There’s nothing on the planet that’s extra scrutinized than cash. How may it not be when cash relays data on the worth of…all the things? And all financial exercise arises from that record-keeping, whether it is carried out precisely.

When Bitcoin launched in 2009, it opened a brand new door, a brand new perspective on how that data is managed and transferred. Or, extra exactly, blockchain expertise did. Whereas Satoshi Nakamoto envisioned Bitcoin as self-contained and sovereign even from governments and central banks, blockchain is a impartial device.

One that may spur one other FinTech wave – tokenization of real-world property (RWAs). A majority of these tokens have all of the hallmarks of blockchain property – transparency, effectivity and self-custody – backed by real-world property.

Web > Blockchain > Tokenization

Blockchain expertise was vital in establishing the belief wanted for Bitcoin to evolve right into a digital asset value half a trillion {dollars}. By leveraging cryptography with chained information blocks, whereby every new block depends on the earlier one, Bitcoin is the pioneering proof-of-concept that digital information could be made immutable.

And if real-world worth could be introduced into the digital world securely, we’re on the doorstep of a brand new period. The period of the tokenization of real-world property (RWAs). If one thing is legally definable as an asset, that logic could be tokenized right into a tradable asset. Because of this, the RWA scope is limitless, starting from actual property, artwork and securities to debt devices, luxurious items and fund-raising equities.

RWA tokenization is groundbreaking in that it opens 24/7 buying and selling doorways to a world market, beforehand reserved for unique establishments. On prime of that, even non-fungible property like equipment or commodities may very well be made fungible with fractional possession. Above all else, RWA tokenization reduces the friction of capital flows by eradicating, or drastically lowering, intermediaries.

But, concerning one thing as vital as worth, “groundbreaking” innovation usually takes a again seat to warning. Furthermore, it’s unclear that intermediaries may very well be eliminated in all cases, which might mute all the level of tokenized RWAs. With that in thoughts, how can we view the present state of RWA tokenization and its future?

Measuring the Momentum of Financial Innovation

Blockchain expertise is each new and revolutionary. One method to gauge its adoption charge is to view investor curiosity. Nonetheless, this usually leads to hype bubbles that don’t point out its longevity. By the identical token, bubbles are one other indicator if framed correctly.

Fourteen years after Bitcoin emerged, 4.2% of the worldwide inhabitants, over 420 million, have interaction with blockchain expertise by holding crypto property. Is that this proportion good or dangerous? How can we anchor it in a reference level to measure the RWA tokenization charge?

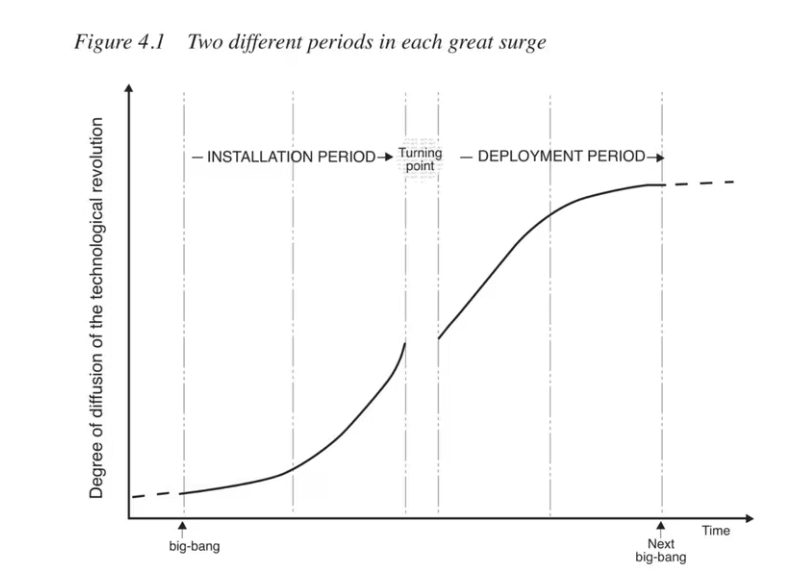

Economist Carlota Perez developed a framework to gauge the long-term dynamics of technological disruption. This “Perezian framework” revolves across the adoption phases of a cycle:

- Irruption – New tech emergence that disrupts present industries.

- Set up – The economic system and society restructures across the new tech, accompanied by new enterprise fashions and regulatory frameworks.

