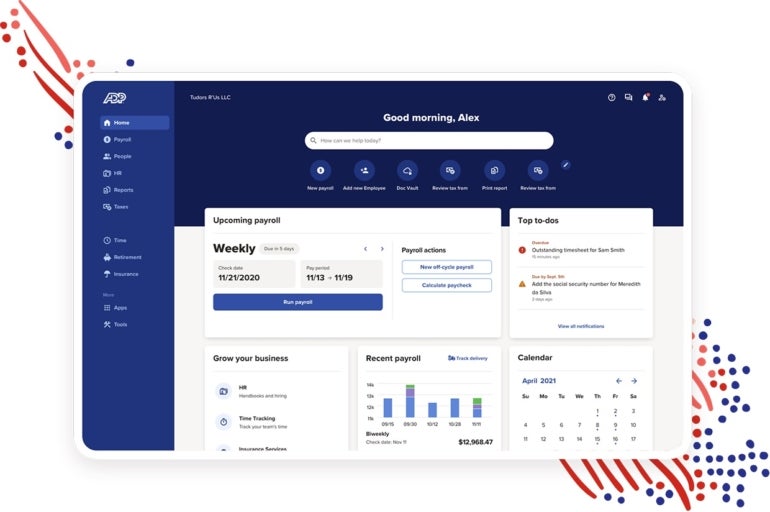

Automated Knowledge Processing Inc. is a number one supplier of complete payroll, human capital administration, advantages administration and enterprise course of outsourcing options. Based in 1949, ADP is among the most established gamers within the HCM area, providing a variety of companies to assist companies handle their most important useful resource: their folks. With a presence in additional than 140 nations, ADP is among the largest HCM suppliers on the planet.

SEE: Payroll processing guidelines (TechRepublic Premium)

ADP serves a couple of million purchasers worldwide, together with small, mid-sized and enormous companies. Because the {industry} continues to evolve, so too does the competitors, with quite a few options rising to problem ADP’s market share.

There are a number of different options accessible with comparable options and capabilities as ADP. On this evaluation of ADP rivals, we’ll assess their core companies, options and capabilities, buyer expertise and pricing technique to establish the main ADP options out there and what differentiates them.

Leap to:

Prime ADP rivals and options: Comparability desk

Prime ADP rivals

This record offers a quick overview of among the prime rivals and options for ADP. We’ll cowl services, options and pricing that can assist you determine which different is finest for what you are promoting.

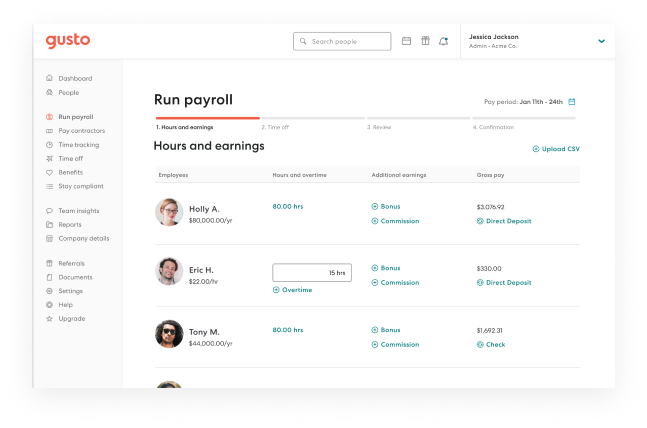

Gusto: Greatest total ADP competitor

Gusto is an internet payroll, advantages and HR platform that automates worker data administration, taxes and payroll. It’s a prime competitor of ADP, providing the same suite of companies to small and medium-sized companies, together with automated payroll processing, time monitoring and digital onboarding. Gusto is among the fastest-growing payroll suppliers within the {industry}.

Gusto is shortly turning into a preferred alternative for companies that need an easy-to-use and inexpensive payroll resolution. Not like ADP, Gusto recordsdata and pays federal, state and native taxes, and it robotically generates and sends W-2s and 1099s to workers and contractors at no additional value. Gusto additionally gives free setup and migration for brand new customers, in contrast to ADP, which costs a setup price.

Gusto gives three totally different affordably priced plans relying in your particular wants, beginning at $40 per thirty days plus $6 per thirty days per worker for the Easy plan. Pricing will increase to $60 per thirty days for the Plus plan plus $9 per thirty days per worker whereas the Premium plan’s pricing data is out there upon request.

