Are you trying to begin your buying and selling journey, or improve your buying and selling technique? In that case, you’ll need to discover ways to spot crypto chart patterns.

On this article, we are going to focus on among the most typical chart patterns that merchants use to make choices. We will even present examples of every sample. So, when you’re able to find out about crypto chart patterns, hold studying!

What Are Chart Patterns?

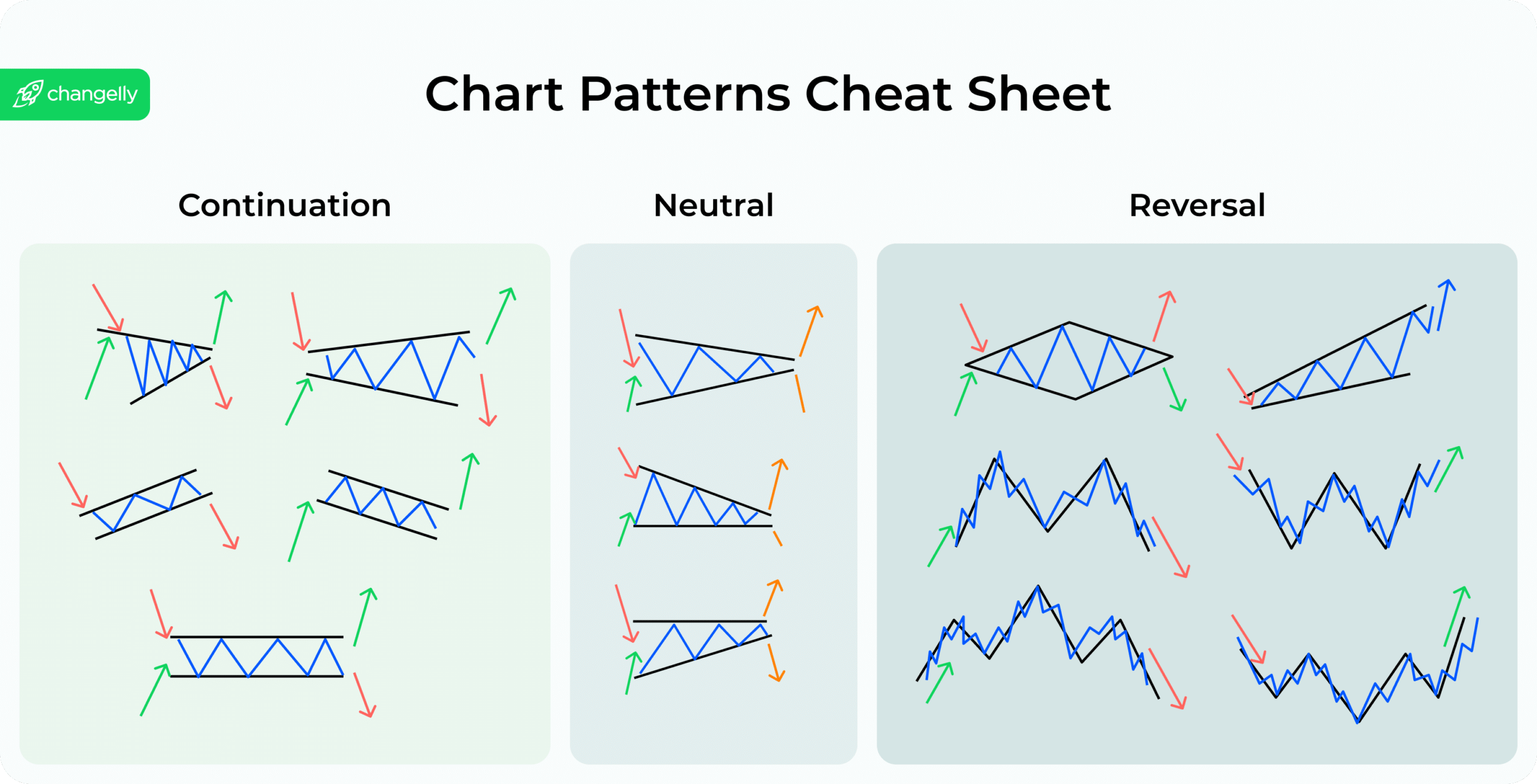

Chart patterns and pattern strains are utilized in technical evaluation to assist determine potential buying and selling alternatives. Merchants use them to acknowledge turning factors and robust reversals that would point out shopping for or promoting alternatives available in the market.

Buying and selling patterns are available many sizes and styles. Being widespread formations that happen on a value chart, they will sign to merchants {that a} sure value motion might happen. These patterns can assist predict future value actions.

Development strains are a key element of technical evaluation. They’re used to determine areas of help and resistance, point out a prevailing market pattern, forecast potential value targets, and filter out noise costs. Development strains might be drawn utilizing knowledge factors comparable to highs or lows on the chart. Whereas drawing one, it’s additionally essential to trace transferring averages, determine explicit market circumstances, and research the slope of the pattern line. These pattern strains assist merchants determine entry/exit factors of their trades in addition to regulate their positions primarily based on future market actions. Finally, they offer merchants higher probabilities at recognizing worthwhile buying and selling alternatives within the markets.

The best way to Learn Crypto Chart Patterns?

Studying to learn crypto chart patterns is a worthwhile ability for buying and selling and investing in cryptocurrencies. Right here’s a step-by-step information tailor-made for inexperienced persons, together with recommendation on the instruments you must use and recommendations on how one can begin:

Step 1: Perceive the Fundamentals of Chart Patterns

Chart patterns are formations that seem on the worth charts of cryptocurrencies and characterize the battle between patrons and sellers. These patterns can point out potential value actions. Familiarize your self with the commonest patterns, like head and shoulders, cup and deal with, flags, and triangles. For those who wrestle initially, don’t be discouraged — like several ability, with follow and expertise, you’ll quickly be capable to determine these patterns effortlessly.

Step 2: Select a Charting Instrument

A very good charting instrument is crucial for viewing and analyzing crypto charts. Some fashionable choices embrace:

- TradingView: Extremely fashionable for its vary of instruments and social sharing options.

- Coinigy: Gives in depth instruments for buying and selling immediately from the chart.

- CryptoCompare: Supplies a much less superior, user-friendly interface appropriate for inexperienced persons.

Step 3: Study to Determine Patterns

This step tends to be probably the most time-consuming, however with the best assets, you’ll be able to grasp it effectively.

Begin by figuring out easy patterns. Make the most of instruments comparable to our chart sample cheat sheets and buying and selling tutorials on YouTube to information your studying. Give it a go along with two or three of the preferred patterns, comparable to head and shoulders, cup and deal with, or triangles. Observe recognizing these patterns on precise charts. By actively looking for these patterns your self, you’ll develop a eager eye for figuring out potential market actions, which is essential for profitable buying and selling.

Step 4: Observe with Historic Knowledge

Use your charting instrument to take a look at historic value actions and attempt to determine the patterns. Most platforms let you “replay” the market from an earlier date to simulate how patterns might need helped predict actions.

Step 5: Apply Fundamental Technical Evaluation

Whereas memorizing chart patterns is beneficial, understanding some fundamental technical evaluation can improve your capacity to learn charts. In case you are a newbie, I might counsel to find out about:

- Assist and Resistance Ranges are costs at which the crypto persistently stops falling or rising, respectively.

- Quantity helps affirm the power of a value transfer. Patterns with excessive quantity on the breakout are extra dependable.

- Transferring Averages easy out value knowledge to create a single flowing line, which makes it simpler to determine the path of the pattern. Easy transferring averages (SMA) and exponential transferring averages (EMA) are good beginning factors.

- The Relative Power Index (RSI) measures the velocity and alter of value actions on a scale of 0 to 100. Typically, an RSI above 70 signifies overbought circumstances (probably a promote sign), whereas beneath 30 signifies oversold circumstances (probably a purchase sign).

- Transferring Common Convergence Divergence (MACD) is a trend-following momentum indicator that reveals the connection between two transferring averages of a cryptocurrency’s value. The MACD is calculated by subtracting the 26-period EMA from the 12-period EMA.

- A Stochastic Oscillator is a momentum indicator that compares a specific closing value of a cryptocurrency to a spread of its costs over a sure interval. It helps to determine overbought and oversold ranges, offering perception into potential reversal factors.

