This story is a part of Priced Out, CNET’s protection of how actual individuals are dealing with the excessive price of dwelling within the US.

Brandon Douglas/CNET

On a heat day final spring, Teja Smith, 31, went to Cedars-Sinai hospital in Los Angeles to go over her birthing plan. As an alternative, at simply over 36 weeks pregnant, she realized she had preeclampsia, a severe high-blood-pressure dysfunction that may happen throughout being pregnant, and needed to be induced instantly. Three days and an unplanned cesarean part later, Smith walked out along with her new child son and a $42,180 medical invoice.

Although her insurance coverage coated $40,000 of that invoice, Smith was left with the remaining steadiness. “I used to be even charged for skin-to-skin contact with my son and my umbilical-cord reducing,” she stated.

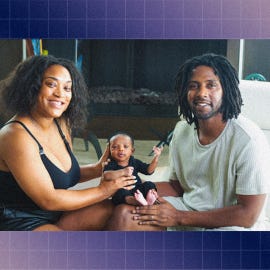

Teja Smith and household.

Smith’s story is not unusual. The price of childbirth in the USA is increased than in another nation. For folks with insurance coverage, the common out-of-pocket expense for conventional childbirth is $2,854, whereas a C-section, like Smith’s, averages $3,214, in response to the Kaiser Household Basis.

If you do not have insurance coverage, prices can rapidly spiral into tens of hundreds of {dollars}. Whereas there are sources accessible to assist decrease pregnancy-related bills, there are nonetheless gaps in accessibility and big disparities in medical care prices for the uninsured or underinsured.

Low-income pregnant folks, from Black and Latino households particularly, are much less prone to have medical insurance, and these households spend a median of between 19% to 30% of their annual revenue on being pregnant and childbirth-related medical bills. And that does not embody the hidden prices exterior of labor that begin within the family-planning stage, or the bills that proceed after supply.

“My largest recommendation is to by no means go right into a being pregnant uninsured, even when it is Medicaid or one thing that’s state offered,” stated Smith.

Being pregnant payments are steep for everybody

Shilpa Nandwani, 30, a trainer in Austin, Texas, at all times knew she wished kids. After getting married, in December 2021, Nandwani and her companion each determined to strive in vitro fertilization, or IVF.

Shilpa Nandwani and her companion.

Nandwani’s insurance coverage provided entry to Progyny, an employer-sponsored fertility and family-building profit. She and her companion went by way of the method of egg retrieval, which price a complete of $8,000 for every thing, together with the sperm donation, embryo genetic testing and frozen embryo switch for each of them. With out the help of Progyny, their invoice would have been $32,000.

Fertility remedies reminiscent of IVF and intrauterine insemination have gotten extra widespread within the US — some 33% of People have turned to fertility remedies or know somebody who has, in response to a Pew Analysis Middle research. However these remedies come at an enormous price for individuals who undertake them.

“The street to parenthood is not at all times as straightforward as what we have heard from motion pictures and storybooks,” stated Janet Choi, a reproductive endocrinologist and medical director of CCRM Fertility Clinic in New York. Choi famous that one spherical of IVF with treatment can price greater than $25,000, and it typically takes two to 3 cycles to achieve success.

Dr. Janet Choi: “The street to parenthood is not at all times as straightforward as what we have heard from motion pictures and storybooks.”

An employer-sponsored fertility advantages program is crucial for individuals who have to go this route, in response to Choi. “It could actually assist not solely offset the monetary burden of fertility remedies, however may also help the psychological and emotional pressure of going by way of the method,” she stated.

Conception prices can depart parents-to-be with excessive medical payments, even earlier than being pregnant begins. For a lot of, the primary bills begin after discovering out they’re pregnant, in the course of the prenatal time period. Common physician’s appointments for exams, blood work, ultrasounds and different testing span $100 to $200 per appointment (most pregnant folks attend 12 appointments over their being pregnant time period). Genetic service testing, which can be required to detect sure congenital issues, is not at all times coated by insurance coverage and might add an additional $100 to $1,000 to out-of-pocket bills.

