After a steady value drop of over 12% in latest days, Tron (TRX) is now poised for an upside rally, as its value motion and on-chain metrics trace at bullishness. Following its breakout of a robust resistance stage of $0.145 has soared greater than 16% and by no means retested.

Tron Profitable Breakout Retest

With the latest market decline, it has efficiently retested its breakout space and is now experiencing an upside transfer with a robust each day candle.

At press time, TRX is buying and selling close to the $0.151 stage and has skilled a value surge of over 3% within the final 24 hours. In the meantime, its buying and selling quantity has dropped by 17% throughout the identical interval. This decline in buying and selling quantity could also be as a result of extremely risky market and bearish sentiment.

Tron Worth Prediction

Based on knowledgeable technical evaluation, in contrast to main cryptocurrencies, TRX seems bullish and is buying and selling above the 200 Exponential Transferring Common (EMA) in a four-time body, indicating an uptrend. Moreover, the formation of a doji candle on the help stage and the 200 EMA additional hints at bullishness.

TRX has efficiently damaged out of a descending trendline and is at the moment going through a small resistance stage close to $0.152. Primarily based on historic value momentum, if TRX closes a candle above this resistance stage, there’s a excessive chance that it might soar by 10% to the $0.167 stage.

Bullish On-Chain Metrics

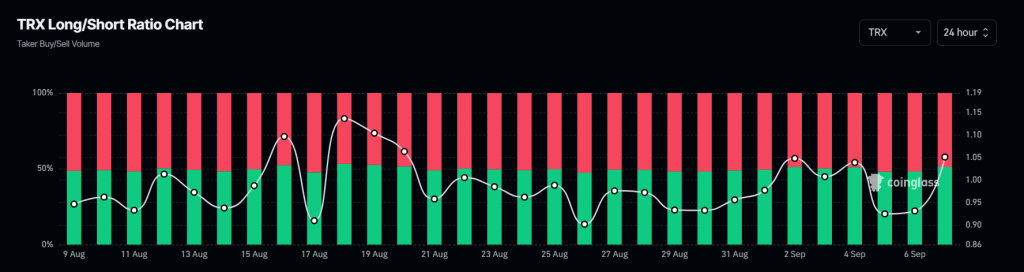

CoinGlass’s TRX Lengthy/Brief ratio indicators a bullish sentiment. Based on the info, the ratio at the moment stands at 1.0509, indicating bullish sentiment (a price above 1 signifies this). In the meantime, 51.24% of merchants personal lengthy positions, whereas 48.7% maintain brief positions.

However, TRX’s open curiosity has elevated by 8% within the final 24 hours, signaling the buildup of extra lengthy positions throughout this era. Combining the bullish lengthy/brief ratio with rising open curiosity suggests a robust shopping for alternative. Merchants typically mix these knowledge whereas constructing lengthy/brief positions.