Step 6: Observe on a Demo Account

Earlier than investing actual cash, follow your abilities utilizing a demo account. Many buying and selling platforms supply demo accounts the place you’ll be able to commerce with pretend cash however actual market knowledge.

Step 7: Keep Up to date and Versatile

Influenced by information and world occasions, the crypto market is very risky. Preserve your self up to date with the newest cryptocurrency information. Be versatile and able to adapt your technique because the market adjustments.

Is Memorizing Chart Patterns Sufficient?

Memorizing chart patterns is an efficient begin, nevertheless it’s not sufficient for constant success in crypto buying and selling. Understanding the context during which these patterns develop and the market sentiment and complementing them with different types of technical evaluation like pattern strains, quantity, and indicators like Transferring Averages or RSI can present a extra complete buying and selling technique.

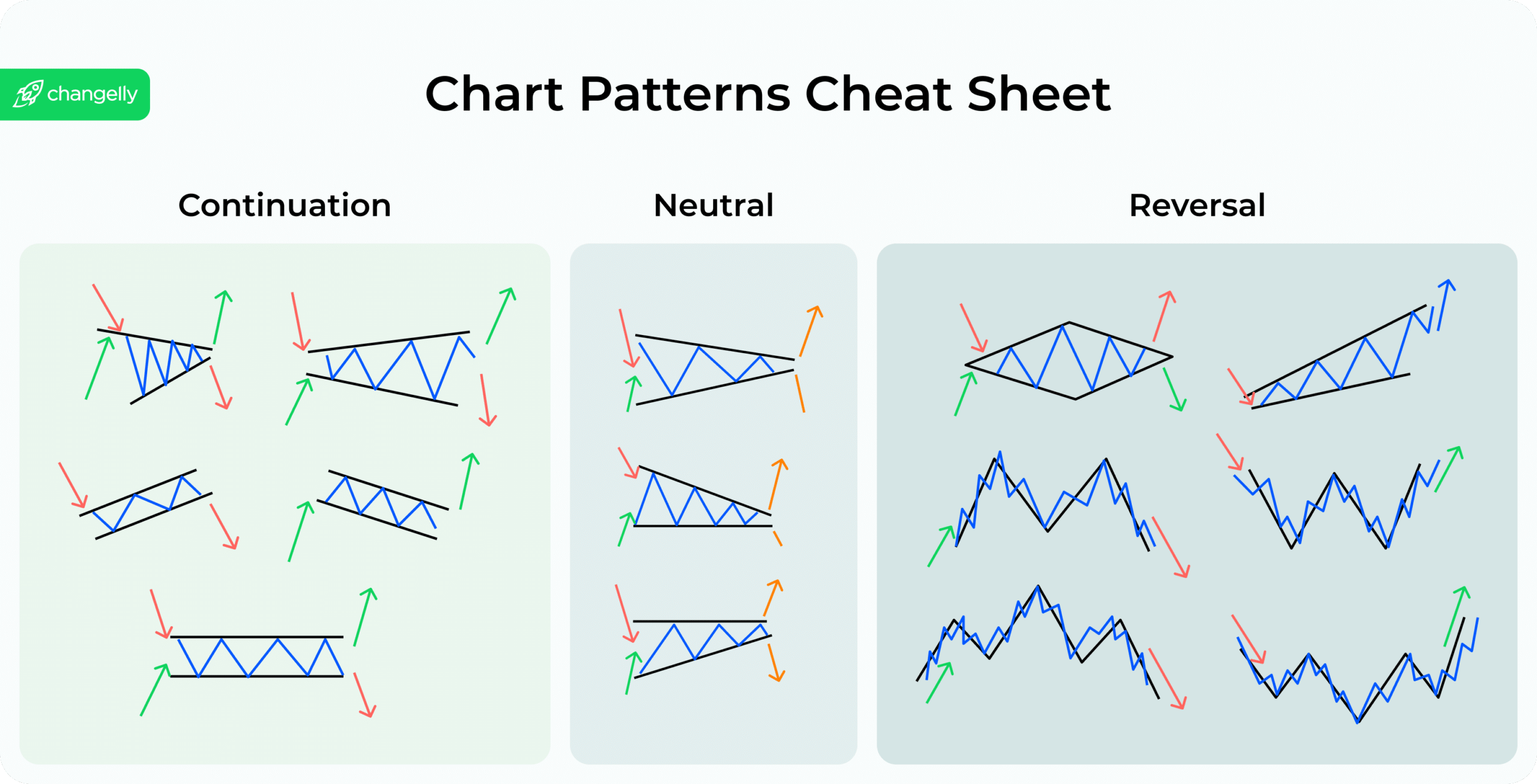

Triangle Crypto Chart Patterns

Probably the most widespread chart patterns is the triangle, shaped by an asset’s converging pattern strains. There are three varieties of triangles:

- Ascending (bullish chart sample)

- Descending (bearish sample)

- Symmetrical

Ascending and descending triangles are continuation chart patterns, which signifies that they sometimes happen in the midst of a pattern and sign that the pattern will proceed. Symmetrical triangles are thought-about to be reversal patterns, which implies they will happen on the finish of a pattern and sign that the worth might reverse its course.

Triangles are among the long-lasting patterns: they will take a number of months and even years to type.

Ascending Triangle

An ascending triangle sample is created when the worth of an asset varieties increased highs and better lows. This sample is taken into account a bullish continuation sample — so it offers a purchase sign.

Listed here are some widespread defining traits of an ascending triangle:

- The worth is forming increased highs and better lows.

- There’s a horizontal resistance line at a sure value degree.

- The chart sample is often discovered in the midst of an uptrend.

Descending Triangle

A descending triangle is a bearish continuation sample that, similar to the identify suggests, is the alternative of the ascending triangle. It happens when the asset value varieties decrease highs and decrease lows. A descending triangle normally offers a promote sign as it’s a signal {that a} bearish pattern will in all probability proceed.

There are a number of methods to determine a descending triangle. These are among the issues you’ll be able to search for.

- The asset value varieties decrease highs and decrease lows.

- You possibly can observe horizontal help.

- It’s the center of a downtrend.

Symmetrical Triangle

A symmetrical triangle chart sample emerges when the worth of an asset varieties increased lows and decrease highs. This chart sample might be discovered on the finish of a pattern; it alerts that the worth might reverse its course. The symmetrical triangle sample might be both bullish or bearish.

Listed here are some indicators that the sample you’re seeing is perhaps a symmetrical triangle:

- The worth varieties increased lows and decrease highs.

- There isn’t a clear pattern.

- It’s the finish of a pattern.

