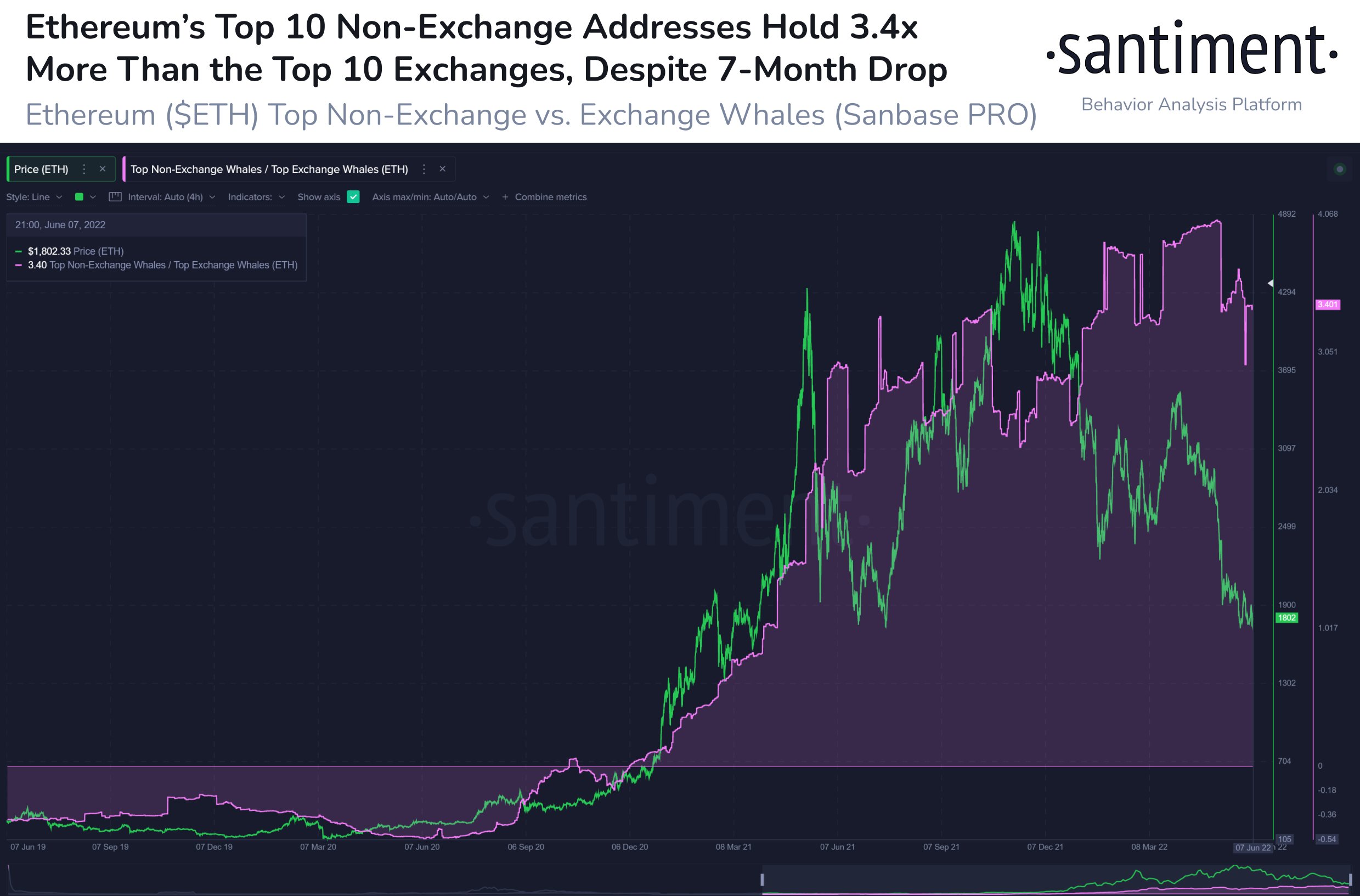

Analytics agency Santiment says the world’s most prosperous crypto traders stay bullish on Ethereum (ETH) regardless of the downturn available in the market.

In line with Santiment, the highest 10 non-exchange wallets keep a excessive ratio of Ethereum of their portfolio and now maintain 3.4 occasions extra ETH than exchanges.

The agency says this implies the biggest whales are protecting a agency grip on the main altcoin.

At time of writing, Ethereum is altering fingers for $1,778.