- Bubble – Frenzy stage throughout set up by which traders turn out to be overly optimistic, accompanied by hypothesis and monetary bubbles resulting in disaster (bubble bursts) and stagnation.

- Synergy – The post-bubble burst restoration, whereby the surviving traders undertake the brand new tech extra effectively.

Within the golden part, maturity, the brand new tech is totally built-in into the social and financial material. This sometimes lasts a number of many years till the purpose of diminishing returns or till the subsequent irruption.

As one reads by these phases, one can instantly recall the dot-com bubble within the late Nineteen Nineties, whereby the core “irruption” was the web itself, as a prerequisite for Bitcoin and tokenization.

By October 2002, the Nasdaq Composite, representing internet-centered firms, plunged 740% from its peak in March 2000. If we apply the Perezian framework, we’ve already gone from one irruption (the web) to the subsequent (blockchain).

Additional, contemplating the relentless string of bankruptcies in 2022, from Terra and Celsius to FTX, we’ve reached the bubble burst stage. That is additionally obvious from a withdrawal of VC capital. In accordance with PitchBook information, the primary half of 2023 noticed solely 814 crypto offers go down, in comparison with 1,862 in 2022.

Harking back to the dot-com bubble burst, this capital drought interprets to solely $325 million in investments in crypto startups in Q2 2023 vs. $3.5 billion within the peak of Q1 2021. In different phrases, RWA tokenization is forsaking the bubble part to the synergy part.

RWA Tokens: Resilience from Decentralization

As beforehand famous, tokenized RWAs solely represent “irruption” whether it is attainable to reliably declare an asset with out an middleman. Working example, let’s say a farmer buys a token to increase operations. This specific tokenized RWA would symbolize farming tools like a tractor.

This token is obtainable on a sure platform. The farmer would pay much less for the token/tractor as a result of he wouldn’t need to take care of an middleman comparable to a dealership. However what occurs if that platform goes bust for some cause?

With out the platform that issued the token, how would the farmer redeem the token or declare possession of the tractor sooner or later when he intends to promote it?

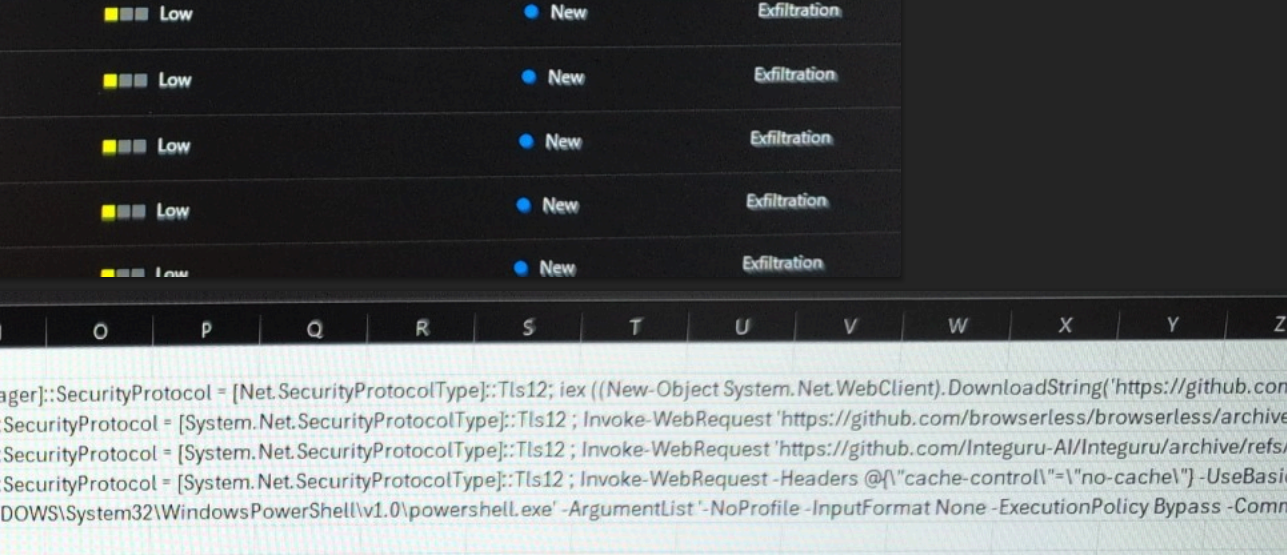

The answer comes within the type of sensible contracts which might be hosted on a big blockchain community, comparable to Ethereum. One could recall that the US Treasury sanctioned forex mixer Twister Money. But, even with the sanction, the underlying sensible contract continued to be hosted, though with out the online interface supplied by Infura/Alchemy.