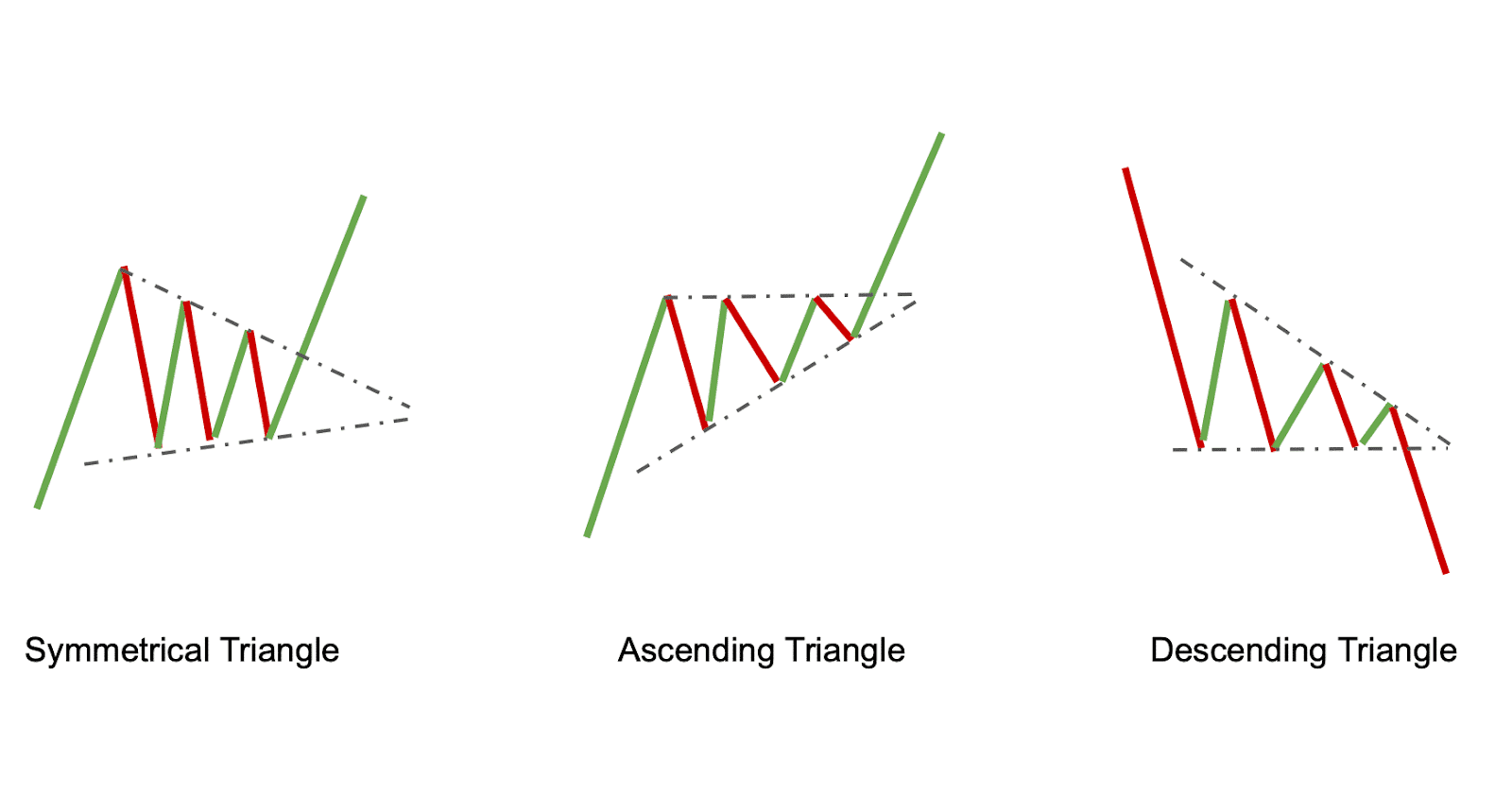

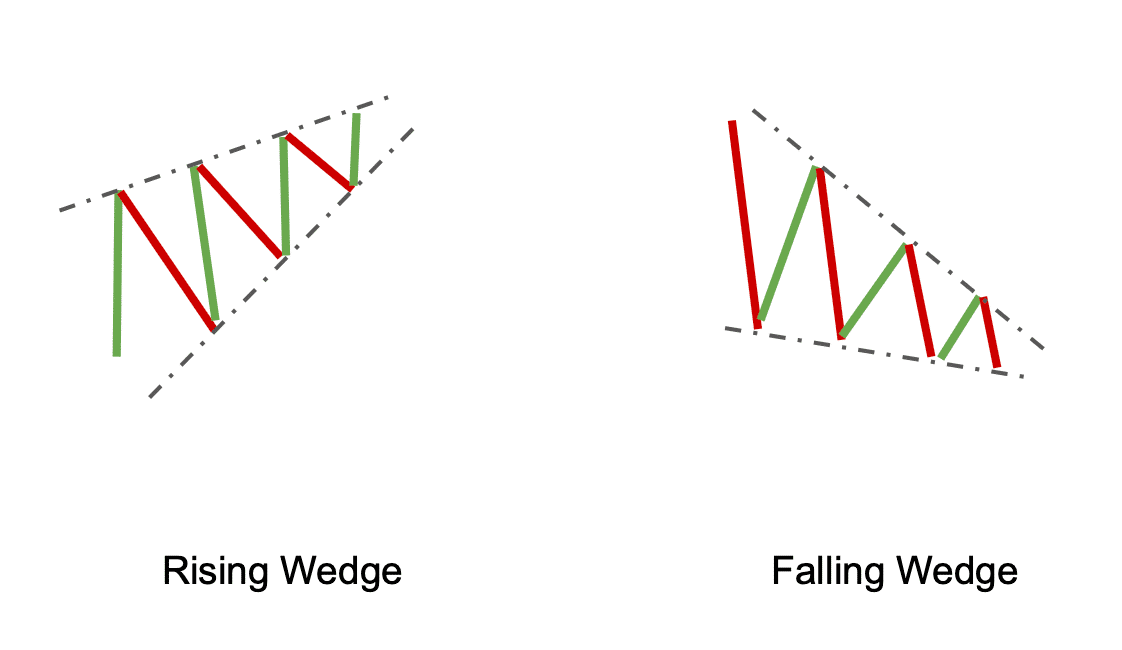

Rising Wedge Crypto Graph Patterns

Wedges are one other subtype of triangle chart patterns. A rising wedge is a bearish reversal sample that involves life when the worth of an asset varieties decrease highs and better lows. This sample alerts that the worth is more likely to proceed to fall. It offers a promote sign.

Listed here are some issues that may level in direction of a sample being a rising wedge:

- The worth varieties decrease highs and better lows.

- There’s horizontal resistance at a sure value degree.

- It’s the center of a downtrend.

Falling Wedge

A falling wedge is a bullish reversal sample that, similar to the identify suggests, is the alternative of the rising wedge. It happens when there are increased highs and decrease lows on the worth chart. A falling wedge normally offers a purchase sign as it’s a signal that an uptrend will in all probability proceed.

There are a number of methods to determine a falling wedge. These are among the issues you’ll be able to search for:

- The asset varieties increased highs and decrease lows.

- You possibly can observe horizontal help.

- It’s the center of an uptrend.

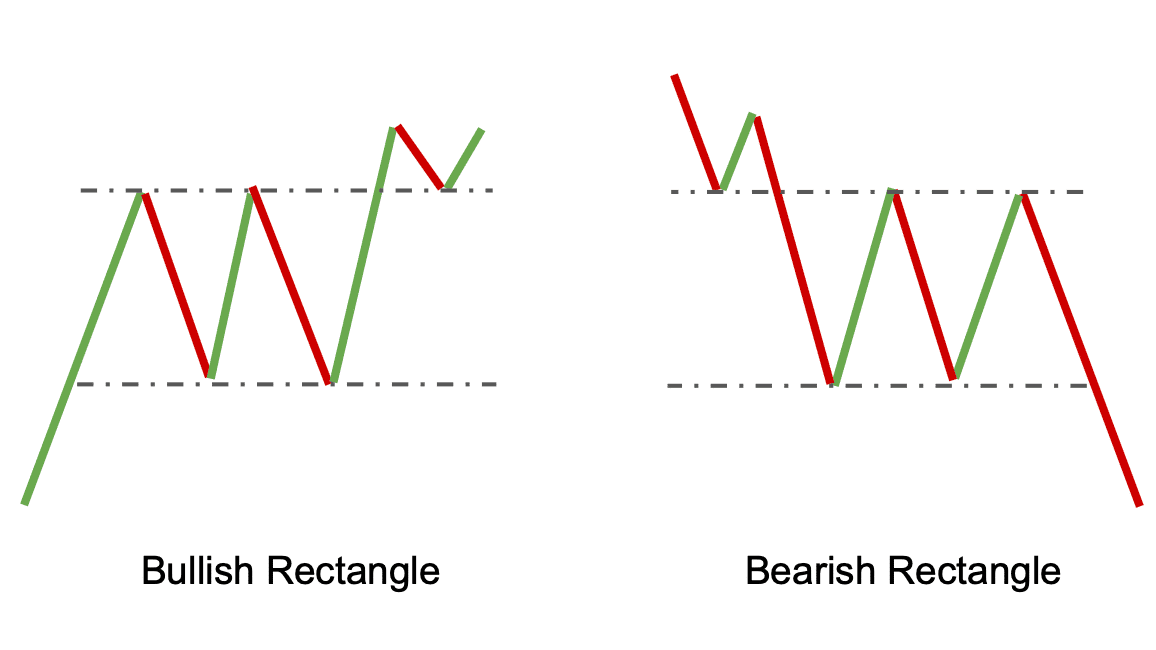

Rectangle Chart Patterns

A rectangle chart sample is created when the worth of an asset consolidates between two horizontal ranges of help and resistance. This chart sample can sign that the worth is about to interrupt out in both path.

