How huge are these considerations about DeFi safety? The overall quantity misplaced to DeFi theft in 2021 was $1.5 billion. Throughout the first few months of 2022, DeFi hacks accounted for nearly $1.4 billion in losses. It is very important perceive that DeFi is just not a random development in know-how. As a matter of reality, it’s the new definition of the monetary ecosystem of the longer term.

The importance of DeFi safety is clearly evident within the variety of monetary losses incurred by customers. Subsequently, you will need to establish the causes behind prime DeFi hacks and work on growing preventive measures. The mainstream adoption of DeFi depends upon the effectiveness of safeguards towards DeFi hacks. The next dialogue helps in figuring out how hackers exploit DeFi protocols, together with detailed protection of prime DeFi exploits. As well as, you may as well replicate on the need of safeguarding DeFi protocols and tokens.

Wish to know extra about DeFi? Enroll Now in our Introduction To DeFi – Decentralized Finance Course!

Why Ought to You Find out about DeFi Hacks?

Decentralized finance has drawn appreciable criticism in current occasions owing to the growing frequency and magnitude of assaults. The considerations of a DeFi exploit might forestall customers from adopting DeFi protocols. DeFi began off with cryptocurrencies, and the area has expanded with the introduction of dApps for staking, lending, and borrowing, in addition to decentralized exchanges.

As of September 2022, the whole worth of property locked in DeFi protocols was $53.73 billion. The variety of losses to DeFi hacks had escalated to nearly $2.32 billion by this time. With such a humongous scale of losses, the record of DeFi hacks has inflicted 50% larger injury on the DeFi trade as in comparison with 2021.

One other alarming side of DeFi hacks refers back to the regularly declining TVL within the DeFi market. Based on DappRadar, the TVL in DeFi had decreased to $41.54 billion by November 2022. Trying again at 2021, the TVL estimate was over $110 million, thereby suggesting a radical decline. One of many frequent causes offered for the discount in TVL factors to the current collapse in stablecoin worth.

However, monetary losses incurred resulting from vulnerabilities in DeFi protocols and tokens is also one of many elements answerable for lowering TVL. Among the hottest DeFi hacks have been focused on the generally used DeFi protocols. The losses resulting from DeFi exploits can create a common lack of belief within the feasibility of DeFi as an alternative choice to conventional monetary providers. Most necessary of all, the worth locked in DeFi serves as an interesting goal for hackers. Subsequently, you will need to study DeFi hacks to keep away from undesirable penalties of safety breaches in DeFi protocols.

Wish to get an in-depth understanding of crypto fundamentals, buying and selling and investing methods? Turn into a member and get free entry to Crypto Fundamentals, Buying and selling And Investing Course.

How do Hackers Exploit DeFi?

Earlier than diving right into a DeFi hacks record, you will need to establish the methods wherein hackers exploit DeFi protocols. What might be the potential causes for vulnerabilities in DeFi?

- The foremost supply of vulnerability in DeFi refers to its open-source nature, which exposes the code to everybody. Whereas the open-source nature ensures the advantages of transparency, it additionally opens up a number of avenues for hackers to use the protocols.

- One other frequent trigger underlying DeFi assaults refers back to the precept of composability, which exposes DeFi protocols to exterior exploitation.

- The subsequent cause for vulnerabilities in DeFi is the tempo of launching DeFi initiatives. Builders usually tend to ignore vulnerabilities and errors in a bid to launch their protocol earlier than opponents.

Hackers can exploit these vulnerabilities and achieve unauthorized entry to the property of DeFi customers. How do DeFi hacks occur? The evaluation of assorted DeFi hacks might showcase a few of the potential methods wherein hackers compromise DeFi protocols. Among the frequent strategies for DeFi hacks embody the next,

Hackers might manipulate the oracle good contract, utilized in DeFi protocols for acquiring exterior data. One of many frequent exploits by means of oracle manipulation includes altering token value particulars.

-

Good Contract Logic Errors

The urge to push DeFi protocols to the market at a sooner tempo is without doubt one of the notable causes for a DeFi exploit, as builders miss trivial vulnerabilities and errors. For the reason that DeFi protocol code can be open-source, attackers might see the good contract code and establish the glitches for exploiting them.

Discover ways to construct good contracts with Solidity. Enroll in our Solidity Fundamentals Course Now!

One other frequent methodology adopted in DeFi hacks factors at reentrancy assaults. Such assaults contain a wise contract calling an untrusted contract externally with out resolving it.