Key options of Gusto

- Extremely customizable

- Full-service payroll migration and account setup

- Full-service multi-state payroll, together with W-2s and 1099s

- Contractor-only plan choice

Use instances

- Contracted worker payroll administration: It’s perfect for small companies with contractor workers.

- Payroll administration for startups and small companies: Its limitless pay runs at no additional price make this software helpful for startups or small companies which might be making a number of funds month-to-month.

- Customise to your personal use case: Gusto companies are extremely customizable relying in your necessities.

Characteristic graph

| Options | ADP | Gusto |

|---|---|---|

| Promotional provide | Free for the primary three months | 30-day free trial |

| Cell app | Sure | Sure |

| 24/7 buyer help | Sure | No |

| Direct deposit | Sure | Sure |

| PEO choice | Sure | No |

| Worker portal | Lifetime entry to see pay stubs, W-2s and hours labored | Fee historical past and as much as three years of W-2s/1099s |

| Medical health insurance advantages | Sure | Sure (Out there in 35+ states) |

| Contractor-only pricing | No | Sure |

| Integrations | Third-party integrations with Wave, Xero, Intuit Quickbooks, Sage, Workday and Docufree | Integrates with QuickBooks, Xero, FreshBooks, Clover, Shopify, Sage Accounting and JazzHR |

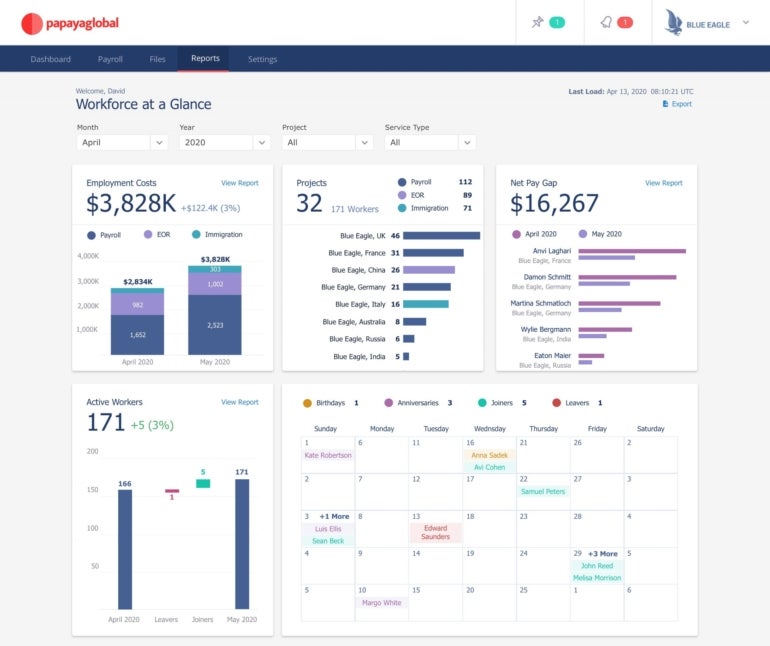

Papaya World: Greatest for world workforce administration

Papaya World is a number one world payroll and workforce administration platform, offering companies of all sizes with the instruments and companies they should handle a worldwide workforce. The platform gives a complete suite of options, designed to assist firms handle payroll, taxes, advantages, compliance and extra in over 160 nations.

With Papaya, companies can precisely pay their workers, handle taxes and adjust to native laws, minimizing the burden of worldwide payroll. Papaya World’s companies are designed to simplify the complexities of worldwide payroll and HR operations, permitting firms to deal with their core enterprise.

Papaya World gives pricing plans that modify relying on the shopper’s particular wants. The price of the plans relies on the variety of workers and companies the shopper requires. Papaya World gives three pricing plans for its companies:

- World Payroll & Funds: Beginning at $20 per thirty days per worker

- Employer of Document: Beginning at $770 per thirty days per worker

- Contractor Administration: Beginning at $25 per thirty days per contractor

Key options of Papaya World

- HR and payroll options that cowl onboarding, payroll, advantages, taxes, insurance coverage and compliance

- Catered options for 160+ nations

- Automated payroll processing

- Compliance with native labor legal guidelines

- Safe storage

Use instances

- World payroll: This software is nice for streamlining payroll operations for companies with workers all around the world, together with for cross-border and cross-currency funds.

- Contracted worker payroll administration: Fee monitoring and progress monitoring options are specifically designed to work effectively with contractor-based workforces.

