Fast Take

- Stablecoin demand seems extraordinarily weak — particularly on this present market setting.

- Patrick Hansen from Circle believes the stablecoin demand is rising. Nevertheless, the information signifies that this isn’t the case.

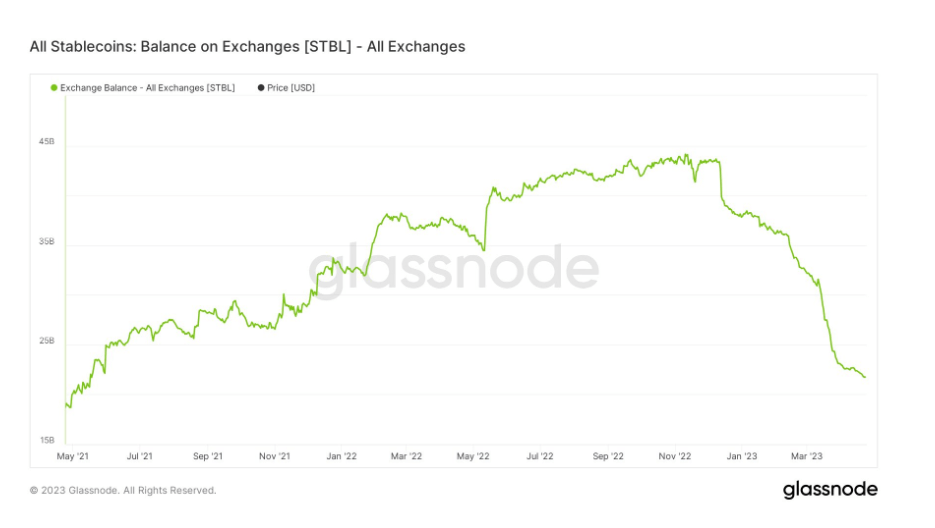

- Stablecoin stability on exchanges has dropped significantly from its peak in November 2022. From $44 billion to below $22 billion — which has both been transformed for fiat or Bitcoin.

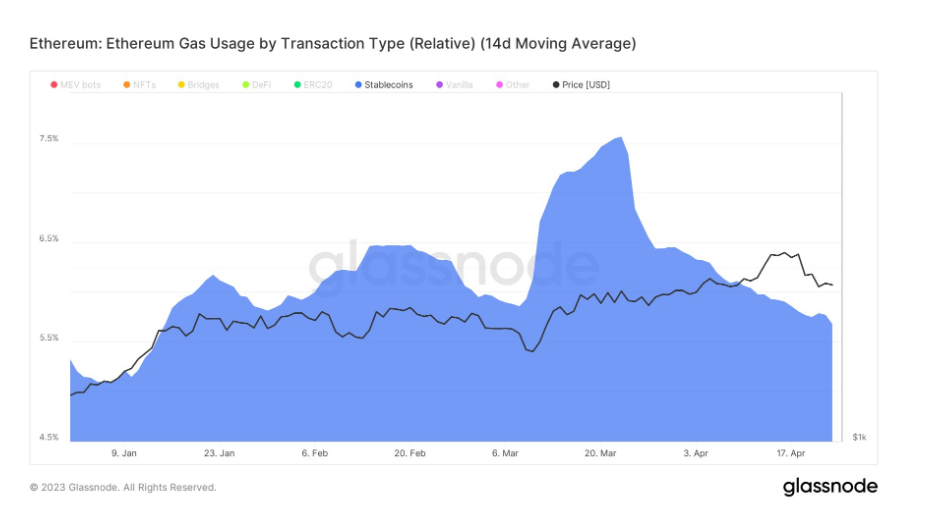

- Subsequent, gasoline utilization on Ethereum for Stablecoins has additionally significantly dropped for the reason that SVB collapse in March. This represents simply 6% of the entire gasoline utilization from 7.5%.

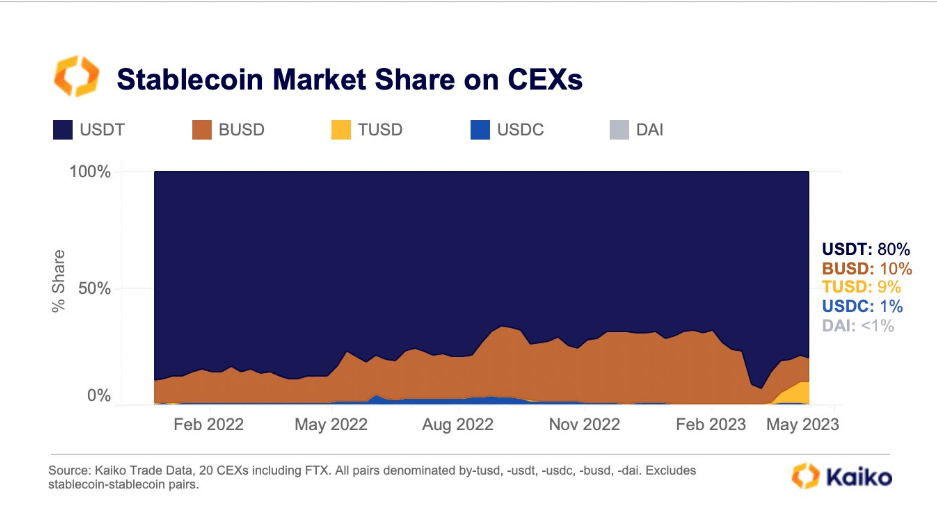

- Whereas in accordance with Kaiko analysis, TUSD now accounts for 10% of world stablecoin commerce quantity on centralized exchanges. Almost all this quantity is from the BTC-TUSD pair on Binance — which has zero fees.

The put up The shocking reality behind stablecoin demand: A steep drop contradicts business expectations appeared first on CryptoSlate.