Analysis agency TokenInsight launched its Q1 Crypto Trade Report — exhibiting centralized platforms had a buoyant begin to 2023.

The report said that, through the quarter, the entire crypto market cap had grown from $831.8 billion to $1.24 trillion — an almost 50% enhance. Bitcoin (BTC) jumped nearly 100% from $16,000 to a $30,000 excessive through the interval.

With that, TokenInsight prompt that crypto winter could also be thawing — recommending readers use alternate metrics to assist make up their minds.

“With the worth of Bitcoin rising from $16,000 firstly of the 12 months to a excessive of $30,000, it appears like winter is over for the Crypto business. However when will the bull market truly arrive? Maybe essentially the most intuitive reply comes from the information on the exchanges.”

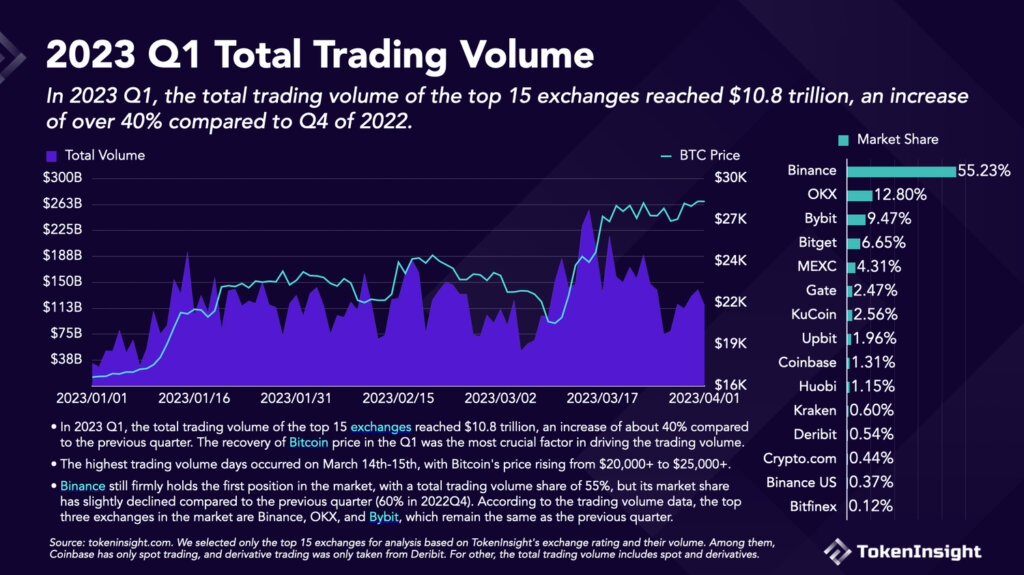

Crypto Buying and selling Quantity

Q1 2023 whole buying and selling quantity for the highest 15 crypto exchanges confirmed a 40% enhance to $10.8 billion versus the prior quarter.

The interval round March 14-15 noticed essentially the most vital will increase in day by day quantity — as the worth of Bitcoin recovered from the banking disaster fallout — seemingly pushed by realizations of fiat fragility and the demand for more durable belongings.

Binance maintained its dominance all through the quarter, taking greater than half the market share at 55%. Nonetheless, TokenInsight identified that in This autumn 2022, Binance held a 60% market share — suggesting latest regulatory enforcement actions and rumors of insolvency have had an impression.