- Worldwide HR and compliance administration: Papaya World gives a robust spine for different worldwide HR duties, particularly with automated world compliance options.

Characteristic graph

| Options | ADP | Papaya World |

|---|---|---|

| Promotional provide | Free for the primary three months | No |

| Presence | 140+ nations | 160+ nations |

| Buyer base | Over 1 million | 700 plus |

| Applicant monitoring | Sure | Sure |

| Attendance monitoring | Sure | Sure |

| Onboarding | Sure | Sure |

| Worker portal | Sure | Sure |

| Cell app | Sure | No |

| HR instruments | Sure | Sure |

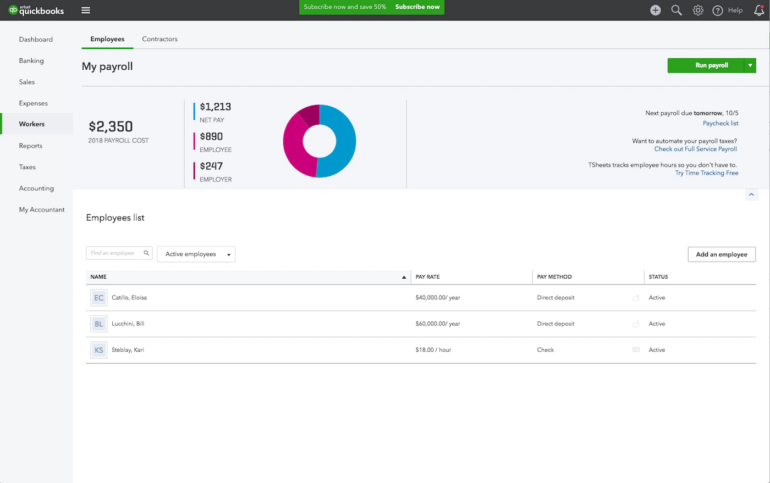

QuickBooks: Greatest for present QuickBooks customers

QuickBooks is among the hottest accounting software program options for small companies. It’s a complete, cloud-based accounting choice that gives options reminiscent of invoicing, payroll, accounts receivable, accounts payable and financial institution reconciliation. It additionally offers instruments for monitoring bills, managing taxes and managing stock. QuickBooks is a good different to ADP for small companies that need an easy-to-use accounting resolution.

Intuit QuickBooks Payroll gives three fundamental pricing plans:

- Core: $22.50 per thirty days plus $5 per worker per thirty days

- Premium: $37.50 per thirty days plus $8 per worker per thirty days

- Elite: $62.50 per thirty days plus $10 per worker per thirty days.

Moreover, QuickBooks has an ongoing 50% low cost on the bottom value for the primary three months.

Key options of QuickBooks

- Automated bookkeeping

- Multi-currency help for world payroll

- Stock administration for inventory ranges and buy orders

- Tax preparation help

- Digital and on-line Invoicing and billing

Use instances

- Small-business finance and accounting: QuickBooks permits small enterprise house owners to trace their funds by creating invoices, managing bills and monitoring gross sales and earnings.

- Small-business payroll: QuickBooks helps small enterprise house owners handle payroll by permitting them to pay workers, monitor payroll taxes and generate correct payroll studies.

- Small-business stock administration: QuickBooks helps small enterprise house owners handle their stock by monitoring inventory ranges, setting reorder factors and producing studies on stock prices and gross sales.

Characteristic graph

| Options | ADP | QuickBooks |

|---|---|---|

| Tax submitting | Sure | Sure |

| Normal direct deposit | 2-day | Subsequent-day (same-day accessible in premium and elite plans) |

| Advantages administration | Sure | Sure |

| Stock administration | No | Sure |

| PEO choice | Sure | No |

| Superior HR instruments | Sure | No |

| Integrations | Integrates with different accounting options | Integrates seamlessly with QuickBooks accounting |