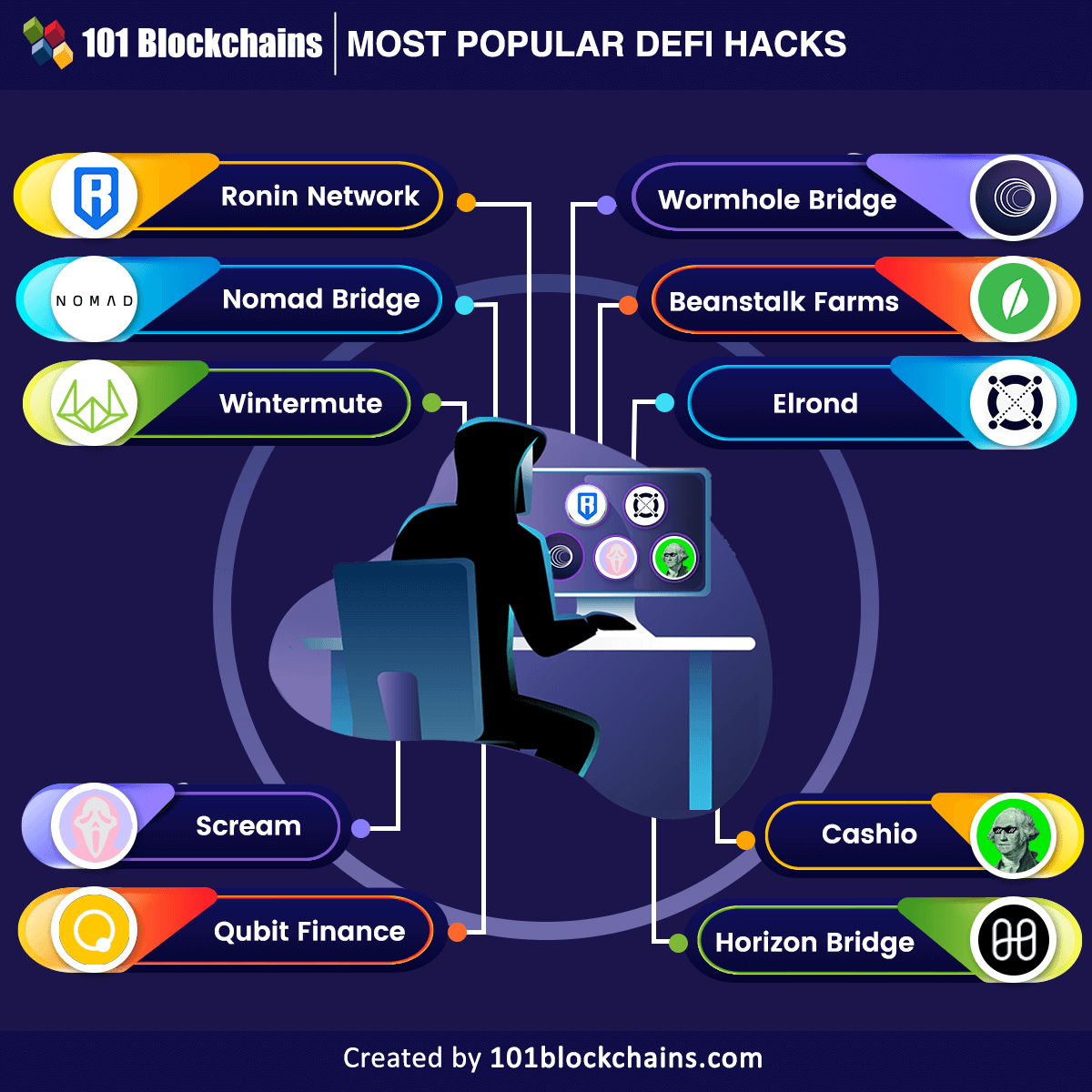

Most Common DeFi Hacks

DeFi vulnerabilities are one of many largest threats to the neighborhood. Aside from the direct affect of monetary losses, the repeatedly rising record of DeFi hacks additionally impacts the fame of DeFi startups. Subsequently, it will be important to try the main points of the next prime hacks within the DeFi panorama.

Ronin Community

Ronin Community is the Ethereum based mostly sidechain of a well-liked play-to-earn sport, Axie Infinity. It incurred a lack of greater than $625 million in ETH and USDC property in a hack. You’ll be able to develop a greater understanding of the hack by understanding how the Ronin Community works. Ronin was designed to assist Axie Infinity gamers benefit from the sport with out the sophisticated interactions with the Ethereum blockchain. The Ronin Bridge served as an efficient channel for gamers to switch their ETH to the Axie Infinity community.

The Ronin Bridge was answerable for one of many prime DeFi hacks, as attackers compromised the bridge and cast faux withdrawals. The attacker utilized the hacked non-public keys for withdrawing property in two totally different transactions. The attacker gained unauthorized management over 5 validators required for releasing funds on the Ronin Bridge. Even when the exploit had occurred on March 23, Axie Infinity had not reported it for nearly per week. The attacker had compromised round 25.5 million USDC and 173,600 ETH in one of many largest hacks in DeFi historical past.