Bullish Rectangle

A bullish rectangle is a chart sample that’s created when the worth of an asset can not escape by means of both the highest or the underside horizontal line and finally ends up consolidating between the help and resistance ranges. This chart sample alerts that the worth is more likely to escape to the upside — so it offers a purchase sign.

Listed here are the defining traits of a bullish rectangle:

- Worth consolidation between two horizontal ranges of help and resistance.

- This chart sample is often discovered on the finish of a downtrend.

Bearish Rectangle

A bearish rectangle is the alternative of the bullish rectangle. It occurs when asset value “will get caught” in between two horizontal ranges of help and resistance. A bearish rectangle normally offers a promote sign as it’s a signal that the worth is more likely to proceed to fall.

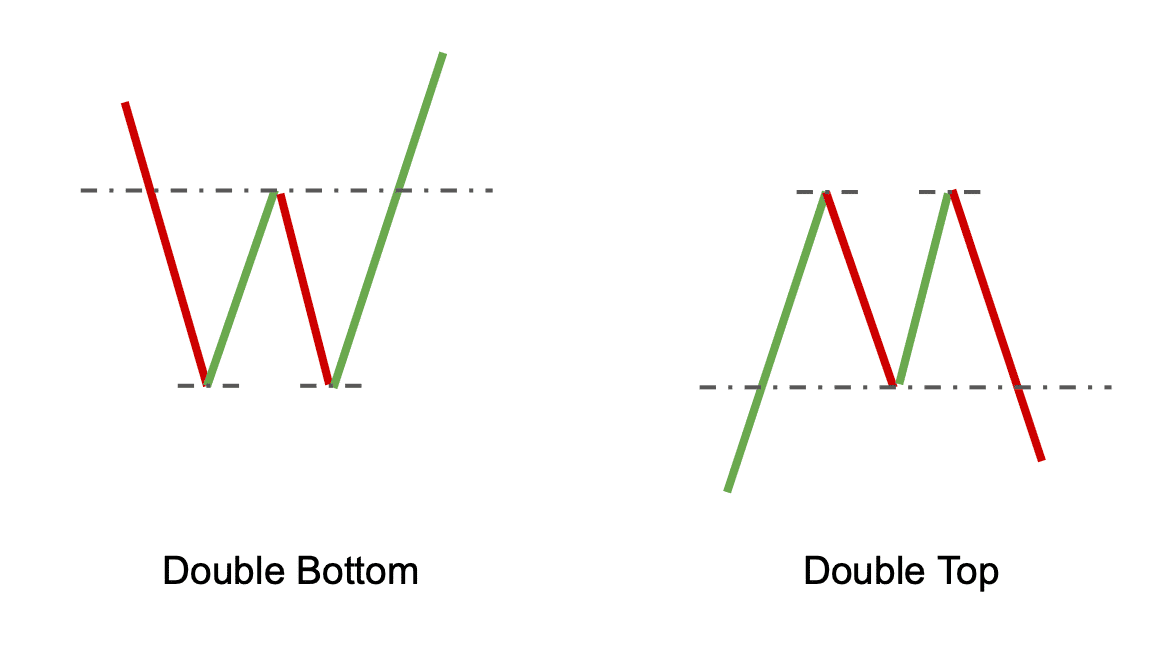

Double High Crypto Sample

A double prime is without doubt one of the most typical crypto chart patterns. It’s characterised by the worth capturing up twice in a brief time frame — retesting a brand new excessive. If it fails to return to that degree and cross over the higher horizontal line, it sometimes signifies {that a} sturdy pullback is coming. It is a bearish reversal sample that provides a promote sign.

Double Backside Crypto Sample

A double backside is a chart sample that, as might be seen from its identify, is the alternative of the double prime. It happens when the asset value checks the decrease horizontal degree twice however then pulls again and goes up as an alternative. A double backside normally offers a purchase sign as it’s a signal that there’ll seemingly be an uptrend.

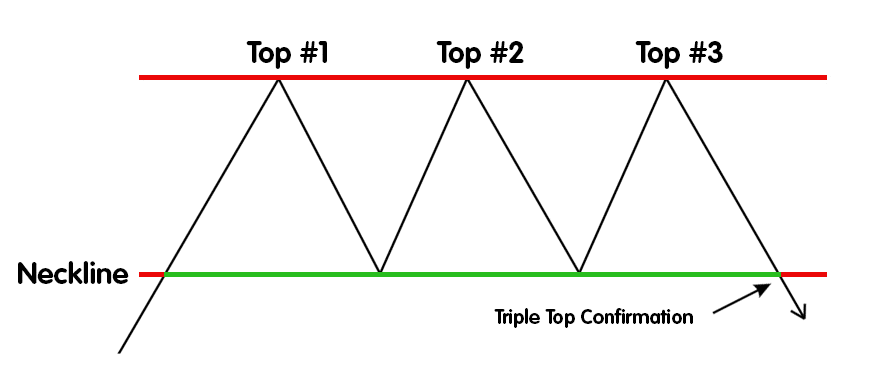

Triple High

The triple prime and backside patterns are similar to their “double” counterparts. The triple prime additionally happens when the worth of an asset checks the higher horizontal line however fails to cross over it — however for this sample, it occurs thrice. It’s a bearish reversal sample that alerts an upcoming downward pattern.

Triple Backside

The triple backside crypto chart sample is noticed when asset value reaches a sure degree after which pulls again two occasions earlier than lastly kicking off a bullish pattern.

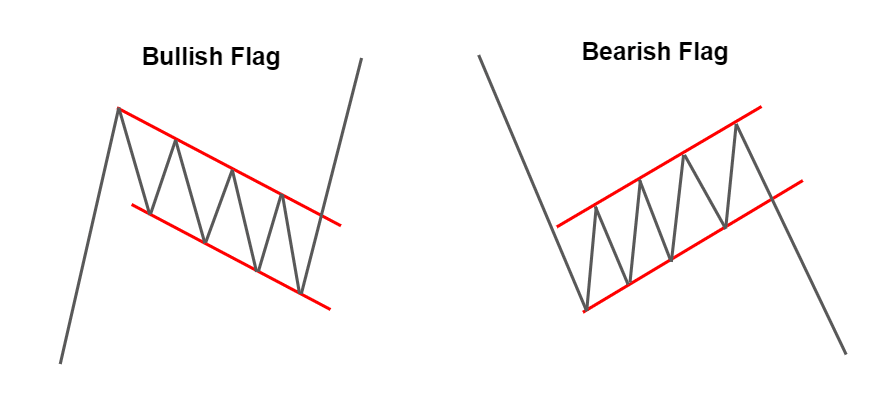

Pole Chart Patterns

Pole chart patterns are characterised by the worth of an asset reaching a sure degree after which pulling again earlier than returning to that degree. These patterns get their identify from the “pole” current in them — a fast upward (or downward) value motion.

Bullish Flag Sample

A bullish flag is a chart sample that happens when the asset value reaches a sure degree after which pulls again earlier than reclaiming that degree. A bullish model of this crypto flag sample normally offers a purchase sign as it’s a signal that an uptrend will in all probability proceed. You possibly can learn extra about it right here.

Essentially the most distinctive factor about this sample is, unsurprisingly, its form: a pole adopted by a flag. Right here’s the way it’s structured:

- Drastic upward value motion

- A short consolidation interval with decrease highs

- A bullish pattern

Bearish Flag

A bearish flag is the exact opposite of a bullish flag crypto chart sample. It’s shaped by a pointy downtrend and consolidation with increased highs that ends when the worth breaks and drops down. These flags are bearish continuation patterns, so they offer a promote sign. You possibly can study extra about them on this article.