| Auto payroll | Sure | Sure |

| 24/7 help | Sure | Six days every week |

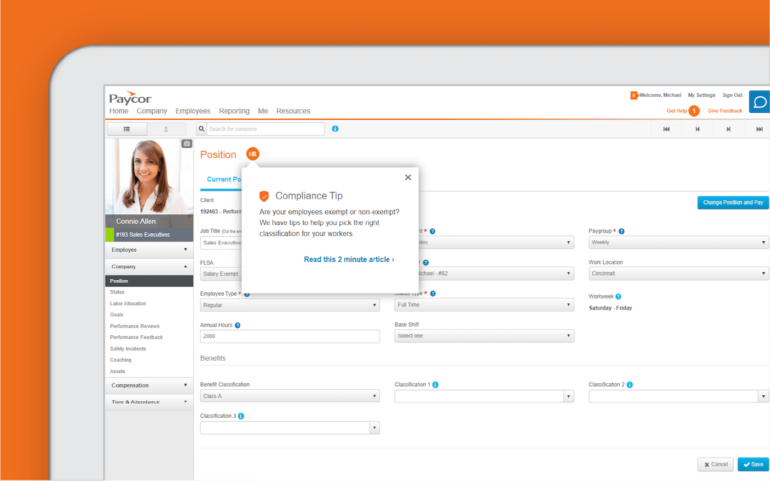

Paycor: Greatest for customized configurations

Paycor is a number one supplier of cloud-based software program options that assist companies handle human capital. They provide a variety of HR, payroll and expertise administration options to simplify and streamline how companies handle their workforces.

Paycor’s options are tailor-made to satisfy the particular wants of every enterprise; they provide quite a lot of options, reminiscent of payroll processing, tax submitting, worker onboarding, and time and attendance monitoring. Additionally they provide complete reporting, analytics and a cellular app to entry their options simply.

Paycor gives 4 pricing plans for small companies, starting from Primary to Full. The Primary plan begins at $99 per thirty days, plus $5 per worker per thirty days. The Important plan prices $149 per thirty days, plus $7 per worker per thirty days. The Core plan is priced at $199 per thirty days, plus $8 per worker per thirty days. The Full plan is $199 per thirty days, plus $14 per worker per thirty days.

Key options of Paycor

- Customizable payroll, HR, time and attendance, recruiting and onboarding options

- Net and cellular app accessibility

- Worker self-service portal

- Complete reporting capabilities

- 256-bit TLS 1.2 information encryption, MFA, IP filtering and different information safety measures

Use instances

- Efficiency administration: Paycor may help employers monitor worker efficiency and develop methods for enchancment and compensation. This will embrace setting targets, monitoring progress and rewarding efficiency.

- Expertise and recruitment administration: Expertise administration duties like recruitment, onboarding, compensation administration and steady expertise growth work are all potential in Paycor.

- Worker expertise and engagement administration: Paycor can be utilized to boost the worker expertise, with options reminiscent of pulse surveys, sentiment evaluation and a built-in studying administration system.

Characteristic graph

| Options | ADP | Paycor |

|---|---|---|

| Promotional provide | Free for 3 months | Waive 50% on month-to-month charges for one yr for small companies; three months free for bigger organizations |

| Tax submitting | Sure | Sure |

| Integrations | Integrates with Jobvite, iCIMS, Efficiency Professional and Iconixx | Integrates with Worker Navigator, HIRETech, Ascensus, Principal and bswift |

| Advantages administration | Sure | Sure |

| Deployment | Net, cloud, SaaS, Android and iOS | Net, cloud, SaaS, Android and iOS |

| Ease of use | Much less so | Sure |

| Self-service portal | Sure | Sure |

| Years of expertise | Over 70 years | Over 30 years |

| LMS | Sure | Sure |

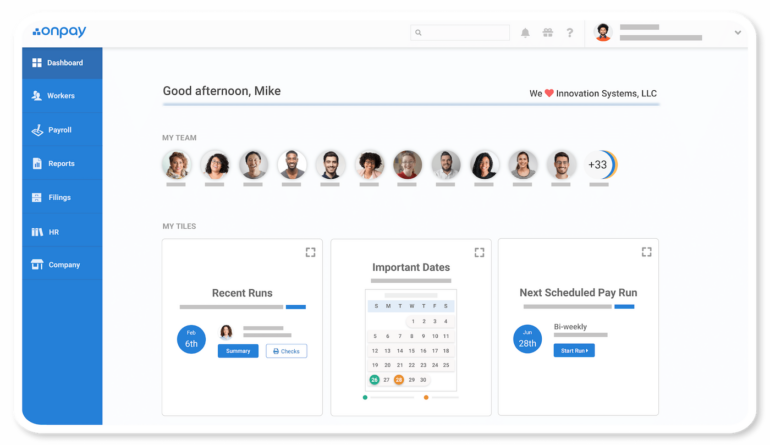

OnPay: Greatest for simplifying advanced payroll processes

OnPay is a cloud-based HR and payroll service that helps small and mid-sized companies handle payroll and advantages. OnPay offers instruments for organising payroll, monitoring time and operating studies. It additionally permits companies to pay workers by including funds on to staff’ pay playing cards, direct deposit or paper test.

