IntoTheBlock says one decentralized alternate (DEX) is now competing with Curve’s (CRV) dominance over the decentralized finance (DeFi) area.

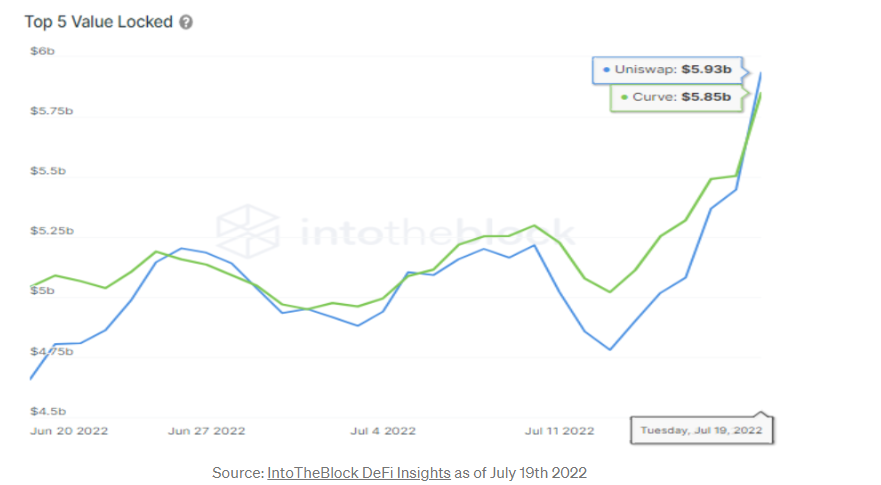

IntoTheBlock reviews that Uniswap’s (UNI) whole worth locked (TVL) briefly surpassed Curve’s this week.

Curve had been the highest DEX when it comes to TVL for greater than a 12 months, in response to the analytics agency.

The TVL of a blockchain represents the overall capital held inside its sensible contracts. TVL is calculated by multiplying the quantity of collateral locked into the community by the present worth of the property.

IntoTheBlock additionally reviews that Uniswap’s TVL has elevated by 24% for the reason that starting of Might this 12 months, whereas Curve’s has dropped by 69%.

Curve has since regained the highest spot, however the race stays shut between the 2 DEXs. Curve has $6.07 billion in TVL at time of writing, whereas Uniswap (UNI) has $5.94 billion.

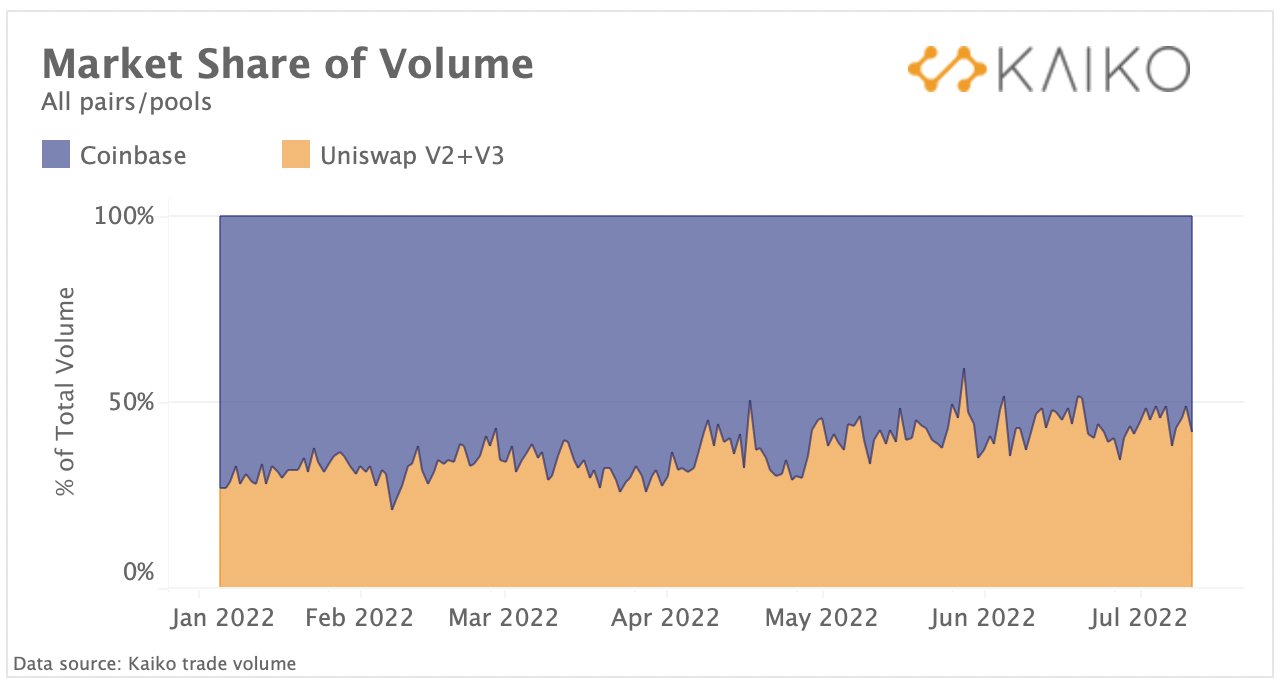

Moreover, Uniswap’s day by day quantity now practically equals that of Coinbase’s, in response to Clara Medalie, the analysis director on the crypto information supplier Kaiko.

Uniswap’s native token, UNI, is buying and selling for $6.97 at time of writing. The Twenty seventh-ranked crypto asset by market cap is down practically 3% up to now 24 hours.

Curve’s native token, CRV, is buying and selling for $1.47 at time of writing. The 88th-ranked crypto asset by market cap is up practically 5% up to now 24 hours.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/sakkmesterke/Sensvector