“Ethereum’s prime 10 non-exchange vs. change addresses are sustaining a excessive ratio of ETH owned excessive 10 non-exchange whales. With an amazing 3.4x extra cash held, there nonetheless seems to be a perception that costs can stabilize.”

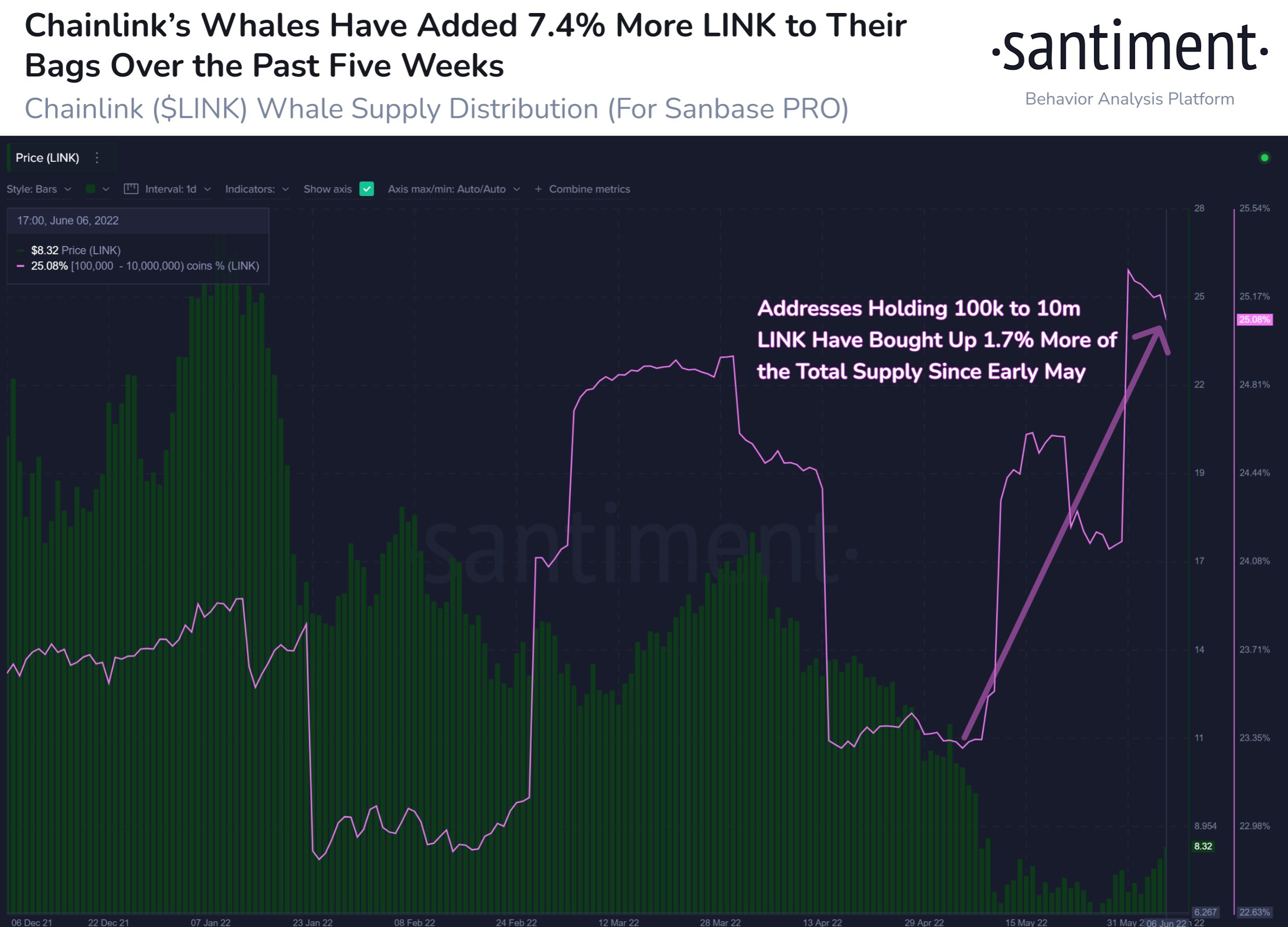

Santiment additionally says deep-pocketed traders are accumulating Chainlink (LINK). The agency says whales have been stocking up the asset since final month when the worth of the decentralized oracle community plunged to lower than $6.00.

At time of writing, Chainlink is buying and selling for $9.35, up by 6.98% during the last 24 hours.

