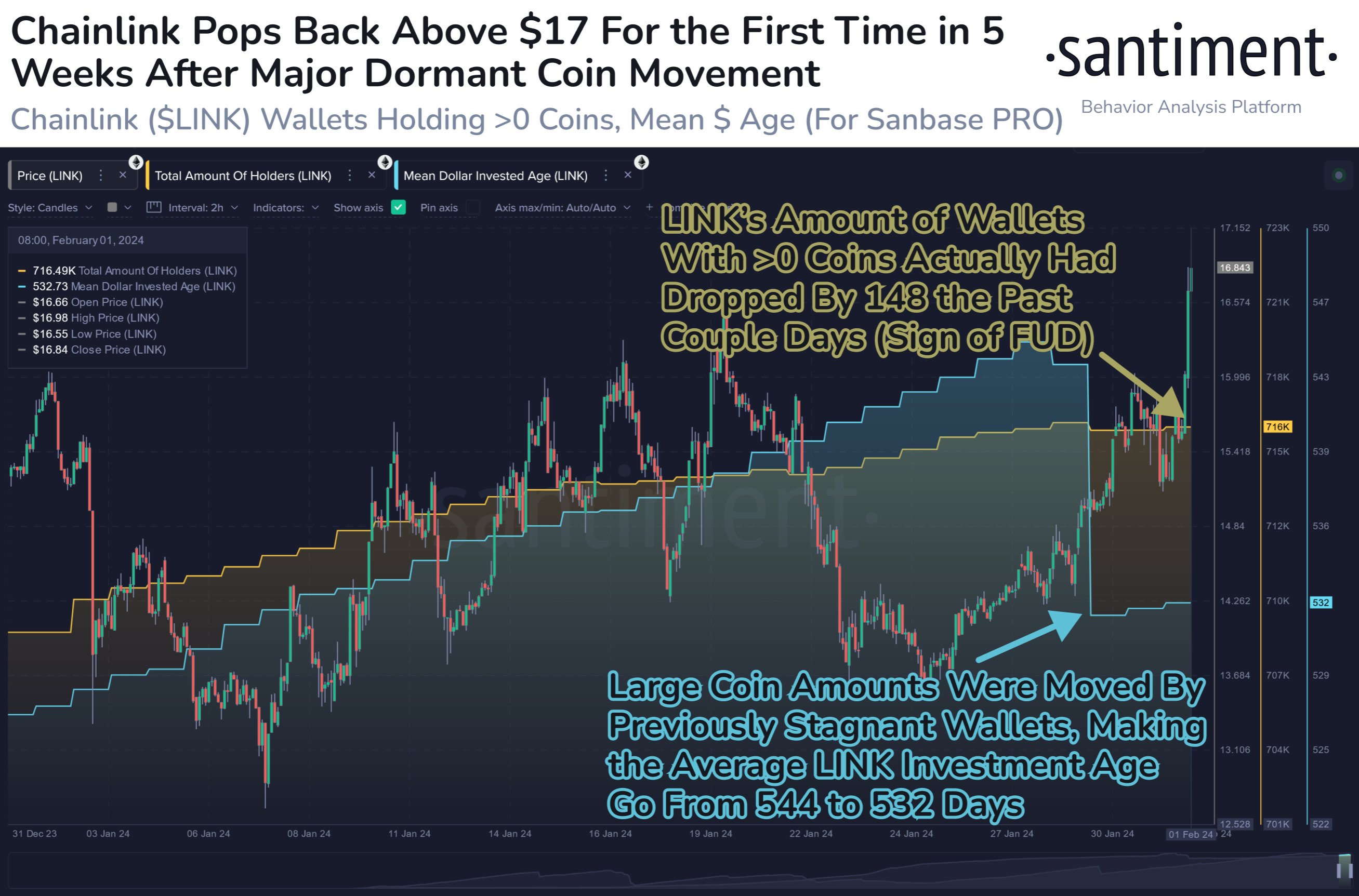

Crypto analytics agency Santiment says one metric is suggesting that decentralized oracle community Chainlink (LINK) may have extra upside potential.

In a brand new thread on the social media platform X, the market intelligence platform says that Chainlink’s rally could proceed at the same time as LINK wallets see a sudden decline.

In response to Santiment, an abrupt pockets decline is mostly an indication of a market capitulation resulting from concern, uncertainty and doubt (FUD) that may point out a rise in costs may quickly observe.

“Chainlink has jumped forward of the altcoin pack after some beforehand dormant wallets created the best age consumed spike (5.38 billion, calculated by multiplying cash moved by the quantity of days these cash had been dormant). This inflow of LINK again into the community’s circulation has possible contributed to the worth leap.

Moreover, the community had seen minor liquidations of wallets, which is commonly an indication of FUD that may contribute to additional value rises.”

LINK is buying and selling for $18.76 at time of writing, up practically 12% within the final 24 hours.