Then, it was solely a matter of circumventing the block with Interplanetary File Storage. That is the form of decentralized finance (DeFi) resilience traders anticipate when shopping for onerous property as tokens. So long as the blockchain community is dwell, secured by hundreds of nodes throughout the globe, redeemability is impartial of belief on any Web3 platform.

In different phrases, tokenized RWAs function redeemable sensible contracts, irreversible to cancellation. We’ve got already seen it with non-fungible tokens (NFTs) which may outline the situations of possession/royalties, together with fractional possession. RWA tokens will additional increase sensible contract logic to cowl disputes by decentralized dispute resolvers.

The Present Panorama of Tokenized RWAs

As fiat forex tokenizers, stablecoins have been pushing the RWA market the , whereas cryptocurrencies can monetize particular tasks or function scarce commodities. As an example, Bitcoin mimics digital gold. Then again, NFTs tokenize common property rights for ebooks, albums and artworks. Basic RWA tokenization is the pure step ahead.

The primary wave will take care of property that don’t require extra infrastructure, such because the Web of Issues (IoT). In spite of everything, onerous property must combine real-time monitoring to ensure that their standing (location/value) to be broadcasted to blockchain networks.

The earliest type of this expertise is current in parcel monitoring. Because of this, extra summary RWAs could have precedence. Larry Fink, the CEO of the world’s largest asset supervisor, BlackRock, had hinted that these can be acquainted shares, bonds, and different monetary devices.

Blackrock is the world’s largest asset supervisor with $10 trillion in AUM.

Blackrock CEO Larry Fink:

“I consider the subsequent era for markets… for securities, will probably be tokenization of securities.” pic.twitter.com/f3MmASXywi

— The Tokenist (@thetokenist) January 20, 2023

Startups Tzero and Securitze have established themselves as veteran tokenizers. Likewise, Goldman Sachs’s Digital Asset Platform (DAP) went on-line in January. Main US banks and Huge Tech firms have joined to construct tokenized merchandise on a permission blockchain community referred to as Canton.

Digital Asset developed the Canton Community, with Goldman Sachs as the primary DA investor. Surprisingly, even exterior monetary establishments joined in. The European Funding Financial institution (EIB) had already issued a second euro-denominated digital bond on Canton.

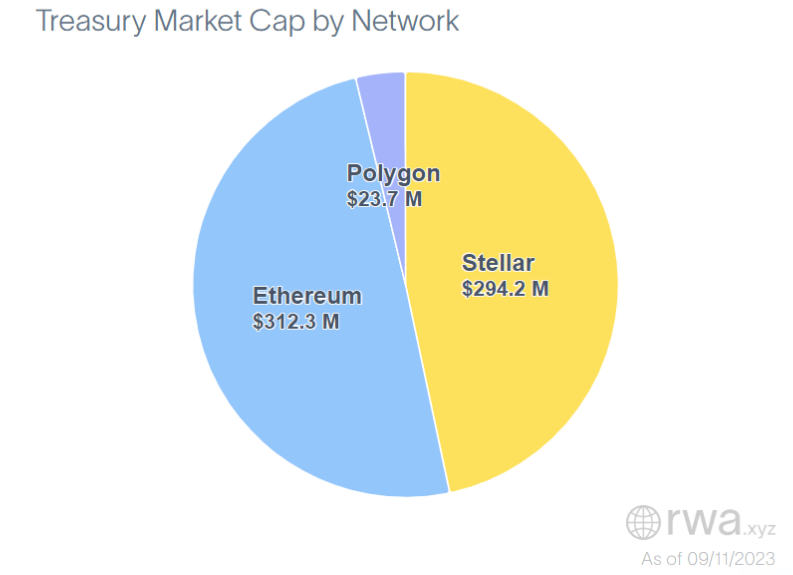

On permissionless networks, tokenized bonds represent a $630.2 million market, at a median yield of 5.25%. Notably, German tech big Siemens used Polygon to challenge its first company digital bond value €60 million, with a maturity of 1 12 months.