Wish to study concerning the Ethereum Know-how? Enroll now in The Full Ethereum Know-how course.

Nomad Bridge

The subsequent addition among the many hottest DeFi hacks would confer with the Nomad Bridge hack. Hackers stole nearly $190 million from the cross-chain bridge, which helps in swapping tokens reminiscent of Ethereum, Moonbeam, Avalanche, and Evmos. Apparently, the assault on Nomad Bridge was not carried out in a single or two transactions. Apparently, the assault concerned 1175 hacks and was one of many first wherein many hackers copied the identical exploit. The assault was attributed to an improve within the code of Nomad, which uncovered a vulnerability wherein a selected part was marked legitimate for all transactions.

The unique hacker discovered this vulnerability, and lots of different copycats joined in with out a lot effort. All of the attackers copied the transaction name knowledge of the unique hacker and talked about their deal with instead of the unique deal with. Subsequently, the hackers withdrew extra property than those deposited on the platform. Apparently, the Nomad workforce requested the return of funds by means of an open message, and a few of the white hat hackers responded by returning round $30 million.

Wintermute

The Wintermute hack can be one of many notable mentions in a DeFi hacks record, with a lack of nearly $160 million. Wintermute used an address-generating instrument for creating distinctive addresses that would scale back transaction prices. Nonetheless, these addresses have been vainness pockets addresses that includes 32 characters. Any hacker with the fitting set of assets might have made their method into the protocol for recreating the non-public keys in an deal with.

The outstanding explanation for the Wintermute hack factors to the potential for their DeFi vault and scorching pockets contract having vainness addresses. Hackers might simply entry the funds in these sources and transfer them in line with their comfort. Wintermute tried eradicating all ETH from its scorching pockets in an try and cease the hack. Nonetheless, they’d not eliminated the deal with of the admin for his or her vault. Regardless that the main points of the hack are nonetheless beneath the shadows of doubt, hackers will need to have made away with every part they discovered within the scorching pockets.

Wormhole Bridge

The Wormhole Bridge is one other outstanding entry amongst DeFi assaults on a bridge. Wormhole Bridge doesn’t function a sport change like Ronin Bridge. Quite the opposite, it really works as a token bridge by means of which customers can change tokens throughout a number of blockchains, reminiscent of Ethereum, Terra, Oasis, Solana, and Avalanche. Customers of the bridge need to stake their ETH and obtain wrapped ETH in return, which might have a backing of 1:1 ETH liquidity. In consequence, the community would additionally embody the wrapped ETH in the identical vary as regular ETH. Apparently, hackers determined to leverage the liquidity to assault the protocol.

The Wormhole Bridge assault presents higher insights on “How do DeFi hacks occur?” with faults within the ‘guardian’ accounts. In a singular method for DeFi hacks, the hacker minted round 120,000 wrapped ETH tokens on Solana with none ETH backing. Then, the hacker siphoned round 93,750 of the wrapped ETH tokens into the Ethereum community and redeemed round $254 million. With these funds, the hackers bought totally different tokens, reminiscent of Lastly Usable Crypto Karma and Bored Apes. The Wormhole Bridge assault attracts consideration to the basic safety challenges with crypto bridges.

Wish to have a deeper information of Ethereum? Enroll now in our Ethereum Growth Fundamentals Course.

Beanstalk Farms

Beanstalk is an algorithm-based stablecoin protocol that doesn’t depend on a liquidity pool. It skilled one of many largest losses with a DeFi hack in April, which price the protocol round $182 million. The Beanstalk Farms DeFi exploit prompt how easy safety vulnerabilities in DeFi tokens might end in formidable losses. The first cause for the Beanstalk hack was its personal decentralized governance protocol and the ability of flash loans.

With the flash mortgage, the hacker obtained a majority stake within the governance mechanism and siphoned crypto property out of the protocol to totally different addresses. The Beanstalk Farms hack clearly emphasizes the basic vulnerability within the Beanstalk DAO.

Wish to develop into a Cryptocurrency skilled? Enroll Now in Cryptocurrency Fundamentals Course

Elrond

The Elrond hack additionally qualifies as one of many prime DeFi hacks, with a lack of round $113 million. Hackers used a loophole in Maiar, a decentralized change, to steal nearly 1.65 million in EGLD tokens, the native token of the Elrond blockchain. Based on reviews, the hacker used a wise contract alongside three wallets to steal EGLD from the decentralized change.

On prime of it, the hackers shortly offered round 800,000 of the native tokens of the Elrond blockchain for nearly $54 million on Maiar itself. The hackers offered off the remaining tokens on centralized exchanges and swapped a few of them in return for ETH.