“Chainlink has pumped +9% prior to now 2 hours, and accumulating whales are capitalizing. After dumping started on March thirtieth, they started accumulating once more after costs dropped in early Could. They maintain 25%+ of the provision for the first time since November.”

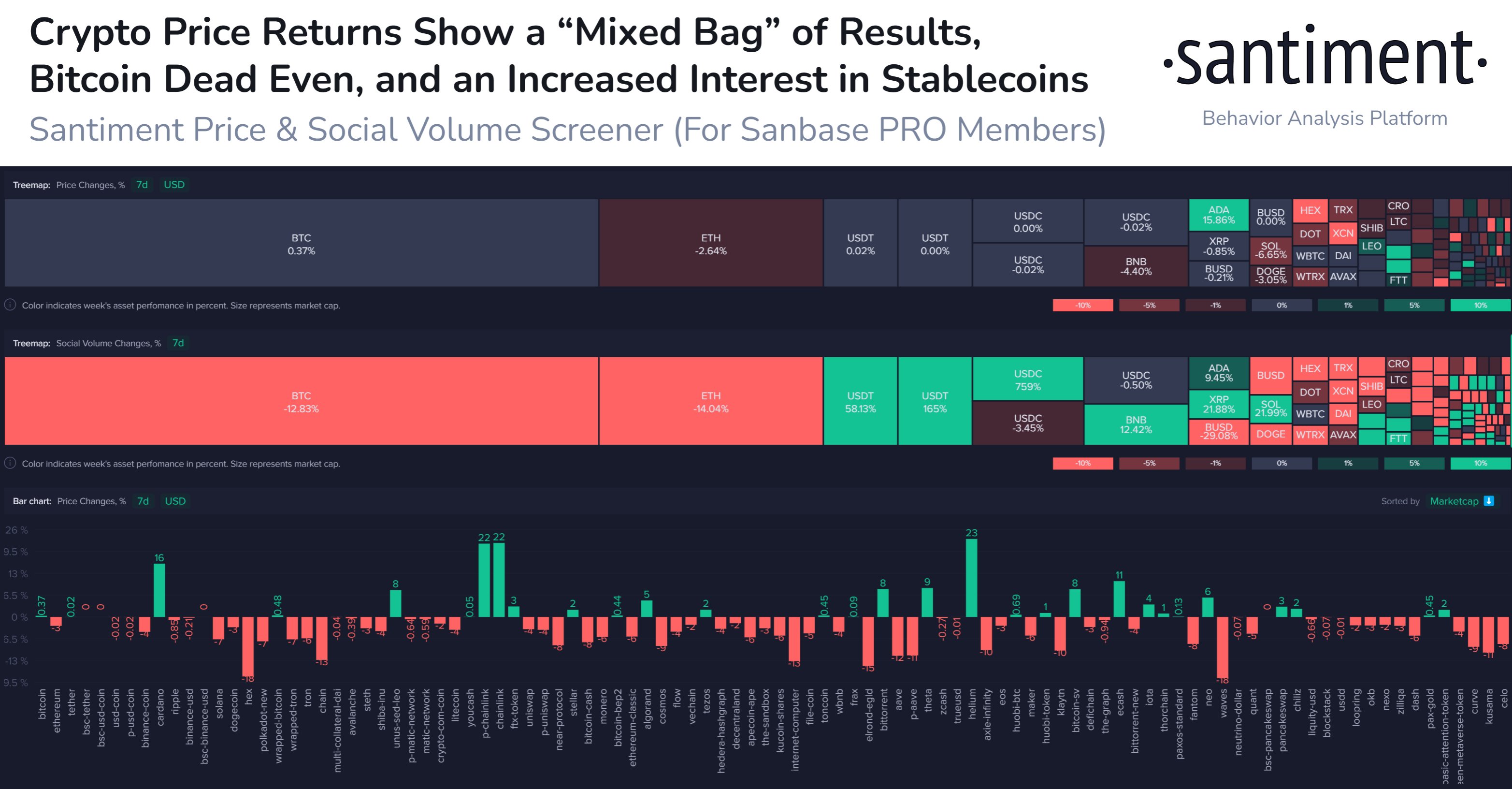

The analytics agency says LINK, together with Cardano (ADA) and Helium (HNT), are performing effectively regardless of the excessive volatility of the crypto market in early June. In the meantime, the costs of Bitcoin (BTC) and Ethereum are nonetheless shifting sideways.

“Crypto costs chopped wildly within the opening week of June, however the outcome has been primarily no motion for Bitcoin and Ethereum. Altcoins, however, have proven main decouplings from each other, with ADA, LINK, and HNT performing effectively.”