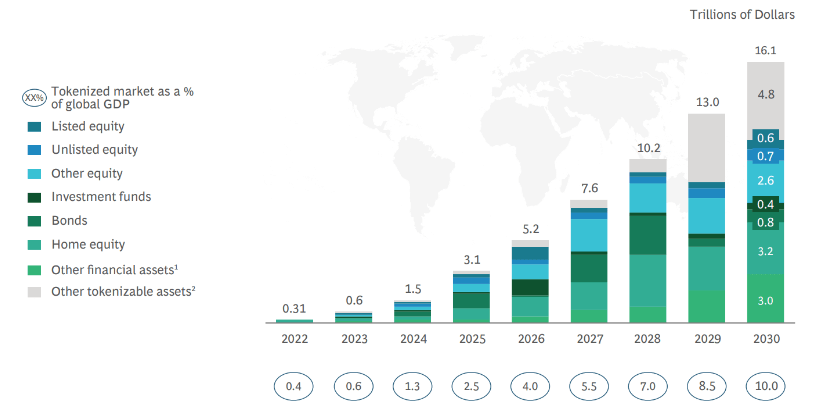

One RWA dApp, as an outgrowth of the favored lending dApp AAVE, holds a $7 million market dimension. Suffice to say, all of those are approach underneath one-billion figures. This is the reason the vary for the worldwide RWA market is so speculative proper now. Boston Consulting Group forecasts on-chain RWA exercise to achieve between $4 trillion to $16 trillion by 2030.

The rise in retail dealer communication as seen by Discord servers targeted on inventory buying and selling has the potential to forge a path into tokenized RWAs too. In accordance with CySEC, almost 22% of retail traders supply their buying and selling concepts from social media platforms. Moreover, these communities function a breeding floor for revolutionary concepts, so it’s not onerous to see tokenized RWAs getting traction there as effectively – on this new ‘dwelling’ of the retail dealer.

Within the close to future, as a proportion of world GDP, the tokenized market ought to attain 2.5% by 2025, primarily in dwelling fairness and bonds. The actual adoption ought to manifest with extra various “different tokenizable property” in late 2020s.

Alongside blockchain and crypto property, understanding conventional monetary devices like choices buying and selling is essential as they nonetheless proceed to play a job in market dynamics. Their coexistence and potential synergies with tokenized property may turn out to be an enchanting space of research and funding as this new period of economic diversification unfolds.

RWAs’ Finish-Objective: Turing-Full Financial system

As a result of funding drought left over by the crypto winter, termination of the banks embracing cryptocurrency, and the Fed’s climbing cycle that made capital costlier, we’re nonetheless within the pioneering stage of the worldwide RWA market.

Nonetheless, the world’s premiere community that mixes educational, social, political and financial capital, the World Financial Discussion board (WEF), is totally onboard with tokenization. In accordance with prof.Jason Potts from RMIT College, the end-goal of RWA tokenization is to “replicate real-world social infrastructure in a digital world.”

Below the Agenda 2030, prof. Potts envisions a brand new form of commerce that seamlessly fuses bodily and digital economic system right into a “computable economic system”. That’s the final cog of the tokenized puzzle. If all of the world’s property are tokenized, and accessible on a public ledger, this is able to allow a “turing-complete economic system”.

Mirroring the Turing machine principle, such an economic system may mannequin any attainable financial system as a result of there can be whole accounting of property. In that state of affairs, all the financial system may very well be simulated. And if one thing could be simulated, it may be directed to comply with optimum outcomes.

This can be a pure outgrowth of the WEF’s stakeholder capitalism idea, which branches out from the slender shareholder curiosity to all stakeholders in wider communities.

Conclusion

Possession illustration has come a good distance from stone tablets. It seems, the strategy of illustration issues drastically. When the web got here alongside, individuals have been amazed they may talk permissionlessly with anybody worldwide.

One other amazement is on the way in which, within the type of tokenized real-world property (RWAs). Simply as one faucets right into a social community, it will likely be attainable to entry world possession ledger. Though divided between permissioned and permissionless, a tokenized market will convey a brand new period of liquidity.

In that area, each consumers and sellers can purchase and promote property simply, transparently and with much less capital friction sometimes generated by intermediaries. Ultimately-game of tokenization, we’d even see a shift to a brand new financial paradigm as new financial techniques are simulated and enacted.