The on-chain analytics agency Santiment has revealed the altcoins which can be at present within the historic purchase zone based on a good worth mannequin.

A Massive Quantity Of Altcoins Are At the moment Close to The Alternative Zone

In a brand new put up on X, Santiment talked about what the varied property within the cryptocurrency sector are wanting like proper now primarily based on their Market Worth to Realized Worth (MVRV) ratios. The MVRV ratio is an indicator that retains observe of the revenue/loss standing of the addresses on any given community.

When the worth of this indicator is bigger than 1, it means the traders are carrying a web quantity of income proper now. However, the metric beneath this threshold implies the dominance of losses available in the market.

Naturally, the MVRV ratio being precisely equal to 1 suggests the unrealized loss on the community is strictly equal to the unrealized revenue, so the common holder might be thought of simply breaking even.

Traditionally, corrections have grow to be extra possible when investor income have ballooned up. Holders grow to be extra tempted to promote the bigger their good points develop. Equally, holders getting underwater has facilitated backside formations, as sellers grow to be exhausted throughout such situations.

Primarily based on these details, Santiment has developed an Alternative and Hazard Zone Mannequin that makes use of the MVRV ratio’s divergence on completely different timeframes to estimate higher whether or not an asset is at present offering a shopping for or promoting window.

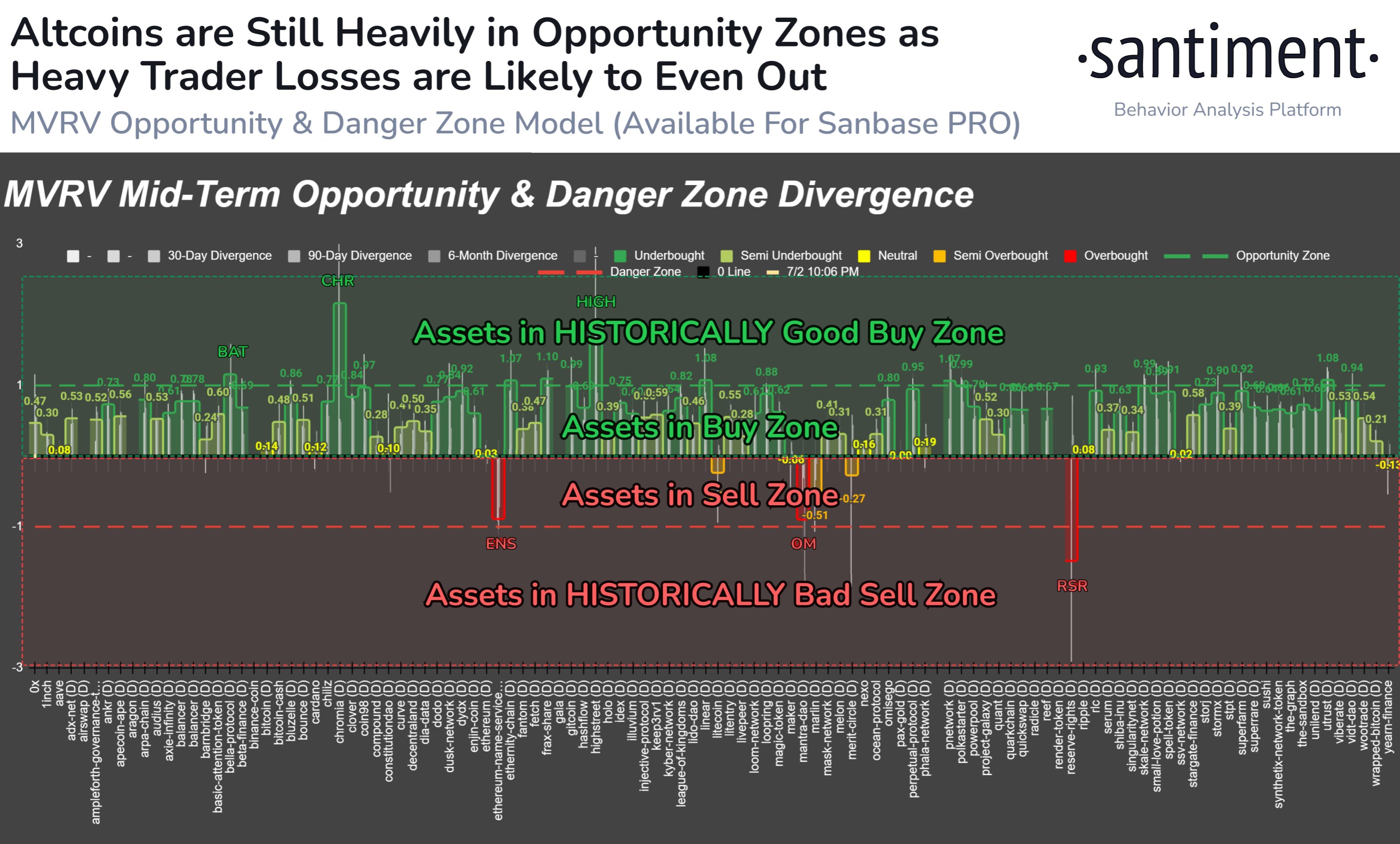

Now, right here is the chart shared by the analytics agency that reveals the place the completely different altcoins stand based on this mannequin:

Word that on this mannequin, the zero mark takes the position of the impartial 1 stage from the MVRV ratio. Additionally, the polarity is flipped right here, with values beneath zero implying revenue dominance and people above signifying loss.

The graph reveals that many of the altcoins are within the constructive area proper now, suggesting that their traders are underwater. Amongst these, Fundamental Consideration Token (BAT), Chromia (CHR), and Highstreet (HIGH) notably stand out as their MVRV divergence exceeds the 1 mark.

Beneath this mannequin, the area above 1 is named the “Alternative Zone,” as property have traditionally supplied probably the most worthwhile alternatives whereas inside it.

Whereas most altcoins are no less than barely undervalued at present, a number of, like Ethereum Identify Service (ENS), MANTRA (OM), and Reserve Rights (RSR), are in or close to the Hazard Zone as an alternative. The Hazard Zone, which happens beneath -1, is the counterpart to the Alternative Zone, the place cash grow to be overvalued.

Ethereum Worth

Ethereum, the most important among the many altcoins, has confronted a plunge of greater than 4% within the final 24 hours, which has taken its worth beneath the $3,300 stage.