Key Takeaways:

- U.S. states, comparable to Kentucky and Missouri, are actually wanting into Bitcoins as a substitute reserve asset.

- The states purpose to hedge towards inflation and embrace technological innovation.

- Balancing potential good points with the necessity for strong regulation and safety is essential.

The mixing of Bitcoin into state monetary fashions is gaining important momentum, with Kentucky and Missouri rising as key gamers on this evolving panorama. Because the sixteenth US state to introduce laws directed towards the institution of the Bitcoin reserve, Kentucky’s determination to undertake digital cash on the state stage is an instance of the digital asset, following within the traditions of the states, comparable to Missouri and Utah. The rising acceptance of Bitcoin as a retailer of worth and an financial software is a pure final result of its growing recognition. Nonetheless, it’s also inflicting a number of difficulties whereas regulation, danger administration, and the way forward for finance are being mentioned.

Kentucky’s Daring Step: HB376 and the Pursuit of Digital Asset Diversification

Kentucky’s invoice, KY HB376, launched by State Consultant Theodore Joseph Roberts, marks a big step in the direction of legitimizing Bitcoin as a reputable asset class throughout the state’s monetary framework. The invoice, if established, will enable the State Funding Fee the precise to assign a most of 10% of the excess state reserves to funding in digital belongings, and Bitcoin would be the most important beneficiary because it tops the listing of digital currencies by market capitalization.

The language of the invoice, whereas not explicitly mentioning Bitcoin, successfully targets the cryptocurrency by setting a minimal market capitalization threshold of $750 billion that solely digital belongings with a totally deserved fame may surpass. As of early 2025, Bitcoin was the one cryptocurrency that met this criterion, holding a market cap considerably increased than its rivals.

Within the case of early 2025, Bitcoin’s market capitalization skyrocketed to nearly $1.9 trillion making it the storm within the cryptocurrency sector. Then again, Ether’s market capitalization was about $330 billion, which highlighted the gaping variations in scale and energy.

Such initiatives by Kentucky reinforce the assumption that Bitcoin may function an efficient hedge towards inflation and a way to diversify the state’s funding portfolio. The state would be capable to cut back their dependence on conventional belongings comparable to shares and bonds. Nonetheless, the choice to make use of state funds for Bitcoin may additionally convey dangers together with the digital forex’s well-known instability and the potential for the market’s melancholy.

Missouri Follows Go well with: HB1217 and the Imaginative and prescient of a Bitcoin Strategic Reserve Fund

To not be outdone, Missouri can be actively exploring the potential for establishing a Bitcoin Strategic Reserve Fund. Ben Keathley, a Missouri State Consultant authored Home Invoice 1217 that gives for the internalization of such a fund to diversify the state’s funding portfolio and defend towards the erosion of buying energy attributable to fiat forex inflation.

HB1217 would empower the Missouri state treasurer to amass, make investments, and maintain Bitcoin underneath particular circumstances, broadening the state’s funding authority and opening new avenues for monetary progress.

Right this moment I filed HB 1217 which might authorize Missouri to carry and settle for Bitcoin for state funds. This can assist diversify our state’s portfolio whereas hedging towards inflation. #moleg https://t.co/tokLpGlWMJ

— Rep. Ben Keathley (@benKeath) February 7, 2025

The invoice consists of an revolutionary stipulation demanding that each one the federal government our bodies in Missouri should allow using cryptocurrency for approved transactions, comparable to taxes, charges, and fines. This revolutionary transfer may place Missouri as a frontrunner in digital asset adoption, driving higher integration of those belongings into the state’s financial system.

A noteworthy account: Consultant Keathley introduced his backing for Bitcoin and his view that it could possibly be a useful gizmo for shielding the monetary pursuits of the state. He pressured the necessity for spreading out Missouri’s funding portfolio and limiting its publicity to the dangers related to conventional monetary belongings.

Discover that regardless of the anticipated efficient date of HB 1217 being August 28, whether or not the invoice has been accepted requires checking the latest legislative information.