Scream

One other notable entry among the many victims of DeFi hacks would confer with Scream, a DeFi lending platform. Based mostly on Fantom blockchain, the Scream hack suggests one of the crucial juvenile exploits, particularly contemplating the failings in protocol safety. The platform ended up with a debt of virtually $38 million following a decline within the peg of stablecoins on the platform, reminiscent of DEO and Fantom USD.

The Scream protocol hack qualifies as one of the crucial widespread hacks as a result of easy but ambiguous loophole for the assault. Scream protocol hardcoded the worth of the 2 stablecoins with none adjusting mechanisms. Subsequently, it was not capable of show the declining worth of the property.

Whales exploited the loophole to attract out priceless stablecoins as they deposited the DEI and Fantom USD stablecoins which have been shedding worth. Scream protocol launched Chainlink oracles for acquiring entry to real-time pricing knowledge as a alternative for hardcoded stablecoin pricing.

You may also be all for Understanding Oracles, Good Contracts, And The Oracle Downside

Qubit Finance

The Qubit Finance DeFi protocol introduced on January 28 {that a} hacker had compromised round 206,809 BNB or Binance tokens. The protocol knowledgeable that its QBridge protocol was the first web site of the assault, and the whole worth of compromised tokens amounted to nearly $80 million.

It’s also one of many vital entries in a DeFi hacks record, with a big loss. The hacker found a vulnerability within the QBridge contract by means of the deposit choice and minted round 77,162 qXETH, which represents the ETH bridged by means of Qubit.

Should you look intently, the hacker made the platform imagine that they made a deposit and repeated the method many occasions. Lastly, the hacker exchanged the property on the protocol for BNB tokens and disappeared into skinny air.

Horizon Bridge

Crypto bridges didn’t have yr in 2022, and the Horizon Bridge hack proved the identical. The Horizon Bridge suffered a DeFi hack on June 23, inflicting injury of round $100 million. Horizon presents a cross-chain interoperability platform that facilitates seamless usability between a number of blockchain networks reminiscent of Ethereum, Concord, and Binance Good Chain.

The analysis of the DeFi exploit identified that hackers had moved out $98 million from the Concord-managed platform. Hackers exchanged the tokens for ETH, affecting greater than 50,000 wallets. Subsequently, the hackers additionally leveraged Twister Money to maneuver out nearly $35 million.

Cashio

Similar to crypto bridges, stablecoin protocols bought featured within the record of DeFi hacks fairly regularly. Cashio is one other instance of a stablecoin protocol that was a sufferer of DeFi hacks this yr. The hack resulted within the decline of the CASH stablecoin of the protocol with losses of virtually $48 million. Cashio allows minting CASH stablecoin by means of deposits with the backing of interest-bearing liquidity supplier tokens.

The hacker used the fundamental performance of Cashio to mint billions of CASH, adopted by exchanging them for UST and USDC. Subsequently, the hacker withdrew the tokens by utilizing the Saber DEX. On account of this hack, the CASH stablecoin died off after crashing to $0.

Wish to study the fundamental and superior ideas of Stablecoin? Enroll in our Stablecoin Fundamentals Masterclass Now!

How Can You Forestall DeFi Safety Assaults?

The dimensions of losses incurred by DeFi protocols resulting from totally different hacks requires rapid consideration to safeguards for DeFi. Many DeFi protocols function incentives for enhancing safety, whereas some use sensible options for preserving DeFi safety. The affect of the highest DeFi hacks on customers and the neighborhood additionally attracts the limelight on following DeFi safety finest practices. For instance, good contract safety audits or complete penetration exams for DeFi protocols. As well as, protocol builders might additionally implement bug bounties and work together with communities of exterior safety specialists for the security of protocols.

Wish to discover in-depth about DeFi protocol and its use instances? Turn into a member and get free entry to Decentralized Finance (Defi) Course- Intermediate Stage Now!

Backside Line

The define of the preferred DeFi hacks displays the dire state of safety within the DeFi ecosystem. The frequent targets for the DeFi hack included stablecoin protocols and crypto bridges. Whereas interoperability is a serious optimistic spotlight for DeFi protocols, the hacks make it appear to be a setback.

Subsequently, you will need to perceive the solutions to “How do DeFi hacks occur?” by means of an in depth evaluation of assorted hacks. Readability concerning the frequent errors and vulnerabilities affecting DeFi protocols might assist in avoiding huge losses. Efficient decision of DeFi safety dangers is to supply customers security and encourage belief in DeFi. So, begin studying extra about DeFi and the way it works to know the safety dangers intimately.

*Disclaimer: The article shouldn’t be taken as, and isn’t meant to offer any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be answerable for any loss sustained by any one who depends on this text. Do your individual analysis!

![What are the best unpopular Android games? [Read the description please] What are the best unpopular Android games? [Read the description please]](https://b.thumbs.redditmedia.com/siCYrisyZ2Knvm3-mzYFQWjOLOd7M3bqwb8PQHwKDzo.jpg)