Then there are prenatal nutritional vitamins, maternity garments and pregnancy-safe skincare and make-up, which simply add up. For example, Nandwani pays $50 for a two-month provide of prenatal nutritional vitamins — she estimates she’ll have spent $750 on dietary supplements alone all through her being pregnant and postpartum.

Childbirth is mostly the priciest of all, and these prices is probably not coated by your insurance coverage if you happen to go for nontraditional childbirth strategies, which have turn into extra common prior to now 5 years.

Nandwani and her companion are selecting to present start exterior a hospital setting. “We determined to go the route of getting a doula and midwife as a result of, as a queer couple, I additionally didn’t need folks to query our father or mother titles and relationship with our child,” she stated. The couple can pay $2,000 for his or her doula and $5,000 for midwife providers.

Well being care protection can decrease being pregnant bills

Excessive physician or hospital payments throughout being pregnant can result in extreme long-term penalties, together with medical debt, chapter and in some instances, worsening well being outcomes. As many as 24% of pregnant or just lately pregnant girls report having unmet well being care wants, which may result in opposed start outcomes and different dangers, in response to a latest research within the Journal of the American Medical Affiliation.

Provided that half of all pregnancies within the nation are unplanned, households that do not have insurance coverage are left scrambling for medical care. Although employer-sponsored well being plans and the general public medical insurance market could provide low-cost choices, the small open enrollment window, which usually falls between Nov. 1 and Jan. 15, may forestall expectant dad and mom from enrolling. Getting protection exterior an open enrollment interval requires a “qualifying life occasion” like beginning a brand new job, getting married or dropping your present protection. Giving start is taken into account a “qualifying life occasion” however being pregnant is not. Relying on timing, some expectant dad and mom is probably not in a position to join protection in any respect, whereas others may have the ability to join towards the tip of their being pregnant.

If medical insurance is not an possibility, Medicaid could present protection. Decrease-income pregnant individuals who meet state revenue necessities can qualify for lowered and even free Medicaid protection, however there are nonetheless gaps within the system stopping protection for broader maternal and baby well being care. And, although nearly all of states have carried out expanded protection of 12 months for postpartum girls, in some states, Medicaid advantages finish 60 days after childbirth.

An extra enlargement of Medicaid advantages to supply inexpensive protection to extra pregnant folks couldn’t solely lower the monetary burden on new dad and mom, but in addition assist scale back maternal mortality charges, that are increased within the US than in another superior nation, in response to the Georgetown College Well being Coverage Institute.

Further sources and help to assist with being pregnant prices

Whether or not you are insured or not, there are alternatives accessible to assist decrease your out-of-pocket being pregnant bills.

Nandwani has taken on contract work along with her full-time job, a monetary answer that is working nicely for her household. Although this selection could also be pragmatic for some, it is probably not really useful for these with high-risk pregnancies. Working greater than 40 hours every week whereas pregnant has been linked to severe well being dangers, together with miscarriage and preeclampsia.

You may additionally have the ability to negotiate a few of your medical bills if you happen to can show monetary want. “Some hospitals mean you can submit monetary data if you’re unable to pay for sure issues or conform to a cost plan,” stated Smith.

If you happen to plan to pay out of pocket for all or a few of your being pregnant care, let your well being care supplier know. It might be able to provide lower-cost care choices or a reduced package deal price, or if it is unable to cut back costs, it might be able to refer you to a extra inexpensive clinic or physician.

For uninsured parents-to-be who do not qualify for Medicaid, there are different applications and sources. The Particular Supplemental Vitamin Program for Ladies, Infants, and Youngsters, or WIC; Youngsters’s Well being Insurance coverage Program, often known as CHIP; and Deliberate Parenthood all provide low-cost being pregnant care service. The US Division of Well being and Human Providers additionally has a checklist of sources to assist pregnant people discover entry to free or lower-cost providers.

Connecting with others in your group or throughout the nation by way of Fb teams and different on-line boards is an effective way to share cost-reducing suggestions. Speaking to different pregnant folks or new dad and mom could assist higher put together you for the monetary expectations, whereas providing options others have carried out. The Youngsters’s Hospital of Pennsylvania has a set of various teams expectant dad and mom can discover.

“Discover help in no matter methods you’ll be able to,” stated Nandwani. “A part of the help is speaking about funds together with your companion or household and understanding the potential prices.”