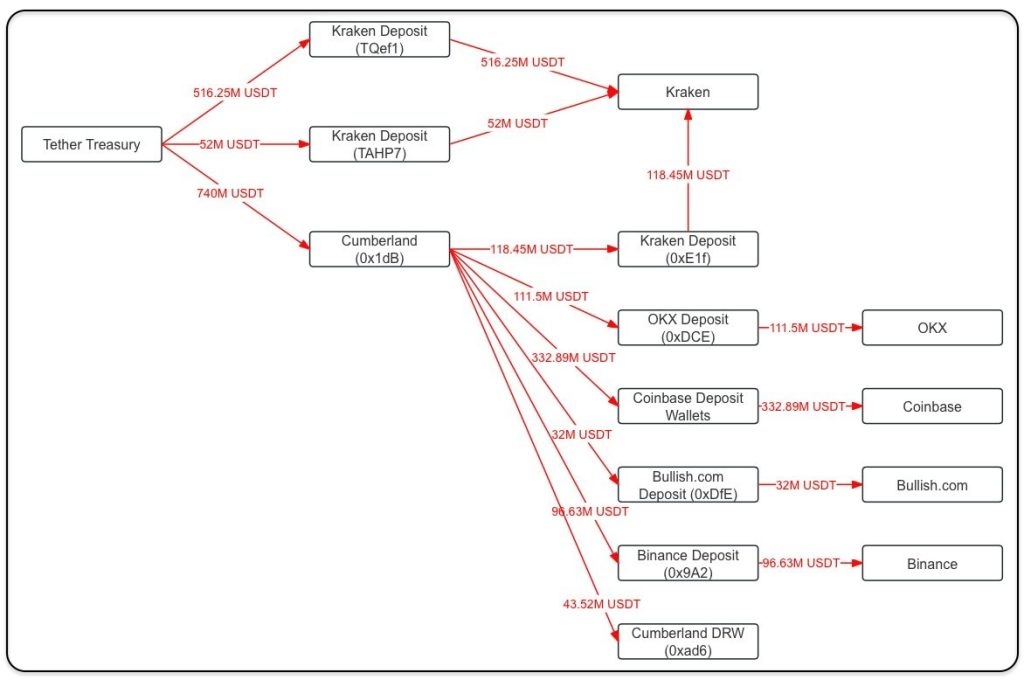

Even whereas dealing with all these challenges, Tether is making spectacular progress. USDT just lately hit a historic milestone by surpassing $115 billion in circulation provide. Final week, its market cap jumped by greater than $1 billion. This occurred on the identical time when Bitcoin’s worth shot as much as $62,000. In accordance to Lookonchain, $1.3 billion price of USDT was shifted to main exchanges like Kraken, OKX, and Coinbase. This surge has helped USDT solidify its place as a dominant participant within the stablecoin market which now holds round 70% of the market share.

In response to Tether’s transparency web page, over 50% of its provide is on Tron. Round 41% is on Ethereum. Tether additionally reported document income of $5.2 billion within the first half of 2024. That is spectacular, particularly contemplating Tether has a smaller workforce than different tech and crypto giants.

Tether is selling blockchain schooling. It has partnered with the Africa Blockchain Institute. This collaboration goals to teach college students throughout 5 universities within the Ivory Coast about blockchain know-how. This additionally consists of schooling associated to cryptocurrencies, good contracts, DeFi, and business functions.

Conclusion: Dealing with Challenges and Celebrating Wins

The brand new MiCA rules are throwing some massive challenges at Tether and the stablecoin market. The robust guidelines about reserve necessities may increase dangers and make USDT’s future in Europe a bit shaky. However even with these obstacles, Tether has proven it’s robust and dedicated to pushing ahead. The corporate’s achievements communicate volumes about its resilience and drive for innovation. Because the crypto world offers with these adjustments, it’s necessary for each corporations and regulators to maintain speaking. Watching how Tether handles these regulatory points will likely be key for anybody invested within the crypto scene.

Additionally Learn : Gemini and Coinbase Conflict with CFTC Over 2024 Presidential Betting Ban!