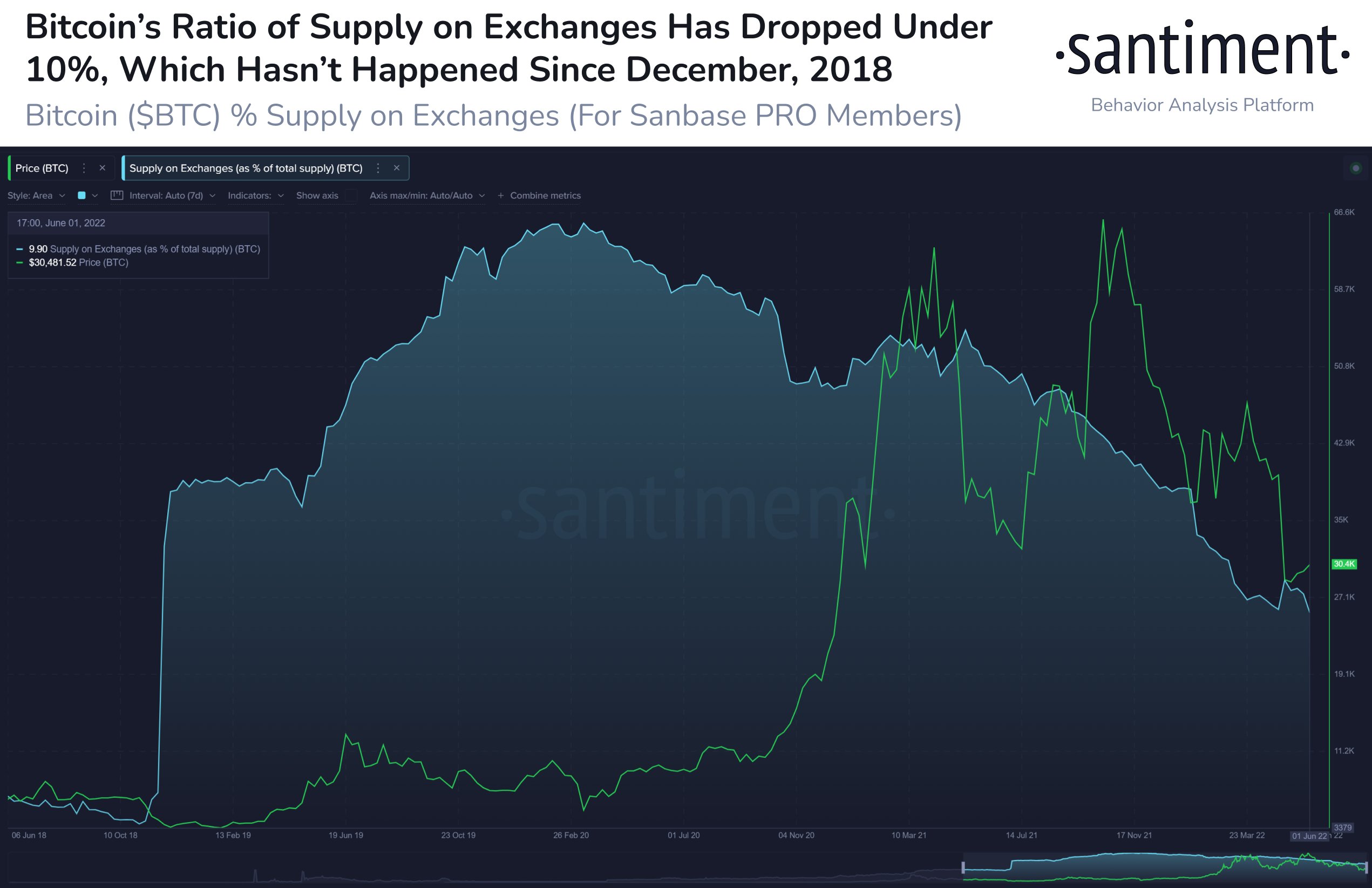

Santiment additionally reveals the ratio of the Bitcoin’s provide on exchanges is now at 10%, the bottom since December 2018, which could possibly be an indication of a bullish stance amongst long-term holders.

“The share of Bitcoin’s provide sitting on exchanges is right down to 9.9% after Could’s volatility brought about an inflow of BTC shifting to exchanges for panic sells. It is a signal of hodler confidence, and change provide hasn’t been this low in 3.5 years.”

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Tithi Luadthong