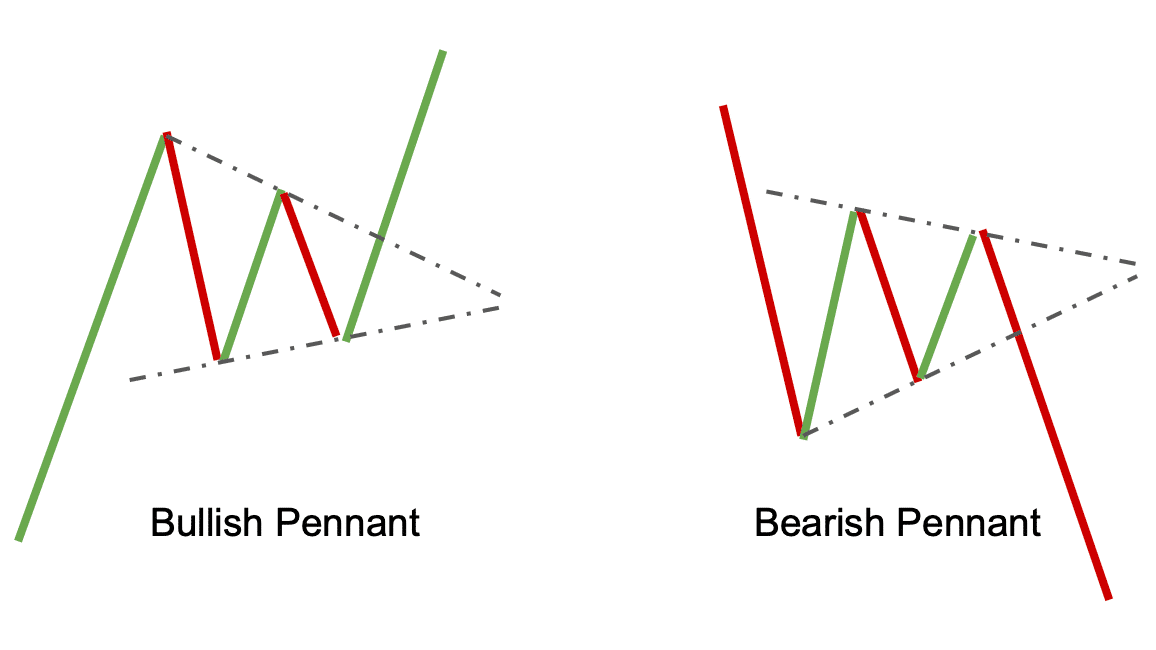

Bullish Pennant

A bullish pennant is a bullish pole chart sample quite just like a bullish flag. It additionally has a pole — a shart uptrend — adopted by a short (or not so transient) consolidation, after which a continued uptrend. Not like the flag, nevertheless, its consolidation interval is formed like a triangle: it has increased lows and decrease highs. It offers a purchase sign.

Bearish Pennant

A bearish pennant is, naturally, the alternative of a bullish pendant. Its pole is a pointy downward value motion, and it’s adopted by a value lower. It offers a promote sign.

Pennants are additionally outlined by buying and selling quantity: it ought to be exceptionally excessive throughout the “pole” after which slowly whittle down throughout consolidation. They normally final between one and 4 weeks.

Different Chart Buying and selling Patterns

There are additionally a number of different chart patterns which you could search for when buying and selling cryptocurrencies. Listed here are a number of of the commonest ones.

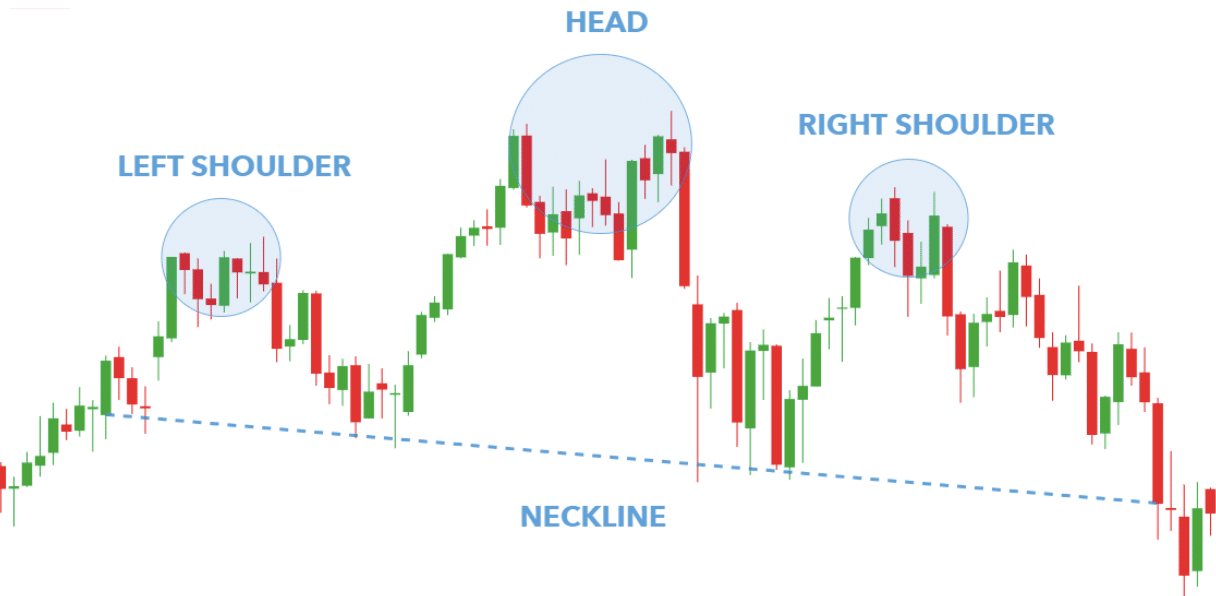

Head and Shoulders Crypto Graph Patterns

Chart evaluation is without doubt one of the finest instruments in buying and selling crypto. Right here’s how one can determine a head and shoulders sample.

A extra superior chart sample, the pinnacle and shoulders chart sample, happens when the worth of an asset reaches a sure degree after which pulls again earlier than retaking that degree. This chart sample might be both bullish or bearish, relying on the place it happens available in the market cycle.

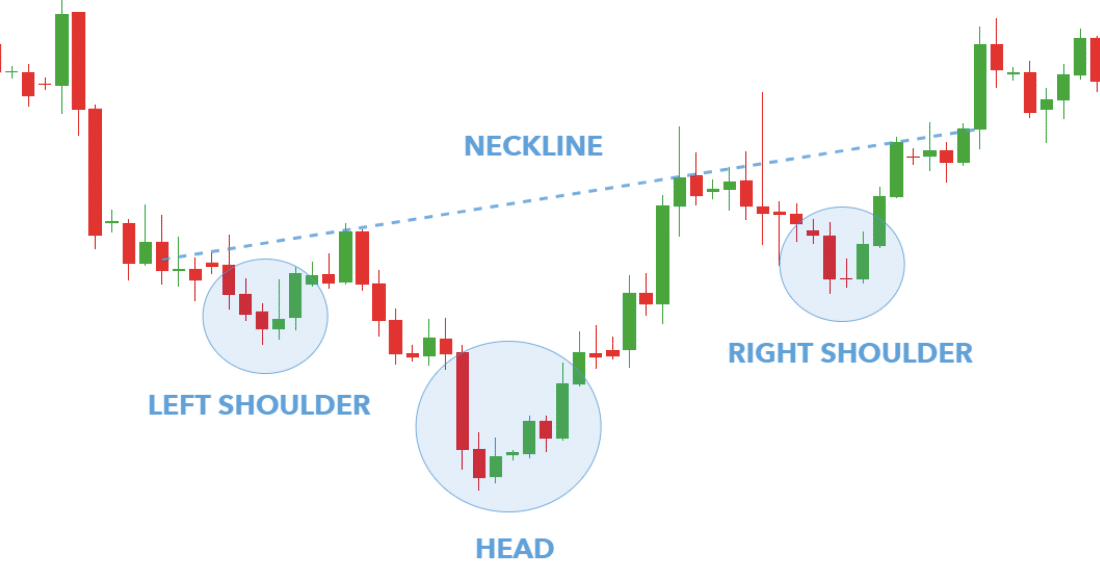

Inverted Head and Shoulders

One of many extra superior technical evaluation patterns, inverted head and shoulders, ought to be used with different indicators earlier than taking a place.

The inverted head and shoulders chart sample is created when the worth of an asset reaches a sure degree after which pulls again earlier than reaching that degree once more. This chart sample is normally bullish and provides a purchase sign as it’s a signal that an uptrend will in all probability proceed. Identical to the identify suggests, it’s the inverted model of the normal head and shoulders sample.

