EUR CoinVertible (EURCV), the primary euro-pegged stablecoin, was launched by Société Générale, the third-largest financial institution in France, marking a major milestone within the banking business. This new achievement heralds the start of a brand new age within the panorama of stablecoins in Europe, marking a key milestone within the integration of standard finance (tradFi) and digital property.

In an effort to shut the hole that exists between standard capital markets and digital property, Société Générale’s cryptocurrency department, SG Forge, has created EURCV. Our purpose is to bridge the hole. Its worth extends past the platform that Société Générale offers since it’s meant to make it simpler to conduct transactions involving digital bonds, funds, and different kinds of property. Due to its versatility, it has the potential to grow to be an indispensable instrument for all kinds of monetary service suppliers by default. Axa Funding Managers has beforehand proven the sensible use of EURCV by investing in Société Générale’s digital inexperienced bond, which has a worth of 10 million euros. This offers proof of the sensible utility of EURCV.

The introduction of EURCV coincides with the deliberate implementation of the Markets in Crypto-Belongings Regulation (MiCA) by the European Union, which is scheduled to take impact within the 12 months 2024. It’s potential that the launch of an enormous bank-issued stablecoin equivalent to EURCV would possibly impact this coverage, which locations appreciable limits on stablecoins through its implementation. The way forward for digital property in Europe could also be totally different because of this. Then again, incorporating a stablecoin inside a traditional banking framework includes quite a few technical challenges and regulatory compliance difficulties, all of which have the potential to affect the acceptance and usefulness of EURCV.

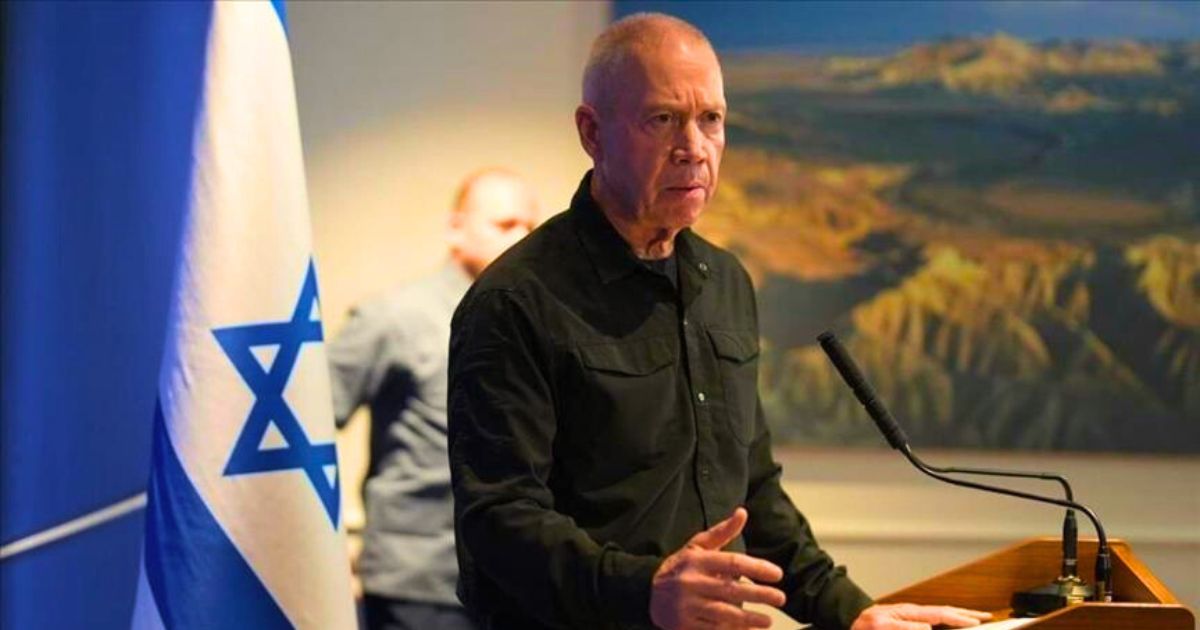

Picture supply: Shutterstock