The platform could be built-in with different accounting and HR software program. OnPay gives complete companies reminiscent of tax submitting, worker onboarding and worker advantages. The platform additionally has a variety of options geared towards serving to companies handle their payroll and advantages, reminiscent of customized guidelines and reporting, payroll tax compliance and onboarding instruments.

OnPay is a perfect different to ADP for companies trying to simplify difficult payroll processes. The OnPay month-to-month base price is $40 per thirty days, plus $6 per worker per thirty days. The price consists of payroll processing, direct deposit and tax submitting.

Key options of OnPay

- Automated, recurring payroll

- Tax submitting for federal, state and native taxes

- Tax submitting for 1099 contractors robotically

- Worker onboarding kinds, entry to worker self-service and direct deposit setup

- Varied studies and analytics metrics

Use instances

- Unemployment administration: OnPay is useful for unemployment insurance coverage withholding.

- Advantages administration: OnPay helps employers handle their worker profit plans, together with monitoring deductions, administering modifications and calculating payouts.

- Personalized payroll reporting: OnPay offers detailed payroll studies with customizable filters, displaying employers a full view of their payroll bills.

Characteristic graph

| Options | ADP | OnPay |

|---|---|---|

| Promotional provide | Free for 3 months | One-month free trial |

| Tax submitting | Sure | Sure |

| Limitless pay runs | Sure (prices additional) | Sure |

| Multi-state payroll | Sure (prices additional) | Sure |

| Accounting and time monitoring integrations | Sure | Sure |

| Self-service portal | Sure | Sure |

| Advantages and compliance administration | Sure (prices additional) | Sure |

| 24/7 help | Sure | No reside help on weekends |

| A number of pay charges and schedules | Sure | Sure |

Is ADP value it?

ADP is value it for companies searching for a complete suite of payroll, HR and advantages options. It gives numerous options, together with payroll processing, time and attendance monitoring, tax submitting and worker advantages administration.

The platform is scalable, and its intensive options make it an important alternative for companies of all sizes. Additionally they provide 24/7 help to spice up difficulty decision time. ADP is especially well-suited for companies that want a complete payroll and HR resolution and people who need to outsource their payroll and HR operations.

ADP professionals and cons

ADP’s options, flexibility and scalability make it a horny alternative for a lot of organizations. Nonetheless, ADP has some professionals and cons that it is best to take into account earlier than making a choice.

ADP professionals

- Streamlines payroll processes, making paying workers shortly and precisely simpler.

- Automates time and attendance monitoring, permitting managers to watch worker hours labored.

- Gives worker self-service choices, enabling workers to entry their very own payroll and advantages data.

- Provides numerous payroll and HR companies, together with the power to file taxes and handle worker advantages.

- Provides employer-specific payroll and HR companies, reminiscent of worker onboarding.

- Integrates with different software program reminiscent of accounting and HR methods for simpler information sharing.

- ADP retains companies compliant with numerous federal and state legal guidelines, reminiscent of these associated to payroll taxes and worker advantages.

- ADP gives buyer help that’s accessible 24/7 so companies can get assist after they want it.

ADP cons

- The system could be costly, relying on what options and companies are bought, particularly for smaller companies.

- No clear pricing.

- The system could be troublesome to be taught and requires specialised information to get essentially the most out of it.

- Some customers have reported difficulties in navigating the consumer interface

Do you want an alternative choice to ADP?

ADP gives sturdy and complete options for companies of all sizes, however there are just a few potential drawbacks. Some customers have discovered that ADP’s consumer interface generally is a bit cumbersome and troublesome to be taught. Moreover, a few of ADP’s options include a steep price ticket, making it troublesome for smaller companies or startups to reap the benefits of them.

SEE: Payroll processing guidelines (TechRepublic Premium)

Fortuitously, there are a number of options to ADP that provide comparable options however with extra user-friendly interfaces and higher pricing constructions. Earlier than you choose your most well-liked payroll processing software program or service, make sure you take into account your finances, your inner staff’s talent units, and any industry-specific compliance or safety necessities that it is advisable abide by.

Learn subsequent: Prime payroll processing companies for small companies (TechRepublic)