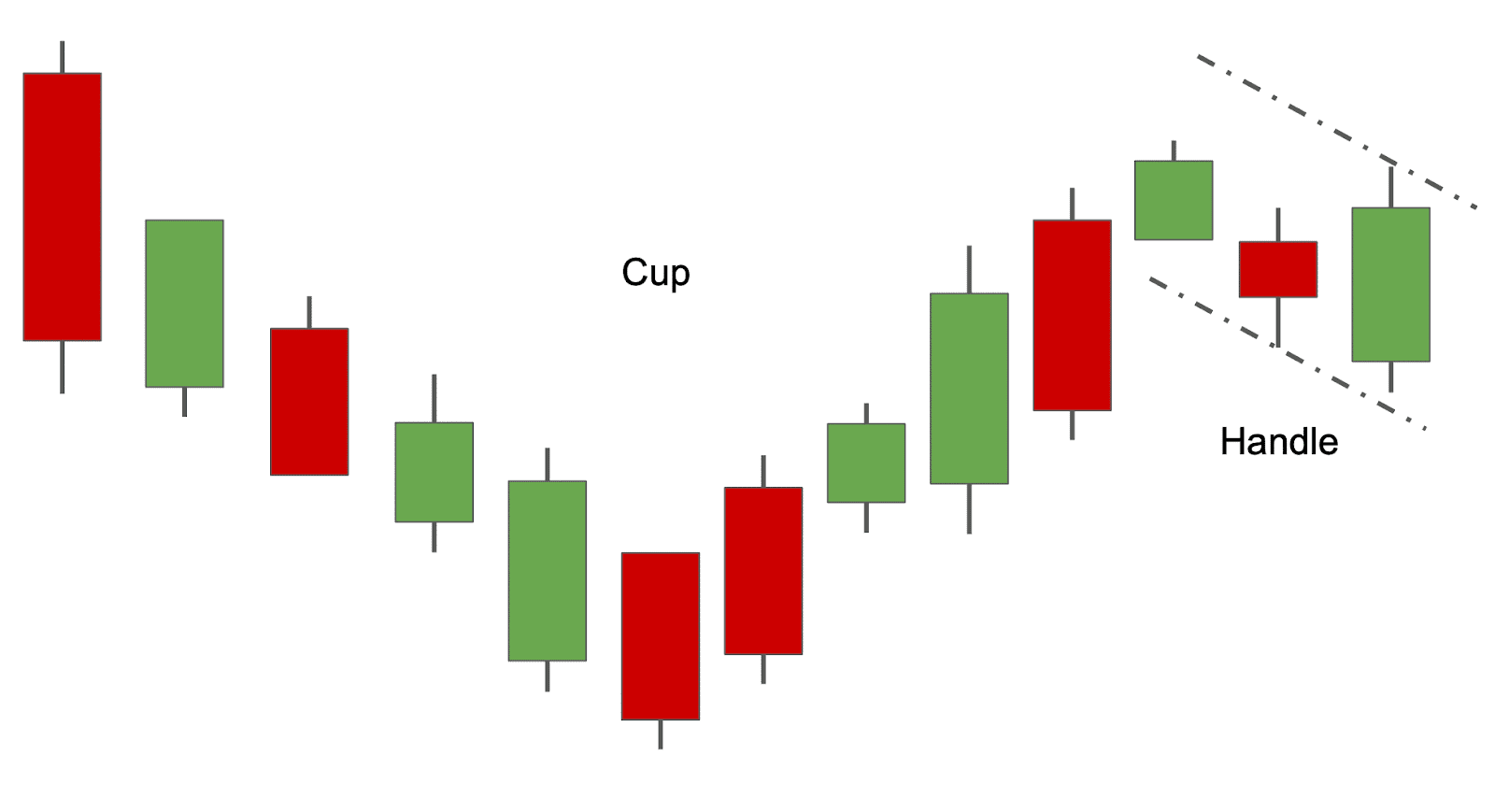

Cup and Deal with

The cup and deal with is a sample that may be noticed when the worth of an asset reaches a sure degree after which pulls again earlier than reclaiming that degree. It’s named like that as a result of it really appears to be like like a cup.

This chart formation is also known as the bullish reversal sample. Nevertheless, it may give both a bullish or a bearish sign — all of it depends upon what level of the cycle it’s seen in.