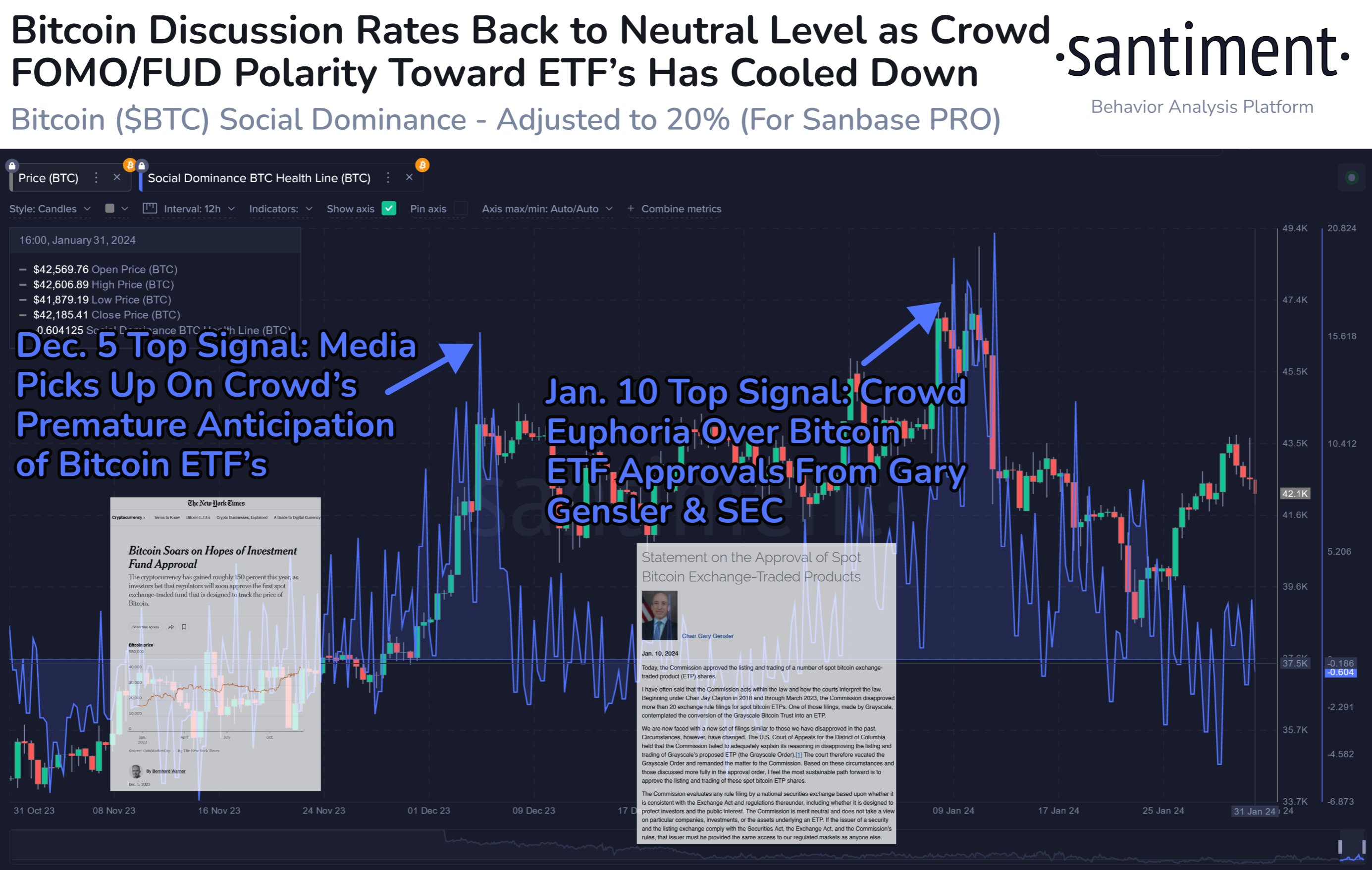

Subsequent up, Santiment says that the social dominance indicator, which tracks crypto discussions on social media platforms, could flip bearish for Bitcoin (BTC) this week and bullish for altcoins.

“Traditionally, a excessive ratio of crowd discussions towards Bitcoin is an indication of concern. Nonetheless, since mid-2023, the euphoria and optimism surrounding the ETFs (exchange-traded funds) has flipped excessive BTC discussions right into a greed indicator resulting from (arguably) unrealistic expectations for markets.

Three weeks because the SEC (U.S. Securities and Trade Fee) accepted the Bitcoin ETFs, it seems that this indicator has lastly normalized.

Excessive altcoin discussions could push the ratio of BTC discussions right into a bearish ‘unhealthy’ space in the event that they outperform the #1 market cap asset throughout this primary week of February. In contrast to the final two Bitcoin social dominance spikes that foreshadowed predictable tops, a destructive spike means the asset is being ignored as soon as once more in favor of the gang greedily over-leveraging portfolios towards alts as soon as once more.”

Bitcoin is buying and selling for $43,140 at time of writing.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Tithi Luadthong