The Nationwide Panorama: A Rising Motion In direction of Bitcoin Adoption

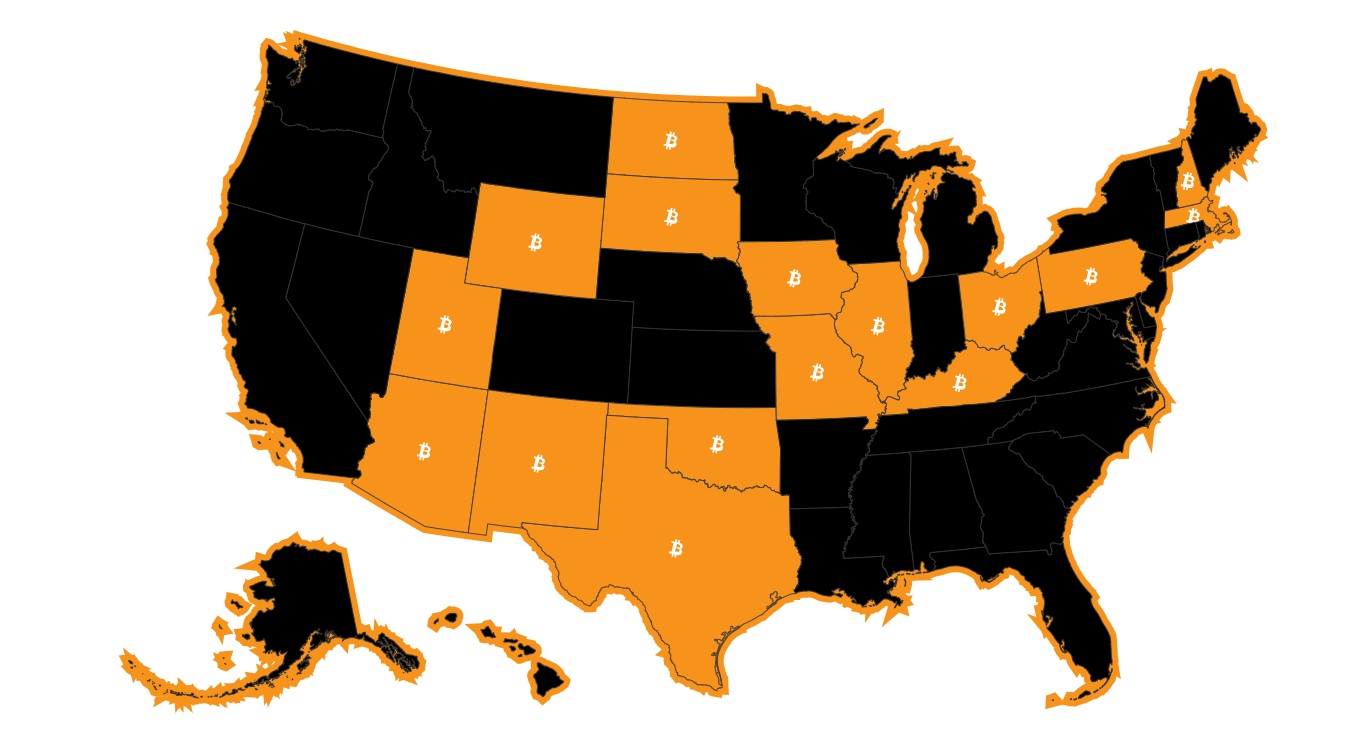

The actions in Kentucky and Missouri don’t occur independently however are half of a bigger development happening within the U.S. Primarily based on the information offered by bitcoinlaws.io, there are various states which can be participating within the dialogue or are contemplating the passage of laws on Bitcoin reserves. These states are Arizona, Alabama, Florida, Massachusetts, New Hampshire, North Dakota, South Dakota, Ohio, Oklahoma, Pennsylvania, Texas, Utah, Kansas, and Wyoming.

US states with Bitcoin reserve invoice propositions. Supply: Bitcoinlaws

Extra Information:

For instance, Utah shouldn’t be lagging behind by way of organising a Bitcoin reserve however has in actual fact been fairly energetic in its plan to ascertain such. The passing of the invoice by the Home and sending it to the Senate is proof of this, and the state of Utah can be contemplating authorizing its treasurer to channel as much as 5% of the general public funds to “qualifying digital belongings,” this would come with Bitcoin.

Nonetheless, the street to the adoption of Bitcoin shouldn’t be at all times easy. The legislative setbacks in North Dakota and Wyoming spotlight the challenges states face in securing approval for Bitcoin reserve payments.

State-level curiosity in Bitcoin reserves has intensified, sparking discussions concerning the potential creation of a nationwide Bitcoin reserve. At the moment, then-President Trump decided for the administration to “consider the potential creation and upkeep of a nationwide digital asset stockpile.” Senator Cynthia Lummis submitted a congressional invoice for the U.S. reserve, with the proposal that the nation ought to acquire one thing like $20 billion price of Bitcoin through the first 12 months and an additional 200,000 BTC in every of the next 4 years.

The Street Forward: Challenges and Alternatives

The adoption of Bitcoin in state and nationwide monetary methods could appear bold, however its volatility presents important challenges. Legislators and blockchain corporations are discovering it arduous to arrange the foundations for digital asset markets, which may be very dangerous and even result in hacking and loss in case of cyberattacks.

An actual-world instance: The cryptocurrency trade FTX suffered its collapse in 2022 proving the truth that the method of coping with unregulated digital asset platforms is riskier than acknowledged earlier than. Its impact has shocked the cryptocurrency market and proven the weak spot of funding safety in blockchain applied sciences.

Then again, integrating Bitcoin into state monetary methods may unlock financial progress, drive innovation, and contribute to monetary stability at each the state and nationwide ranges. Nations might mix conventional and digital belongings to drive sustainable financial progress and strengthen monetary resilience.

A key consideration is that market volatility and shopper safety should stay central to discussions surrounding the invoice. On a optimistic observe, Kentucky’s pro-Bitcoin stance may have a big stimulative impact on the funding world. It might trigger different states and international locations to begin contemplating the identical. However adoption isn‘t nearly value; it‘s about infrastructure. Kentucky will want strong custody options, cybersecurity measures, and a transparent exit technique if issues go south.

Because the Bitcoin reserve motion good points traction, policymakers, regulators, and trade leaders should have interaction in open discussions to navigate challenges and capitalize on rising alternatives. By means of collaboration, they’ll design a regulatory framework that nurtures innovation, safeguards customers, and encourages the accountable adoption of digital belongings.