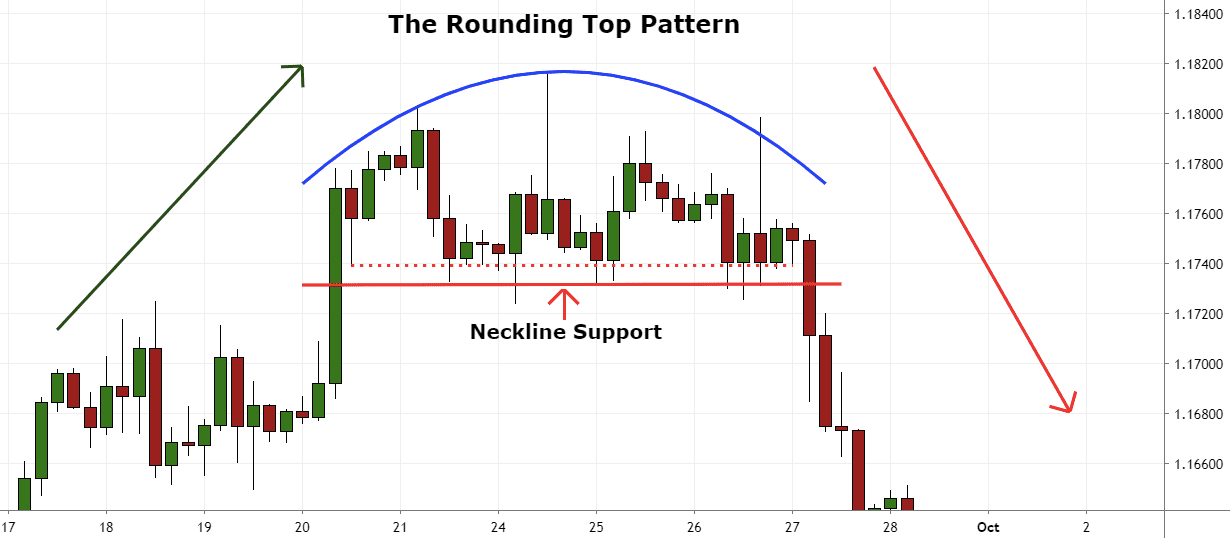

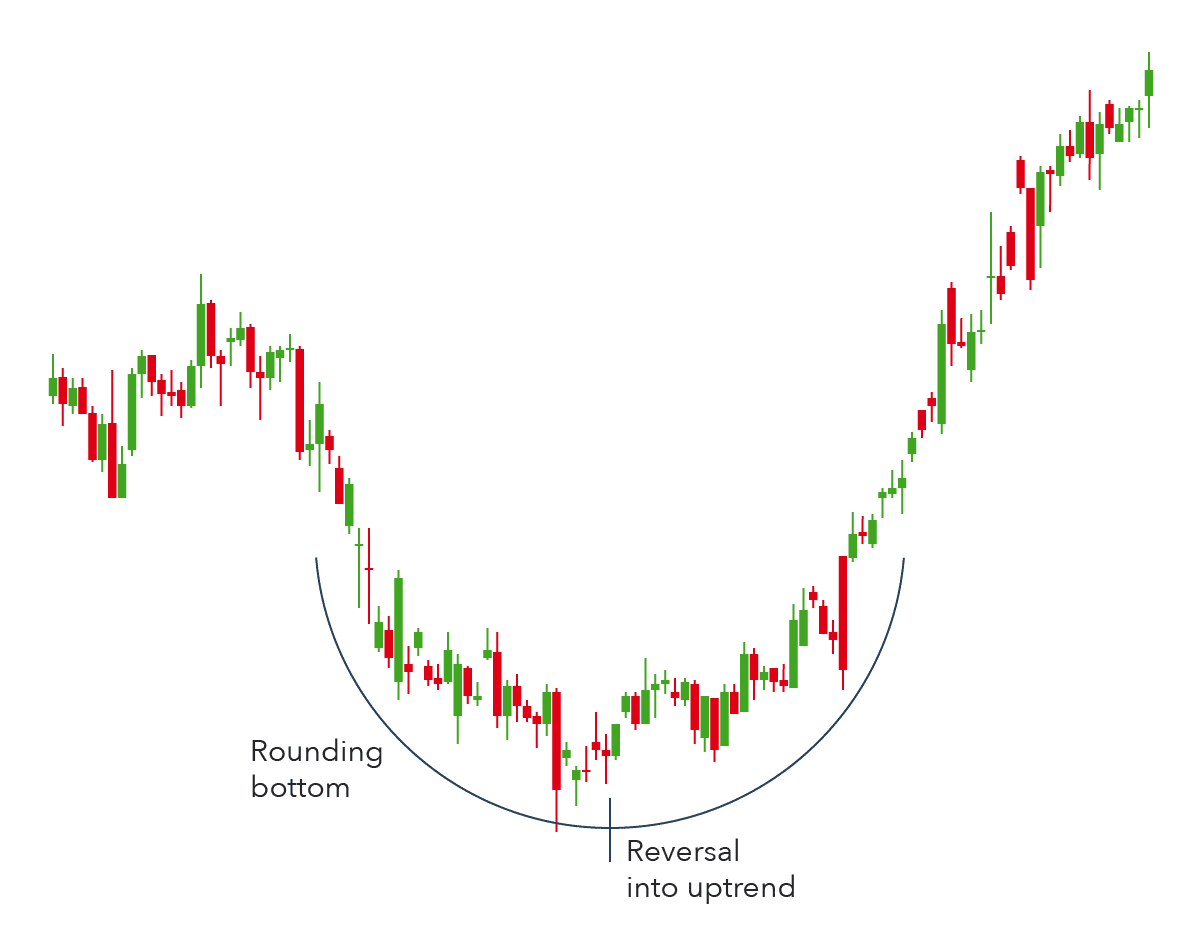

Rounded High and Backside Crypto Chart Sample

The rounded prime and backside chart sample seems when the worth of an asset reaches a sure degree after which pulls again earlier than retaking that degree. This chart sample might be both bullish or bearish, relying on the place it happens available in the market cycle.

This crypto chart sample sometimes happens proper earlier than a pattern reversal. The “prime” sample alerts a attainable bearish reversal, creating a possible shorting alternative. The “backside” sample is the alternative and infrequently precedes a reversal from a downward pattern to an upward one.

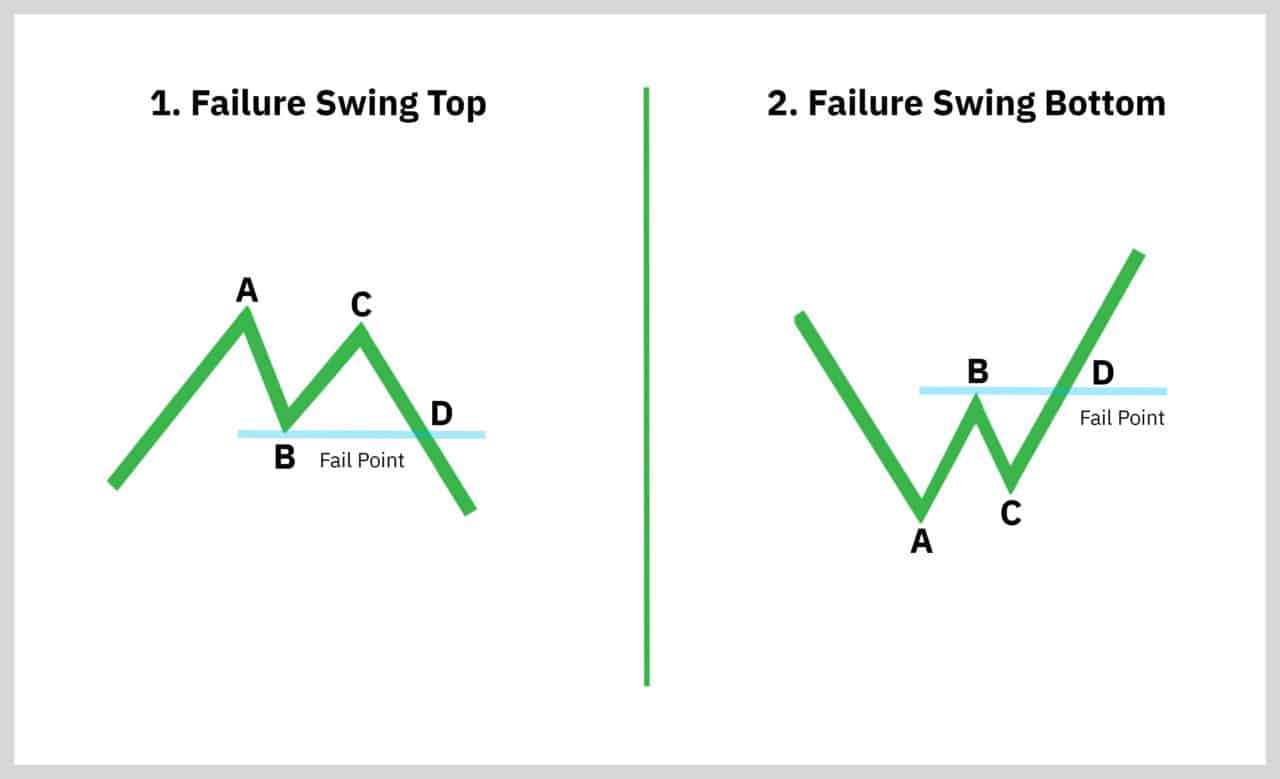

The Failure Swing Buying and selling Crypto Chart Sample

The failure swing chart sample occurs if the asset value reaches a sure degree after which pulls again earlier than reaching that degree once more. Widespread failure chart patterns sometimes contain pattern strains, comparable to breakouts earlier than a fail level, or descending triangles. When these patterns seem on charts, they might point out {that a} reversal or pullback is due; nevertheless, false alerts can happen if the underlying circumstances or fundamentals don’t help the formation of the sample.