Different alternate metrics

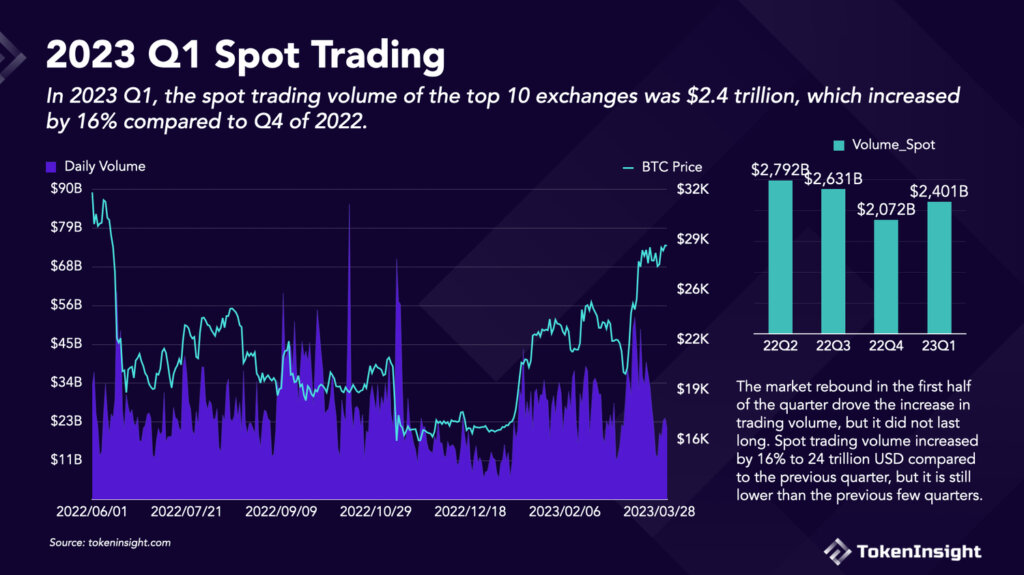

Spot quantity for the highest 10 crypto exchanges elevated by 16% over the prior quarter to $2.4 trillion. Nonetheless, that is nonetheless down versus Q3 and Q2 2022 — which had been $2.6 trillion and $2.8 trillion, respectively.

The identical sample is repeated with derivatives quantity, with Q1 2023 exhibiting a 30% enhance on the prior quarter to $7.8 trillion. However nonetheless down in comparison with Q3 2022 at $8.4 trillion and Q2 2022 at $10 trillion.

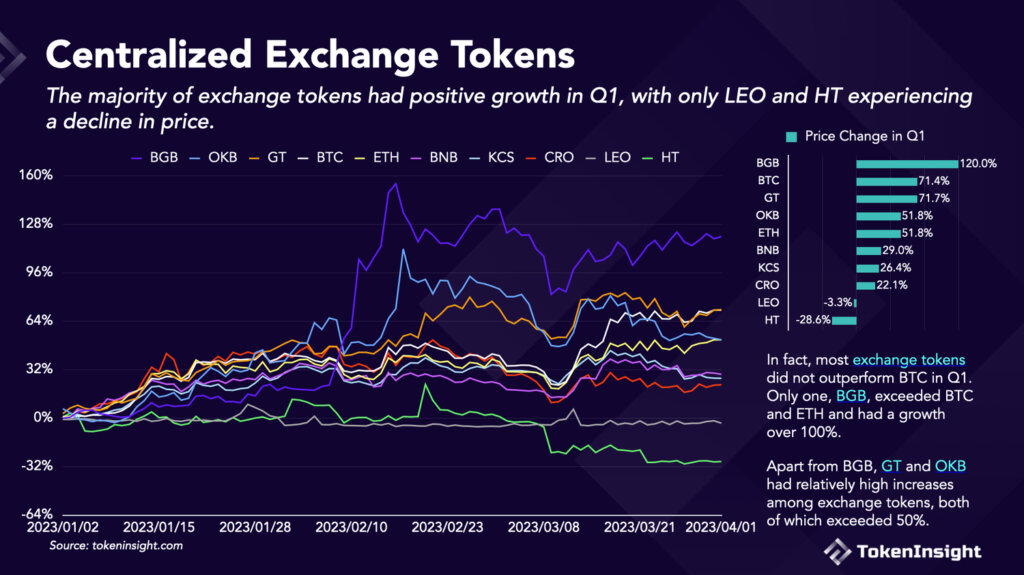

Trade tokens

Given the spate of centralized finance (CeFi) bankruptcies in 2022, alternate tokens had garnered a nasty fame.

Living proof, FTX’s FTT token was used to prop up the alternate’s stability sheet — enabling the agency to borrow towards the token. This labored nicely till panic promoting tanked the worth of FTT, that means FTT collateralized loans misplaced their backing and have become nugatory.

Nonetheless, the chart under reveals a return in confidence in alternate tokens. TokenInsight discovered all however UNUS SED LEO, and Huobi Token noticed worth appreciation — with the Bitget Token experiencing 120% development through the interval to outperform Bitcoin.

GateToken positioned second, roughly matching Bitcoin’s development, at a 72% enhance in worth through the quarter — the opposite alternate tokens underperformed versus the market chief.