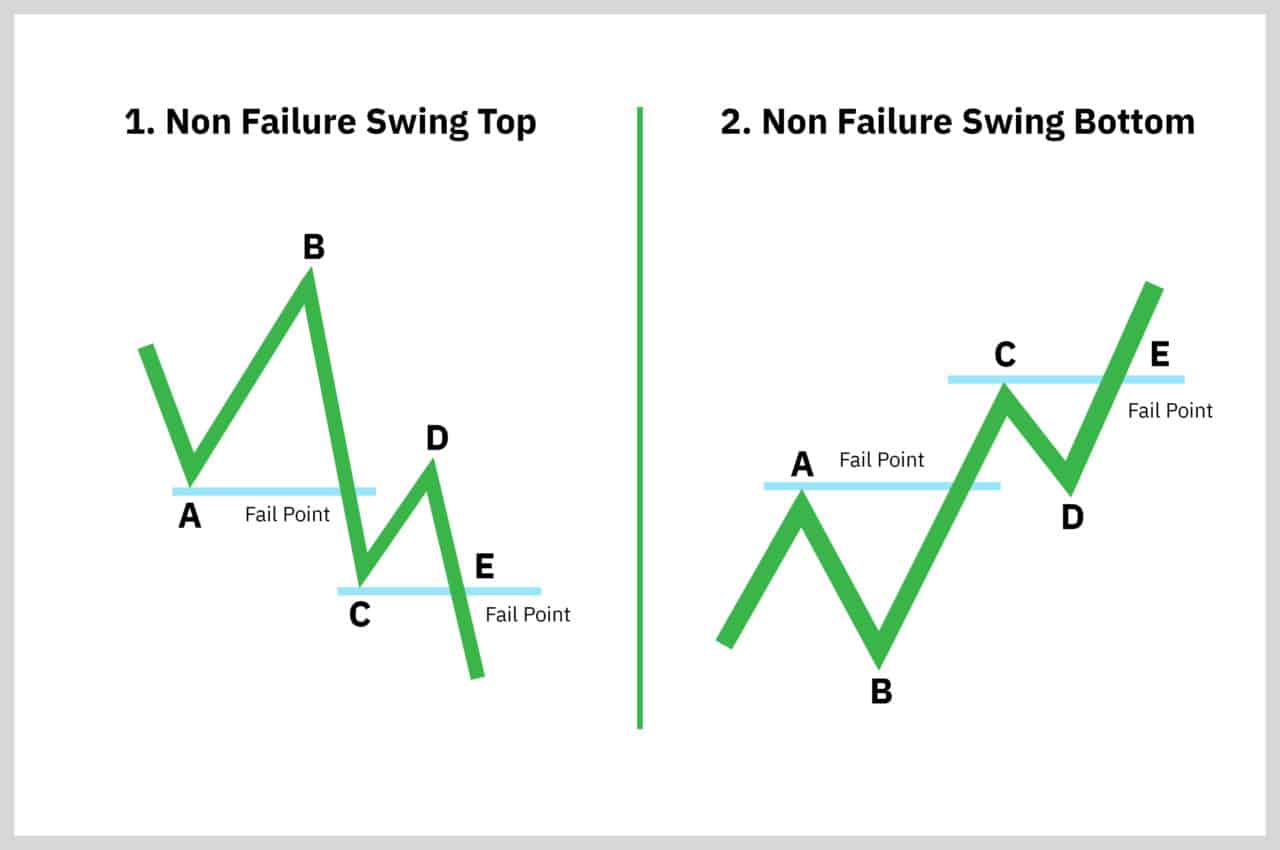

Non-failure swing chart patterns are just like failure swing charts, however they contain the second peak staying above the primary one (an upward continuation). Non-failure swings can point out sturdy tendencies and sustained value actions. One ought to take a look at each varieties of patterns together with different market indicators to validate their accuracy.

The best way to Commerce Crypto Utilizing Chart Patterns

So, you’ve noticed a sample on a crypto chart. What do you have to do subsequent? Whereas the crypto market strikes quick and waits for nobody, it’s sensible to heed the recommendation of seasoned merchants and take an intensive strategy to maximise the advantages of your chart sample.

To take advantage of out of chart patterns in crypto buying and selling, take note of these crucial elements:

- Worth Motion: Observe whether or not there are increased highs or decrease lows, which might point out the power of a pattern.

- Assist and Resistance Ranges: These are crucial areas the place the worth might stall or reverse.

- Development Stage: Decide whether or not the pattern is at its starting, center, or finish to raised gauge potential strikes.

Listed here are different important tricks to improve your buying and selling technique:

- Make it possible for the chart sample is legitimate. Because of this it ought to meet all the standards we mentioned earlier on this article.

- Watch for a affirmation sign earlier than getting into a commerce. A affirmation sign is one thing like a breakout or a candlestick sample.

- Make the most of technical indicators. They can assist crypto merchants determine potential entry and exit factors, in addition to decide the general pattern available in the market.

- Take note of totally different time frames. Quick-term merchants might deal with hourly or every day charts, whereas long-term buyers might take a look at the larger image — weeks or months.

- Have a correct risk-reward ratio. Because of this your potential income ought to be higher than your potential losses.

- Have a plan for exiting the commerce. This consists of setting a revenue goal and a stop-loss order.

In case you are an skilled dealer or have a higher-than-average danger urge for food, you’ll be able to attempt to commerce patterns earlier than the affirmation. Nevertheless, please do not forget that it’s extremely dangerous — to not point out insanely onerous. Whereas these patterns are simple to determine on reflection, they are often not-so-easy to note when they’re simply occurring. In fact, ыщьу instruments and indicators (and even bots) can assist with that, and you’re going to get higher at catching them as you follow extra, however they will nonetheless be extremely treacherous.

Crypto Chart Sample Success Fee

There are lots of totally different chart patterns that you should use to commerce crypto, however not all of them are equally efficient.

Some chart patterns have a better success price than others. For instance, the pinnacle and shoulders sample has a hit price of about 70%. Alternatively, the cup and deal with sample has a hit price of about 80%.

It’s necessary to notice that the success of those patterns might be influenced by a number of components:

- Chart Timeframe: Patterns on longer timeframes are usually extra dependable than these on shorter ones.

- Sample Kind: Continuation patterns may carry out in another way in bull markets in comparison with bear markets.

- Exterior Elements: Black swan occasions, sudden information releases, and main bulletins can closely affect market circumstances, typically disrupting established patterns.

Due to this fact, whereas chart patterns could be a worthwhile instrument for merchants, they need to be used together with a complete understanding of the general crypto market, particularly in day buying and selling, the place market sentiment can shift quickly. Correct danger administration and technique alignment are important to maximise their effectiveness.

On the finish of the day, what issues most is utilizing the patterns that suit your buying and selling technique finest, in addition to using correct danger administration.

Danger Administration

Danger administration is extremely necessary in the case of buying and selling crypto chart patterns. Irrespective of how good or outstanding the chart sample is, issues can all the time go flawed. So, it’s essential to have a stable danger administration technique in place earlier than you begin buying and selling and regulate it accordingly. Listed here are some issues to bear in mind:

- Set a cease loss. That is in all probability crucial factor you are able to do by way of danger administration. A cease loss will enable you to restrict your losses if the commerce goes in opposition to you.

- Use a take revenue goal. A take revenue goal will enable you to lock in income if the commerce goes in your favor.

- Use a trailing cease. A trailing cease is a good way to guard your income as a result of it’s going to routinely promote your place if the worth begins to fall.

- Handle your place dimension. Place dimension additionally issues. You don’t wish to danger an excessive amount of of your account on one commerce.

Hedging can also be an necessary idea to grasp when buying and selling chart patterns. It includes opening a place in a single asset to offset the chance related to one other asset.

For instance, let’s say you’re lengthy on BTC, and also you’re frightened a couple of potential market crash. You may hedge your place by going brief in altcoins. This manner, if the market does crash, your losses shall be offset by your features in altcoins.

These are just some issues to bear in mind in regard to danger administration when buying and selling chart patterns. For those who can grasp danger administration, you’ll be nicely in your technique to success as a dealer.

FAQ

Do chart patterns work for crypto?

Sure, chart patterns might be extraordinarily helpful for buying and selling crypto. They is probably not 100% dependable, however they will undoubtedly enable you to make extra knowledgeable buying and selling choices.

As with all different asset on the market, combining chart patterns with different types of technical and basic evaluation offers a extra complete buying and selling technique. This combine can assist mitigate the dangers related to deceptive alerts from any single methodology.

What’s the finest sample for crypto buying and selling?

There’s nobody “finest” sample for buying and selling cryptocurrencies as a result of it actually depends upon what works finest for you. Nevertheless, when you’re simply beginning out, it’s a good suggestion to deal with less complicated patterns which are simpler to identify and have a tendency to work nicely. Some good ones embrace Horizontal Resistance, Ascending Triangle, Channel Down, Falling Wedge, and Inverse Head and Shoulders. These patterns can assist you determine when to purchase and are usually extra dependable, which might make buying and selling a bit much less daunting for inexperienced persons.

What technical evaluation instruments are one of the best for cryptocurrency buying and selling?

There are a number of technical evaluation instruments that may be actually helpful for cryptocurrency buying and selling. A few of the hottest ones embrace:

- Transferring Common (MA)

- Bollinger Bands

- Relative Power Index (RSI)

- MACD indicator

The best way to catch a crypto pump?

Predicting a crypto pump isn’t any simple process, however there are some things you’ll be able to look out for that will provide you with some clues. These embrace:

- Elevated social media exercise

- Frequent occurrences of FOMO in the neighborhood

- Pump and dump teams

- Uncommon buying and selling exercise on exchanges

What number of chart patterns are there in crypto?

Loads of chart patterns that can be utilized in crypto buying and selling. In technical evaluation, whose fundamentals work for all monetary markets, there are about 30 formations. These embrace head and shoulders, double tops and bottoms, triangles, wedges, flags and pennants, cups and handles, channels, and ranges. Every sample has its personal distinct traits and can be utilized to determine potential entry or exit factors to make worthwhile buying and selling choices. Completely different crypto patterns will work higher relying on the asset, so it will be important for buyers to know the way every chart sample applies to their particular scenario.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.